Monty Rakusen

I upgraded Tesla, Inc. (NASDAQ:TSLA) to “Strong Buy” in my previous coverage published in May 2024, highlighting its growth opportunities in the full self-driving (FSD). Since then, the stock price has surged by more than 32%. The company is set to report its Q2 results on July 23rd after the market close. Although Tesla is facing challenges such as declining production/deliveries and a delay of the Robotaxi event, I remain confident in Tesla’s FSD technology, and reiterate a “Strong Buy” with a one-year target price of $295 per share.

Declining Production/Delivery

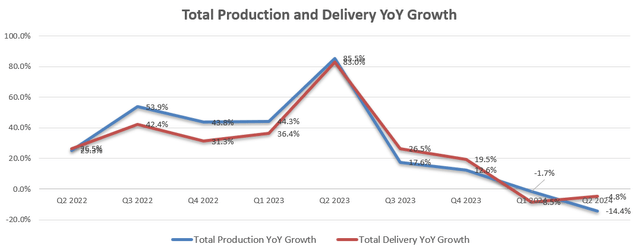

Tesla released its Q2 production/delivery figures on July 2nd, showing a 1.7% decline in electric vehicle (“EV”) production and an 8.5% decline in delivery, as depicted in the chart below.

I think the decline in both production and delivery is quite reasonable and understandable. The reasons are:

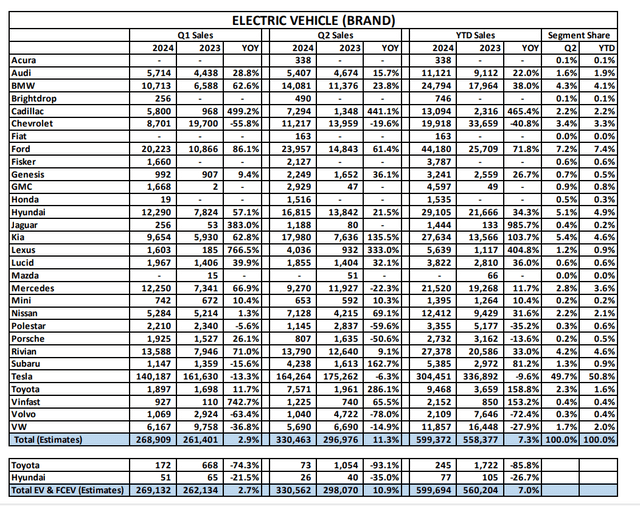

- Cox Automotive reported that EV sales in the U.S. grew by 11.3% year-over-year, reaching a record volume of 330,463 units. While Tesla remains the leading player, its market share has dropped below 50% for the first time due to the growth of other brands such as BMW, Cadillac, Honda, and Kia etc., as detailed in the table below. Tesla’s weak growth in Q2 could be caused by the introduction of new models from other brands, including BMW i5, Cadillac Lyriq and Kia EV9 SUV.

- As reported by the media, Tesla halted its production in German plant for five days in June to improve processes in the factory. The temporary shutdown may have impacted the total product and delivery growth in Q2. However, I view this event as one-time in nature.

Overall, I remain confident with Tesla’s leading technology, both in EVs and autonomous driving, as emphasized in my previous coverage. It is understandable that other brands are beginning to launch more and more EV models to catch market share. However, the whole EV market is enormous, with penetration growth just beginning. According to Kelley Blue Book, EV sales accounted for only around 8% of total new-vehicle sales in Q2.

Delay of Robotaxi

Elon Musk confirmed that the upcoming Robotaxi event, originally scheduled on August 8th, has been delayed, with no new date announced yet. It appears that Tesla is still making some last-minute changes to its Robotaxi architecture. The delay might give Tesla’s R&D team additional time to unveil a more advanced Robotaxi vehicle.

I don’t view the delay of Robotaxi as a material issue for the company. Instead, I am more interested in the progress that Tesla has made in its AI training. As discussed in my previous coverage, one of Tesla’s main competitive advantages is its vast real-world driving data, which can be leveraged for AI training. With AI-powered autonomous driving, Tesla has the potential to disrupt the entire autonomous driving market.

As reported by the media, Tesla is nearing completion of a new 50k H100 chip data center extension near its Giga Texas. In addition, Tesla is adding 20k of its HW 4.0 AI computers into the data center. The massive AI computing power could potentially accelerate advancement in its FSD.

China Growth

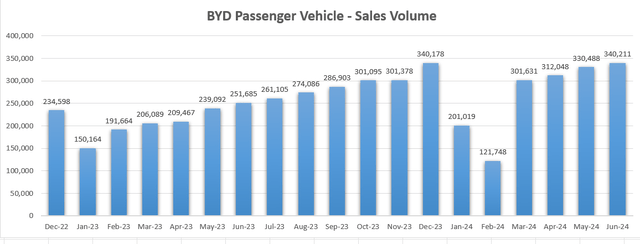

China is a critical region for Tesla, accounting for more than 20% of total revenue. BYD Company (OTCPK:BYDDF) posted a strong volume growth in June 2024, as shown in the chart below. BYD’s EV volume increased by 35.2% year-over-year in June, indicating a robust recovery in the domestic EV market.

GizmoChina reported that Tesla’s Shanghai Gigafactory is currently operating at full capacity, with the Model Y production line producing a new car every 30 seconds. I anticipate that China will continue to be a strong growth market for Tesla. More importantly, as discussed in my previous coverage, Tesla’s FSD could potentially start to commercialize in China soon.

Valuation Update

As pointed out in my previous coverages, I don’t view Tesla solely as an automaker. Instead, FSD significantly enhances the company’s valuation.

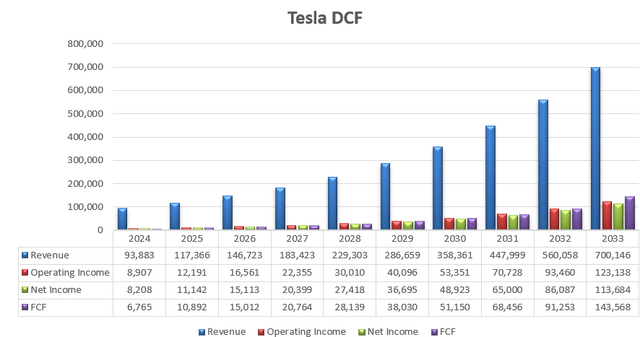

I view FY24 as a transitional year for Tesla, facing several challenges, including a factory shutdown, price cut, new EV models launched by competitors, and delays in its Robotaxi event etc. Based on the current production and delivery data, I forecast a 3% decline in revenue for FY24.

For long-term growth rate, my calculation is straightforward. As discussed earlier, EV sales accounts for only 8% of total new-vehicles sales. I project that the EV market will grow at a CAGR of 19.8% over the next 10 years, assuming:

- The EV penetration will rise to 40% within the next decade.

- The total passenger vehicle market will grow by 2% annually, primarily driven by population growth.

In addition, I forecast FSD could potentially contribute an extra 5% to the topline growth. Consequently, I forecast Tesla will deliver a 25% growth in revenue in the near future.

The margin expansion will be driven by the operating leverage from business scales, primarily via gross profit leverage. In the DCF model, I assume the average selling price for EVs to decline over time, as more brands will participate in the market. I forecast Tesla can expand its margin by 90bps annually assuming the total operating expenses will grow by 23.7% year-over-year.

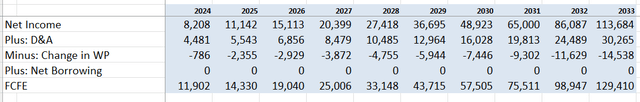

The discounted cash flow (“DCF”) summary can be found in the chart below:

Tesla DCF – Author’s Calculations

I calculate the free cash flow from equity as follows:

Tesla DCF – Author’s Calculations

The cost of equity is estimated to be 17% assuming: risk-free rate 4.2% (US 10Y Treasury Yield); beta 1.83 (SA); equity risk premium 7%. Discounting all the free cash flow, the one-year price target is calculated to be $295 per share, as per my estimate.

Key Risks

My valuation of Tesla relies on the success of its FSD technology. Without FSD, Tesla’s fair value would be at least $100 lower than my target price, as per my simulations. Tesla’s FSD technology has experienced several delays in the past. Of course, CEO Elon Musk has broken his promises numerous times as well.

Additionally, former President Trump has expressed intentions to end the Inflation Reduction Act and redirect EV credits to gasoline vehicles. If this were to happen, the entire EV market could face significant challenges.

End Notes

It looks like all the negative news has impacted Tesla in FY24, raising many questions and concerns about the company’s long-term prospectus. I remain confident that Tesla is the leading player in both EVs and autonomous driving. Its AI-based FSD technology has the potential to disrupt the entire industry. I continue to be a long-term shareholder of Tesla and reiterate a “Strong Buy” with a one-year target price of $295 per share.