Kirk Fisher

Tesla, Inc. (NASDAQ:TSLA) had a tough start to the year as its shares have depreciated by ~30% YTD as a result of the weak performance of its business that was caused by a tough macro environment and increased competition within the electric vehicle (“EV”) industry. The company’s poor deliveries in Q1 have already negatively affected its performance. Even though Tesla’s shares slightly rebounded last month on news about the launch of a new vehicle next year, the ongoing price war within the industry is likely to prevent the rapid improvement of the company’s business and could kill the stock’s momentum as well.

Price War Accelerates

Back in January, I wrote an article about the company titled Tesla: Avoid In 2024 which noted that the unfavorable market environment is likely to negatively affect the performance of Tesla’s business and its shares in the following months. Since that time, Tesla’s stock has underperformed against the broader market and depreciated by ~10%. Going forward, there are reasons to believe that Tesla will remain an unattractive investment in the foreseeable future.

This is because the company has already started the fiscal year poorly and there are no major growth catalysts that could significantly improve the performance in the following quarters. The Q1 earnings results that were released last month showed that Tesla’s revenues declined by 8.5% Y/Y to $21.31 billion and were below the estimates by $950 million. The bottom-line performance has also suffered as the non-GAAP EPS during the quarter was $0.45, below the expectations by $0.05.

The decline in sales happened due to the decrease in deliveries as Tesla had delivered 386,810 vehicles in Q1, down from 433,371 vehicles a year ago. The last time Tesla had a decline in quarterly deliveries was almost four years ago during the pandemic, which indicates that the increased competition has already greatly damaged Tesla’s ability to significantly scale its business. Considering that the EV market continued to grow in April, while Tesla’s shipments once again decreased last month, it becomes obvious that the rise of Chinese EV manufacturers has hampered the company’s ability to grow at the same rate as before in the current environment.

While Tesla tried to mitigate the competition risk by slashing prices for its cars, it appears that those efforts have been futile so far. Not only did sales not improve under the reduced vehicle selling price, but the company’s bottom-line performance suffered as well. In Q1, operating margin was only 5.5%, down from 11.4% a year ago. Considering this, it becomes hard to imagine how the business is going to improve in the second half of the year given the latest developments.

In addition to the ongoing price war within the EV industry, Tesla also faces major geopolitical risks that could undermine its business model. For years, the company has relied on undisrupted globalization to grow its business at an aggressive rate. As protectionist policies are getting traction across the globe, while the freedom of navigation on the seas is under threat, Tesla is starting to lose macro growth catalysts that could’ve helped the company improve its performance.

Earlier this year, the disruptions in the Red Sea have negatively affected Tesla’s operations in Europe and in part were responsible for the decline in deliveries in Q1. With the war in the Middle East still raging on, the Red Sea crisis is still far from over and the higher shipping costs along with the potential for another major trade route disruption could have another material effect on Tesla in the following months.

Moreover, there’s a risk that later this year the European Commission will decide to raise the import tariffs on the electric vehicles made in China after it finishes its anti-subsidy probe that started last year. This could have a meaningful effect on Tesla’s operations, as the company continues to export its EVs from China to the old continent, since its factory in Berlin constantly faces various disruptions that negatively affect the business’s performance in Europe.

Considering all of those developments, it’s difficult to see how Tesla will be able to significantly improve its performance in the following months. The Street believes that Tesla’s revenues will grow at only ~3% this year, as there are no major growth catalysts to boost the sales this year, while the risks to its growth story continue to mount.

Recovery On The Horizon?

Despite all the negative developments, there’s still one thing that can drastically improve Tesla’s business in the future, and that thing is the expected release of a new affordable vehicle next year. During the latest conference call, Elon Musk said that the production of the new affordable vehicle will begin in the first half of 2025, and it could accelerate Tesla’s total capacity to over 3 million vehicles a year.

This announcement in large has been responsible for the appreciation of Tesla’s shares after the relatively weak performance in Q1. It’s yet to be seen whether the production starts on time and whether it will have a major positive impact on the company’s performance next year, but the announcement nevertheless helped somewhat mitigate the downside of the relatively weak performance in Q1.

What’s Next For Tesla’s Shares?

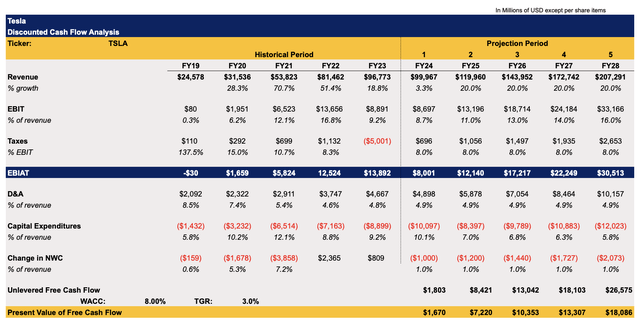

Given the fact that Tesla’s revenue growth rate this year won’t be as impressive as in the past, questions are arising about whether the company’s shares would be able to aggressively appreciate in the foreseeable future. To answer that question, I’ve created a discounted cash flow (“DCF”) model that can be seen below.

The revenue assumptions in the model for FY24 are mostly in-line with the Street expectations, after which the growth rate returns to double-digits in FY25 and beyond due to the potential boost in sales from the expected launch of a new affordable vehicle next year. Similar thinking is applied to the earnings assumptions as there’s a possibility that after the weak competitors are squeezed out of the market due to the price war this year, the environment will start to improve and lead to the gradual return of previous margins in the following years.

The CapEx assumptions for the next three years are in-line with Tesla’s expectations, under which the management plans to spend over $10 billion this year and around $8 billion to $10 billion in FY25 and FY26. After that, I assume that the CapEx once again will increase due to the need to scale the business, but the spending will account for the smaller share of revenues due to the expected aggressive rise in sales in the following years. The assumptions for all the other metrics closely correlate with Tesla’s historical performance. The WACC in the model is 8%, while the terminal growth rate is 3%.

Tesla’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

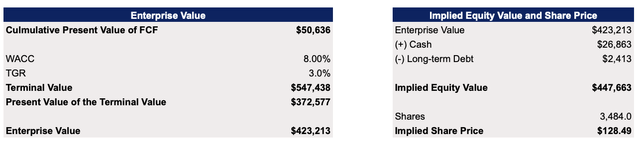

This model shows that Tesla’s fair value is $128.49 per share, which is below the current market price. This indicates that the company trades at a premium and could be overvalued right now solely based on the fundamentals. By having a forward P/E of over 60x, above the market’s average P/E of ~27x, it certainly looks like the stock offers little margin of safety at this stage.

Tesla’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The Bottom Line

Even though Tesla’s shares have slightly rebounded after the release of the latest earnings results on news about the upcoming vehicle launch, there’s still a risk that the overall business will continue to underperform this year and make investors quickly lose their optimism about the future. What’s more is that in addition to being overvalued based solely on the fundamentals, the ongoing price war within the EV industry could kill the momentum of Tesla’s stock in the following months. That’s why I believe that avoiding Tesla at the current price is likely the best option, as the upside appears to be limited while the margin of safety is almost non-existent at this stage.