Kirk Fisher/iStock Editorial via Getty Images

The stock of technology company Tesla, Inc. (NASDAQ:TSLA), which focuses on driving humanity towards a sustainable future, has long been seen as costly and overvalued. Focusing on pricing metrics such as price-to-earnings or price-to-sales may cause investors to disregard this company, but those taking the time to value the company might instead find a very compelling opportunity.

In this article, I will value the company using a sum-of-the-parts approach, and what we will discover is a fairly valued company with a lot of optionality at today’s trading price. To get a sense of what that optionality may imply, I will do a separate calculation where I include hypothetical optionality converted to value.

The reason I use a sum-of-the-parts approach for Tesla is because the different business segments have different margin profiles, scalability, and maturity. Throwing a blanket over these and not breaking the segments apart would make it very difficult to accurately project numbers, as you lose out on the granularity.

Automotive

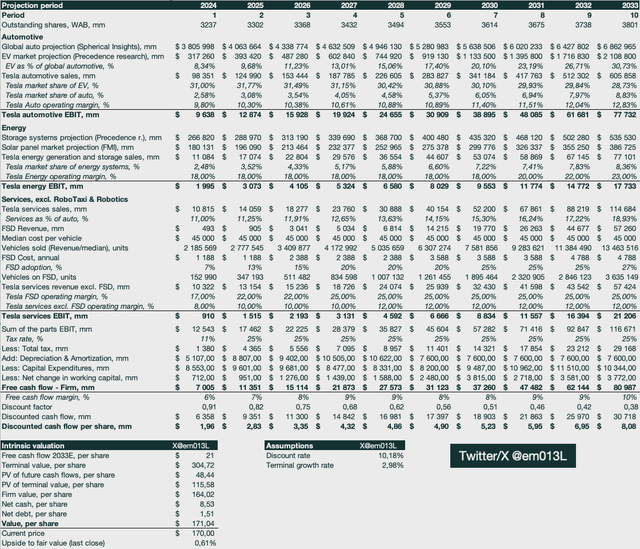

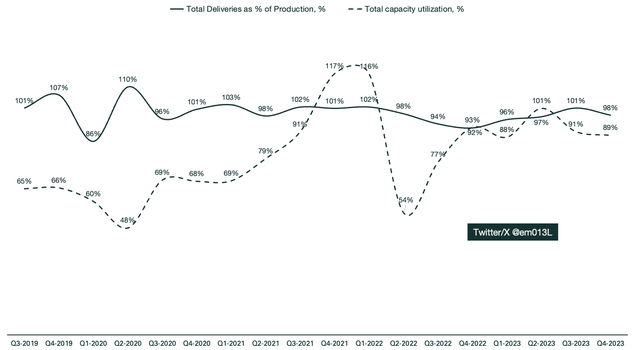

The main business segment of Tesla is the manufacturing of electric vehicles. Historically, we have seen the ramping of various models, and Tesla has already solved the major challenges that come with the manufacturing process. The gigafactory principle is on a copy-and-paste basis, and while heavy on capital expenditures, I expect Tesla building out more gigafactories to be a relatively smooth process. A build out will be necessary, as Tesla is close to capacity as it stands.

Emir Mulahaliliovic X@em013L, Tesla SEC Filings

Tesla consistently stays at ~90% capacity and sells more or less all manufactured vehicles each period. This will have to increase exponentially, and I expect it to, as the global EV market compounds at 23.4% annually through 2033 (source: Precedence research). The current annual production capacity is ~2.25 million vehicles; I project Tesla to deliver ~5 times that in 2033.

I project that Tesla will lose market share in the EV space but gain market share as a percentage of the global automotive market, as EVs will make up a greater portion of global automotive sales.

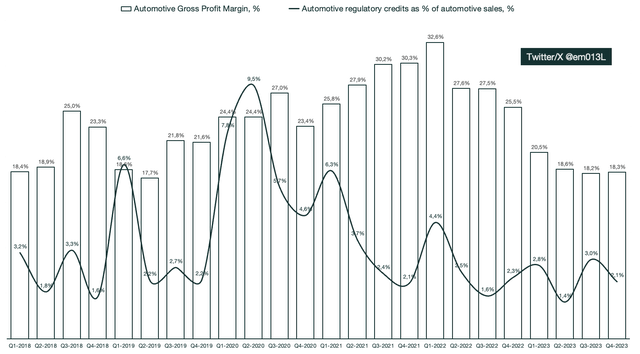

When it comes to margins, I project that Tesla will see greater overall margins compared to other vehicle manufacturers due to manufacturing efficiency and brand equity. I project operating margins to increase from ~10% to ~13% by 2033.

I chose not to include regulatory credits in my projections, as it is still difficult to correlate them to business performance. In theory, regulatory credits should expand margins or incentivize more sales, but such a correlation does not appear historically. Regulatory credits will logically increase globally to incentivize customers to move to EVs as we inch closer to net-zero goals. As such, they can be seen as optionality, meaning we get their upside for free outside this valuation.

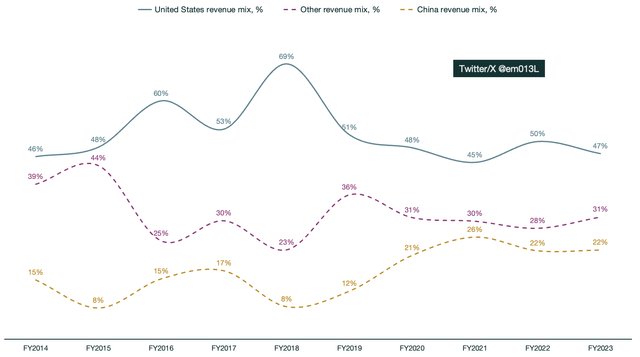

Emir Mulahalilovic X@em013L, Tesla SEC Filings

While the Shanghai factory can manufacture vehicles at higher gross margins compared to factories placed in the west, I don’t see China taking a larger part in the overall revenue mix due to fierce competition within the country. Historically, it seems to have stagnated at ~20–25%, and while other revenues outside the U.S. have been largely shipped from Shanghai, I imagine the factory in Germany will start covering more of the west outside the United States. I expect countries with relatively cheaper labor to cover for that over time, for example, by building out a factory in countries such as Mexico.

Emir Mulahalilovic X@em013L, Tesla SEC filings

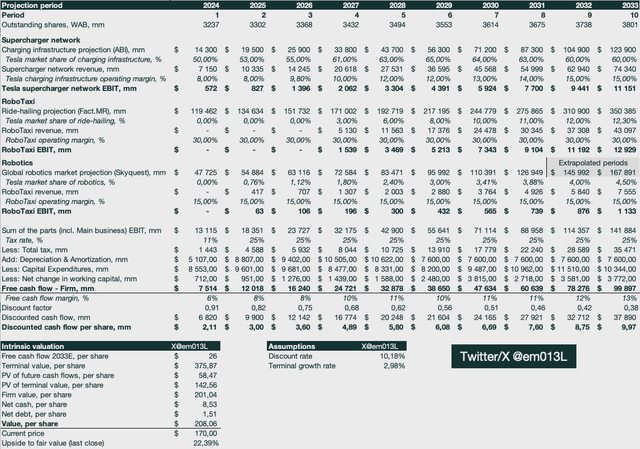

Services, excluding Robotaxi and robotics

I have formulated the services segment to be made up primarily of full self-driving (FSD) and vehicle servicing revenues. I project this segment to account for ~20% of Tesla’s overall earnings before interest and taxes (EBIT).

Furthermore, I specifically chose not to include the potential Robotaxi and robotics segments, even though they are expected to be very significant for Tesla. This was done for two main reasons:

- The optionality of not assigning them value

- Unproven industries make it difficult to project accurately.

The main driver in this segment is FSD, and before we can start projecting numbers, we need to make a few assumptions.

- I assume that on average, a subscription life cycle is ~5 years, i.e., the expected length of a customer owning the same vehicle. This means that I will trail subscription revenues on a 5-year basis.

- The next assumption is that I will exclude one-time purchases of FSD and only use subscription revenues, for the sake of simplifying the model. This starts at $99 for 2024 and 2025, ramping up slowly until reaching $399 in 2033.

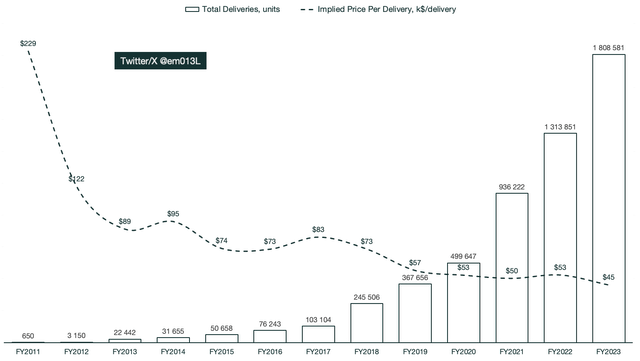

To get an understanding of the number of vehicles to extrapolate FSD adoption rates from, I will assume a $45,000 average sales price per vehicle. That is equivalent to the current implied sales price per vehicle. Due to our not yet knowing the full extent of the vehicle lineup Tesla will carry through 2033, I chose to keep it at $45,000. There are more factors that affect average sales price in a direct-to-consumer model, which Tesla has, namely cyclicality, inflation, brand equity, and so forth.

Emir Mulahalilovic X@em013L, Tesla SEC Filings

The above assumptions make us arrive at ~13.5 million vehicles delivered in 2033. Hefty from today’s position, but not unreasonable.

The adoption rate is a bit tricky, but we know that FSD is a major goal for Tesla and perhaps the main focus for the coming annual periods. CEO Elon Musk said the following in the Q1 2024 earnings call:

But really, the way to think of Tesla is almost entirely in terms of solving autonomy and being able to turn on that autonomy for a gigantic fleet. And I think it might be the biggest asset value appreciation history when that day happens when you can do unsupervised full self-driving.

With this in mind, we know that a global rollout is mainly an issue of regulation. I ramp the adoption from 7% in 2024 up to 25% in 2033. I do not factor in licensing FSD, providing even further optionality in the valuation.

We don’t have much clarity in terms of margins yet, but we do know that the neural network training is heavy on capital expenditures. I have likened the operating margins to those of a well-run software business, aiming for 27% in 2033 from a starting point of 7% in 2024.

As for vehicle servicing, I project that it will scale up in terms of revenues as a percentage of the delivered vehicles. I have set operating margins at an industry standard range, from 8% to 12% in 2033, as they grow more efficient in producing spare parts and performing servicing.

Energy, excluding Supercharger network

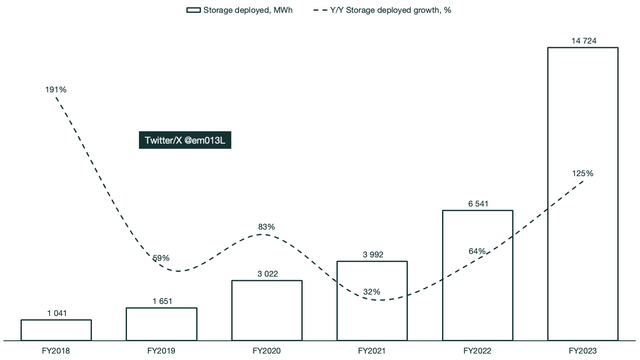

The energy segment is the most profitable among Tesla’s different businesses. Despite this, we have surprisingly little insight into the metrics and key performance indicators that surround it. Tesla shares storage and solar deployment metrics in megawatt hours and megawatts, but there’s no further breakdown between these two. We do not know the granular breakdown of what it costs Tesla to deploy these, and as such, we have to generalize our assumptions until we gain clarity on the matter.

Solar has remained stagnant over a six-year period; it’s also notably missing from Tesla’s Q1 2024 earnings presentation. Tesla deployed 326 megawatts of solar in 2018, notably higher than 223 megawatts in 2023. Unfortunately, the earnings call did not give us much clarity into what Tesla plans for the future with solar. I also noted a decrease in solar energy systems on the balance sheet.

Tesla’s focus seems to instead be on energy storage systems. Energy storage systems have grown at a rapid clip while also maintaining healthy margins. What was a large surprise was yet another forecast of strong growth by Tesla in their Q1 2024 earnings call:

We expect the energy storage deployments for 2024 to grow at least 75% higher from 2023. And accordingly, this business will begin contributing significantly to our overall profitability.

Emir Mulahalilovic X@em013L, Tesla SEC Filings

With storage systems as the main driver, I forecast Tesla to grow their market share of energy systems from ~1.6% in 2023 to ~8.4% in 2033. By the forecast period’s end, I project Tesla’s operating margins in this segment to be 23%, or, in other words, very profitable.

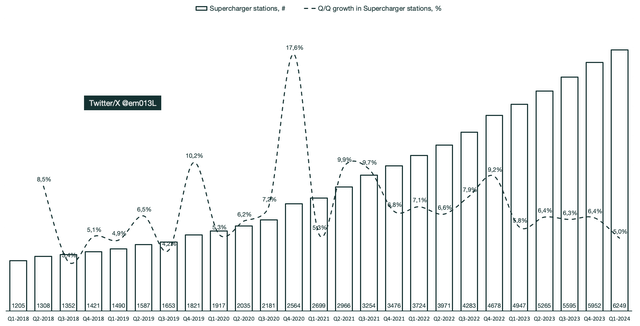

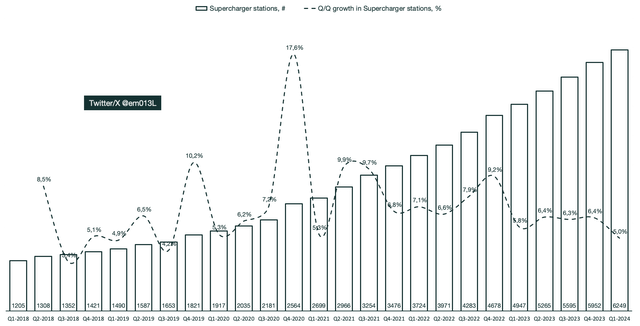

I chose to exclude the supercharger network for the same reasons I chose not to value Robotaxi and robotics, namely the lack of clarity and the added optionality. The supercharger network is positioned to be monopolistic, with more and more manufacturers vying to partner with Tesla for access. The growth and build out of the supercharger stations have been impressive, considering that they span global markets. If electric vehicles as a whole are to grow, solving range anxiety will be key. Excluding the supercharger network from my valuation will provide a major optionality: getting it for free.

Emir Mulahalilovic X@em013L, Tesla SEC filings

Valuation

Using the figures discussed previously in the article as the backbone of a discounted cash flow model, we can start deriving intrinsic value.

For companies that issue shares, I find it critical to factor in the dilutive effect in the valuation model. To achieve this, each projection period has a discounted cash flow output on a per-share basis for that period, which is in turn used to arrive at intrinsic value. Buybacks are not modeled because doing so would mean double-counting the free cash flow used for buybacks. A more common approach is to remove stock-based compensation expenses from the free cash flow. However, that would assume that the cash is not available for leverage and, as such, is a less accurate approach.

An interesting factor to note is that the model using my assumptions shows us that two-thirds of the value of the company is during the terminal period. This essentially means that Tesla is still a company in its early stages in terms of revenues, profitability, and free cash flow generation.

At the time of writing, Tesla is trading around the $170 mark, meaning that Tesla is currently fairly valued according to my projections. However, we have not valued the following business segments, each of which could be considered a major segment for Tesla’s future:

- Robotaxi

- Robotics

- Supercharger network.

This is instead considered optionality, a potential upside to our model that is not considered in the valuation model. The question is, how much added value would the optionality provide? I have modeled estimates for these largely unproven business segments using market forecasts for the related industries.

The supercharger network is the most tangible because we have some sort of number to extrapolate from. However, the numbers are only the total number of supercharger stations and connectors, without any economic metrics tied to them. This means that we are largely in the dark in terms of margins and revenues for this part of the business.

Emir Mulahalilovic X@em013L, Tesla SEC Filings

The number of stations is growing steadily, likely to match demand. We do know that Tesla is vying to create a monopoly of charging stations, already having many major automotive manufacturers consign themselves to using the Tesla standard for charging. I would not be surprised to see accelerated growth as we approach larger electric vehicle adoption.

There are some publicly traded charging network companies, but these are either unprofitable, inefficient compared to Tesla, or on a different scale. For this reason, I have gone with an operating margin of 8%, growing to 15% by 2033. The margin also reflects the licensing of the technology.

As for the Robotaxi segment, I went with an approach that likens it to the ride-hailing industry. I have used global ride-hailing market projections as the basis of my revenue assumptions. From there, I have initiated Tesla absorbing market share by offering their own ride-hailing services as well as partnering with other major players. I expect the margins to be high as a result of licensing and partnering, as well as the company receiving the full fare fee excluding operating costs. In addition, Tesla will not need to own the cars outside their own ride-hailing service. I project Tesla to have 12.3% market share of ride-hailing revenues in 2033 with a 30% operating margin. Also note that I do not start Robotaxi revenues until 2027, which is my guess at regulatory approval.

Robotics is an interesting and deep segment with many competitors, mainly from Japan. I can’t currently see Tesla reaching anything beyond 5% market share of this space by 2033, as the market as a whole encompasses much more than only humanoid robotics. Surprisingly, the Tesla robot appears to be operational in internal testing and expected to roll out to customers in 2025, according to Elon Musk during the Q4 2024 earnings call:

we do think we will have Optimus in limited production in the natural factory itself, doing useful tasks before the end of this year. And then I think we may be able to sell it externally by the end of next year. These are just guesses.

I have not touched on reinvestment while adding these segments, as the numbers are already extrapolating historical figures that include Tesla spending capital towards these goals. Combining these estimates in the sum-of-the-parts valuation model raises the fair value from ~$170 to ~$210 per share, or ~22.5%.

Summary

Breaking down the different business segments within Tesla allows for a better understanding of where the value comes from. Intrinsic value from my sum-of-the-parts DCF model shows that Tesla is currently trading at fair value, despite deliberately not including Robotaxi, robotics, or the supercharger network in my model.

By not including the segments in my valuation, I open up the possibility for optionality. This means that the performance of the aforementioned segments is essentially free when I purchase Tesla stock at current trading levels. With this in mind, I assign Tesla, Inc. stock a buy rating.