Wirestock/iStock Editorial via Getty Images

Executive Summary

Tesla, Inc.’s (NASDAQ:TSLA) valuation is influenced by whether the firm will remain an automaker or it will evolve into a technology hardware company, with the company’s expected value ranging from a low of $300 billion to a high of $1 trillion.

At the present day, Tesla is undoubtedly an automobile company, with 1.8 billion vehicles sold in 2023. However, it’s undeniable that the company is heavily investing in new technologies, among all in its Full Self-Driving (FSD) capabilities.

But Tesla tech doesn’t stop at autopilot, the firm is notably investing and developing robotics manufacturing solutions, currently implemented in its factories to improve efficiency and profitability, and obviously, they couldn’t miss investing in AI technologies.

The management couldn’t stress more on their robotics and AI future during the 2024 Q1 earnings call:

We should be thought of as an AI or robotics company. If you value Tesla as just like an auto company, it’s just the wrong framework. If you ask the wrong question, then the right answer is impossible.

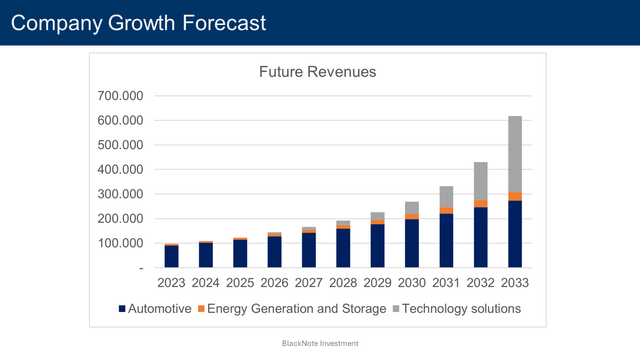

Hence, the following analysis will try to correctly answer the question, by assessing how revenues, operating margins, and free cash flows will change in two different scenarios: one assuming Tesla remains an excellent EVs maker, and another one assuming Tesla will evolve into a technology hardware company leveraging on its vehicles to capitalize on its tech solutions.

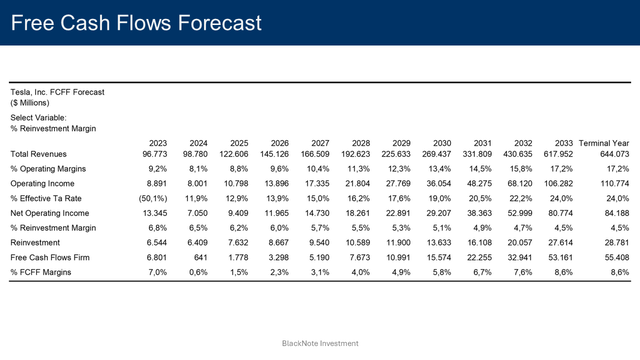

1st scenario (Source – BlackNote Investment) 2nd scenario (Source – BlackNote Investment)

Before deep diving into the valuation, it’s worth mentioning that, by any means, this analysis does not want to be a technical and detailed assessment of the technologies under development by Tesla.

Rather, it will treat the topic from a general point of view – using the reference “Technology solutions revenues” instead of discerning from “robotaxis,” “robotics,” and “AI revenues” – focusing on how Tesla’s value changes based on how investors identify the company.

Despite we agree that more detail is always preferable, in this case, we believe that excessively dwelling on single technologies not yet fully implemented won’t add value – or change the results of the valuation – if not increase the chance of committing mistakes.

Tesla The Auto Company

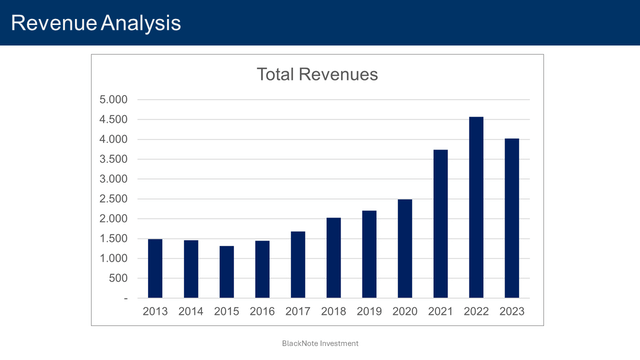

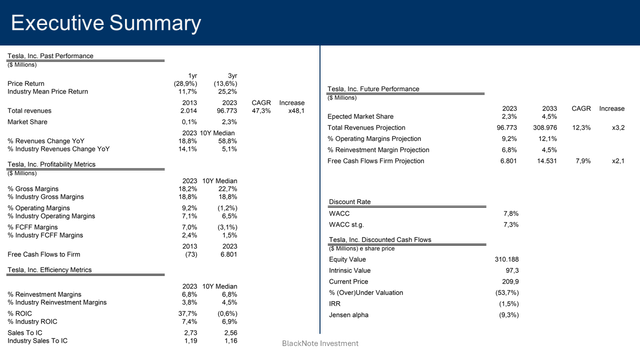

In 2023 Tesla’s total revenues sat at $96.7 billion, an increase of 18.8%, significantly lower than the 58.8% median revenue growth rate investors were used to. However, it was still a good performance when compared to the y-o-y automobile industry growth rate of 14.1%.

As of the 2024 Q1, revenue declined (8.7)% q-o-q.

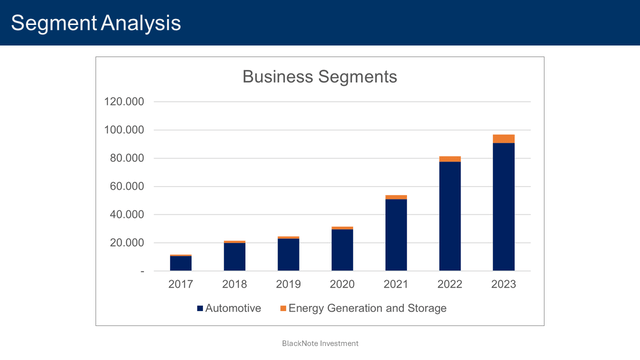

Leveraging on its battery and renewable energy know-how, Tesla is also active in the solar and energy storage business, which in 2023 accounted for 6.2% of revenues, equal to $6 billion.

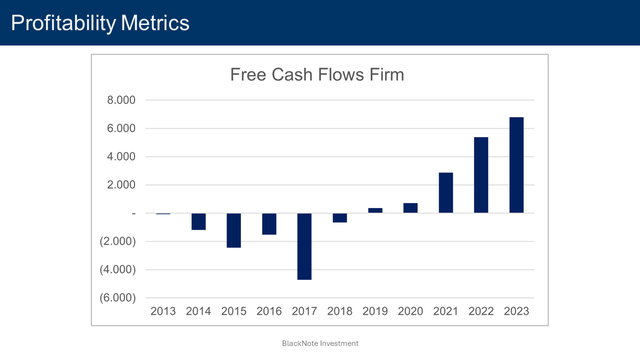

Profitability Metrics

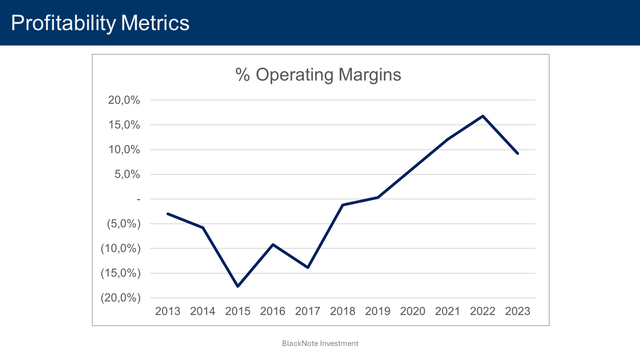

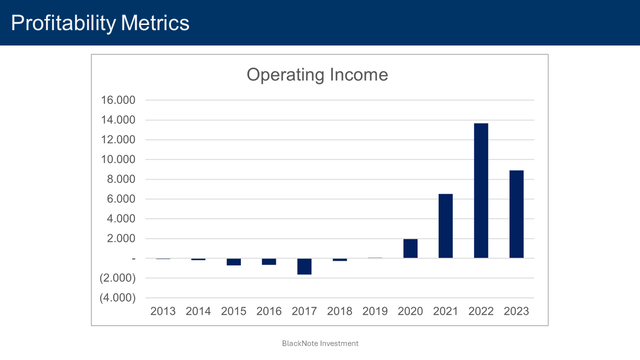

The 2023 Tesla’s operating margin was 9.2%, declining from the 12.1% and 16.8% operating margin registered in 2021 and 2022 respectively, but still better than the past decade’s industry median value of 6.5%.

The total operating profit was $8.9 billion, registering a decrease of (34.9)% y-o-y, while in the latest Q1, the operating margin was at 5.5%, with the operating profit declining (56)% q-o-q.

Looking at free cash flows to the firm (FCFF), in 2023 the FCFF sat at $6.8 billion, equal to a FCFF margin of 7% – significantly better than the automobile industry’s 10Y median FCFF margin of 1.5% – continuing on the positive trend begun in 2019 when the company turned free cash flow positive.

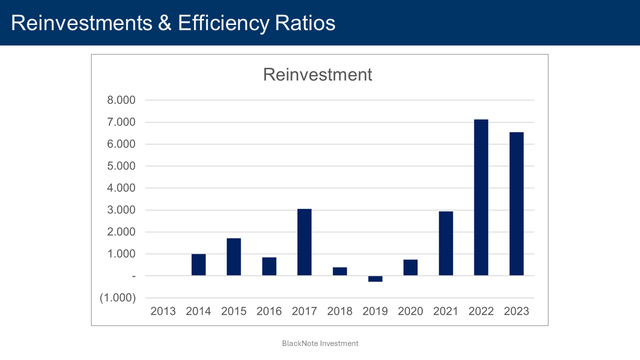

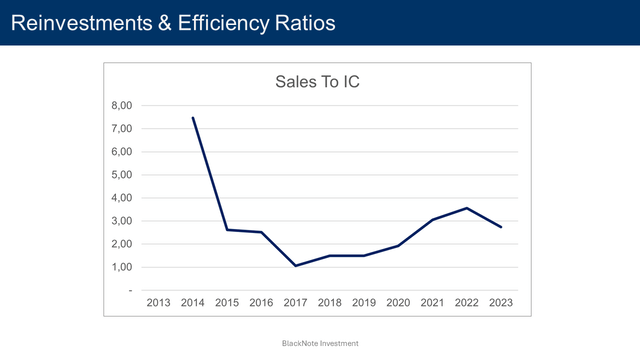

Reinvestments & Efficiency Ratios

Over the past decade, Tesla has reinvested heavily into its business with the median reinvestment margin of Tesla standing at 6.8%, comprising net capital expenditures, acquisitions, and changes in working capital. When treating R&D expenses as capital expenditures due to their long-term value generation, this figure adjusts to 11.2%.

The same adjusted reinvestment margin scored by the automobile industry over the past decade sits at only 4.5%.

In terms of efficiency on capital reinvested into the company, during the period 2013-2023, Tesla boasts a median sales to invested capital ratio of 2.56, more than doubling the industry median value of 1.16.

Tesla The Tech Company

Tesla’s performances speak for themselves, in all aspects they are superior to your average automaker.

Despite the stumble in 2023 and the first half of 2024 – due to a weaker-than-expected EVs environment, which is tackling every automaker, not just Tesla – the firm is playing in a league of its own.

Tesla’s revenues are growing faster, they are more profitable, and more efficient with their capital investments, when compared to traditional companies in the automobile industry, all culminating in greater free cash flow generation.

Even if Tesla is still deriving the majority of its revenues from the sales of vehicles, it appears that treating the firm as a pure auto company is wrong in the first place, at least from a metric perspective.

Tesla is still – and likely will always be – highly influenced by automotive industry dynamics, as shown by the downturn in revenue growth rates following the 2023 deterioration of the EVs market.

But if the firm is undoubtedly an automobile company when it comes to revenue generation, in terms of profitability, reinvestment, and cash flow generation it is full-fledged a technology hardware company.

The 10Y median operating margin for a technology hardware company is 12.1%, while the 10Y median FCF margin is 8%.

Thanks to the technology in its EVs, Tesla was able to create a solid moat, resulting in greater revenue growth; selling its vehicles at a premium, improving profitability; and thanks to robotics to improve its factories’ efficiency, improving cash flow generation.

Here is an extract from the 2021 Q4 earnings call:

From the hardware side, we are aggressively driving manufacturing innovations and operational efficiency to reduce cost. And with the rapid development of FSD, software-based profits will ultimately become a strong addition to the profits generated by selling hardware.

Industry Overview

However, as said previously, Tesla will always be highly influenced by the automotive industry dynamics when it comes to selling its hardware, as without first selling its electric vehicles, Tesla cannot capitalize on its technologies.

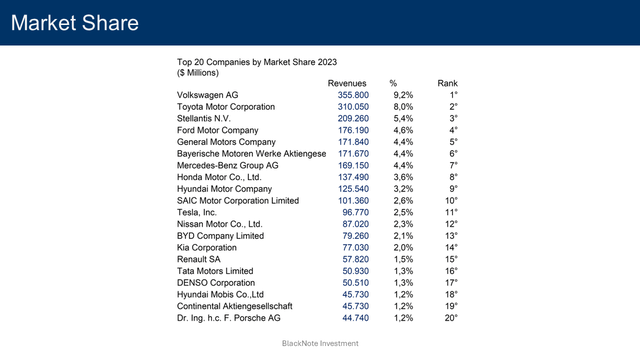

With its $90.7 billion revenues from the EVs segment, tesla has established a decent presence in the automobile industry, representing 2.3% of the industry’s total revenues of $3.86 trillion.

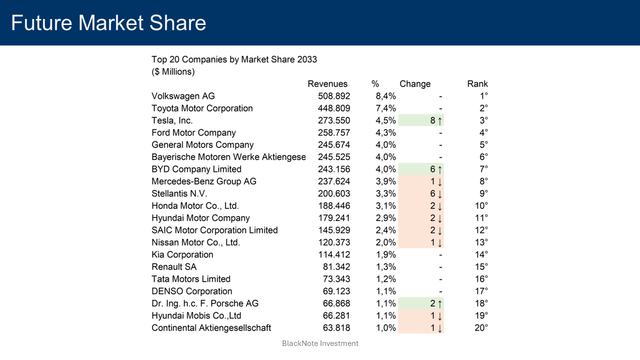

The automobile industry is highly competitive. Looking at the industry in its entirety, primary players consist of Volkswagen (OTCPK:VWAGY) with a 9.2% market share, Toyota (TM) with an 8% market share, and Ford (F) with a 4.6% market share.

In the EVs segment, Tesla’s main competitor is the Chinese conglomerate BYD, which despite boosting only an overall 2.1% market share, is the leading new energy vehicles automaker in China and is rapidly expanding its presence in overseas markets thanks to its low-price vehicles.

Industry Growth Forecasts

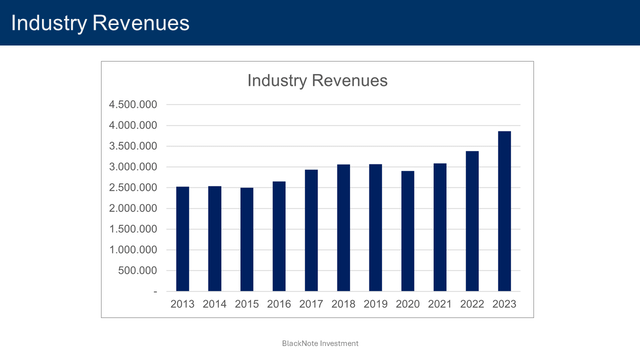

From 2013 to 2023, the industry’s revenues grew at a CAGR of 4.3%, increasing 1.53 times from $2.52 trillion to $3.87 trillion.

Despite lower-than-anticipated electric vehicle adoption rates, which have led legacy automakers to adjust spending, production, and product launches of new energy vehicles (NEVs), it’s clear that NEVs are the future of the automobile industry with automakers that, eventually, will be forced by legislators to cease the production of internal combustion engine (ICE) vehicles to promote more sustainable means of transportation.

Other than a secular switch in vehicles’ powering systems, which will boost the sale of new vehicles throughout the next decade, emerging economies – especially Asian ones like Thailand, India, Indonesia, Taiwan, and China for a lesser part – are expected to drive the demand for new cars.

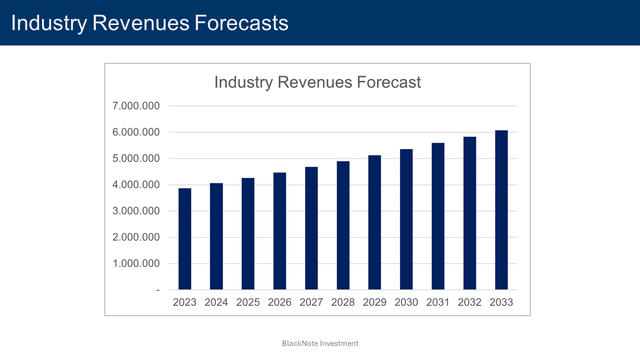

Combining both the reinvestment made through the past decade and the industry’s ability to generate revenues from the investments made, the 2024 expected revenue growth rate for the industry is 5.1%.

The industry’s expected growth rate, and all the related industry assumptions, are based on the 2024 Automobile Industry Outlook published by BlackNote Investment.

By 2033, the automobile industry revenues are expected to reach $6.07 trillion, increasing 1.57 times from the $3.87 trillion registered in 2023 at a CAGR of 4.6%. We projected the industry’s expected revenues 10 years from now, applying the expected growth rate of 5.1% and allowing it to slowly decline as the industry approaches the economy’s perpetual growth rate, represented in this case by the USD risk-free rate.

Tesla Auto Company Growth Forecasts

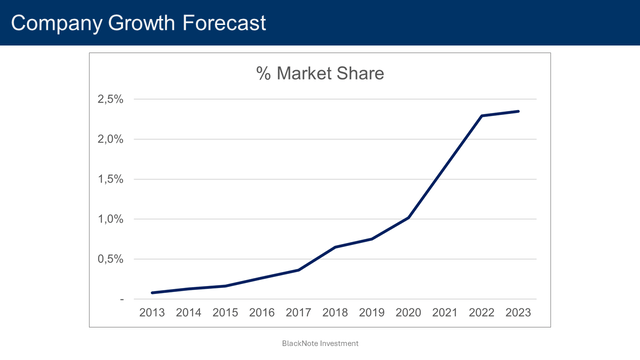

Projecting Tesla’s future market share, over the period 2013-2023, its market share significantly improved from 0.1% to 2.3%.

Despite the general slowdown in new energy vehicle adoption, it’s not a bold statement to say that electrification is the future of the automotive industry. As a pioneer in the EVs segment, it is undeniable that Tesla is at the forefront of this secular transition towards more sustainable means of transportation.

Considering Tesla’s brand recognition and superior features of its electric vehicles, we expect Tesla to achieve a 4.5% by 2033, becoming the third-largest automaker, with revenues from the automotive segment projected to reach $273.5 billion, representing an increase of 3 times from the 2023 revenues of $90.7 billion at a CAGR of 11.7%.

Assuming the average selling price of its vehicles remains around $50k – for the sake of simplicity – it would translate into 5.6 billion vehicles sold by 2033.

Briefly dwelling on the solar and energy storage segment, revenues are expected to improve from $6 billion in 2023 to $35.4 billion by 2033, as Tesla improve its market share in the renewable energy industry from 1% to 3.8%.

Therefore, assuming Tesla will remain only the excellent automaker it already is, its total revenues are projected to reach $308.9 billion by 2033, representing an increase of 3.2 times from the 2023 revenues of $96.7 billion at a CAGR of 12.3%.

Tesla Tech Company Growth Forecasts

Now, projecting Tesla revenues in the scenario where it becomes a full-fledged technology hardware company, here is an extract from the 2020 Q4 earnings call that displays perfectly how Tesla’s investments in new technologies are expected to play out in the future:

If Tesla ships, let’s say, hypothetically, $50 billion worth of vehicles and those vehicles become Full Self-Driving and can be used as robotaxis, the utility increases from an average of 12 hours a week to potentially an average of 60 hours a week if they’re capable of serving as robotaxi. So that’s like roughly a 5x increase in utility…But let’s just assume that the car becomes twice as useful, that would be a doubling again of the revenue of the company, which is almost entirely gross margin. So it will be like having $50 million of incremental profit basically from that because of the software.

The key concept here is the vehicles’ increased utility due to the new technologies implemented by Tesla.

The primary usage derived from increased utility would be the long-awaited robotaxis services, but the management also expressed their interest in being able to remotely use the advanced AI chips needed to operate FSD capabilities for computational needs when the cars are not used for transportation needs.

However, as said at the very beginning, our valuation won’t be a thorough analysis of Tesla’s tech. Hence, we will just assess how the assumption of increased vehicle utility will play on Tesla’s ability to generate revenues.

Assuming Tesla will eventually double the utility of each EV sold, we assumed that starting from 2026 the firm will start to recognize revenues from its technological solutions business line, and from 2026 to 2033 the segment revenues will grow from 5% to 50% of total revenues.

We are aware that this particular assumption is totally arbitrary and subjective, however, we think it is a plausible pathway towards the management goal of doubling vehicles’ utility in the next 10 years.

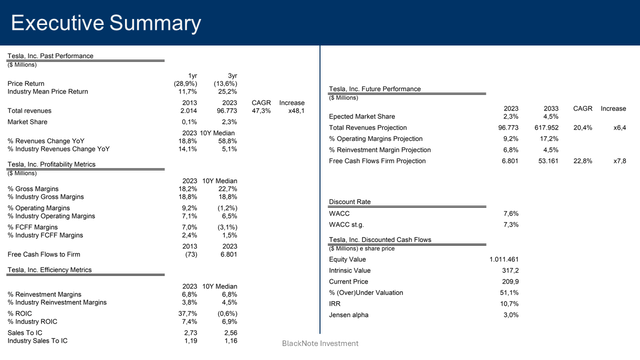

Therefore, assuming Tesla will evolve into a technology hardware company, its total revenues are projected to reach $617.9 billion by 2033, representing an increase of 6.4 times from the 2023 revenues of $96.7 billion at a CAGR of 20.4%.

Tesla Auto Company Profitability

Moving on to projecting profitability, as said previously, even if Tesla remains only an automaker, its business model already benefits from all the tech developed by the firm, granting it better profitability than the average company in the automobile industry.

For such reason, even in the scenario of Tesla the auto company, we still expect the firm to achieve an operating margin in line with the median operating margin of the technology hardware industry equal to 12.1% by 2033.

Tesla Tech Company Profitability

As regards the scenario in which Tesla evolves to be a full-fledged technology hardware company, starting from the 12.1% operating margin expected for the automotive segment, we assumed the technology solutions segment to achieve profitability levels on par with software companies.

It might seem – and probably is – an aggressive assumption to make, however, sticking with management’s expectations of doubling vehicles’ utility, the extra revenues derived by the increased utility, are likely to be generated with little marginal costs on top of the already expensed R&D costs incurred to develop new technologies and vehicles.

The software industry boasts a 10-year median operating margin of 22.3% and a 10-year median FCF margin of 10.7%.

By 2033, given our assumption the technology solutions segment accounts for 50% of revenues, the average operating margin for Tesla in the scenario it generates revenues as a technology hardware company is expected to be 17.2%.

Reinvestment Needs

In both scenarios, we expected Tesla to maintain a reinvestment margin in line with the automobile industry average, equal to 4.5%, whether it remains an auto company or evolves into a tech company.

Despite the future of the company, it is undeniable that Tesla has to keep investing in the development of new vehicles and in maintaining and improving factory capacity, as without selling the hardware in the first place, it cannot capitalize on its tech.

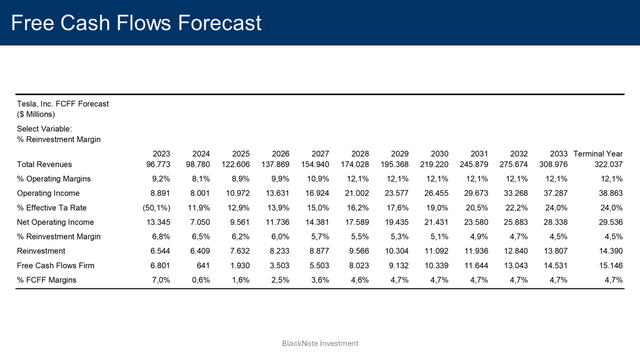

Tesla Auto Company Future Cash Flows

Synthesizing all underlying assumptions in the scenario where remains an excellent EVs maker – $308.9 billion in revenues by 2033, 12.1% operating margin, and reinvestment margin of around 4.5% – Tesla’s free cash flows to the firm are anticipated to swell to $14.5 billion by 2033, equal to a FCFF margin of 4.7%.

1st scenario (Source – BlackNote Investment)

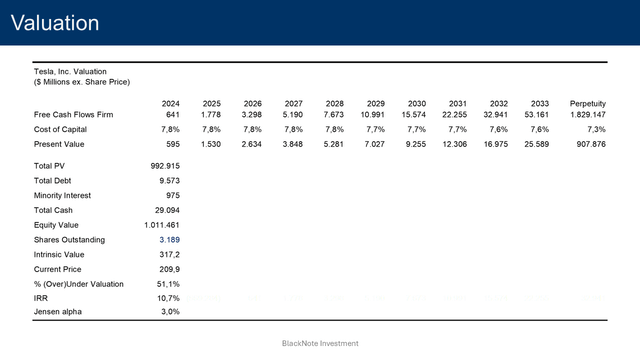

Tesla Tech Company Future Cash Flows

Synthesizing all underlying assumptions in the scenario where evolve into a technology hardware company – $617.9 billion in revenues by 2033, 17.2% operating margin, and reinvestment margin of around 4.5% – Tesla’s free cash flows to the firm are anticipated to swell to $53.2 billion by 2033, equal to a FCFF margin of 8.6%.

2nd scenario (Source – BlackNote Investment)

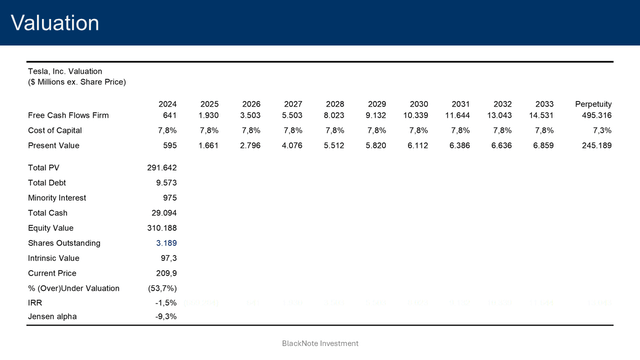

Company Valuation

In the first scenario, we apply a discount rate of 7.8% for the next 10 years, and a discount rate of 7.3% in perpetuity, while in the second scenario, we start with a discount rate of 7.8%, but we gradually adjust it to 7.3% as also the company risk profile changes as the firm evolves from an auto company to a technology hardware company

With these assumptions, we obtain that the present value of these cash flows – after adjusting for debt and cash on hand – is equal to $310.2 billion or $97.3 per share, in the auto company scenario, and $1.01 trillion or $317.2 per share, in the tech company scenario.

Compared to the current prices, in the first scenario, Tesla stock is overvalued by 53.7% – negative alpha of (9.3)% – while in the second scenario, Tesla’s stock is undervalued by 51.1% – positive alpha of 3%.

1st scenario (Source – BlackNote Investment) 2nd scenario (Source – BlackNote Investment)

However, given the number of assumptions made throughout the valuations, especially as regards the scenario seeing Tesla becoming a full-fledged technology company, it would be more realistic to assume that the truth lies somewhere in between.

Assigning a likelihood of 50% to both scenarios – again for the sake of simplicity – results that the intrinsic value of Tesla is equal to $670.6 billion or $210 per share, making Tesla’s stocks fairly valued at current prices.

The Street target for Tesla – based on 42 different analyst expectations – is sitting at $183 per share, as of the 1st of July 2024, with a high of $310 and a low of $85, and 21 Street recommendations expressing the rating “Hold.”

Discount Rate

To determine the appropriate discount rate, we employ the WACC method, which considers both the cost of equity and the cost of debt.

The cost of equity – 7.8% for the auto company and 7.3% for the tech company – is derived using the USA equity risk premium of 4.6% – as of June 2024 – the current USD risk-free rate of 4.2%, and the company’s beta of 0.79, for the auto company, and 0.7, for the tech company. The auto company’s beta is based on the automobile industry’s unlevered beta of 0.65, while the tech company’s beta is based on the technology hardware industry’s unlevered beta of 0.57.

The cost of debt – 4.9% – represents the expected return demanded by debt holders and is influenced by the company’s specific risk profile and the broader market conditions. It is computed considering the current USD risk-free rate of 4.2%, the company’s default spread of 0.7%, and the USA default spread of 0%.

With a current Equity to Enterprise Value of 98.8% and a Debt to Enterprise Value of 1.2%, Tesla’s discount rate for the next 10 years is 7.8%, in the auto company scenario, and 7.4%, in the tech company ones.

As Tesla enters the steady state, both the company’s beta and company default spread are expected to approach the industry’s median values of 0.82 and 0.7%, respectively for the auto company, and 0.71 and 0.9%, respectively for the tech company.

Mature companies often have more predictable cash flows and may change their financing strategies. We anticipate Tesla to adjust its Equity to Enterprise Value and Debt to Enterprise Value towards the industry median of 83.4% and 16.6%, respectively for the auto company, and 89.5% and 10.5%, respectively for the tech company, reflecting a more typical capital structure for a stable company.

With these assumptions, the discount rate used to discount the cash flows in perpetuity is 7.3% in the auto company scenario, and 7.2% in the tech company scenario.

Conclusion

In conclusion, Tesla’s valuation is highly influenced by how investors see the firm, whether as an automaker or as a technology company, with the company’s expected value ranging from a low of $300 billion to a high of $1 trillion.

Regardless of how pessimistic investors’ assumptions are, it is undeniable that Tesla is not a simple automaker, and even in the auto company scenario, it should be treated – at least from a profitability and cash flow perspective – as a company with strong similarity to the tech sector.

In conclusion, our assumptions suggest that Tesla’s intrinsic value lies above the $210 per share assumed in the blended scenario and that at current prices, Tesla’s risk-reward profile has the potential to generate a positive return to its shareholders, representing a good investment opportunity.