Sunny/DigitalVision via Getty Images

Investment Thesis

Tesla, Inc. (NASDAQ:TSLA) has lost its first to market advantage and faces intense competitive pressure as Musk insists on his ~$50 billion pay package.

A slowdown in global EV sales and a stale product line has caused Tesla’s Q1 2024 sales to drop 9% YoY. Tesla is now increasingly banking on autonomous driving, AI and robotics to justify its forward earnings multiple of 70.

Even in those areas, Tesla does not particularly shine. Many companies are working on full self-driving (“FSD”), and some are not far behind Tesla, if not ahead of Tesla. Tesla has no (other) AI products to speak of and the Tesla Optimus robot is far from a leader in its field, let alone being a significant revenue driver.

Results are likely to disappoint in the coming quarters and years. As a result, faith in Tesla and Musk will erode, triggering a significant re-rating of the stock.

The many red flags of Tesla

Stale product line-up vs increasing competition

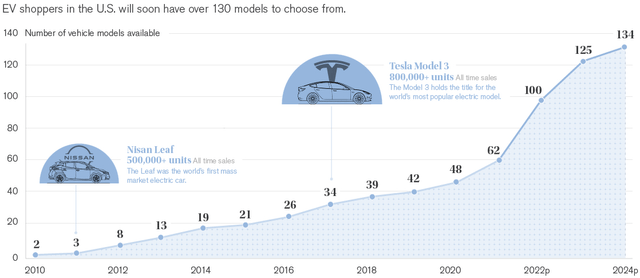

Tesla is losing its first-to-market advantage fast. The model Y and 3 have now been on the market for 4 and 7 years, respectively. It is also increasingly likely that no new model is coming anytime soon.

The competition has not been sitting still meanwhile. There are more electric models on the market now than ever, with even more affordable models being introduced soon. Some notable ones include the Chevrolet Equinox EV and the Fiat 500e.

EV models available by year (visualcapitalist.com)

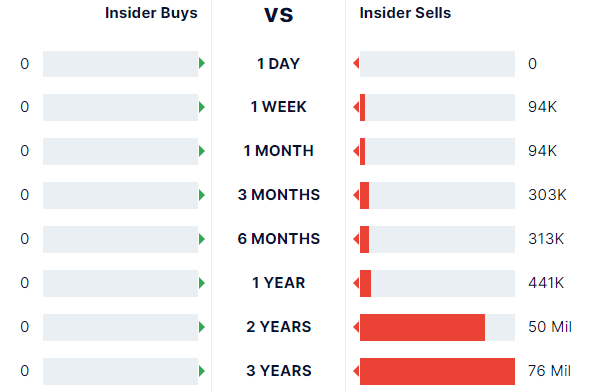

Heavy insider selling

If anyone knows the health and prospects of a company, it’s the insiders, and they’ve been selling.

More revealingly, insiders have not bought a single share in the last 3 years.

Recently, former Tesla executive Drew Baglino sold $181.5 million worth of stock after quitting.

Below, you will find a chart highlighting the amount of Tesla shares that have been sold and bought by insiders in the last 3 years.

Insider transaction overview. (gurufocus.com)

Musk’s erratic leadership

It seems not a month goes by without CEO Elon Musk doing something controversial. Walter Isaacson, who has followed Musk for 2 years to write his biography, made a notable observation: “He’s Addicted to Drama, He’s Addicted to Risk.”

Musk is infamous for overpromising and underdelivering. Musk has been promising self-driving cars for almost 10 years now.

Musk hinting at self driving in 2020 (x.com)

Musk is also notoriously difficult to work with. He’s known to dismiss employees on a whim and reportedly has unpredictable mood swings.

Musk also has a peculiar attitude towards his employees and shareholders. Take the recent lay-offs for example.

To “prepare Tesla for the next wave of growth,” Tesla is laying off 10% of its global workforce. A former employee stated: “I got the email on my off day, and they sent it in the middle of the night — no warning.” He was dismissed out of the blue.

This ties in to the reason Musk doesn’t like unions. It would give his workers more rights. On average, Tesla workers make 30% less than UAW automakers while being expected to “sleep on the production lines.“

Meanwhile, Musk insists he really deserves his ~$50b dollar bonus while tweeting he is “uncomfortable growing Tesla to be a leader in AI & robotics without having ~25% voting control.”

This presents investors with two potentially bad outcomes. Huge share dilution as a result of the bonus or the potential shutdown of entire business segments combined with the departure of Musk as CEO.

Tesla’s questionable leadership team

In my view, the independence of Tesla’s board is questionable. Take for example Ms. Denholm, the chairman of the board. Her job has earned her more than $280 million. In court in 2023, Ms. Denholm described that pay as “life changing.”

Other members of the board consist mostly of close friends, limiting effective checks and balances on his leadership.

A critical look at Robotaxis

As Tesla’s core business is stagnating, Tesla needs a new narrative to keep investors excited. The promise of utopian self-driving robotaxi’s is a lot more attractive than a stagnating car business.

While I don’t question that there will be self-driving vehicles. I do question the timeline at which they will be deployed and their profitability once they are.

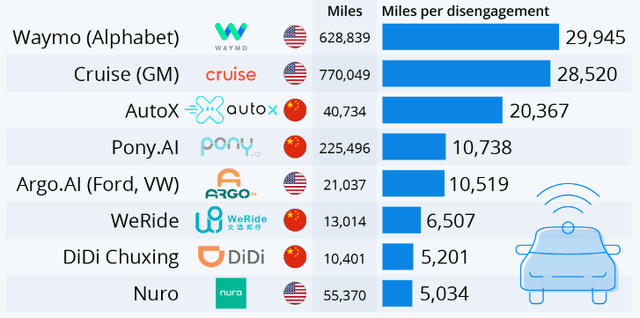

Besides, Tesla is not the only company working on self-driving vehicles. There are many companies working on it. Most of them are not far behind, if not ahead, of Tesla. Take, for example, Waymo, which is already operating a robotaxi service.

Another example is Nvidia’s (NVDA) DRIVE, which is a self-driving platform for the entire automotive industry to use. Who would want to license software from Tesla (a competitor), while there is such an alternative?

There are also multiple Chinese companies with self-driving software matching or exceeding Tesla’s FSD. Take the Huawei AVATR 11 for example.

One metric of objectively measuring self-driving performance is “miles per disengagement.” A fan-based tracker estimates the figure is about 200–400 miles for Tesla’s FSD v12+

To show you just how unimpressive that is, here is a chart from 2019-2020 from other companies.

Miles per disengagement in 2020 (statista.com)

In short, no valuation premium should be assigned to Tesla’s FSD, as it has no competitive edge. The self-driving industry is already highly competitive.

Tesla’s Optimus project

In January 2024, Musk shared a video of the Tesla Optimus robot folding laundry. After users found out it was being controlled by a human through teleoperation, Musk quickly added commentary that “Optimus cannot yet do this autonomously.”

A few months later, Musk announced that Tesla may start selling its Optimus humanoid robot next year. Musk thinks demand could be as high as 10 to 20 billion units. He went as far as “confidently predicting” that Optimus will account for “a majority of Tesla’s long-term value.”

Another grandiose claim by Musk. How realistic is it really? As with self-driving, there are many companies working on humanoid robots.

Boston Dynamics, a leader in humanoid robotics, already has a humanoid robot that can jump, run and make backflips. The best we’ve seen Optimus do is walk. Slowly.

Another company, Figure AI, is developing a humanoid robot that that integrates OpenAI, rivaling or even exceeding the capabilities of the Tesla Optimus in the general AI department.

Nvidia is also getting in on humanoid robots with Project GR00T. This is an AI platform for leading humanoid robot companies, including Boston Dynamics and Figure AI.

Again, Tesla does not have a competitive edge here, and no valuation premium should be assigned to this segment.

Valuation analysis.

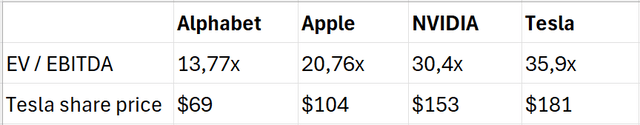

Tesla’s valuation is very optimistic to say the least. I will compare Tesla to the following tech companies: Alphabet Inc. (GOOG), Apple (AAPL) and Nvidia.

We will be doing the valuation analysis based on an EV/EBITDA basis, which provides a good indication of the underlying business profitability and includes debt. Valuation will be based on 2024 forward earnings.

The “Tesla share price” row shows Tesla’s share price if it were valued at the same multiple.

Based on the above figures, investors believe Tesla’s future profitability is worth more than even Nvidia. A rich valuation if i’ve ever seen one.

This premium has in part been caused by falling earnings. People are debating whether Tesla should be removed from the “Magnificent 7.”

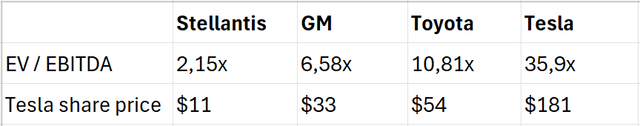

As of Q1 2024, more than 80% of Tesla’s revenues still come from the automotive business. So it makes sense to compare Tesla’s valuation to other automotive companies. I will compare Tesla to the following automotive companies: Stellantis (STLA), General Motors (GM), and Toyota (TM).

Compared to other car companies, Tesla’s valuation makes little sense. Should Tesla really be valued more than 5 times as high as General Motors? Even as its margins are no longer higher than the industry?

Even if we’re being optimistic, and assume Tesla is partly a technology company, a value of more than $75 per share is difficult to justify on a fundamental basis.

Risks

At the end of the day, the stock price is decided by supply and demand. If Tesla investors keep their bullish convictions, the stock might not go down anytime soon. An economist is already calling Tesla a meme stock, which reminds me of an (in)famous quote by John Maynard Keynes:

Markets can remain irrational longer than you can remain solvent.

Other than a major breakthrough or a 180-degree shift in growth and earnings, I don’t see many other positive catalysts for Tesla.

Conclusion

The vast number of “red flags” for Tesla, Inc., combined with an incredibly rich valuation, lead me to conclude Tesla stock is a Strong Sell.

As current results are disappointing, most of Tesla’s valuation is attributable to investor belief in its future growth potential, which is unlikely to materialize.

As competition continues to intensify, growth stalls and governance issues increasingly cause problems, I believe investor confidence will continue to erode, leading to a significant re-pricing of the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.