baileystock

I’ve been a Tesla, Inc. (NASDAQ:TSLA) bull for a long time, and expressed my bullish stance in my previous Tesla article. In fact, I remember it like yesterday. I purchased my first Tesla stock in October 2013, almost 11 years ago. Split adjusted, Tesla was around $11 bucks then. So, we’re looking at a more than 2,100% return, making Tesla one of my best-performing investments over the years.

Of course, the size of my Tesla position has varied considerably over time. It’s gone from my most significant position (2015-2018) to a minor holding recently. There have been times when I exited Tesla shares completely, especially when increased volatility and substantial downside occurred.

However, I picked up Tesla shares during its generational bottom buying opportunity at around $100. Also, I’ve been steadily increasing my Tesla position in recent quarters. Last quarter, I bumped it up to around 8% of my total portfolio holdings, and the stock took off. Now, Tesla is the best-performing stock in my portfolio, up by around 25% in the first five days of Q3.

But we are not here to talk about the past. Let’s talk about the future instead. Despite Tesla’s 80% surge from its temporary low point in mid-April, Tesla’s stock has considerable upside potential in the intermediate and long term. Tesla recently beat the consensus Q2 delivery estimates, implying it could beat consensus sales and EPS estimates. It is set to report Q2 earnings post-market on July 23rd.

Additionally, Tesla has received substantial, numerous upgrades, and the company’s standoff with CEO Elon Musk apparently has ended peacefully (a $56B pay package has been approved by shareholders). This opens the door to future AI, robotics, full self-driving (“FSD”), and other developments that could drive Tesla’s stock price much higher as we advance.

The Technical Image – Bullish Despite Being Overbought

Tesla has skyrocketed by 80% since its low point around mid-April. There have been numerous positive developments, but perhaps the most notable was the approval of Elon Musk’s pay package. This dynamic implies that Elon Musk will likely get his 25% stake in Tesla, which will give him enormous control over the company and voting rights. Elon’s stake was around 22% before he sold shares to buy Twitter (now X). With the increased control, Elon could push Tesla aggressively into AI, robotics, FSD, and other lucrative ventures. Therefore, the approval of his pay package was a significant development and a clear buy signal for Tesla’s shares. I increased around the $170-180 buy-in zone, and sent out an alert to our Investing Group members.

Tesla’s stock has enormous intermediate and long-term potential, but technically, the stock is significantly overbought now. The stock has turned vertical, and the RSI is around 85, which is the highest level in years. The CCI, full stochastic, and other technical indicators are also highly overextended here, suggesting we may have a consolidation or a pullback soon before proceeding higher again. Despite the possibility of near-term turbulence, I expect Tesla’s stock to be considerably higher by year-end.

Tesla’s Deliveries – The Slowdown Was Transitory

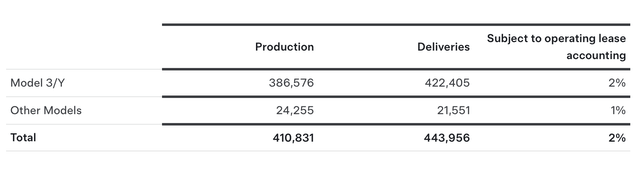

Production and deliveries (ir.tesla.com)

Tesla delivered 422,405 total vehicles last quarter, considerably higher than many estimates. While the consensus estimate was for around 439K, many analysts on Wall St. had much lower expectations. For instance, Barclay’s estimated only 415K deliveries in the quarter. RBC had the estimate down to just 410K, and UBS expected just 420K. Therefore, Tesla surprised many analysts by delivering a solid number, implying it will likely beat its Q2 sales and earnings estimates soon.

Tesla’s Q1 Model 3/Y average selling price (“ASP”) was likely around $40K due to the temporary slowdown in EV sales, a sluggish economy, and Tesla price cuts. However, Tesla raised prices in Q2, and the ASP for the Model 3/Y segment may have increased to around $41,000 in the second quarter.

Also, due to high-interest rates, fewer people seem to be leasing Teslas, as only 2% of Model 3/Y vehicles were subject to lease accounting in the second quarter. Therefore, Tesla likely sold around 414K Model 3/Y cars last quarter.

Tesla’s “other models” primarily include Model S/X, and there are still very few Cybertruck vehicles. The company mostly sells higher-end Cybertruck models currently, and the ASP for the other model segment may be around $110,000. Tesla also sells many higher-end Model S/X vehicles with expensive options that can drive prices to $130K or higher in numerous instances. Only 1% of the other model segment was subject to lease accounting in Q2. Thus, Tesla may have sold around 21,335 vehicles in this higher-end segment.

My Q2 Estimates

- Model 3/Y: 414,000 X $41,000 = $17B

- Other Models: 21,335 X 110,000 = $2.4B

- Regulatory credits: $500M

- Automotive leasing: $500M

- Total automotive sales: $20.4B

- Energy generation/storage: $2B

- Services and other: $2.6B.

Total Sales Estimate: $25B

Gross Profit: $4.55B

- R&D: $1.1B

- SG&A: $1.4B

- Operating Costs: $2.5B

- Operating Profit %: 8.2%.

Operating Profit: $2.05B

- Interest income/expense/other income: -$100M

- Income tax provisions: $500M.

Net Income (GAAP): $1.45B

EPS (normalized): $0.63.

Tesla Likely To Outperform Q2 Estimates

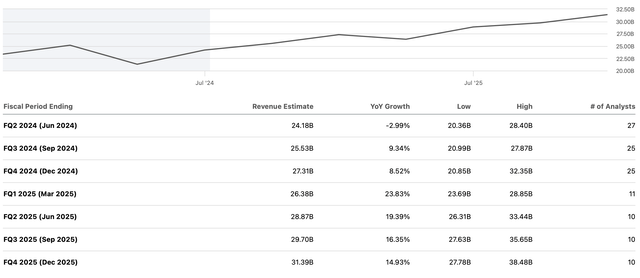

Sales estimates (seekingalpha.com )

Tesla’s consensus revenue estimate is $24.18B vs. my $25B estimate. However, the estimate range is vast, ranging from just $20.36B to a street-high estimate of $28.4B. This is an interesting range, but I believe Tesla will deliver around $25B in sales for Q2, which should be received favorably by the market.

Moreover, we must look ahead. An easier monetary policy should lead to lower interest rates, sparking demand for EVs, Teslas in particular. We should also see an increase in Cybertruck sales as the vehicle’s production picks up steam. Also, we must look at future sales increases from FSD, robotics, AI, and other Tesla initiatives.

2024 A Low Point For Tesla

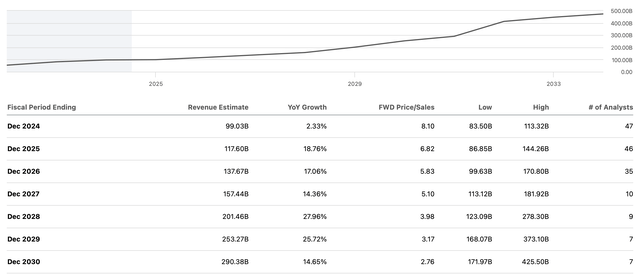

Sales estimates (annual) (seekingalpha.com )

Tesla’s sales will likely only increase by single digits this year. The EV demand slowdown, high interest rates, a temporary oversaturation in the market, and other transitory elements caused Tesla’s growth to slow considerably, providing an excellent buying opportunity for long-term investors.

Despite the slowdown this year, Tesla’s sales should increase considerably in future years, posting solid double-digit growth for (possibly) many years as we advance. While next year’s consensus estimate is about $118B, the higher-end estimates go above $140B, suggesting that Tesla’s revenues could increase much more than expected.

EPS Projections May Be Too Low

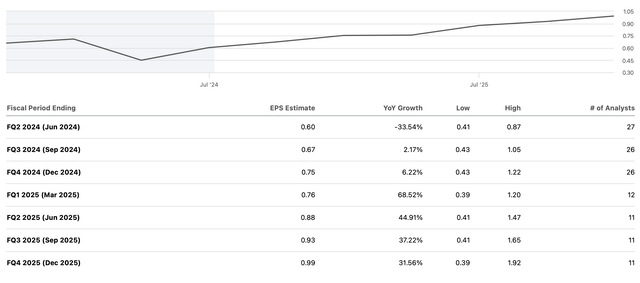

EPS estimates (seekingalpha.com)

The Q2 consensus estimate is $0.60, but the range is 41 cents to 87 cents. My estimate is $0.65, but the EPS number could be higher. Also, Tesla’s earnings are around a low point now, which is typically the time you want to accumulate shares for the long term. While 2025’s consensus EPS estimate is only $3.51, the higher-end estimates go beyond $6. Tesla’s 2026 consensus EPS estimate is only around $4.50, but the higher-end estimates are above $9. I believe Tesla’s EPS estimates are far too pessimistic here, and there is a high probability that Tesla can achieve higher-end EPS estimates or better in future years.

The Upgrades Likely To Continue

We’ve seen significant upgrades for Tesla’s stock recently. For instance, Wedbush recently boosted its 12-month price target “PT” to $300 for Tesla and set a $400 PT as its bullish case outcome. The note indicates that the street is starting to realize that Tesla may be the most undervalued AI play in the market right now. Dan Ives and the bull team at Wedbush believe that Tesla’s FSD segment may be worth $1 trillion alone at some point.

Wedbush is often ahead of the herd regarding tech stocks, but they are certainly not alone in getting more bullish on Tesla. Recently, Steifel became bullish, launching a $265 PT for Tesla. For reference, this PT was launched when Tesla was still below $190. Morgan Stanley (MS) has a $310 price target on Tesla, and I believe there are many upgrades ahead, which should enable Tesla’s stock to move much higher in future years.

Where Tesla’s Stock Could Go From Here

| The Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $105 | $137 | $171 | $205 | $255 | $285 | $320 |

| Revenue growth | 8.5% | 30% | 25% | 20% | 23% | 12% | 12% |

| EPS | $3.35 | $6 | $9 | $12 | $16 | $20 | $24 |

| EPS growth | 7% | 79% | 50% | 33% | 32% | 25% | 20% |

| Forward P/E | 50 | 52 | 50 | 48 | 45 | 40 | 35 |

| Stock price | $300 | $470 | $600 | $768 | $900 |

$960 |

$1,020 |

Source: The Financial Prophet.

I’ve adjusted my estimates since my previous Tesla analysis. While my last sales growth estimates may have been too aggressive (relative to consensus figures) for a base case scenario, Tesla’s revenues could increase more and faster than expected in a bullish case outcome. I’ve also adjusted the forward multiple, as Tesla’s P/E ratio could remain higher than previously anticipated due to its high AI, robotics, FSD, and other potential. The underlying are my “base-case” estimates, but Tesla’s sales, earnings, and stock price could appreciate substantially more in a bullish case outcome.

Risks To Tesla

Tesla has risks despite my favorable assessment. In the near term, Tesla faces demand growth issues as the EV industry remains sluggish. Also, we see substantial competition in the EV segment for Tesla in the lower, mid, and high-end markets. There is also the risk of a slower-than-anticipated economy for longer. High rates could continue impacting demand. There is also the Cybertruck ramp-up and some uncertainty regarding how it will affect the bottom line. There are also valuation concerns, as Tesla appears overvalued by some metrics. The stock is also overheated technically for the near term. Investors should consider these and other risks before establishing a position in Tesla.