Gennaro Leonardi

Investment Thesis

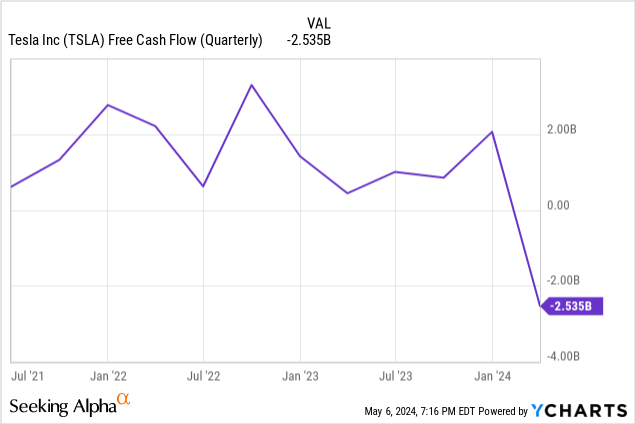

Last December, we highlighted the intensifying competition threatening Tesla’s (NASDAQ:TSLA) EV dominance in the US, adding to the company’s challenges in Asia. Since then, Tesla temporarily lost its position as the largest BEV maker to BYD (BYD) in Q4 2023 and reported the first-ever unit volume decline in Q1 2024 (excluding the pandemic disruptions), leading to a 13% decline in automotive dollar sales during the quarter. In the US, Tesla sold 21,443 fewer vehicles than it did in Q1 2023, while BMW (OTCPK:BMWYY), Hyundai (OTCPK:HYMTF), Ford (F) Rivian (RIVN), Mercedes-Benz (OTCPK:MBGAF) added a combined 35,656 EV units during the same period, highlighting the increasing competitive dynamics facing Tesla in North America. The disappointing quarter was also highlighted by the company’s first negative Free-cash-flow ‘FCF’ since Q2 2021, and the steepest in its history, with unsold inventory piling up. At their lowest, shares declined 41% before recovering some of the losses on speculations tied to Elon’s recent visit to China and Tweets about a potential Robotaxi unveil next August.

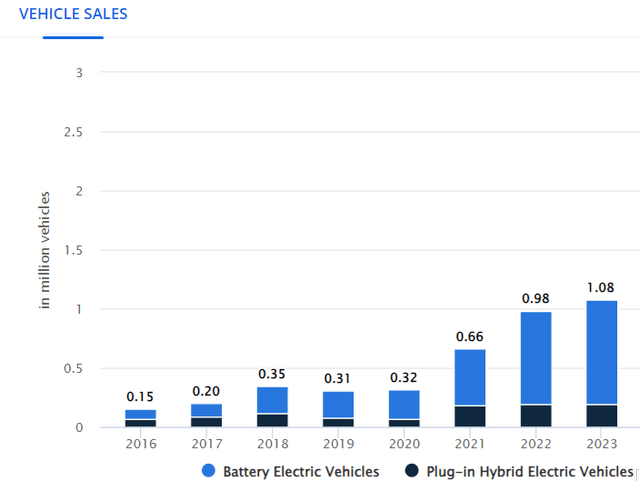

Today, a far more sinister issue emerges. Recent market data (paywall) suggests that the EV market itself is smaller than the initial hype suggests. According to Statista, US BEV and Plug-in hybrid unit sales remained relatively flat YoY in 2023. While different sources point to different unit sales figures, there is a broad consensus that the EV market is decelerating.

During Last Week’s earnings call, Elon Musk offered little insight into the company’s flailing EV sales or the industry’s mediocre growth. Instead, he primarily focused on Tesla’s moon-shot projects: AI, self-driving, and Optimus robots. There’s a strategic reason for this. Traditional valuation models indicate that Tesla is grossly overvalued. Even with generous growth assumptions, our DCF model suggests significant overvaluation despite the ticker’s recent slump. Here’s the breakdown of our model’s assumptions:

- Average Selling Price: Remains at 2023’s $43,500. This is an optimistic assumption given last month’s price cuts (which more than reversed earlier price increases in late March) and inventory build-up in Q1 24, suggesting continued price discounts to clear unsold vehicles in a slowing EV market.

- Unit Volume Growth: Increases by 500,000 vehicles annually, a level Tesla has never achieved historically. This assumption also dismisses potential manufacturing bottlenecks for which Tesla is known.

- Capital Expenditure: Matches depreciation costs plus an extra $2 billion annually for new Gigafactory capacity to support the projected growth.

- R&D: Holds near 5% of sales, reaching $12 billion by 2030.

- Other Income: Interest Income remains steady at $1 billion per year.

- Taxes: Start at 10%, rising to 17% by 2028.

With these assumptions and a 15% discount rate, our DCF analysis suggests a fair value of $230 billion, a significant discount to the current valuation. This likely explains why Elon Musk is keen for investors to view Tesla as a tech company. Here’s his perspective from last week’s earnings call.

“We should be thought of as an AI or robotics company. If you value Tesla as just like an auto company, you just have to – fundamentally, it’s just the wrong framework, and it will come to be.” Elon Musk, Tesla Q1 2024 earnings call.

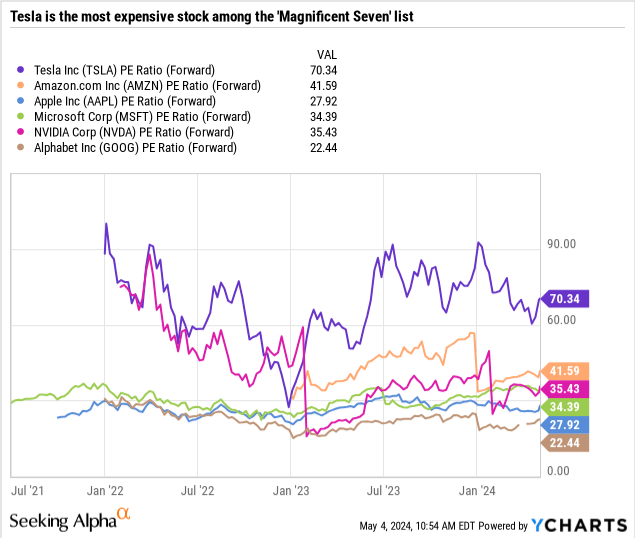

The problem with this premise is that Tesla generates nearly 80% of its earnings from EV sales and the remaining 20% from its Energy segment, automotive leasing, car repair services, and regulatory credits. Equally important, Tesla isn’t the clear leader in these futuristic endeavors. But even if it was a tech company with a forward PE ratio of 70x, it’s the most expensive among the ‘Magnificent Seven.’

While some automakers are delaying or shelving EV debuts (like Ford (F) and Bentley -part of Volkswagen (OTCPK:VWAGY)), others, like Toyota (TM), are accelerating their market entry. Xiaomi (OTCPK:XIACF)(OTCPK:XIACY), the third-largest smartphone maker, released a new EV that pundits say drives like a Porsche but sells $4000 less than the Model 3. These dynamics underscore our core hypothesis laid in December, but the challenges facing the EV market are proving more severe than initially anticipated, revealing cracks in Tesla’s growth narrative that fuels its exorbitant valuation, leaving it heavily reliant on moon-shot projects to justify its price.

Autonomous Driving

Tesla’s Autopilot and Full Self-Driving ‘FSD’ services dominate autonomous driving discussions, fueled by Elon Musk’s bold claims and the company’s aggressive marketing. A recent company directive to demonstrate FSD on every test drive, along with price cuts, highlights Tesla’s push for adoption. However, this comes amid product recalls, Federal investigations, Tesla owners’ online reports of near-death experiences, and high-profile accidents involving FSD.

Some argue Tesla’s disruptive approach justifies these risks. However, as the market increasingly factors autonomous driving into Tesla’s valuation, it is crucial for investors to move beyond the hype. Direct comparison with competitors will shape Tesla’s valuation story in the second half of 2024, with the Robotaxi update in August serving as a potential down catalyst.

Even with the new updates, Tesla’s FSD remains stuck in Level 2 on the Driver Assistant Systems scale, requiring constant driver attention. For many, it feels less like assisted driving and more like a stressful chore for avoiding disaster.

Recent videos of ‘near-misses‘ with V12 FSD paint a less-than-stellar picture, exposing the system’s fundamental limitations and raising serious questions about Tesla’s claims of near-autonomy.

V12 also marks a significant shift in strategy, leaning almost entirely on neural networks. It eliminates 300,000 lines of ‘safety code’ that augmented the technology in previous versions. Given the inherent unpredictability of real-time learning associated with Neural Networks, this could lead to regulatory delays. These issues raise questions about Elon Musk’s rollout timeline for the Robotaxi service, which might become evident during the planned product unveiling in August, constituting a potential downward catalyst.

Moreover, competition is also no longer playing catch-up. Waymo, which already runs a Robotaxi service in several cities, uses Neural Networks but augments it with other technologies, offering a more comprehensive approach. Unlike FSD, it incorporates LiDAR (Light Detection and Ranging), HD Mapping, and, by extension, safety code. This might limit Waymo’s service to specific geographies, as opposed to Tesla’s more comprehensive, ‘drive anywhere’ aspirations, but still, it is safer, and more importantly, the valuation premium of Tesla is too big to explain using the FSD premise alone. For example, Waymo, whose autonomous driving program has been expanding into new geographies, was valued at $30 billion based on their latest funding round ($2.5 billion, series E) in April 2021. At the time, Tesla was trading around a $750 billion market cap. Mercedes and BMW are also making strides in autonomous driving, yet their valuation remains a fraction of that of Tesla.

Robotics

Elon Musk continues to hype Optimus as a revolution, but a closer look at December 2023 marketing materials shows the robot doesn’t truly rise to par. The videos show the Gen-2 Optimus walking, waving, and performing basic tasks like color-sorting and egg-handling. These feats, accompanied by boasts of ‘new torque sensing’ features and ‘improved hands,’ are underwhelming compared to what other robots are already achieving. For example, The da Vinci surgical system by Intuitive Surgical (ISRG) can handle delicate tissues and surgical instruments. Boston Dynamics’s robots are known for their spectacular dexterity, which far exceeds that of Optimus Gen-2. Although Tesla’s strategy is unique in that it aims to build an all-purpose humanoid instead of an application-specific robot, these examples show how far behind Optimus is in terms of physical prowess in a pretty crowded robotics market.

To Tesla’s credit, an all-purpose humanoid could open a great market with a flexible product that can address labor shortages and work safety issues. Still, while Tesla is playing catch-up in terms of physical capabilities, the true test is yet to come. A crucial component of the humanoid is its ‘Brain,’ or Generative AI capabilities, which Elon has decided to develop outside of Tesla, expressing hesitance to develop these technologies at Tesla without at least 25% interest, which ties back to his Stock-Based Compensation package which was turned down in a Delaware court recently. This also touches on questions about Elon’s dedication to Tesla as one of the primary talents at the company, being the CEO of multiple multi-billion dollar companies, including SpaceX, Twitter, and others.

Optimus uses FSD technology for navigation and basic processing tasks, but to achieve the potential touted by Elon Musk, it will need to be fitted by a Generative AI brain. This technology falls outside the scope of Tesla. The company will likely outsource AI from a third-party vendor, possibly Twitter (also known as X), which raises conflict of interest issues, with Tesla owners potentially subsidizing Elon’s Twitter generative AI project, known as xAI and Grok.

From a financial perspective, Optimus, in its current form, can’t justify Tesla’s price. Boston Dynamics, with all its physical prowess might, was purchased by Hyundai (OTCPK:HYMTF) in 2020 for $1.1 billion. Open AI was valued at $80 billion as of February 2024 and recently announced investing $675 million (along with Microsoft (MSFT) and Jeff Bezos) in Figure, a new humanoid start-up that utilizes ChatGPT in its robots. The funding round, which concluded last month, valued Figure at $2.6 billion. To justify its current market cap of $600 billion, Tesla’s Optimus needs to be valued at multiple times Open AI, Figure, and Boston Dynamics combined. This is a far-fetched premise in light of its lagging capabilities in both physical prowess and the absence of generative AI capabilities. Going into 2024, as the focus and narrative shift towards Tesla’s moon-shot projects, these shortcomings will find their way into Tesla’s narrative, negatively impacting its valuation.

Power Segment

Tesla’s power segment grew by a modest 7% in Q1 2024. However, its contribution to overall profitability increased due to the automotive segment’s rising fixed costs from capacity expansion and manufacturing development (including those under tax incentive agreements with several states that carry investment obligations for Tesla) without a corresponding increase in EV sales. In Q1 2024, EV sales declined 13%, from $18 billion to $16 billion.

The Energy segment’s gross margin improved in Q1, possibly because of economies of scale achieved from the ramp-up in battery production in the automotive segment, which also supplies the Energy Segment’s storage solutions.

Using comparable P/S multiples of solar panels, residential solar, and electric component manufacturers, we value the company at $12 billion.

| Sales (millions) | % YoY Sales | P/S ratio | |

| Tesla Energy | $6,141 | 7% | NA |

| Sunrun (RUN) | $2,260 | -2.65% | 1.14x |

| SunPower (SPWR) | $1,685 | -3.21% | 0.28x |

| Enphase (ENPH) | $1,828 | -30% | 8.5x |

| Generac (GNRC) | $4,024 | -6.8% | 2x |

| Array Technology (ARRY) | $1,576 | -3.7% | 1.3X |

| SolarEdge (SEDG) | $2,976 | -4.3% | 2.3x |

| Sunnova Energy (NOVA) | $720 | 10.1% | 0.8x |

This valuation considers Tesla’s push for greater control over its battery technology, including its 4680 battery project. However, the disappointment performance of the 4680, with an energy density of 272 -296 Wh/kg, and according to some studies, far less (tying, at least partly, to Tesla’s decision to reduce range estimates of its EVs on its website earlier this year), suggest a less pronounced technological moat than initially anticipated.

Moreover, traditional automakers shifting to EVs are rapidly advancing their battery technology. BMW is preparing to shift its EV fleet to Gen6 New Class Lithium-ion batteries, promising significant performance improvements, including a 30% increased range, 30% faster charging, and a 20% reduction in production costs. Although the battery specs haven’t been released yet, these performance metrics allude to potentially a superior battery density than Tesla’s 4680.

Furthermore, Tesla continues to rely heavily on outsourcing for solar panels (Q Cells in South Korea) and batteries (Panasonic, LG, CATL, and BYD), diminishing the impact of proprietary technology in this valuation.

Summary

During last week’s earnings call, Elon Musk tried to shift the narrative away from the struggling auto segment to the company’s moon-shot projects to find some grounds to justify valuation. However, a closer look at Tesla’s market position in these fields shows that it lags in each one of them.

Our sum-of-parts valuation analysis indicates a best-case scenario fair value price for Tesla at $85. Based on 3.2 billion shares, this translates to a $272 billion valuation. Key drivers of this valuation are:

- Automotive Resurgence: A strong rebound in auto sales, fueled by the Model 2 launch and FSD’s potential advancement to level 3 by 2025, places the value of this segment at $230 billion.

- FSD Licensing: Sales of FSD technology to other automakers could add $30 billion to Tesla’s value. This aligns with private equity assessments of Waymo, a key player in the autonomous vehicle space.

- Energy Segment: Tesla’s Energy segment is valued at $12 billion based on industry multiplies.

In addition to considering a high-growth scenario, this analysis does not factor in historical share dilution. Specifically, it does not account for the potential impact of a massive stock compensation package, previously rejected by the court, that could significantly increase the share count.

Our hold rating remains unchanged from the previous article, mirroring Elon’s control over the meme-stock narrative supporting Tesla’s valuation. Despite its recent drop, Tesla’s shares still trade at a familiar range, which it has been trading at since 2020. A rating downgrade is conditional on signs Elon is losing control over the growth narrative supporting the ticker’s exuberant valuation. A potential catalyst for a rating downgrade is a potentially disappointing Robotaxi unveiling in August, breakthroughs in Open AI’s humanoid project, and further deterioration in Tesla’s automotive sales. On the upside, we see a rating upgrade if Tesla succeeds in meaningfully defending its market share and a reacceleration in the EV transition trends.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.