Scott Olson

After the bell on Tuesday, we received first quarter results from Tesla (NASDAQ:TSLA). The electric vehicle giant has been one of the worst performing names in the market so far this year as rising competition and price cuts have sparked questions about vehicle demand. While the overall Q1 results were not great, a major change in the medium term plan seemed to end the stock’s recent losing streak for now.

My previous coverage

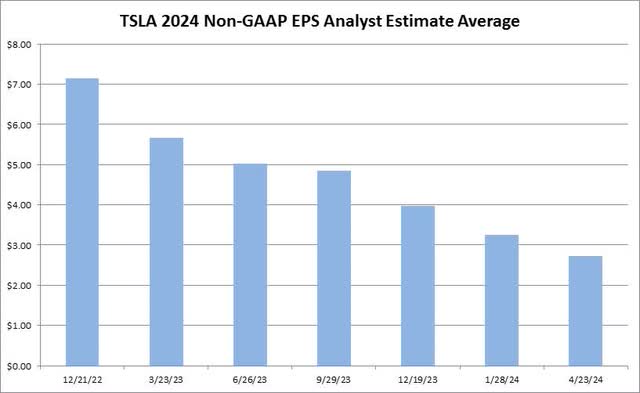

It was about six months ago when I lowered my rating on the stock to a sell after the company’s Q3 2023 earnings report. Tesla reported lower than expected revenues and margins, and management’s near-term forecast didn’t seem as optimistic as some were hoping for. At that time, it was obvious that ongoing price cuts weren’t driving huge demand increases, and management couldn’t get costs down enough to keep margins at a high level. I stated in my most recent article that analyst estimates needed to level off before I could consider an upgrade on the stock. As the chart below shows, the street has continued to cut its bottom line numbers since.

2024 Tesla EPS Estimate Average (Seek)

Just a few days before Christmas last year, analysts were at nearly $4 a share for Tesla adjusted earnings in 2024. Going into Tuesday’s report, that number was down to $2.73, a drop of more than 31%. These continued estimate cuts are one of the key reasons why shares have lost more than a third of their value since I moved to a sell rating, compared to a more than 17% rise for the S&P 500.

Q1 results

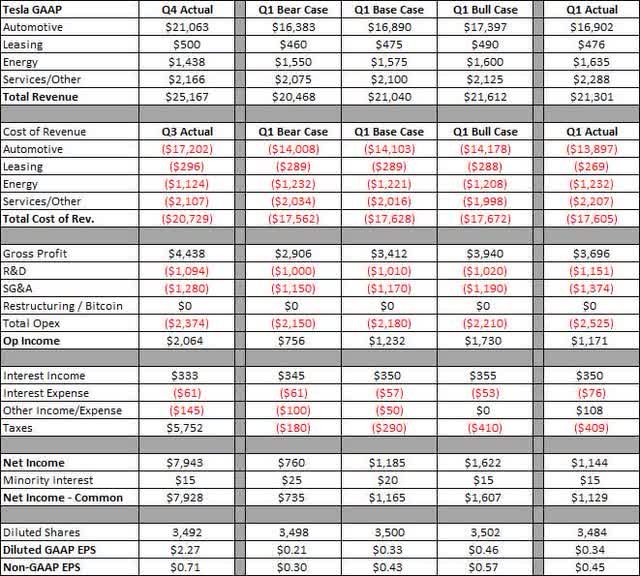

As the quarter progressed, data from around the globe showed that Tesla sales weren’t faring too well. As a result, revenue estimates that stood at nearly $25.5 billion in early February were down to $23.75 billion by the end of the quarter. When Tesla announced a very disappointing delivery number below 387,000 vehicles, analysts were forced to keep trimming their sales figures. The average came down to $22.26 billion by Tuesday’s report, but that seemed too high given average selling prices in previous quarters. In the table below, you can see how Tesla fared against the usual three cases I provide, with dollar values in millions except per share amounts.

Tesla Q1 Results (Author’s Estimates, Company Report)

Overall, Tesla’s results were fairly close to what I was expecting. Total revenues came in above my forecast, basically on the non-auto side, but fell way short of the street’s average that was just too high. While gross margins on the automotive and energy segments fared a little better than my base case, the company spent a lot more on the operating lines, wiping out those potential gains. In the end, most of my bottom line difference was due to other income items, which probably has to do with currency movements, but we’ll find out more when the 10-Q comes out.

Where things really disappointed was on the balance sheet and cash flow side. Tesla reported cash burn of more than $2.53 billion, while the street was expecting a positive number of nearly $700 million. Working capital items went significantly against the company here, mainly due to the surge in inventory from deliveries being well below production. Tesla did have a surprise jump in accounts receivable, a little strange given the sequential revenue drop. The cash flow numbers would have been even worse if not for days payable outstanding jumping sequentially from 63 to 75, although that number was flat year over year. Had Tesla payments to suppliers matched the Q4 2023 equivalent, Tesla likely would have reported negative operating cash flow as well. Still, the company has over $27 billion in cash against a little more than $5 billion in debt and finance leases, so it’s in solid financial shape.

Changing things up for the near term future

The biggest concern for Tesla lately has been competition, primarily being cheaper models coming out of China. Tesla had planned to launch new models based on its next-generation platform in the second half of 2025. This new platform would require new production facilities, which is what previously many thought Gigafactory Mexico would be for, before plans for that facility had been put on hold. Tesla management provided this major update in the Q1 shareholder letter:

We have updated our future vehicle line-up to accelerate the launch of new models ahead of our previously communicated start of production in the second half of 2025.

These new vehicles, including more affordable models, will utilize aspects of the next generation platform as well as aspects of our current platforms, and will be able to be produced on the same manufacturing lines as our current vehicle line-up.

This update may result in achieving less cost reduction than previously expected but enables us to prudently grow our vehicle volumes in a more capex efficient manner during uncertain times. This would help us fully utilize our current expected maximum capacity of close to three million vehicles, enabling more than 50% growth over 2023 production before investing in new manufacturing lines.

While analysts have been cutting their 2025 vehicle volume estimates for a while now, they still seemed to be above what it looked for given the current Tesla lineup. Now, it appears that the company will be able to return to some level of growth next year, although it will be interesting to see if consumers hold off on vehicle purchases now given new cheaper vehicles will be coming.

The valuation argument

What Tesla shares should be worth has been one of the biggest arguments on the street over the past decade. Traditional automakers like Ford (F) and General Motors (GM) trade at single digits on a price to earnings basis, and around 0.3 times their expected yearly sales. With Tesla rapidly growing, the bull camp was able to argue that a large premium was deserved, with the EV giant going for 50-100 times earnings at times and mid to high single digits on a price to sales basis.

Now that Tesla isn’t growing as fast, and a lot more competition has entered the fray, one may argue that a premium valuation is no longer warranted. Entering Tuesday’s report, Tesla still commanded a large valuation over many of its EV peers as the chart below shows, going on price to expected sales for 2025. Tesla was nearly four times the average of Lucid (LCID), VinFast (VFS), Rivian (RIVN), XPeng (XPEV), BYD (OTCPK:BYDDY) (OTCPK:BYDDF), NIO (NIO), and Polestar (PSNY).

Tesla Price to Sales Comps (Seeking Alpha)

Recommendation / final thoughts:

It’s clear that Tesla management reacted to the falling share price given that it was mostly tied to the reduction in street estimates for vehicle volumes, revenues, and earnings. Pushing ahead these new models on the old production platforms is a good way to focus on short-term delivery growth, but it probably won’t deliver the financial results in the longer term that bulls had previously been hoping for, especially on the margin side.

Given that management has thrown a line to those arguing for more growth in the near term, I’m going to upgrade my rating back to a hold for now. This new plan seems to be liked by investors so far, with the stock up about 8% in the after-hours session and more than 12% from the recent low. Management will now have to execute on this new plan, and consumers will be curious to see what these lower priced models are. While I would not be a buyer of shares currently, Tuesday’s report in the end removes the bearish stance I had previously as the stock has come down considerably since.