Sue Thatcher/iStock Editorial via Getty Images

Tesla, Inc. (NASDAQ:TSLA) has never been a sleepy stock. The world’s leading manufacturer of electric vehicles (“EVs”) has always been a lightning rod for the press, and the most recent stir-up is the upcoming June 13 vote for CEO Elon Musk’s proposed $56 billion compensation package – where rejection of this package is expected to cause a decline in Tesla share prices.

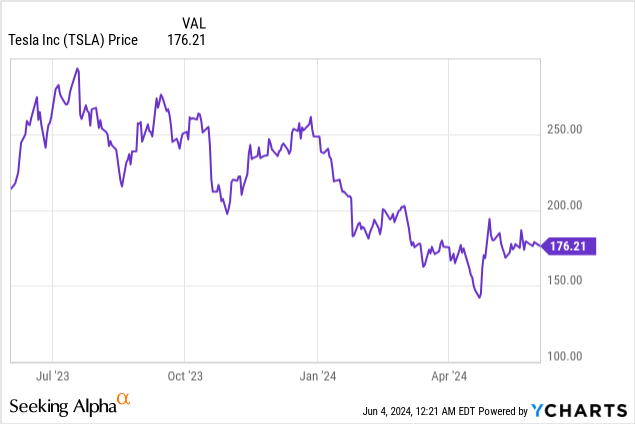

But when speculating about the outcome of nearer-term drivers, we lose sight of the veritable fundamental progress that Tesla is achieving, even amid a difficult operating environment. With the stock still down nearly 30% year to date, I continue to see an opportunity for investors to load up here, especially if the vote goes south.

I last wrote a bullish article on Tesla earlier this year, in January, when the stock was still trading closer to $200 per share. At the time, I had argued that Tesla’s price drops – though certainly a headwind to near-term gross margins and profitability – would make the company more appealing vis-à-vis other EV makers and hybrids, which have resurged in popularity this year.

Now, with Tesla stock still lower than the start of the year, I’m renewing my buy call on Tesla – and in addition, there are a few more green light positive catalysts to bank on for the company.

In short: Tesla has long been a volatile stock, especially around key milestones like earnings, production updates, and flashy shareholder votes. But as a long-term believer in EV adoption and Tesla’s brand and technology advantage in the space, I’m holding firm.

Gross margin stabilization, with further upside from greater FSD adoption

Much ado has been made over the past year about Tesla’s price cuts. The company has slashed prices, sometimes multiple times in the same quarter, always triggering a violent investor reaction (especially to the price cuts made in China, where the company is competing against much cheaper local alternatives).

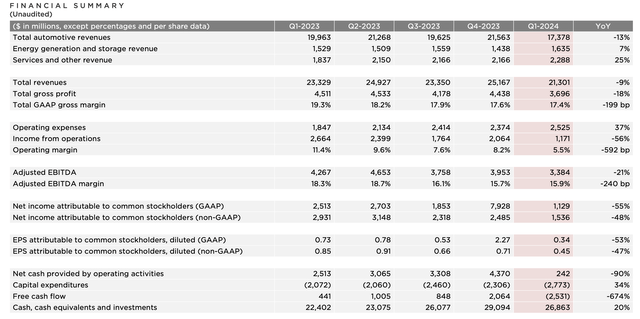

But amid this round of price cuts, we saw in Tesla’s Q1 results that the company has achieved sequential gross margin stabilization.

Tesla trended metrics (Tesla Q1 shareholder deck)

Q1 gross margins of 17.4% fell 2 points y/y, compared to an eight-point y/y reduction in Q4, and fell only 20bps sequentially from Q4 as well.

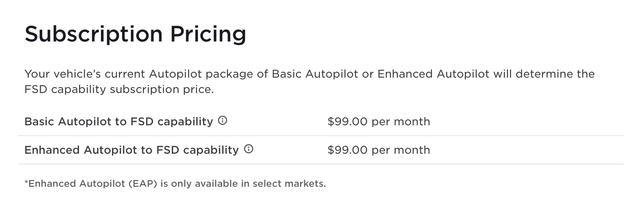

We note that there are a number of positive drivers for a recovery in gross margin, over and above vehicle production efficiencies, that will be naturally gained over time. It’s worth recognizing that Tesla has recently initiated free full self-driving (“FSD”) trials to buyers of new Teslas as well as existing Tesla holders starting in March, to encourage more adoption of the $8,000 feature.

Equally, worth noting is the fact that in a number of markets, FSD is now available as a $99/month subscription, which is substantially less of a barrier to entry than an $8,000 sticker price. We as consumers have been trained now by the subscription model, and many big-ticket purchases (including and especially smartphones) have also shifted to a monthly payments model.

Tesla FSD subscription (Tesla.com)

In my view, the rollout of both free trials and subscription pricing will boost Tesla’s FSD attach rates on new vehicles, which is essentially a “free” lever to gross margin leverage.

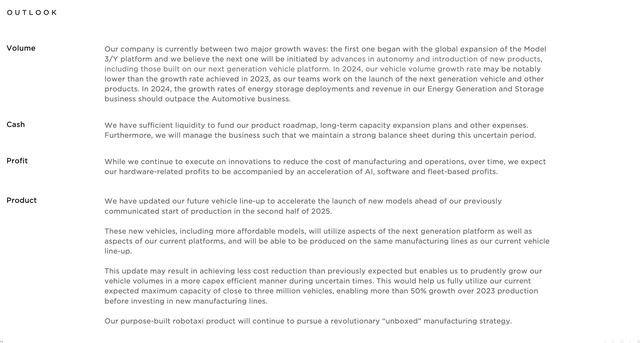

Accelerated timeline for next-gen vehicles

In my view, Tesla also isn’t getting enough due credit for the pulled-in expectations of launch timing for its next-gen lower-priced vehicles. We know by now that Tesla believes itself to be in between two major growth phases, the second of which will be unleashed when cheaper cars are available on the market.

Tesla anecdotal outlook commentary (Tesla Q1 shareholder deck)

As seen in the company’s anecdotal outlook commentary above, the company notes that it expects to begin production of these new vehicles by early 2025. Also core to note is that Tesla has existing installed capacity to grow vehicle volumes at least 50% above 2023 levels when these new vehicles come online before investing in any new manufacturing lines. So right now, the gross margins we’re observing has idle costs embedded that are being reserved for these new vehicles.

Per Elon Musk’s roadmap commentary on the Q1 earnings call:

We also continue to expand our AI training capacity in Q1, more than doubling our training compute sequentially. In terms of the new product roadmap, there has been a lot of talk about our upcoming vehicle line in the next – in the past several weeks. We’ve updated our future vehicle lineup to accelerate the launch of new models ahead, previously mentioned startup production in the second half of 2025, so we expect it to be more like the early 2025, if not late this year. These new vehicles, including more affordable models, will use aspects of the next generation platform as well as aspects of our current platforms, and will be able to produce on the same manufacturing lines as our current vehicle lineup. So it’s not contingent on any new factory or massive new production line. It’ll be made on our current production lines much more efficiently. And we think this should allow us to get to over 3 million vehicles of capacity when realized to the full extent.”

Valuation metrics still look reasonable, especially when a number of upside margin catalysts are still on the horizon

If we judge Tesla on near-term earnings metrics, many may consider the stock to be expensive versus the broader market, but against a longer-term context, I think Tesla actually trades at reasonable levels even against trailing metrics.

At current share prices hovering around $175, Tesla trades at a market cap of $552.4 billion, and when we net off the substantial $24.0 billion of net cash on Tesla’s most recent balance sheet ($26.9 billion of cash, offset by a relatively minor $2.9 billion in outstanding debt), its resulting enterprise value is $528.4 billion.

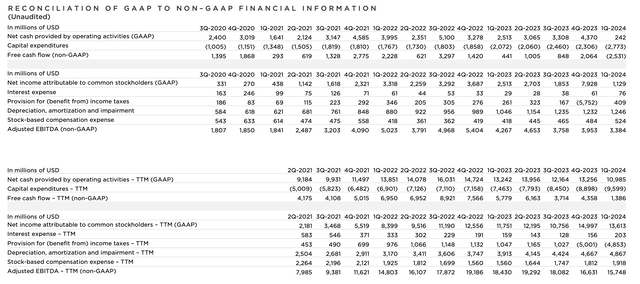

As shown in the chart below, Tesla’s TTM adjusted EBITDA clocks in at $15.7 billion. Against this, Tesla trades at 33.6x EV/TTM adjusted EBITDA.

Tesla trailing profitability metrics (Tesla Q1 shareholder deck)

We could argue that Tesla is at a low point in terms of profitability, having just gone through a round of price cuts. We’ve already discussed the potential of greater FSD adoption (from free trials and subscriptions) to boost gross margins. Beyond a recovery in sales, another core lever to profitability expansion is the company’s recent decision to lay off 10% of its headcount. These moves are expected to deliver at least $1 billion of annualized savings.

Key takeaways

Amid shorter-term volatility, I continue to see a number of positive catalysts for Tesla, including and especially an accelerated next-gen vehicle roadmap. Take advantage of this year’s stock slide to build a long-term position here.