Yagi Studio

In my last article, I recommended starting a 50/50 investment in Tesla, Inc. (TSLA) and Stellantis N.V. (STLA), a traditional car manufacturer that I believe complements Tesla well. I was, and still am, bullish on both stocks. Some commenters asked about Tesla’s valuation and wanted more details on why I’m bullish on it. That’s why I decided to write a detailed article focusing exclusively on Tesla and what I see as key catalysts in the foreseeable future.

Thesis: I’m focusing on the Model 2 and I don’t see a significant opportunity in Robotaxis presently

My bullish view on Tesla is driven by its brilliant pricing strategy, its clear category vision, and the launch of the Model 2, code-named Redwood. I anticipate the Model 2 will be a simplified version of Tesla’s Model 3, priced around $30,000. In the current car market, with an average new car in the U.S. selling at $48,000, this price tag is competitive to challenge most internal combustion engine (ICE) and hybrid vehicles. I expect it will also significantly accelerate the mass adoption of electric vehicles ((EVs)).

On the other hand, I do not see robotaxis as a realistic business opportunity for Tesla in the short or medium term. While I do believe in Tesla as a tech company rather than just a car manufacturer, I also believe that the current state of full self-driving (“FSD”) technology and the existing legal framework present too big of an obstacle to the mass adoption of autonomous driving. Additionally, Tesla has a history of over-promising on its robotaxi initiatives and not delivering.

Understanding Tesla’s (genius) pricing strategy and category vision

I believe Tesla’s pricing strategy is crucial to its success. Its pricing approach also influences plans for the Model 2, which I will discuss in the next section.

Tesla has category vision. The company does not exclusively focus on the next quarter result, but rather on growing the EV vehicle category. This makes perfect sense for Tesla because it has by far the best EVs in the world currently, as proven by its global market share in EV cars and stellar ratings by consumer associations.

Tesla uses pricing as the primary tool to grow the overall EV car market and benefits in return. In a nutshell, Tesla reduces the prices on its cars to make them more appetizing to people that are considering switching to EVs. Since Tesla has more than 50% of the market share in the USA, growing its sales automatically grows significantly the entire category. As more people convert to EVs and realize they are a viable option to ICE vehicles, this further accelerates growth – and Tesla stands to benefit, given it has the monster market share in that category and the best reviewed EV cars.

Accelerating EV adoption and pricing competition out of the market

Focusing on category growth has two benefits in the case of Tesla. First, it accelerates the adoption of EVs.

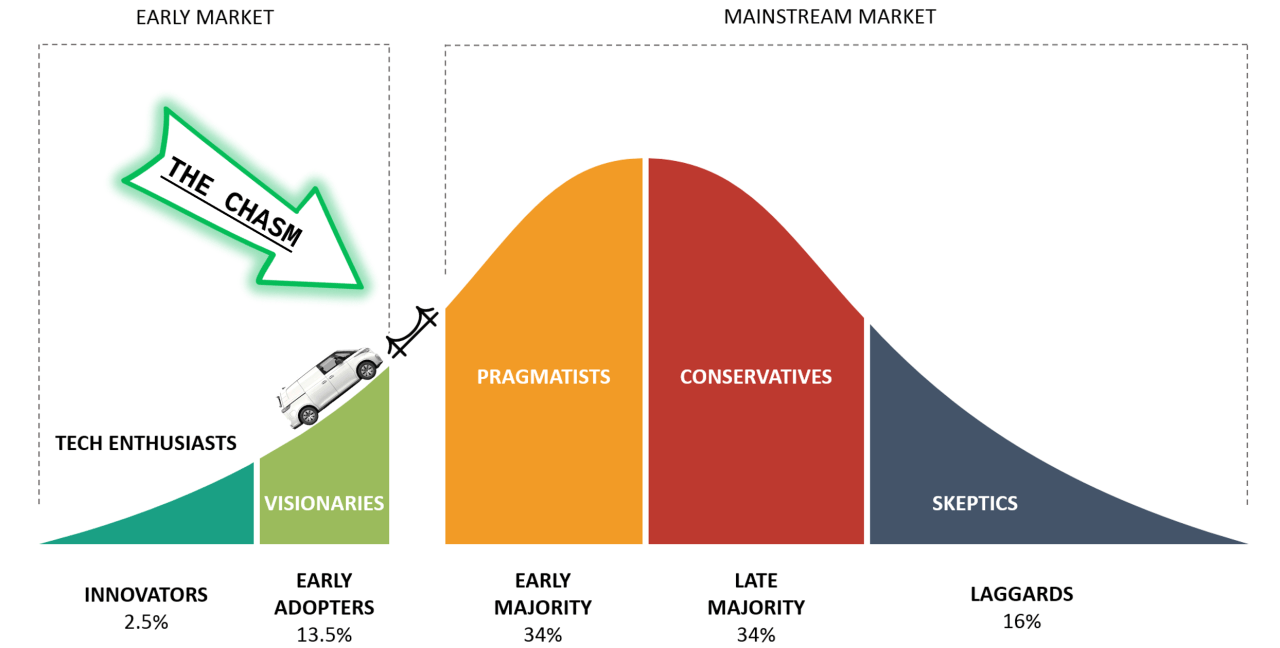

EV Category adoption curve (Torsten Freytag on LinkedIn)

In marketing, the adoption curve (displayed in the above picture) is a tool used to understand the stage of maturity of a product or a category. I, like many others, believe that EVs are currently sitting between Early Adopters and Early Majority, in the first half of the curve. This is similar to where iPhones and smartphones were around the year 2010, in my opinion. Tesla is using its pricing strategy to accelerate the mass adoption of EVs, which is referred to as “the chasm” in marketing theory. As Tesla is the market leader in this category, it is the company that stands the most to gain from this switch.

The second advantage of Tesla’s pricing strategy is that it is effectively pricing out competition from the EV market. I have already mentioned Tesla’s market share and car ratings, but let’s take an example by comparing what the market has to offer today to understand how.

EV alternatives to the Tesla Model Y include the Hyundai Ioniq 5 and the electric Ford F150. Both of these models have starting prices that are significantly higher than Tesla, but with worse reviews, worse technology and limited access to Tesla’s Supercharger system. EV-native car brands, such as Rivian and Polestar, also have difficulty in competing with Tesla. A base Polestar 2, for example, starts at $51,000 in the USA, which is just $1,000 less than the starting price of the newly updated Model 3 Performance, a far superior car in terms of performance, range and technology. A Rivian R2 starts at $45,000, which is almost $7,000 more than the base Tesla Model 3.

I believe most consumers in the market for an EV today simply have no alternative to buying a Tesla, just because of how competitive it is. Pricing competition out of the market is a strong strategy because it allows Tesla not only to expand the EV category, but also to gain more market share within that growing segment.

Category vision is a distinct trait of winning companies

Focusing on category growth is not exclusive to Tesla. I believe it is actually a distinct trait of all winning companies.

Take, for example, The Procter & Gamble Company (PG). This CPG company has historically used innovation to grow the categories it plays in, and disproportionately benefited from that growth as the market leader. Around 2011, P&G launched a new form of laundry detergent, the “laundry pod,” an evolution of laundry tablets. This allowed the laundry detergent category to grow 4x in the subsequent years, and P&G sales in that category to grow ahead of the market, at 5x. This approach has created value for P&G shareholders, its customers (retail stores) and consumers (now benefiting from a better way to do laundry).

Other, more known, examples of companies with category vision include Apple Inc. (AAPL) and Amazon.com, Inc. (AMZN). Until recently, Amazon has prioritized expanding its ecommerce and Cloud Services, often at the cost of short-term profitability. In contrast, Apple has consistently leveraged product innovation to create entirely new categories. The markets for smartphones, tablets, and smartwatches were all considerably smaller before Apple introduced its groundbreaking products.

By focusing on growing a category, rather than a single product, a company is setting itself up for long-term success. It also forces itself to focus on product innovation – since this is the primary way to grow a category. In addition to innovation, a company like Tesla is also aggressively using pricing as a strategic tool to foster category growth and encourage mass adoption.

The Tesla Model 2 might not be what you expect: it will be different, but better

Tesla first hinted at the Model 2 in 2016, a time when the world, and particularly the automotive industry, looked very different from today. The average price for a new car in the USA in 2016 was $34,077. Eight years later, that figure stands at $48,000. This is equivalent to a 41% cumulative inflation, well ahead of the general inflation for the USA, which stands at a cumulative 30% increase between 2016 and 2024.

The parabolic rise in the price of new cars is explained by the supply chain crisis that followed COVID, as well as the general inflation that the US experienced in the past couple of years. The situation in Europe is not that different. Average new car prices in Germany, France, Italy and Spain are at all-time highs, and they have increased well ahead of general inflation figures.

The way that most people think about the Model 2 today is still as a well distinct, entry-level car that starts at $25,000. This will not be the case anymore because an EV car in that price range would make no economic sense in today’s market.

I expect Tesla’s Model 2 will rather be a “stripped down” and possibly slightly smaller version of the Model 3. This will allow Tesla to hit a marginally lower price tag than the Model 3, while still targeting new demographics and market segments.

One of the reasons I believe Tesla is changing its plans for the Model 2 is all the noise surrounding the Model 2 as of late. At the beginning of April, Reuters reported that plans for the Tesla Model 2 were being scrapped. Shortly thereafter, the news was denied by Musk, who declared that “Reuters is lying.”

I believe there is some truth behind this rumor reported by Reuters. The Model 2 is not being scrapped, but rather re-designed as a slightly smaller, cheaper variant of the Model 3. I expect the Model 2 to be priced at just below $30,000. This price tag, in 2024, will allow the Model 2 to compete against most Internal Combustion Engine (ICE) and Hybrid entry and mid-level vehicles.

New cars that are currently priced at just below $30,000 in the U.S. today include the Honda HR-V, Honda Accord, Toyota Camry, Toyota RAV 4, Hyundai Elantra, Chevrolet Bolt and Volkswagen Taos. I expect the Tesla Model 2 to go head-to-head against these vehicles when it gets out.

I will go one step further and say that I wouldn’t be surprised if Tesla’s new plans for the Model 2 include two vehicles. One as a sedan, one as a small SUV or Crossover. This would follow Tesla’s strategy for its Model 3, and it would allow Tesla to compete in the crucial small SUV segment. I will, however, note that this is purely my speculation, as there has not been any news regarding different versions of the Model 2 as of the time of writing this article.

From a shareholder’s perspective, a Model 2 intended as a “stripped down” Model 3 is better. That is because it allows Tesla to save money on developing a new car. Rather than developing a new dedicated car platform, Tesla can use the existing Model 3’s platform and technology to achieve the same objective. This allows Tesla to retain higher margins while keeping the car priced competitively.

Robotaxis: Why They Won’t Move the Needle in the Short to Medium Term

I like Tesla’s vision for itself as a Tech company, rather than a car manufacturer. This said, I am personally skeptical about Robotaxis as a realistic catalyst for the short or medium term.

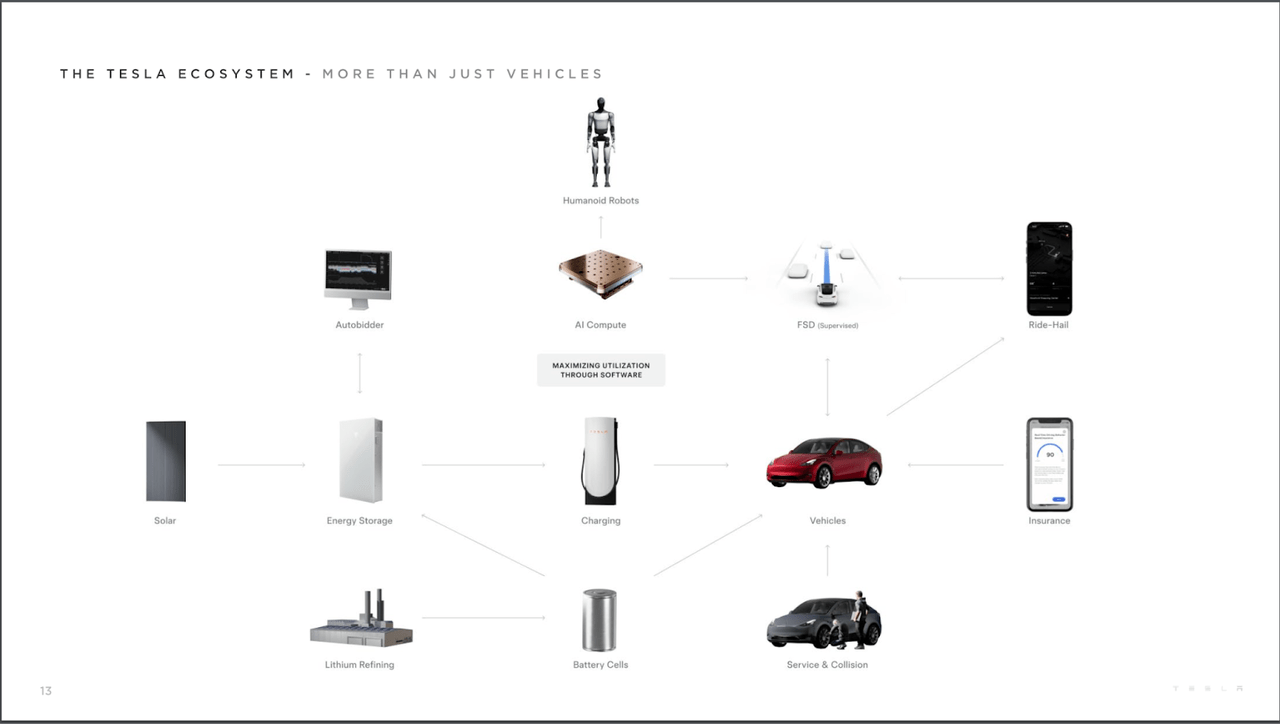

Tesla’s Ecosystem (2024 Q1 Tesla Shareholder Presentation)

I believe Tesla will eventually get there and offer a full self-driving vehicle that can be “rented out” when the owner is not using it. However, I see significant issues with legislation and technology for this to happen in the short or even medium term.

Self-driving technology is not there yet

It is 2024, and robotaxis are still not a reality for the vast majority of consumers. One of the few examples of actual robotaxis in operation today is Google (GOOG, GOOGL) Waymo’s and GM’s Cruise services in Phoenix, Arizona. If you are wondering why robotaxis seem to be successful in Phoenix, it has to do with its desert climate.

The problem is, current self-driving technology still struggles massively with rain. That is the reason why robotaxis have not been significantly deployed into far more lucrative taxi markets such as New York City or Los Angeles. The technology simply cannot do it.

I have no doubt that technology will evolve. Definitely, we will eventually be in a situation where an autonomous car can handle any sort of traffic. However, going back to Tesla – I do not see how the current hardware on board Teslas can ever make it.

Comparison between Waymo’s Robotaxi and a Tesla Model Y (Author’s work)

Just look at the difference between Waymo’s self-driving taxis in Phoenix and a Model 3 or Model Y. Notice how Waymo’s cars are equipped with a massive set of additional cameras and sensors. With current technology, there is simply no way that Tesla can offer Robotaxis for any of the cars it currently sells.

Of course, Tesla might develop an extra “kit” that people can purchase to be able to offer robotaxi services. Or technology might develop to a point that allows software to self-drive a car by using the set of cameras normally included in a Tesla.

But this evolution will not happen in the short or medium term, and I do not see it as a catalyst for Tesla’s stock in the foreseeable future.

The legal framework and Tesla’s bad track record with robotaxis

In 2024, there is no country that fully allows for a vehicle to be self-driven without a human behind the wheel. The only exceptions are local regulations, for pilot programs like the one I mentioned in Phoenix, Arizona.

To be clear – there are some significant steps in that direction. Germany has recently allowed Level 4 self-driving in selected areas, for example. The USA also released the Federal Automated Vehicles Policy (USDOT) Occupant Protection for Automated Driving System (NHTSA), which paves the way for further regulations on self-driving.

These are not legal frameworks that allow autonomous driving, as a human behind the wheel is still very much needed. They are nevertheless a step towards autonomous driving.

For Tesla’s robotaxis to work, there is the need for a legal framework that allows for cars to be driven and rented out autonomously, without anyone behind the wheel. Currently, the legal environment is far from supporting this, and I don’t foresee these regulations changing in the near future.

Tesla also has a bad track record when it comes to autonomous driving, too. Back in 2019, during a moment of weakness for the EV car market, Elon Musk announced how robotaxis would be available as early as 2020. I see history repeating itself – with Tesla saying they are “all-in” robotaxis again at a time of weakness for the EV car market.

Risks to my Thesis: Tesla’s valuation

Tesla currently traded at a 70 P/E, which is roughly 10 times higher than Ford’s (F) at the time of writing. The main risk with investing in Tesla today is that the company could lose the sky-high valuation it enjoys.

The market is already discounting Tesla as a tech company, rather than a car company. If it wasn’t the case, Tesla wouldn’t have that P/E. If Tesla were to consistently fail at delivering products and services beyond automotive, the stock might eventually correct significantly and long term.

Investors might be scared and skeptical about this valuation, but I believe it simply is not relevant. Tesla reminds me of Amazon in the early 2010s – in that many analysts saw Amazon as a fundamentally unprofitable business that was bound to correct. Here is a prominent example of an article on Seeking Alpha from 2013 trying to cope with its valuation.

Similar to Amazon a decade ago, Tesla is currently prioritizing category growth over margins and quarterly results. This approach means Tesla is, and will continue to be, valued significantly higher than other car companies, reflecting its status as more than just an automaker. Like Amazon, Tesla can shift its focus back to improving margins once the EV category reaches the “late majority” phase of the product life cycle. However, I don’t anticipate this shift happening soon.

Conclusion

Tesla’s pricing strategy is a key tool for its category vision. By cutting prices, Tesla is simultaneously growing the EV category (by accelerating EV mass adoption), growing its sales (since Tesla has the highest market share in the EV segment) and growing its market share (by pricing competition out of the market).

While Tesla is very aggressive with its pricing strategy, when it comes to the Model 2, today’s market does not warrant the existence of a $25,000 EV car. A $30,000 EV Car is very competitive in a market where a Honda HR-V costs north of that amount. It will be enough to disrupt the car industry by accelerating mass adoption of EVs.

I view the Model 2 as the short-term catalyst that will reignite Tesla, Inc.’s growth and serve as a stepping stone to accelerate the mass adoption of electric vehicles. For me, Tesla is a buy today. While I expect volatility in its stock to continue, I strongly recommend purchasing if you can hold on to the shares for the next 5 to 10 years.