Klaus Vedfelt

I remember a quotation made by a hedge fund professional soon after his retirement. “For the first time in decades, I woke up without wondering what Apple had done overnight.” This came to mind recently because I now realize that I have been living under a rock for most of the last decade. I really haven’t given much thought to Tesla, Inc. (NASDAQ:TSLA) stock as an investment because it didn’t fit the investment criteria that have been imposed upon me. But, a trillion-dollar company that turns into the S&P 500’s (SP500) worst performer? Historical parallels with Detroit in the 1970s when a wave of new entrants from Asia knocked General Motors (GM), Ford (F), and Chrysler (STLA) from their perch? A charismatic but controversial founder? Maybe there’s an interesting story here, I thought.

So, I did some research and wrote this article, Tesla Is No Longer A Growth Stock…, fresh eyes and all the rest. It was like I kicked over a nest of hornets – soooo much time playing Whack A Mole. A point unrelated to the main thesis would be brought up in the comments section, I would respond with facts and logic, the issue would be sidelined for another unrelated issue, which would be dealt with, and then eventually, the original issue would be raised again, even though it had nothing to do with whether Tesla is still a growth stock.

Classic distraction – look at the shiny object in the right hand, cameras versus LIDAR for example, while I pick your pocket with the left hand. I find it difficult to credit that an anonymous emotionally invested Tesla shareholder’s opinion regarding full self-drive, or FSD, is more reliable than the opinion of an independent source such as the Society of Automotive Engineer, but really, it’s a distraction from the question of what is the value of the commercial opportunity. People who, to put it charitably, do not have a positive view of CEO Elon Musk or Tesla chimed in. Many of them also missed the point – Elon Musk’s politics are not relevant to the investment case for Tesla.

While all of this was going on, there were a number of developments with the company which caused the price of the stock to whipsaw up and down. In the end, the price is basically back to where it was when I wrote the article, and when I sit back and reflect upon the last month, here’s what I learned.

I. Retail Tesla shareholders are like Knicks fans

I heard a professional gambler active in Sports Betting-speak once say that his company consistently made money because they were data-driven, whereas amateur gamblers who took the other side of their bets were driven by emotion. Games where the New York Knicks were playing were low-hanging fruit for professional bettors for several reasons. First, many Knicks fans have a lot of money and only the Lakers and Warriors have higher ticket prices. Second, Knicks fans are incredibly loyal. Supporting the Knicks brings back memories of going to MSG with dad, the feeling when the buzzer rang in the final game of the two 1970s championship series, and a sense of community with other long-suffering fans with whom one could commiserate with over a beer.

In the end, you can’t bet against the Knicks. It’s like betting against Patrick Ewing struggling up and down the court on one good knee. Betting against the Knicks is like taking Reggie Miller’s side over Spike Lee. Betting against the Knicks is like cheering for the Nets.

Now think about long-time Tesla owners and shareholders. Elon Musk was so smart the way he built his brand. He targeted influencers with a lot of money, and he had a zero defect policy. “You’re having trouble with your side view mirror, sir? We’ll send someone out to your house this afternoon to fix it.” He made his initial customers ambassadors, and there are none so committed as converts. Being affluent, a lot of them invested in Tesla when it was an early-stage company, and they made a ton of money, the ultimate positive reinforcement. And to top it off, they could feel good about their purchase / investment choice. In their own small way, they were helping to save the planet. Who wouldn’t be emotionally invested?

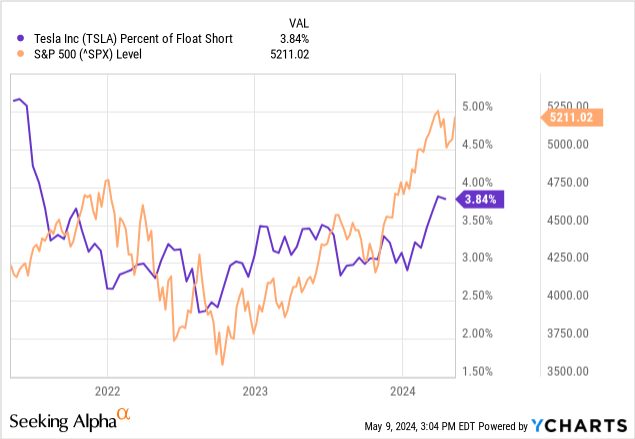

II. Despite what Tesla shareholders say, short sellers haven’t caused Tesla’s poor performance in the past year

Even though it doesn’t pay a dividend (which short sellers have to cover), when compared to its own historical levels, and to the average company in the S&P 500 (SPX), Tesla isn’t heavily shorted …

Chart 1

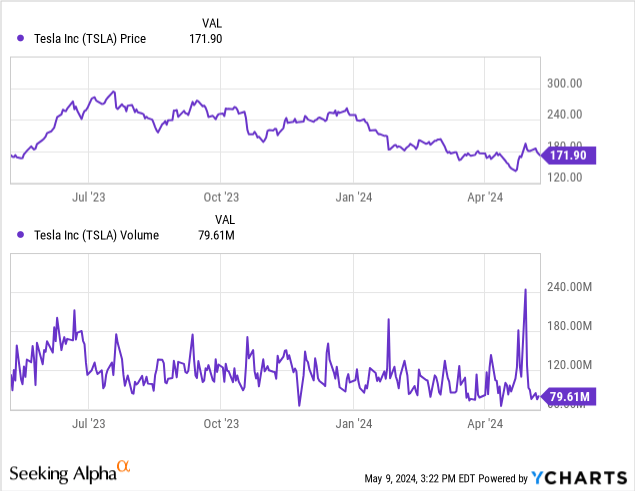

… and, trading volume tends to be heavier during periods when Tesla’s price is rising than when it’s falling.

Chart 2

III. Tesla is, in fact, a Meme Stock

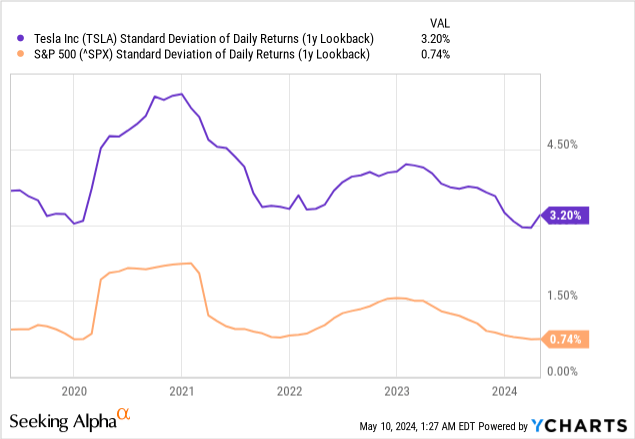

One definition of a Meme Stock is that it is highly followed on social media, and as a result, the price of its shares is volatile and prone to extreme moves.

1) Tesla’s stock is certainly more volatile than the average stock.

Chart 3

2) Tesla is widely followed on Social Media.

- A quick scan of the interest shows that TSLA is widely mentioned on platforms like Reddit, or in posts similar to this one from US News.

- Before its demise in December 2023, TSLA was a member of the Roundhill Meme ETF.

- Elon Musk owns his own Social Media platform and he has a huge following. He regularly posts messages, some of which are uncorroborated or which are contradicted by others, that move the market for TSLA.

There were numerous negative comments about Tesla over the last month, and a number stated that TSLA is a Meme Stock. While I have come to conclude that this is, in fact, the case, I actually don’t view this as either a negative attribute or as a positive attribute. It certainly isn’t surprising, many Tesla shareholders are emotionally invested in the company in the same way that Knicks fans are emotionally invested in their team. It is what it is – trade the swings if it suits you, speculate, but don’t invest in it for the long term.

IV. Tesla Agrees With Me – It Isn’t A Growth Stock – It’s Laying People Off

Growth stocks are ones which allow you to invest in businesses that are growing.

- On April 15, 2024, Tesla announced that it was laying off 10% of its workforce and Elon Musk reportedly wanted to lay off 20%. “The sweeping layoffs announced yesterday, amounting to a reduction in crewed production capacity, should now leave no doubt that the decline in deliveries has been a function of lower demand and not supply,” JPMorgan analysts wrote last week.

- Tesla reported a 9% drop in revenue in the first quarter of 2024, the steepest year-over-year decline since 2012 and Earnings Per Share were 45 cents adjusted versus expectations of 51 cents.

- Tesla’s automotive revenue fell 13% year over year to $17.38 billion in the first three months of 2024. This was a larger decrease than its decline in 2020, when business activities were interrupted by the COVID-19 Pandemic.

V. Tesla’s moonshots are like the V2 Rocket: flashy, but ultimately didn’t change the outcome of the Second World War

The jack of all trades is the master of none. Tesla seems to have forgotten this fundamental truth. Reading various social media posts, from Elon Musk and others, I learned that Tesla is the most valuable and advanced automobile manufacturer in the world. What a sec – it’s actually a battery company …. no, scratch that, it’s a software company.

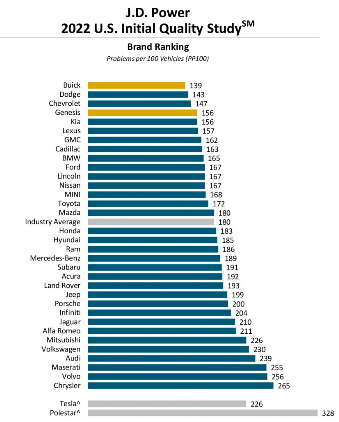

What Tesla actually is, is a company with no clear strategic direction, spraying capital around in an undisciplined fashion, all the while wasting its first mover advantage while prevailing over a decline in the value of its brand. Who would have thought ten years ago that Tesla would rank 28th out of 35 car manufacturers in the JD Power Quality Survey, joint equal with Mitsubishi?

JD Power

So let’s re-examine some of Tesla’s moon shots.

1) Tesla now agrees with me, its Self-Charging Network won’t be a home run or a moat.

Tesla “has let our entire charging org go,” William Navarro Jameson, strategic charging programs lead at Tesla, wrote on X.

Others such as BlackRock and Daimler Truck, who have a $650 million Joint Venture, or Enel, an Italian energy giant, that wants to deploy 2 million chargers in the U.S., will take advantage of any future wave of EV adaptation by the mass market.

2) What about Tesla Semi?

The field is getting crowded and Tesla’s reputation with customers is deteriorating. Here are some quotations from a Reuters Article dated April 20, 2024.

- “The 100 (Tesla Semis) we have a deposit on, we’ll get those out in ‘23 for sure,” Mike O’Connell, PepsiCo’s vice president of supply chain, told Reuters at the time. But, as of this month, PepsiCo was “focused on best leveraging the 36 (Tesla Semi) vehicles that are currently in our fleet,” a spokesperson told Reuters in early April.

- UPS reserved 125 Tesla Semi trucks in 2017, one of Tesla’s biggest orders at the time. A spokesperson for the package delivery company told Reuters on April 16 that it is “working closely with Tesla to determine a date for us to take delivery of the trucks.”

- Svein Sollie, the transportation director at ASKO Norway, the logistical arm of Norway’s largest food retailer NorgesGruppen, used his personal credit card to put down an initial deposit on 10 of the Tesla Semis in 2017 but has not received any. “We are not happy with the situation at Tesla,” Sollie said. “(It’s) almost seven years now, it’s a long time to wait.”

- Other would-be Tesla customers, including food distributor Sysco (SYY), United Parcel Service (UPS), and Walmart Canada (WMT), continue to wait for Tesla Semi trucks and are turning to rival electric-truck makers.

-

Meanwhile, UPS, Walmart Canada, Sysco and Schneider National (SNDR), a transportation company that works for PepsiCo’s Frito-Lay, said they are turning to Daimler Truck, maker of the Freightliner eCascadia. All four companies said they had begun to put dozens of eCascadia electric big rigs on the road.

Daimler Truck (OTCPK:DTRUY, OTCPK:DTGHF), which is mentioned in the last point above, has 40% of the American commercial vehicle market. It isn’t the only company active in this space. Paccar (PCAR), which has 30% of the U.S. market, is also actively investing in the EV commercial vehicle space, as are numerous others. Here is a quick overview of the competitive landscape.

- In April 2023, Daimler Truck launched, Rizon, a new electric truck brand.

- Greenlane is a $650 million Joint Venture between BlackRock (BLK), NextEra Energy, and Daimler Trucks North America, that aims to build a nationwide network of battery charging and hydrogen feeling stations. Plans for its flagship corridor, a 280-mile route between Los Angeles and Las Vegas, were announced in March 2024 and its next two corridors will be in the Texas Triangle and the Northeastern United States.

- Daimler Truck plans to introduce the Mercedes-Benz eActros 600 this year.

- It was announced in September 2023 that Daimler North America, Paccar, the manufacturer of Peterbilt and Kenworth Trucks, and Accelerate (the clean energy arm of Cummins Inc. or CMI) would form a Joint venture to manufacture batteries for the North American commercial vehicle market. Each company will own 30% of the Joint Venture, and Eve Energy, a leader in the manufacture of lithium iron phosphate (LFP) batteries, will own the remaining 10 percent. Plans are well underway, and in January of this year, it was announced that a 21 GWh factory will be built in Mississippi, with a 2027 target set for the start of production.

- In May of 2023, Daimler Truck and Toyota (TM) announced plans to merge Hino and Fuso in a new holding company that would be equally owned by both companies. The new entity will initially focus on the development of zero emissions technology and global procurement, before both companies are fully merged.

- Volvo Trucks (OTCPK:VOLVF) delivered 1,977 electric trucks during 2023, an increase of 256 percent compared to the previous year. Volvo’s share of the electric heavy-duty segment in Europe increased to 47.2 percent from 32.3 percent in 2022.

This isn’t 2010 and Tesla isn’t the only game in town. For the first time ever, it has to compete, and it’s failing miserably.

3) What about FSD v12 and Robotaxis?

Tesla could spend $10 Billion on FSD v12, its cars will be worth 2X what they are today because every Tesla owner will have their own self-driving taxi, and Tesla itself will displace DiDi (OTCPK:DIDIY) in China, and UBER in the rest of the world. Maybe, but the field is crowded, and before we drink the Kool-Aid, let’s consider a few things.

a) Since I wrote my article, Tesla has cut the price of FSD from $12,000 to $6,000 upfront, with a similar magnitude of reduction for those on a monthly subscription. All of a sudden, that pot of gold has shrunk by 50 percent.

b) People of good conscience can argue in circles all day about issues such as whether Tesla’s approach to autonomous self-driving vehicles (having only cameras) is superior to the rest of the world (LIDAR and cameras) and about dozens of other points. In the end, such arguments are irrelevant because the bottleneck is regulatory approval, not technology.

Waymo has had a Robotaxi fleet for seven years, and it has only been able to get approval in three US markets. Even if Tesla does launch a Robotaxi service in August 2024, and even if its technology is so superior that it catches up to, and then surpasses Waymo and other companies with commercial operations, Tesla won’t have a sniff of positive cash flow for years. And if by chance Tesla goes on to dominate the US Market? Unfortunately, in such a case, it’s unlikely that its platform will be suitable for China, the world’s biggest market. See the following captions from page 10 of Tesla’s 2023 Annual Report that illustrate the issue.

USA –

“While there are currently no federal U.S. regulations pertaining specifically to self-driving vehicles or self-driving equipment …. Certain U.S. states also have legal restrictions on the operation, registration or licensure of self-driving vehicles, and many other states are considering them. This regulatory patchwork increases the legal complexity with respect to self-driving vehicles in the U.S.”

EU – Europe’s just different from America. It’s perfectly fine to sell Genetically Modified Organisms for food in America, but you can’t do it in the EU. Regarding self-driving vehicles,

“In markets that follow the regulations of the United Nations Economic Commission for Europe (“ECE markets”), some requirements restrict the design of advanced driver-assistance or self-driving features, which can compromise or prevent their use entirely. Other applicable laws, both current and proposed, may hinder the path and timeline to introducing self-driving vehicles for sale and use in the markets where they apply.“

China –

“Other key markets, including China, continue to consider self-driving regulation. Any implemented regulations may differ materially from the U.S. and ECE markets, which may further increase the legal complexity of self-driving vehicles and limit or prevent certain features.”

Facial recognition technology is pretty well-developed. A camera takes a picture, it’s sent to a computer with a neural network, and a match is made. Tesla has decided that this approach is superior to using LIDAR and sensors for self-driving cars because it’s cheaper, and because it believes that cameras will work better when there is rain, snow, fog etc. Here’s what Elon Musk has said in the past:

“The two main crutches that should not be used, and will in retrospect be obviously false and foolish, are lidar and HD maps,” Musk said in April 2019, referring to light detection and ranging sensors, and high-definition maps. “Mark my words.”

“Carmakers wishing to offer advanced driver-assistance systems in the country must meet what is called a map-surveying qualification, which applies to a broad range of mapping software. Even AI-driven systems that effectively build maps on the fly through their detection hardware may be subject to this classification.”

To operate in China, Tesla will have to change its approach.

c) Autonomous self-driving vehicles are a threat to carmakers such as Tesla.

Self-driving cars have the potential to put a serious dent in overall car sales because some two car households will be able to get by with only one self-driving car. A typical day will be as follows: Partner One will be driven to work. He or she will be sitting in the back seat, drinking their Latte or eating an Egg McMuffin, while reading their texts. After being dropped off at work, the car will drive itself home. Partner Two will have use of it during the day, and then the car will pick up Partner One in the evening. Overall automobile sales will decrease.

My last article gave a brief overview of the progress several other car companies are making in this field, and I have read several other articles on Seeking Alpha that do a better, more comprehensive job. Briefly, there are many, many automobile manufacturers that are investing significant amounts of money, and many of them are much further along than Tesla is. Rather than re-hashing these articles, it’s worth looking at some of the companies where Autonomous self-driving vehicles are an opportunity and not a threat.

The relevance to the Tesla Growth Story is that many of the companies mentioned in Table 1 are software companies whose technology will be available to all. Just as not every automobile manufacturer has its own proprietary self designed airbag, so too not every automobile manufacturer will have its own team of software engineers developing its own system. There will be no need to invest billions of dollars or to undertake rigorous regulatory reviews on three continents. Many carmakers just buy an approved off the shelf system. Tesla’s FSD system will be one of many, similar to others, in much the same way that Honda’s GPS is similar to GPS systems offered by Toyota, Ford, GM etc.

Table 1

|

Alphabet |

Its spinoff, Waymo has been operating Robotaxis in Phoenix for 7 years, San Francisco for 4 years, and it was just granted approval to operate in Los Angeles. Waymo has licensed its software to Uber, and it is working with Daimler Truck, the largest Commercial Vehicle manufacturer in the USA. |

| Baidu | Operates China’s largest search engine. Has been operating a Robotaxi fleet in multiple Chinese cities for 4 years. Tesla has stated that it has an agreement to use Baidu’s equivalent of GPS for China when it develops its own Self Driving System. |

| Nvidia | In discussions with, or has licensed its DRIVE Thor™ platform to BYD, Hyper, XPENG, Li Auto, ZEEKR, Nuro, WeRide, Wabi, Plus, and Daimler Truck. |

| Uber | Has licensed Waymo’s platform and is trialling it in Phoenix. Self-drive has the potential to reduce labour costs. |

| Pony.ai | Started testing its vehicles in Guangzhou in 2017, now has commercial operations in multiple Chinese cities, just granted a license to operate in San Francisco. Toyota invested $400 million into Pony.ai in 2020, and in 2023 the two companies announced a JV to mass produce Robotaxis for the Chinese market. |

| DiDi | Largest Ride Hailing company in China. Influential shareholders are Uber, Tencent, and Alibaba. Expects mass production of Robotaxis to commence in 2025. |

| Amazon | Purchased Robotaxi company Zoox in 2020 for $1 billion. Self-Driving systems have the potential to produce significant cost savings. |

| Daimler Trucks | For the development of SAE Level 4 vehicles, Daimler Truck is pursuing a dual-track strategy, in which it is cooperating with two strong partners: Waymo and Torc Robotics. The aim is to enable customers to choose the best autonomous driving solution for their company from two different products. |

| Paccar | Has formed a Joint Venture with FedEx, and Aurora, a leading autonomous driving technology company. Paccar’s autonomously enabled trucks configured with the Aurora autonomous Driver have |

For software companies like Alphabet / Google (GOOG) and Chip designers like Nvidia (NVDA), autonomous self-driving vehicles represent a source of new revenue. For companies that move freight by truck, such as Amazon (AMZN) and FedEx (FDX), autonomous self-driving vehicles offer potential cost savings. A new Class 8 Semi-trailer truck costs between $150,000 to $200,000 on average. The median annual salary for truck drivers is $108,000, with a wide variance depending upon if the driver is employed by a company ($59,000) or if the driver is an owner operator ($324,000). Health and Safety Rules limit the maximum daily and weekly number of hours that a driver can drive, and they mandate a minimum frequency and length of rest stops. Therefore, for long-haul journeys, it is common to have two drivers who can spell each other. Self-driving software has the possibility of cutting a trucking company’s labor costs in half, as the automated vehicle can take over for 12 hours a day or more.

There are winners and losers for every technological change. Self-driving cars may well wind up being a poison chalice for Tesla, and not a golden goose.

VI. The P/E Ratio for Tesla’s Chinese business should be lower than its company-wide P/E Ratio

1) Tesla received 22% of its revenue from China in 2023, but its share of the Chinese market fell to 6.7% from 10.5% the year before. It has since rebounded slightly in Q1 2024 to 7.5%, due to price cuts and offers of no down payment loans for new customers. However, it is by no means a growth story.

2) Investing in China has risks that aren’t associated with other markets.

- Chinese accounting standards and norms are different from those of the U.S. and International Standards. There is a long history of scandals that have led to large bankruptcies, ranging from the 2016 $1.6 Billion default of debt issued by Sino-Forest, to the recent $300 Billion default by Evergrande, which were allegedly caused by the fraudulent misstatement of income by $78 billion. Not every Chinese company should be tarred with the same brush. For example, as recently noted by Warren Buffett, Berkshire Hathaway has been a long-time backer of BYD Company (OTCPK:BYDDF), and it would be surprising if Berkshire didn’t have its own accountants reviewing BYD’s books.

- Political Risk is an issue. Most pertinently, there is always the possibility of a trade war. Donald Trump has stated that he will levy 100% tariffs on Chinese EVs, and there are reports that Joe Biden will announce similar tariffs this week.

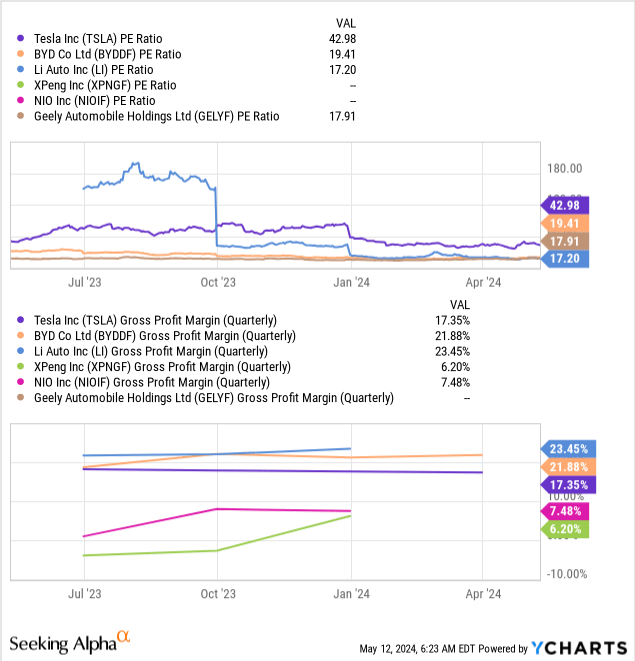

It makes sense, therefore, that Chinese EV Makers have a lower valuation than that of Tesla, but should Tesla’s China business be valued at a higher multiple than that of BYD and other pure play Chinese EV Manufacturers?

Chart 4

Tesla’s market share in China is falling, not growing. If the US imposes punitive tariffs on imports of Chinese EVs, who will China retaliate against – its own companies like Geely, Li Auto, Cherry and BYD, or Tesla? How will Chinese consumers’ perceptions about an American brand like Tesla change in such circumstances? Not positively, I am willing to bet.

So if anything, Tesla’s China business should be valued discounted, not at a premium, to Chinese automobile manufacturers. If we take a multiple of 20 for Tesla’s Chinese business, which is comparable to BYD’s margin, and assume that China comprises 20% of Tesla’s over all business, then we can arrive at a P/E Ratio for Tesla’s non Chinese-business.

Table 1

| Overall P/E Ratio |

Non-Chinese P/E Ratio (Overall Ratio / 0.8) |

|

| Historic P/E Ratio ttm | 43 | 53.75 |

| Forward P/E Ratio | 66 | 82.5 |

VII. Conclusion

I love this version of the New York Knicks, especially since they were able to make a trade for OG Anunoby. After he joined the Knicks, their odds of winning the Eastern Conference improved from 2400-1 to 950-1, and he delivered the goods; their record in games that he has played for the Knicks is 26 wins and 5 losses. So it’s no surprise that many New York Knicks fans have placed bets on their team. Professional gamblers who took the other side of the bet would have considered the following.

- The year the Toronto Raptors won the NBA Championship, OG Anunoby missed the entire playoffs due to injuries.

- This year, OG Anunoby played 50 games and missed 32 games due to injury

The Knicks won their first playoff series, and the first game of their second round series when Anunoby was playing. Last week, in Game 2, he was having one of his best games before he became injured. The Knicks went on to win the game, but they have since lost Game 3 when he did not play, and he will not be playing in Game 4. The Knicks’ odds have widened substantially.

So regarding Tesla, Inc. stock, don’t get angry with Social Media Warriors who are emotionally invested in the stock. It is what it is – trade the swings if it suits you, speculate, but don’t invest in it for the long term.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.