Baloncici/iStock Editorial via Getty Images

Article Thesis

Tesla, Inc. (NASDAQ:TSLA) reported its most recent earnings results on Tuesday afternoon. The company, which has seen its shares come under a lot of pressure in 2024, reported weaker-than-expected results and burned through billions of dollars of cash. On the plus side, Tesla plans to introduce new models sooner than expected, which was well-received by the market. Overall, I believe Tesla remains an “avoid.”

Past Coverage

I have covered Tesla repeatedly in the past, most recently in January 2024. In this article, my most recent one on Tesla, I gave the company a bearish rating due to Tesla’s weak growth performance. That has worked out well so far, as shares have declined by 24% since my article, even though the broad market is up over the same time frame. In this article, I will focus on what has changed over the last quarter and what Tesla’s Q1 results mean for the company going forward.

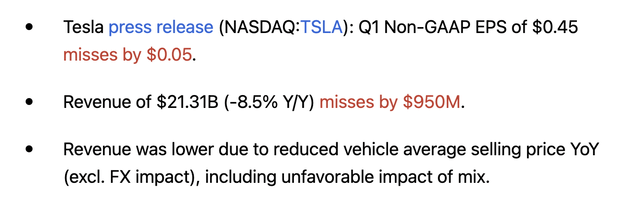

What Happened? We can see the headline results in the following screencap:

A double miss is an unfortunate surprise, for sure. While analysts did not have high expectations for the company, actual revenues and profits came in at an even lower level compared to what was expected.

Somewhat surprisingly, Tesla still saw its shares rise in after-hours trading, as investors seem to be enthusiastic about management’s remarks regarding Tesla’s future model line-up.

Tesla’s Q1: The Good And The Bad

Business growth

The company has recorded revenues of $21 billion for the first quarter, which was down 9% year-over-year. That was the first time Tesla has reported falling revenues in a long time, although there are some mitigating factors to consider — it wasn’t all the company’s fault.

Most importantly, the company was negatively impacted by the attack on the power supply of Tesla’s production plant in Germany. Tesla did not feel a long-lasting impact, but for a couple of weeks, production was impacted — since a quarter only has 12-13 weeks, there was a meaningful headwind during the first quarter.

That being said, Tesla’s deliveries and production are not 100% tied to each other. The fact that Tesla was unable to produce vehicles at the normal rate during some weeks in Q1 does not necessarily translate into fewer deliveries and lower revenues. After all, the company could theoretically also have sold vehicles from its inventory, but Tesla didn’t even manage to sell all the vehicles it produced during the first quarter — it sold 47,000 vehicles less than it produced.

The fact that vehicles need to be moved from the production plant to the respective end market explains some of the difference, but if demand was very strong, one would still expect the production number and the delivery number to be relatively close to each other. That hasn’t been the case for Tesla in a while, as inventory has been piling up — at the end of the first quarter, inventory was equal to 28 days of supply. That is still not a bad number compared to many other vehicle manufacturers, but relative to Tesla’s own track record, this is a pretty high inventory level. To me, this suggests that demand is rather weak, despite the price cuts we have seen in the recent past. The ongoing global EV market slowdown likely explains some of this demand weakness, but increasing competition, especially in China, also plays a role in the rather weak demand picture for Tesla.

Automobiles are not the only revenue source for the company, however, and things look somewhat better in other areas. In the energy business, storage deployed has risen slightly compared to the previous year’s quarter. While a 4% year-over-year increase wasn’t strong, it was still better compared to the performance of the auto business. The energy business saw a 7% revenue increase compared to the previous year’s quarter. While that is far from explosive growth — some bulls have argued that the energy business would be a huge growth booster in the future — Tesla’s energy business is still growing, despite a sluggish macro picture and high interest rates. I don’t see this as a reason to buy the stock, but things could be worse, and the energy business is doing reasonably well.

Last but not least, Tesla’s service business experienced the best revenue growth rate, at 25%, thanks to the help of higher revenue recognition for Tesla’s FSD offering.

Profitability

Tesla’s profitability moved in the expected direction — profits declined. Profits had been pressured for quite some time, on the back of weak business growth and margin headwinds. While Tesla had excellent margins during the peak of the pandemic, ongoing price reductions for its vehicles made its margins fall massively.

In the first quarter, Tesla generated an operating margin of 5.5%, which was down from 11.4% in the previous year’s quarter. This was Tesla’s worst operating profit margin in recent memory, and down by more than half in a single year. The power supply issue in Germany plays a role here, but it is highly likely that profits would have been weak even without this problem — after all, Tesla wasn’t able to sell all the vehicles it produced, despite a production disruption, so even higher production levels would not have helped improve profitability by a lot. Earnings per share, which are highly important for driving share price upside eventually, were roughly down by half compared to the previous year’s quarter.

But while these earnings results look rather bad already, it is important to consider that these profits include considerable tailwinds from revenue (and thus earnings) recognition based on the roll-out of new FSD features. For customers that have bought full self-driving software, or FSD, in the past (i.e., before Q1 2024), a part of the sale has been recognized in Q1, but no additional cash inflow was generated. This helps explain why the cash flow picture was even worse than the profit picture.

Cash flows

Cash flows did not experience a meaningful tailwind from increased revenue recognition from past FSD sales. At the same time, cash flows were hurt by Tesla’s growing inventory levels — when the company produces vehicles that it can’t sell, its working capital is growing, resulting in lower operating cash flows, all else equal.

During the first quarter, Tesla’s operating cash flow was just $0.2 billion. Annualized, that makes for around 0.2% of the company’s current market capitalization. When we consider that this number does not yet include any capital expenditures, neither for maintenance and retooling nor for new production plants, then the cash flow picture looks even worse.

On a free cash flow basis, where capital expenditures are accounted for, Tesla burned through $2.5 billion of cash — or $10 billion annualized. Competitors Rivian Automotive, Inc. (RIVN) and Lucid Group, Inc. (LCID) have received a lot of criticism for their high cash burn rates of $6 billion a year and $3 billion a year, respectively — but Tesla’s cash burn rate during the first quarter was even worse. This is new, as Tesla has generated reliable cash flows during the last couple of years. If the company does not turn things around in the near term, its balance sheet will receive considerable damage.

To sum things up, most things looked rather bleak in Tesla’s first quarter. While increased service revenue generation and some growth in the energy business were minor positives, the automobile business continued to perform badly, with inventory growing, ASP declining, and margins turning lower. Profitability was relatively bad, and the cash flow picture was terrible.

There is, however, also some reason to be enthusiastic — at least when we go by the share price reaction following the earnings release. Tesla stated it wants to accelerate the launch of new models. While announcements of production plans, etc., do not necessarily translate into these production plans materializing, the comments were still seen as a positive.

And one can definitely argue that the launch of new models would help Tesla quite a lot. Its current model line-up is rather stale, and the company still does not have a low-price model, so if Tesla manages to grow its portfolio with some major new model introductions, its growth could improve again. At least for now, we don’t know about the actual timing of new model introductions, however — Tesla has a history of being late versus its plans and announcements (this also holds true for some other automobile companies).

Tesla also again put a lot of focus on its autonomous driving plans during the earnings release. Bulls and bears will argue about the value of this business, but judging from the share price reaction, some investors liked these robotaxi-related statements, such as the following one (see link above):

The future is not only electric, but also autonomous. We believe scaled autonomy is only possible with data from millions of vehicles and an immense AI training cluster. We have, and continue to expand, both.

To me, this sounds rather vague and doesn’t give a strong hint about strategy and how the company is progressing with its plans. After all, we already know that Tesla is collecting data from many vehicles. But it appears that some investors see significant value in statements such as these, which is why Tesla was bid up following the earnings release.

Takeaway

I have been bearish on Tesla for a while, and that didn’t change with the Q1 report. After all, most of the data points looked bleak — margins are falling, the company is burning cash, and inventory keeps growing despite ongoing price cuts.

I don’t short Tesla, however, and would not recommend this to anyone. After all, the company may have success with its self-driving plans eventually, and that might generate significant value at some unknown time in the future. For me, this is too speculative to make for an appealing investment case, however, and I believe that the current nature of the business is not strong enough to warrant a market capitalization of $500 billion or even more.

While some might like Tesla as a higher-risk autonomous-driving investment, I prefer to stay away from Tesla as the Q1 report has indicated that Tesla has considerable operational problems while still trading at a premium valuation.