baileystock

EV Business in Trouble, Elon Changes Direction

Q1 was a challenging quarter for Tesla, Inc. (NASDAQ:NASDAQ:TSLA). Revenue declined 9% YoY and EPS came in at $0.45, both missing consensus. The company attributed the revenue miss mainly to the global EV sales slowdown and weakening customer spending. The outlook for the remaining of the year doesn’t look very promising either as the stock gets downward revisions in terms of sales and EPS. To make things even worse, Tesla continues to cut prices on a monthly basis as the company is struggling with competition in Europe and China. There is also continuous negative news about the company and EV adoption in general. See some of the news headlines below:

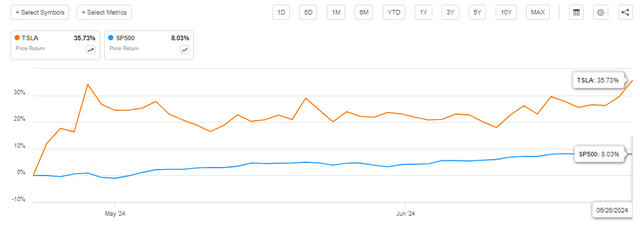

However, despite all the negativity and weak sales outlook, Tesla’s stock is showing great resilience. As shown below, the share price has increased more than 30% since earnings and outperformed S&P 500 (SP500) by a significant margin.

TSLA price performance (Seeking Alpha)

We believe Elon Musk has shown great leadership in responding to the market challenges. He’s been doing what successful CEOs do: responding boldly to disruption and setting a strategic focus for the company. Cheap Chinese EVs are disrupting the EV market, and Elon has recognized that the 20 million EV strategy has limited future potential. As a result, he has deprioritized the EV plans and shifted the company’s focus to the robotaxi market.

In this article, we want to make the case that Tesla’s robotaxi aspirations are real. In the long term, we believe that Tesla will likely disrupt the transportation industry (in five years). We will share our review of ARK Invest’s (“Ark”) bullish Tesla valuation, which estimates a target price of $2,600 by 2029. Overall, we find Ark’s valuation valuable, but we also believe that the assumptions and estimates that are made by the company are overly optimistic. Therefore, we have conducted our own analysis with more realistic assumptions. Our findings show that even with moderate projections, Tesla is positioned to deliver impressive returns to its investors.

Ark: $11 Trillion Robotaxi Market by 2030

One of the main reasons why there is so much disagreement on Tesla’s valuation is the lack of consensus on the size and potential of the robotaxi market. Current market size projections are very constrained, as they’re based on today’s ride-hailing and taxi markets, which don’t account for the disruptive effects of the robotaxi technology. Since the robotaxi market doesn’t exist today, it becomes very challenging to envision one.

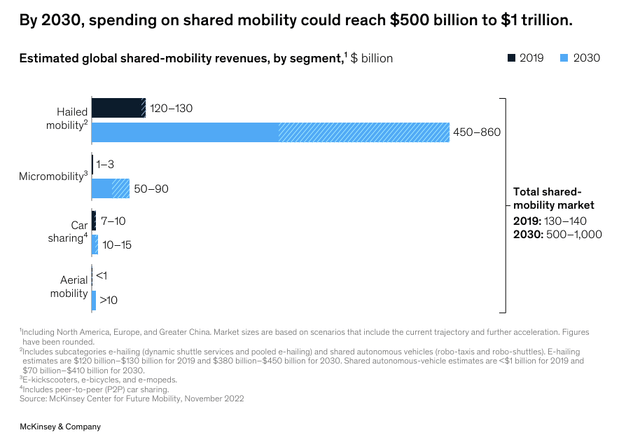

One reasonable market projection we found is from UBS Evidence Lab, which estimated in 2019 that the robotaxi market could be worth over $2 trillion by 2030 based on a NYC robotaxi scenario. On the other hand, McKinsey estimates the shared mobility market (includes robotaxis) will be between $500 billion and $1 trillion by 2030 (see below).

Mobility market size (McKinsey)

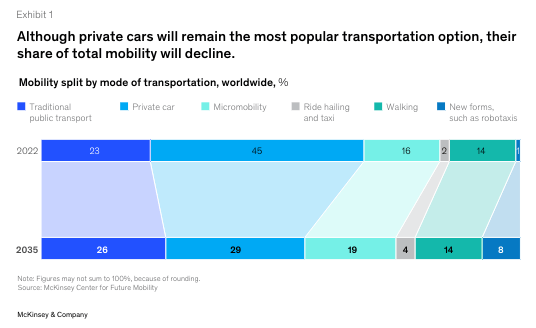

McKinsey says that consumer transportation preferences will shift significantly, and private car sales will decline over the next ten years. New forms of transportation like robotaxis and micromobility services will take over instead (see below).

Future of mobility (McKinsey)

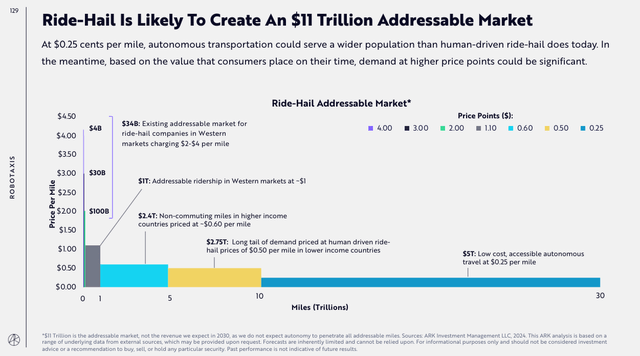

In contrast to others, Ark estimates an $11 trillion addressable market, or TAM, for robotaxis by 2030, which is the largest robotaxi market size projection made to date. Ark believes that the low-cost basis of robotaxis (as low as $0.25 per mile) will disrupt the transportation sector and create a massive $11 trillion addressable market (see below)

Robotaxi market size (ARK Invest)

This $11 trillion robotaxi market assumption is important because it is the basis of Ark’s bullish valuation model. Ark believes that Tesla can capture and capitalize on this massive new market due to its first-mover advantage and technology leadership.

Although we believe the $11 trillion market size is possible, we don’t expect it to be realized by 2030. We expect slower market growth due to various barriers, including slower technology adoption and regulatory delays. We will discuss these challenges in our next sections.

Ark: Robotaxi Commercialization by 2026 (Bear Case)

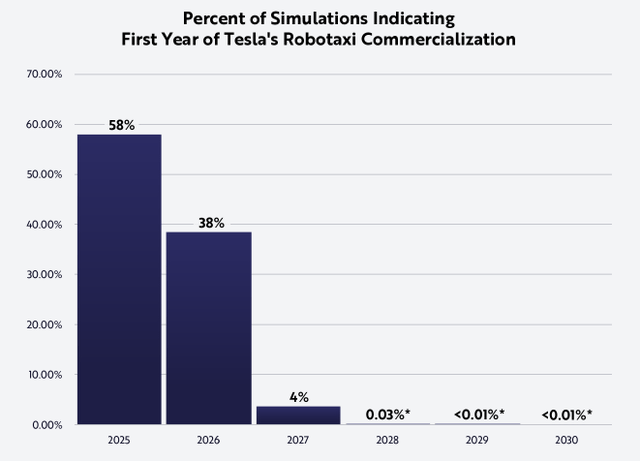

Ark predicts that robotaxi commercialization will begin by 2025 or 2026 at the latest (see below), which, we believe, is overly optimistic. Although the technology may be ready by 2026, we think Tesla will need multiple technology iterations and pilot programs to prove its robotaxi technology. Such a pilot period will likely require at least one year, as seen with some of Tesla’s competitors. Also, we estimate that regulatory approvals will take a significant amount of time (8-12 months), and further delay the commercialization process.

Robotaxi commercialization timelines (ARK Invest)

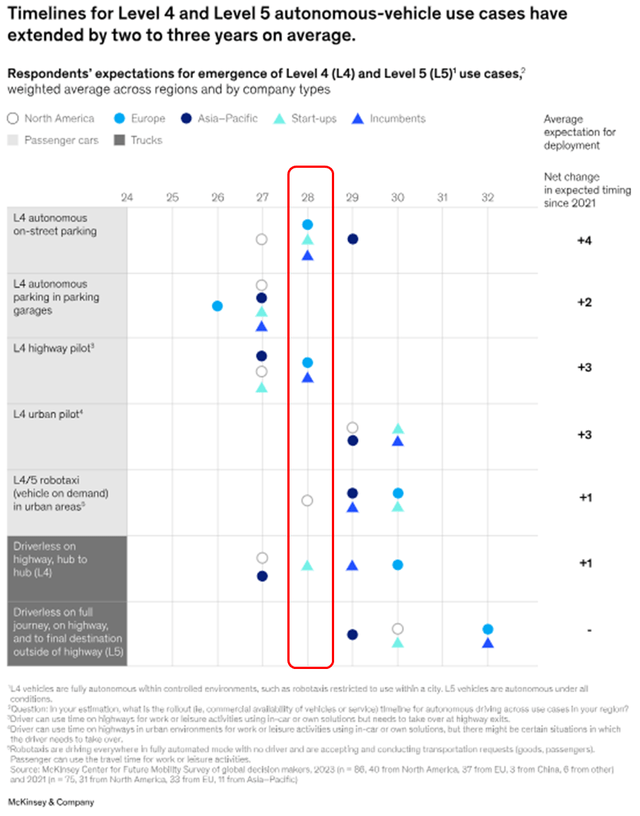

McKinsey predicts commercial availability of robotaxis by 2028, which is two years later than Ark’s projection (see below).

Our view is that Tesla’s robotaxi will become commercially available in 2027, a year earlier than McKinsey’s estimate. This is due to the company’s rapid progress on FSD and its aggressive investments in AI.

Ark: 5.9 Million Robotaxis Operating by 2029 (Bear Case)

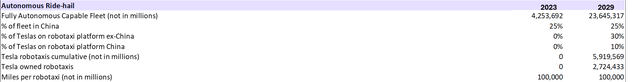

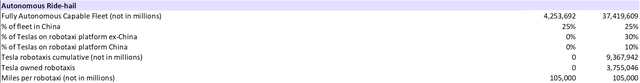

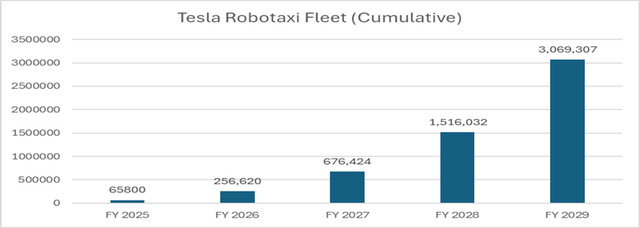

Ark assumes that all Tesla cars are robotaxi-ready and can be integrated into the robotaxi fleet. Their model suggests a capacity of 24 million robotaxi-capable vehicles by 2029 (bear case) with 30% of this capacity operating as a robotaxi. This equals to 5.9 million robotaxi fleet for the bear case (see below).

ARK Tesla Valuation model (ARK Invest)

In the bull case, the model implies 37 million robotaxi-capable vehicles, and a 9.3 million operating robotaxi fleet (see below)

ARK Tesla Valuation model (ARK Invest)

However, we believe that existing private Tesla cars are not suitable for the robotaxi fleet and that Tesla will need to produce robotaxi-specific cars on its next-gen platform. These specialized cars will be designed for maximum margins (below $20K), and built specifically for ride-hailing purposes. Adding private Tesla’s to a robotaxi fleet is not a viable scenario, as it would create significant complexities. Our analysis suggests that the company can produce a cumulative fleet of 3 million robotaxis by 2029 (see below).

Tesla robotaxi production (Author)

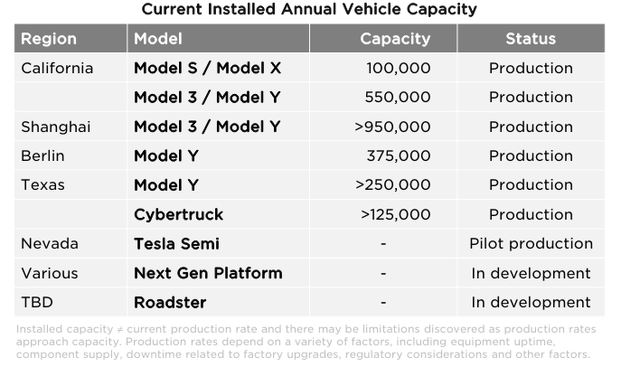

Although we don’t foresee robotaxi commercialization before 2027, we think Tesla will start robotaxi production in 2025. Tesla will have enough capacity to achieve a production scale for 3 million cumulative robotaxis by 2029 as the company will use the next-gen platform factories that are planned for a 2025 opening. The company has currently a yearly production capacity of approximately 2.5 million units, so we do not foresee any capacity constraints for scaling robotaxi production.

Tesla Production capacity (Tesla Q1 Earnings presentation)

Our robotaxi figures are significantly less than Ark’s bearish scenario, but still represent a massive opportunity for Tesla. We take a more cautious approach due to various risks and constraints we see in the market.

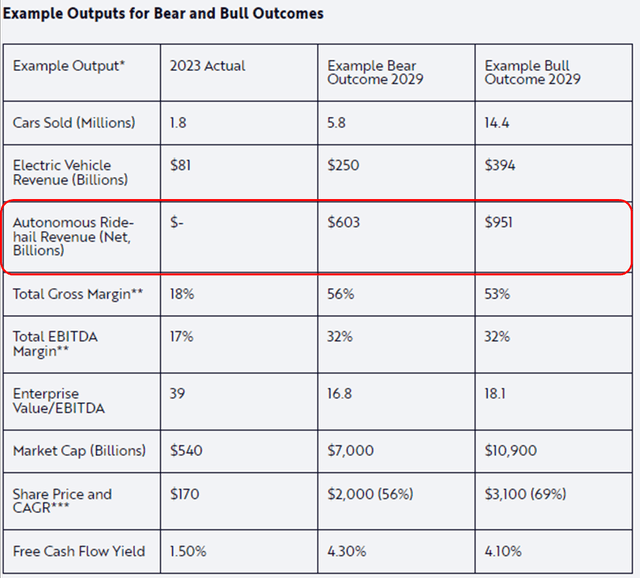

Ark: $603B Robotaxi Revenue in 2029 (Bear Case)

Ark says that 90% of Tesla’s value in 2029 will be based on the robotaxi business. According to Ark, Tesla will generate between $600 billion and $951 billion in robotaxi revenue in 2029 (see below). This is assuming that the robotaxi market will expand very fast, commercialization will start in 2026 latest and the fleet will have at least 5.7 million robotaxis available (bear case).

Tesla Valuation model (ARK Invest)

While we agree that Tesla’s future value will largely depend on its robotaxi business, we believe the revenue numbers for 2029 are aggressive and do not account for market adoption challenges, capacity constraints and regulatory timelines. We expect a slower adoption curve as the commercialization will not start before 2027. Also, we think that the robotaxi fleet will need specially designed vehicles, which will require a manufacturing ramp-up. We think these factors will delay the robotaxi revenue stream.

Valuation

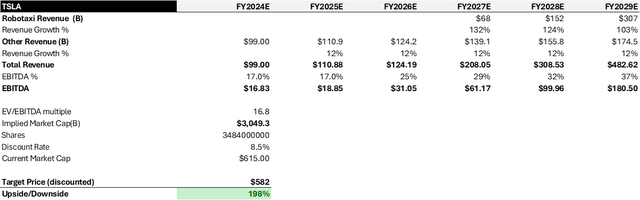

Our valuation model assumes Tesla to successfully deploy and operate a fleet of 3 million robotaxis by 2029 instead of the 5.9 million projected by Ark (bear case). With this assumption, we think that the company could achieve a $3 trillion market cap by 2029. Discounted to present value, this translates to a stock price valuation of $582 and 200% upside (see below)

Our revenue projection is based on the deployment of a 3 million robotaxi fleet by 2029, as explained in our previous section. Based on $100,000 revenue per robotaxi, we estimate a total robotaxi revenue of $307 billion. We estimate other revenue to be $175 billion, which includes revenue from EVs, energy storage, and insurance businesses. Our model assumes 12% CAGR for other business (10% CAGR for the EV and 14% CAGR for energy storage).

We expect Tesla EBITDA margins to expand to 37% by 2029 as the robotaxi business ramps up and achieves 50% EBITDA margins due to its automation capabilities and driverless model. Applying a forward sales multiple of 17x EBITDA (ARK’s Bear case EBITDA multiple) results in a $3 trillion market cap in 2029.

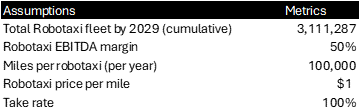

Other assumptions are as follows:

TSLA Assumptions (Author)

- Tesla’s robotaxi EBITDA margin is assumed to be 50% consistent with Ark’s estimate, based on the high gross margin nature of the business due to eliminated driver costs.

- Tesla’s take rate for robotaxi is assumed to be 100%, with the company owning and operating its robotaxi network, retaining all revenue.

- Price per mile for robotaxi is assumed to be $1/mile and the same as Ark’s model, and significantly lower than current ride-hailing rates of $2 to $4.

- Robotaxis have higher utilization rates than normal taxis, assumed to be 100,000 miles per year, compared to the average New York taxi’s 46,800 miles per year.

- Tesla discount rate taken as 8.5% based on its WACC.

- Our model does not include robotaxi revenue from 3rd party companies that will operate Tesla robotaxi fleets. This scenario could introduce an additional revenue for Tesla.

- Our model also doesn’t consider Optimus, FSD licensing to 3rd party automakers and human-driven ride-hail scenarios.

Risks

The robotaxi market is full of risks, and we have identified three major risks for the company:

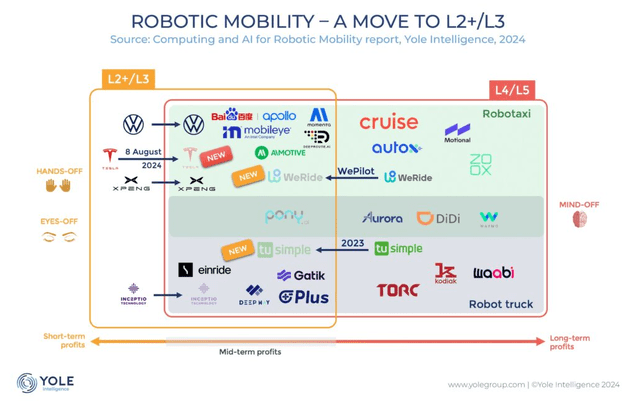

- Competition: The robotaxi industry is moving fast due to advancements in AI and advanced driver assist systems (ADAS). There is increased competition in the market, both from the traditional automakers and tech giants. Companies like Waymo (GOOG), Baidu (BIDU), and Zoox (AMZN) are making significant progress. Elon is investing $10 billion in AI infrastructure this year, including 50,000 Nvidia (NVDA) GPUs from Nvidia (on top of the 35,000 running already). Tesla’s future valuation relies heavily on its robotaxi technology leadership and first-mover advantage. The company must continue investing heavily in self-driving infrastructure to remain competitive, and achieve its projected valuation.

Robotaxi competition (Yole Intelligence)

- Regulation: Regulatory support is critical for commercializing and scaling the robotaxi opportunity. Currently, Tesla only holds a permit in Shangai, China to pilot a limited 10-vehicle FSD operation. A robotaxi service requires approval from multiple public agencies, and the process itself can take several months. For example, Google’s Waymo needed eight months to secure a robotaxi operation permit in San Francisco. Tesla’s regulatory timelines might be similar.

- Human Adoption: Technology might be ready, but convincing people to use robotaxis on a large scale could be a challenging and time-consuming process. Looking at some consumer surveys on mobility, we see that there is growing public interest in autonomous services. At the same time, there is also a rising number of negative reviews, investigations, and trials related to robotaxis. Any accident involving a robotaxi gets extensive media coverage, which triggers public protests and regulatory scrutiny. For example, last October, the Dept. of Motor Vehicles ordered Cruise (GM) to stop its robotaxi services in California after hitting a pedestrian. These type of negative events and incidents can collectively create barriers to widespread robotaxi adoption.

Conclusion

Tesla’s Q1 earnings were very challenging as revenue declined and margins contradicted. The Q2 outlook also looks weak, with continuous downward revisions and increasing negativity regarding EV adoption and competition.

Despite the negativity, we believe Tesla’s long-term potential remains strong. We can see that in the price reaction, which indicates a shift in focus from EV’s to the significant robotaxi opportunity. This shift fundamentally changes the way how Tesla is valued.

As one of the most controversial valuations, we have reviewed Ark’s recently released Tesla valuation model, which estimates a 2029 target price of $2,600. While we find the valuation valuable, we also believe that some of the assumptions are overly optimistic, such as the $11 trillion addressable market, robotaxi commercialization by 2026, 5.7 million robotaxi fleet and $1.1 trillion revenue by 2029 (bear case).

Instead, we have conducted our own analysis, and provided alternative assumptions and valuations for the robotaxi opportunity. Our relatively moderate projections indicate a 200% growth potential for Tesla stock. As the robotaxi market develops, we expect Tesla’s valuation to reflect this potential.

We rate Tesla as a strong buy.