Thananat/iStock Editorial via Getty Images

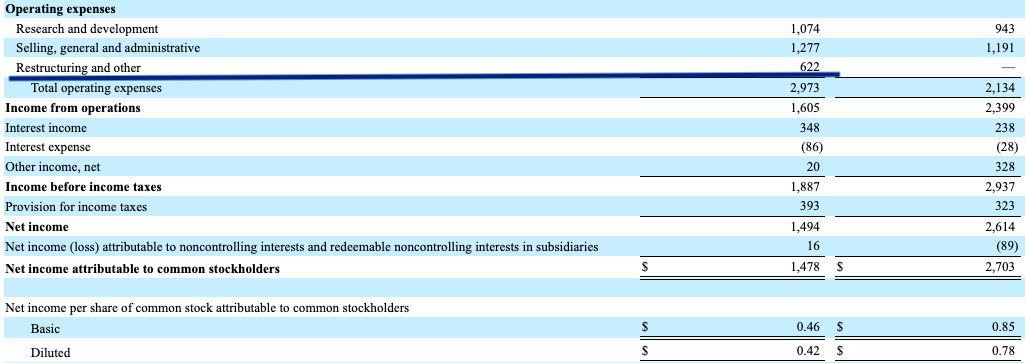

Tesla, Inc. (NASDAQ:TSLA) stock has seen a strong bearish correction after the recent earnings as the company missed earnings estimates and delayed its robotaxi event by another two months. However, this correction is overdone, and we can see strong tailwinds for the company in the upcoming months. Tesla reported restructuring charges of $622 million in the recent quarter. This was one of the key reasons the net income declined from $2.6 billion in the year-ago quarter to $1.5 billion in the recent quarter. Since the previous article published in February 2024, Tesla stock has shown a 15% return compared to 7% by S&P500.

Tesla reduced its global headcount by 10% in April. This cost optimization initiative should provide a big boost to the profit margins in the next few quarters. We have already seen how Meta Platforms (META) and other big tech companies were able to boost their EPS in 2023 with the help of massive layoffs.

The minor delay in robotaxi event to 10th October should allow the company some more time to complete rigorous testing of this product. In the self-driving space, it is better to be late than have a negative performance. We have already seen the massive issues faced by General Motors’ (GM) Cruise, and it is now cancelling the launch of its autonomous Origin vehicles. It is highly likely that the self-driving industry will be cornered by three big tech companies: Alphabet’s (GOOG) Waymo, Tesla, and Amazon’s (AMZN) Zoox. Waymo recently announced completing 2 million paid rider-only trips, which shows a good growth curve since the service was launched in August 2023. This is quite positive for Tesla as we could see a similar or higher growth once the robotaxis are launched.

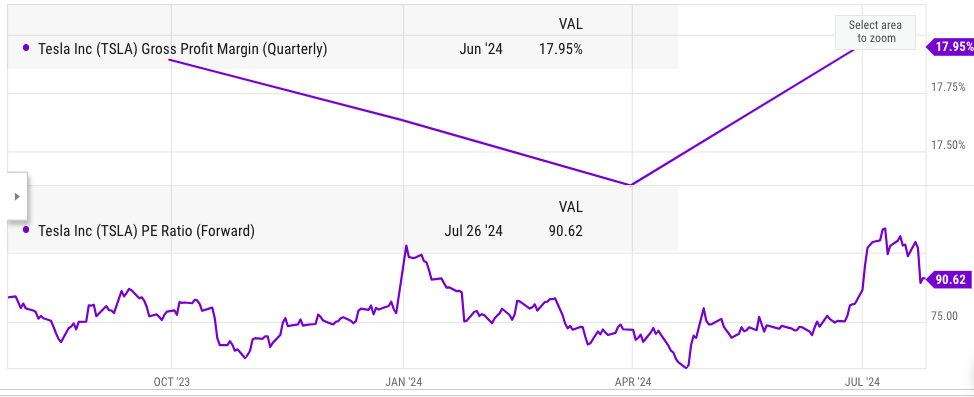

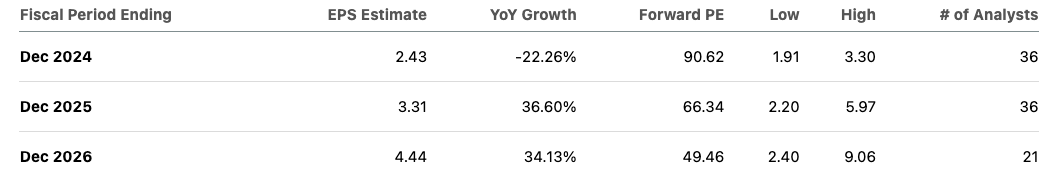

Tesla’s biggest headwind is due to the recent statements made by CEO Elon Musk, which can hurt the overall brand. As more EV options come into the market, we could see a big segment of the customer base avoid Tesla if the brand is perceived as toxic. Tesla has a forward P/E ratio of 90 and the consensus EPS estimate for 2026 is $4.44 which would give the stock a PE ratio of 50 for the EPS 2 fiscal years ahead. This is quite an expensive multiple, and Tesla would need to show good progress in the robotaxi segment to improve the valuation multiple from this level. However, the EPS trajectory might improve in the next few quarters due to cost optimizations, which will be a strong tailwind for the stock in the near term.

Bearish sentiment is overdone

Tesla missed the EPS estimate by $0.10 and reported a delay in robotaxi event by two months. Both these factors have led to a double-digit correction in the stock after the earnings. A big reason behind the increase in operating expenses has been the restructuring expense of $622 million. This was the main reason operating expenses increased from $2.1 billion in the year-ago quarter to $2.9 billion in the recent quarter. The 10% layoffs from global headcount announced earlier this year should help Tesla improve its net income in the next few months. We saw a massive improvement in EPS trajectory of several big tech companies in 2023 as they implemented their cost optimization initiatives.

Tesla Filings

Figure: Restructuring charges have a massive cost for Tesla. Source: Tesla Filings.

The scale of layoffs from Tesla was massive, and we should see a big improvement in profit margin due to this initiative. On the other hand, Tesla’s gross margin has been relatively stable, coming at 17.95%. This is slightly lower than the 18.19% gross margin reported by the company in the year-ago quarter. It is a positive development because we have seen massive price cuts in the last few quarters as the Chinese EV industry rapidly improves its market share.

YCharts

Figure: Gross profit margin and forward P/E ratio of Tesla. Source: YCharts.

Delay in robotaxi event

The delay in robotaxi event has been another big reason behind the recent correction. However, the delay is only for two months and this indicates that the company is very close to launching its robotaxi program. More time for comprehensive testing before commercialization should help Tesla encounter lower issues. We have seen the massive challenges faced by GM’s Cruise, which has led to curtailing the program despite massive investment.

The recent expansion of Alphabet’s Waymo is a very positive development for Tesla. Waymo’s growth has increased customer acceptance and removed some of the regulatory issues that were there. This should make it easier for Tesla to gain regulatory approvals. It is likely that regulators would not want a monopoly in self-driving space from Alphabet’s Waymo. Alphabet has recently announced another $5 billion “multiyear” investment in Waymo, which is a big vote of confidence for this program. Waymo has also completed over 2 million paid trips since its launch in August 2023. The massive investment shows that the entry barrier in the self-driving industry is quite high and very few players would be able to afford it. We have already seen Apple (AAPL) with its massive resources end its self-driving Project Titan.

Tesla along with Waymo and Amazon’s Zoox will likely be the main player with overwhelming market share in the self-driving industry. Waymo has completed more than 2 million paid-trips in less than 10 months of operation. This service is being launched in more cities and is now open to all customers. The total paid-trips might increase rapidly in the next few months. It should also be noted that self-driving taxis are a small fraction of the total addressable market. We should see the expansion of this service to robotrucks and package delivery in the near term. According to Bureau of Labor Statistics, BLS, there are more than 5 times truck drivers as there are taxi drivers. Successful expansion of Waymo in new cities and segments should improve the estimates of the addressable market for Tesla and boost the overall sentiment towards the stock.

Risks for Tesla investors

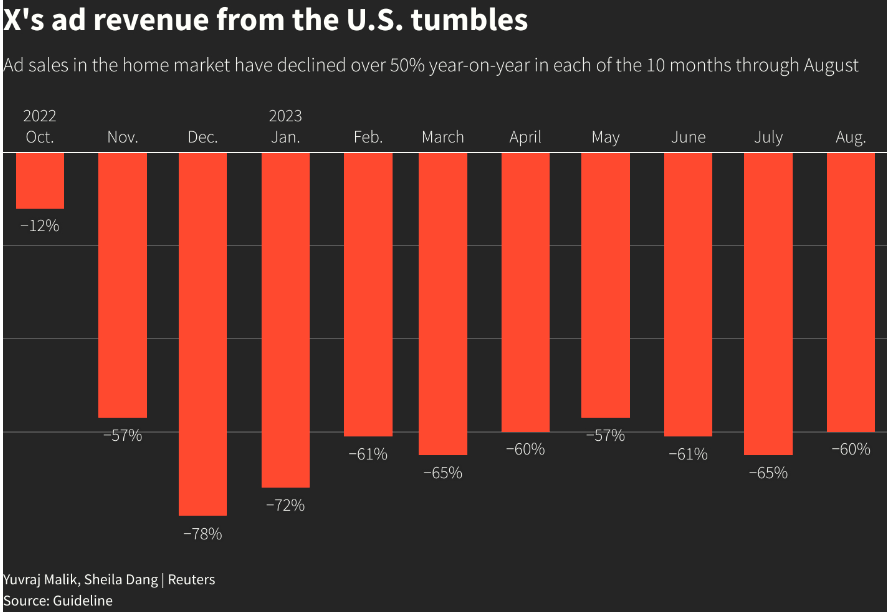

Tesla stock has always received a big premium compared to other auto companies and also many tech companies. A lot of this premium is tied to Elon Musk and the ability to launch new exciting products and services. However, some recent statements by Musk can be quite extreme for some customer base. This can make the brand a bit toxic and hurt the ability of the company to effectively compete with new EV options.

We have already seen a massive decline in revenue on X within a very short time. According to Reuters, the YoY revenue of X has declined by close to two-thirds in 2023.

Reuters

Figure: Ad revenue decline in X. Source: Reuters.

We could see strong headwinds for Tesla if the brand image tied to Musk changes drastically.

Another major risk is the slowdown in new products launched by Tesla compared to some Chinese EV brands. The new EV options by BYD are priced at very attractive levels in China and Tesla would find it difficult to compete with them if they increase their market share in other international regions including Europe.

Impact on Tesla stock

Tesla’s recent quarterly gross margin is quite stable despite new competition. The company also has the resources and skills to successfully launch and ramp up its robotaxi service despite delays. However, the biggest near-term impact will be due to cost cuts, which can see a strong upward revision in EPS estimates in the next few quarterly results.

There is a massive gap between the low and high EPS estimates of Tesla among analysts. For the fiscal year ending 2025, the lowest EPS estimate is $2.20 and the highest is $5.97. For the fiscal year ending 2026, the gap is even bigger, with lowest EPS estimate of $2.40 and highest EPS estimate of $9.06.

Seeking Alpha

Figure: EPS estimates of Tesla. Source: Seeking Alpha.

In other big tech companies, this forward EPS estimate gap is not as big as Tesla. As an example, Alphabet’s lowest EPS estimate for fiscal year ending 2026 is $8.5 and the highest is $11.2. The big gap in Tesla’s forward EPS estimate can cause higher volatility and also gives investors an opportunity to enter the stock if there is a big correction.

I believe Tesla has a strong near-term tailwind in terms of EPS as the cost optimization from recent layoffs delivers positive margin expansion. A successful launch of the robotaxi service should also be a major boost to sentiment and help in improving the valuation multiple. Over the medium term of 2–3 years, the launch of robotaxis and its expansion should improve the bullish sentiment toward the stock. While the stock seems expensive at 90 times the forward PE ratio, we could see a strong uptick in EPS estimate trajectory by the end of 2024.

Investor Takeaway

Tesla stock has shown a correction after the recent earnings as it missed the EPS estimate and delayed its robotaxi event. However, the company reported a big restructuring cost of $622 million, which negatively affected the EPS. These cost optimizations should create a good tailwind by the end of the year as the profit margin expands.

Tesla’s robotaxi event delay is also minimal, and it is likely that the company is close to completing the testing for this service. A successful launch and ramp up of robotaxi service and improve the valuation multiple of the stock. I maintain a buy rating for the stock.