Brandon Woyshnis/iStock Editorial via Getty Images

Tesla, Inc. (NASDAQ:TSLA) recently reported “worse-than-expected” sales and EPS figures. I recently discussed the high probability of Tesla missing the consensus Q1 estimates due to the worse-than-anticipated deliveries in the first quarter. I also mentioned the crucial $145-160 buy-in zone/critical support area around where the stock bottomed and surged from post-earnings.

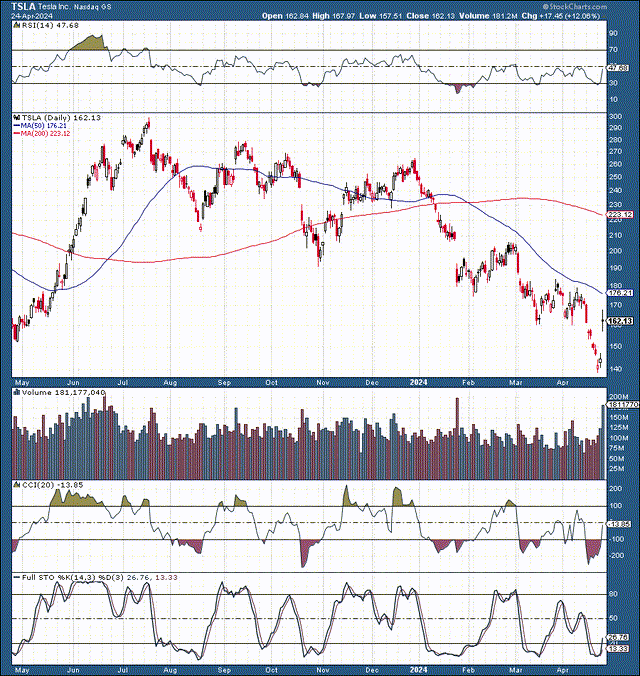

Tesla: 1-Year Chart – The Bottom May Be In

TSLA (StockCharts.com | Advanced Financial Charts & Technical Analysis Tools )

We see Tesla’s stock going through a bear market phase, declining by over 50% from peak to trough this year. The technical dynamic looks exceptionally bullish, as the recent low (possible long-term bottom) occurred on relatively low volume, suggesting seller exhaustion.

The sharp reversal and rebound occurred on increasing volume, illustrating significant buy interest and likely short covering around the crucial support area around $140-160.

Moreover, the RSI declined to about 30 during the recent probable bottom, relative to the much lower RSI in early 2024. This dynamic suggests that technical momentum could improve from here.

The RSI and full stochastic also show positive characteristics associated with improving technical momentum, which indicates a potential long-term bottom and a probable start to a new long-term uptrend.

Note: In full disclosure, I increased my Tesla stake on the morning of April 23rd at an average price of $141.64 (Tesla later reported earnings after the bell).

This Is Not A Problem That Tesla Can’t Fix

Tesla has gone through challenging periods, and the current transitory slowdown phase is insignificant compared to when Tesla had significant issues with the Model 3 ramp-up, recording a staggering net loss of $2.24B in 2017. Many analysts doubted Tesla’s future then, yet I remained highly confident, insisting that Tesla was not approaching “terminal decline” and would inevitably succeed. We know that the Model 3 and Y became enormous blockbuster successes.

Tesla is now one of the most influential tech/auto companies in history and is likely to deliver around $100B in sales this year. A temporary growth and earnings decline period should not negatively impact Tesla’s long-term prospects. I feel very fortunate that I added to my Tesla position around the recent lows.

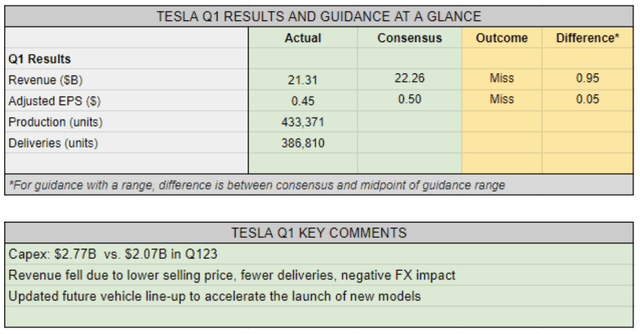

Q1 Is The Kitchen Sink Quarter

Tesla’s Q1 kitchen sink quarter is nothing compared to the troubles Tesla has faced many times before. Moreover, Tesla’s sales and earnings should improve considerably from here.

Q1 Earnings (Stock Market Analysis & Tools for Investors )

Tesla missed consensus sales figures by about 5%, slightly more than I anticipated. Still, the ASPs didn’t increase as much as projected over the previous quarter, with Model 3/Y segment ASPs likely remaining around $40K. The good news is that Tesla’s price increase should favorably impact its profitability in Q2 and H2. Moreover, Tesla’s profitability could increase substantially more in 2025 due to the compound effect of increasing revenues and improving margins.

Why Tesla’s Earnings Could Go Much Higher

The five-cent EPS miss is insignificant in the greater scheme of things, and earnings could improve more than expected in H2 and in future years. The Model 3/Y slowdown is likely temporary due to a general slowdown in EV growth. However, global economic growth should strengthen, and the Fed will probably introduce a more accessible monetary regime soon.

This dynamic should make Tesla and other EV financing more affordable, improving growth and increasing sales. Tesla could benefit the most because of its extensive infrastructure, popularity, technology, and market-leading position in the space.

Furthermore, Tesla has enormous prospects in AI, robotics, FSD, Cybertruck and Semi sales, energy generation and storage, new car models, robotaxis, and other lucrative segments as we advance.

Therefore, current sales and EPS projections are extremely depressed because their main focus may be Tesla’s transitory slowdown in sales, essentially missing the “big picture.”

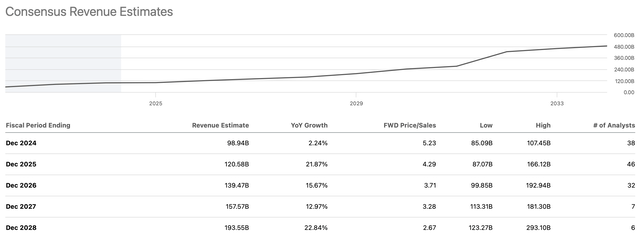

Sales Could Go Significantly Higher

EPS estimates (Stock Market Analysis & Tools for Investors )

Consensus analysts expect sales to increase by only 2-3% this year. However, given Telsa’s Cybertruck and Semi sales, as well as other diverse income channels, Tesla’s revenues should increase closer to the higher end of estimates, around $108B.

In my view, Tesla could achieve even higher sales this year because there is a massive market for the Tesla Semi. The question is how long it will take Tesla to acquire a considerable market share in the lucrative EV Semi space, but it may occur much faster than some analysts anticipate, providing considerably more revenue for Tesla.

Also, judging by the recent Cybertruck recall, Tesla sold around 3,880 Cybertrucks in a four-month period, more than GM’s EV Hummers sold in all of 2023. The Cybertruck ramp-up may be more robust than expected, leading to faster revenues and better-than-anticipated sales and profitability growth as we advance.

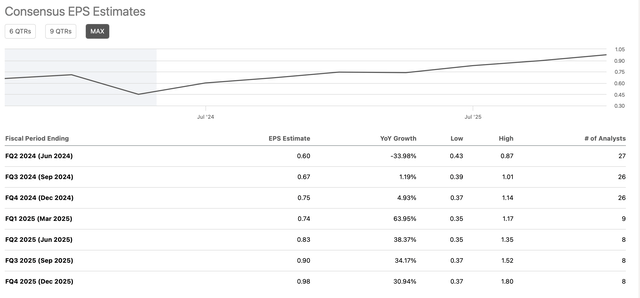

Tesla’s EPS – May Be Around A Rock Bottom

EPS estimates (Stock Market Analysis & Tools for Investors )

Tesla’s EPS growth projections are incredibly modest in my view and are probably lowballed here. The vehicle and other segment margins could improve as the company raises prices and optimizes its Cybertruck production. Tesla’s gross margin came in at 17.4% last quarter, compared to 19.4% in the same quarter one year ago.

Therefore, Tesla’s margins should be around a low point, and higher-than-expected revenue combined with improving margins will likely have a highly positive effect on EPS.

Although I believe Tesla will beat this year’s consensus EPS figures, they will likely remain relatively low due to the factors we discussed, like lower vehicle pricing, costly production ramp-ups, high interest rates, and other short-term adverse effects.

Nonetheless, 2025 EPS results could be much higher than expected, and we should consider forward earnings when assembling our stock investment thesis.

Where Tesla’s stock price could be in future years:

| The Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $108 | $150 | $188 | $225 | $265 | $305 | $350 |

| Revenue growth | 25% | 39% | 25% | 20% | 17% | 15% | 15% |

| EPS | $3.45 | $7 | $10 | $13 | $16.3 | $20 | $24 |

| EPS growth | 10% | 103% | 43% | 30% | 25% | 22% | 20% |

| Forward P/E | 35 | 36 | 35 | 36 | 33 | 32 | 30 |

| Stock price | $240 | $360 | $455 | $587 | $660 |

$768 |

$865 |

Source: The Financial Prophet.

Since my previous analysis, I’ve slightly altered my near-term estimates due to Tesla’s transitory (likely short-term challenges). However, Tesla stock recently crashed to the $140-160 zone. Moreover, Tesla’s intermediate and long-term prospects remain excellent and could be significantly underappreciated by the market.

This dynamic creates an ideal long-term buying opportunity (in my view), as Tesla’s stock has a high probability of appreciating considerably in the short, intermediate, and long term. Tesla’s stock could benefit from multiple expansion and higher-than-expected earnings, compounding into a much higher stock price as we advance.

Of Course, Tesla Has Risks

Despite my constructive intermediate and long-term outlook, Tesla faces various risks and challenges, especially in the near term. There’s decreased growth demand in the EV industry. Moreover, we see considerable competition in the EV space in the lower, mid, and higher-end sectors. Tesla also has the risk of operating in a slower-than-anticipated economy with higher rates for longer, in a worse-term case. There are also some concerns about certain Cybertrucks, but this could be a temporary event (in my view). Investors should consider these and other risks before establishing a position in Tesla.