Hiroshi Watanabe

Overview

I have a few coverages of Tesla, Inc. (NASDAQ:TSLA). Most notable for this discussion is my initial coverage and my most recent coverage. Both articles are quite bullish on the company itself, and the recommendations have underperformed the market since publishing. My initial article titled “Tesla: Electrifying the Earth” was focused on Tesla’s dominant market share in electric vehicles (“EVs”) and why it was likely to be retained. That thesis remains intact in the U.S. market but is being challenged by an influx of cheap Chinese competitors in the Asian and European markets.

My most recent coverage was about Tesla’s core business and why the company is more than just another auto manufacturer. In this article, I touch on the company’s manufacturing process, the Supercharger network, and the Dojo Supercomputer as key factors for Tesla becoming the most valuable company in the world.

The time that has passed between those articles and today has not been kind to Tesla stockholders. The market has punished Tesla ruthlessly through Q1 2024, but sentiment seems to be changing. I remain bullish on Tesla and reiterate my Buy rating, although I note that my thesis has changed quite significantly since my initial coverage. Central to the investment thesis in Tesla now is successful execution of full self-driving, or FSD, rollout. CEO Elon Musk is betting the house on FSD and redirecting company focus on its rollout.

Let’s discuss.

Setting the Stage: Leading Up to the Q1 Report

On Friday, April 5th, Reuters released a bombshell report that Tesla would no longer be pursuing a mass market vehicle. This was met with a brutal reaction from the market, but CEO Elon Musk quickly took to X, formerly Twitter, to dispel the rumors. The stock pared some losses. In a shocking twist, Musk later posted that Tesla would unveil the Robotaxi platform on August 8th. The market heavily rewarded the post after hours and the rally continued on through Monday, April 8th.

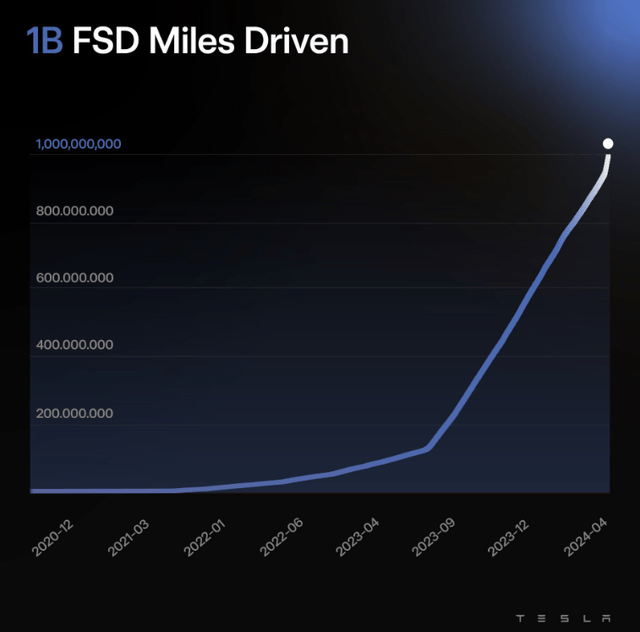

Robotaxi is the long-awaited autonomous driving use case that Musk has been promising for years. Time will tell if “this time is different” or if this is just another bold deadline that the company misses. There is some credence to the bull camp here, namely Tesla’s stockpile of compute between Nvidia (NVDA) H100 GPUs and Dojo chips and the parabolic FSD mileage graph.

Overall, sentiment on Musk’s platform X is mixed on the recently released FSD 12. There are numerous outspoken critics and supporters, but one fact remains: the more mileage on FSD and the more compute powering it, the better.

FSD differs from some other notable autonomous driving players because it’s based entirely on an AI neural network. It makes decisions in real-time based on vast amounts of training data. It is imperfect, requiring “interventions” by users if it seems to be making a mistake. This has been the key obstacle keeping it at ADAS level 2, within the threshold of being “Supervised” autonomy, not full autonomy as the name suggests.

The important difference this time is, again, the compute capacity the company has. The current chip version in Tesla cars is known as “Hardware 4,” or “HW 4” for short. These are 7nm chips, an upgrade from the 14nm HW3 chips. Tesla is reportedly working with Samsung (OTCPK:SSNLF) on HW5 chips, which will be built on a 4nm node. This isn’t expected to hit the market for another few years, though.

Tesla believes it can achieve full autonomy at scale with HW4 and FSD 12 by August 8th, 2024. Time will tell.

Regardless, investors rightfully became wary of the Reuters report about the mass market model (I will refer to it as Model 2). This is the rumored $25,000 model, built to be affordable for vast swaths of the market. Walter Isaacson’s recent biography on Elon claims the model will be built in Austin:

So in May 2023, he [Elon Musk] decided to change the initial build location for the next-generation cars and Robotaxis to Austin, where his own workspace and that of his top engineers would be right next to the new high-speed, ultra-automated assembly line.

Throughout the summer of 2023, he spent hours each week working with his team to design each station on the line, finding ways to shave milliseconds off each step and process.

As he had in the past with both Tesla cars and SpaceX rockets, he knew there was something just as important as the design of the project: the design of the manufacturing systems that would build the products at high volume.

This all ties into Elon’s wider goal of reaching 20 million deliveries per year by 2030. The mass market vehicle is absolutely critical to achieving that goal, both because of its affordability and manufacturability.

Tesla is taking a novel approach with Model 2 which has been dubbed “unboxed manufacturing.” Some years ago, Tesla revolutionized the auto manufacturing process with its gigapress die casting machine. This contributes to the consistently falling unit costs that Tesla reports quarterly. The company is attempting to disrupt auto manufacturing once again with an even larger gigapress and a fresh approach to the process. Instead of manufacturing and assembling parts sequentially, in resemblance to Henry Ford’s assembly line, the “unboxed” method would essentially build all components of the car separately and bring them together into a completed car in one final step. It would be a major step forward, but there’s absolutely no guarantee of success. It will be critical to the scalability of the Model 2.

However, recent speculation in a Reuters report suggests the company may be stepping back from this ambition a bit. The company will report earnings once more before the August 8th date and will likely give an update on this at that time, if not before.

This drama comes at a bad time for Tesla and Elon Musk. The U.S. EV market has been hit with numerous setbacks dating back to the pandemic. In 2020, strong demand was contained by a global chip shortage that cost the auto-market an estimated billions in sales. This was followed by a strong 2021, but this would quickly be overshadowed by the rampant inflation in 2022. In the latter half of 2022 and all of 2023, rising rates eroded auto-demand.

Now, the start of 2024 has seen an utterly abysmal delivery number amidst swirling rhetoric of cheap China EV’s flooding the Asian and European markets. Tesla was the worst performing stock in Q1 of calendar year 2024.

At this time when sentiment seems completely broken, Elon dangled the Robotaxi carrot. And the market is hopeful.

Q1 Earnings Review

The Q1 earnings report and subsequent market reaction was a spectacular display of what makes this stock so frustrating to navigate. The report itself was abysmal, utterly terrible. Yet, the stock jumped up materially.

On one hand, this is partly because much of this Q1 underperformance was priced in. On the other hand, the market was rewarding a shift in strategy.

Tesla reported Non-GAAP EPS of $0.45, missing by $0.05. Revenue of $21.31B missed by $950M and was down 8.5% on the year, this was partially due to reduced vehicle ASP YoY. Auto gross margins fell from 22% in 2023 Q1 to 18.5% in 2024 Q1. The overall gross margin fell as well.

Further, a decline in vehicle deliveries hurt performance, partially due to the Model 3 update in the Fremont factory and Giga Berlin production disruptions. It was a perfect storm for the company. High rates, easing government subsidies, and increased competition made 2023 and Q1 2024 a particularly challenging environment for Tesla. Just when sentiment seemed to be completely broken, Elon Musk managed to convince the market otherwise.

Tesla is betting the house on autonomous driving. Shortly after the earnings report, news broke that Tesla will be partnering with Chinese firm Baidu (BIDU) for localized ADAS implementations. More recently, reports note that Tesla is leaning more heavily into Europe as well

Musk is attempting to rebrand Tesla as a Robotics and AI company to justify the multiple that is materially higher than that of competing auto manufacturers. FSD advancing past regulatory hurdles and clearing the way for Robotaxis would be the first major step in this direction, and this could come as soon as August 8th, 2024. Although, Musk is not known for adhering closely to publicly disclosed deadlines. The rebranding to AI and Robotics comes at a time that the company is diverting focus from elsewhere, such as a pause on the expansion of the Supercharger network. This comes amidst mass layoffs and an exodus of senior executives.

And now Elon Musk is leaning into the publicity that FSD got at the recent Berkshire Hathaway annual meeting, calling on Warren Buffett to buy Tesla stock. While it’s extremely unlikely Berkshire will become a Tesla stockholder, the post came after Buffett commented on how FSD might impact Geico’s pricing power.

One thing is clear: this is an inflection point for the company. Success in FSD would keep Tesla securely in the top 10 most valuable companies globally for the next 10 years. On the other hand, FSD implementation could lead to regulatory headaches and endless litigation. If the company fails to successfully implement FSD, it will be a long and painful contraction down to a lower multiple.

Investor Takeaway

Buying Tesla today basically represents a unilateral bet on FSD. Elon Musk has set his ambition on full-scale commercialization of FSD and Robotaxis, a path that is rife with risk and uncertainty. Elon is axing staff and realigning the company’s focus to AI and robotics. He’s betting big on this to be the next leg of Tesla’s growth. If you believe FSD is likely to succeed, Tesla is a wonderful investment opportunity. If you believe otherwise, then there’s far too much risk presented here.