sarawuth702

Introduction

It is always tough to analyze companies with a highly enthusiastic investor base. Tesla (NASDAQ:TSLA) (NEOE:TSLA:CA) is definitely one of them. With its popular CEO Musk, Tesla’s investors seem ready to jump on the boat after even slightly positive news. This seems to be the case in recent weeks.

Tesla announced that it would post its financial results for the second quarter on the 23rd of July, and it gave a sneak peek into its deliveries, beating estimates. We’ll understand why this is not a real success story later, but the announcement led to a 20% surge in the stock price.

I published my initial coverage on Tesla with a “Hold” rating in April, and I think this is a great time to provide a follow-up. That article was named “Beyond the Hype”, but seemingly, the market could not look beyond the hype, and the stock is up significantly since.

In this article, we’ll discuss what Tesla really is and explain its identity as an automaker, understand why the stock has surged so much, break down growth opportunities, and evaluate the current pricing.

I believe the recent surge in the stock price shows how irrationally the market behaves. Fundamentally, the core business is doing worse than it was a year ago. Additionally, growth opportunities highlighted by the company and investors are still a long way off.

Although I think the company is expensive and the stock price should be significantly lower, the company will host events this summer such as the earnings call and the Robotaxi day, which could further boost investor sentiment. Because of that risk, I reiterate my “Hold” rating for the company, meaning it is still a stay-away.

Reminder Of What The Business Really Is

Much has been speculated about Tesla’s future. It may revolutionize how we think about cars, pioneer the transition to fully autonomous vehicles, or even be the licensor of the technology to all the other car companies.

These are all future possibilities we should consider. Forward-looking perspectives are crucial when pricing a stock. However, two critical factors determine how much these future prospects influence the current price: if and when earnings will be generated. In Tesla’s case, both factors remain uncertain. That’s why I focus on Tesla’s current business and its present performance.

Tesla is fundamentally an automaker. It manufactures high-quality electric vehicles and has a smaller business focusing on energy generation and storage.

Its cars mostly include electric passenger cars, as well as the recently introduced Cybertruck. The company generates revenue not only from vehicle sales but also from Tesla Superchargers and in-vehicle upgrades.

The energy generation and storage business manufactures lithium-ion battery storage solutions and retrofit solar energy systems for residential and commercial real estate.

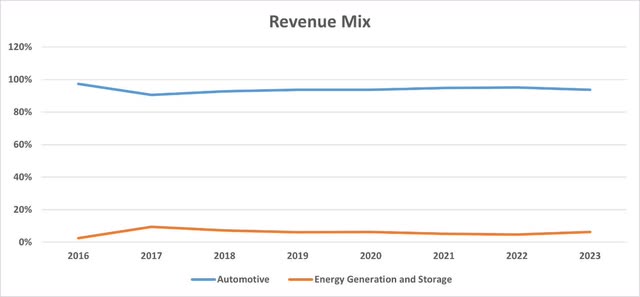

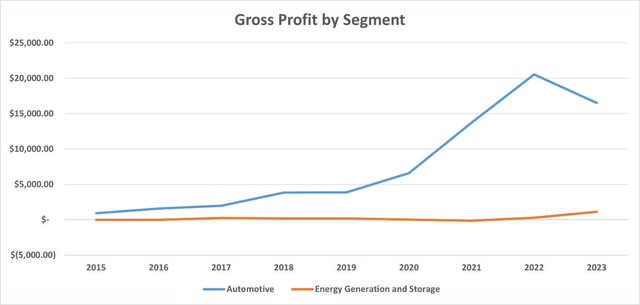

The following charts highlight how big the automotive business is compared to the energy business. It constitutes over 90% of revenues and generates a significant portion of gross profits.

The Stock Rallies on Recent News

Tesla stock has surged 33% since the end of June and 47% since the end of May. While this may seem like a correction in the stock’s declining trend, the rise was heavily influenced by specific company news.

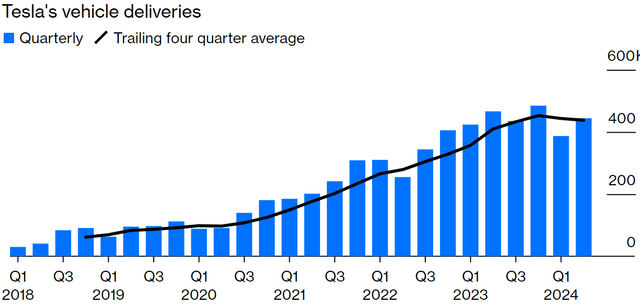

Tesla provided a sneak peek into its financials, announcing its production and delivery numbers in the second quarter. It announced that it produced 410,831 vehicles and delivered 443,956.

This means that the company sold more than BYD (OTCPK:BYDDF) and delivered slightly more than expected, which was 439,302 deliveries.

My initial coverage of Tesla was called “Beyond The Hype,” and I intend to look beyond the hype this time as well. The current market sentiment is driven more by hype than by solid fundamentals.

Firstly, this success story of high deliveries is misleading. Tesla’s reported vehicle deliveries were actually lower than the second quarter of the previous year.

So, why did these production and delivery numbers lead to such a significant increase in the stock price? It all comes down to expectations…

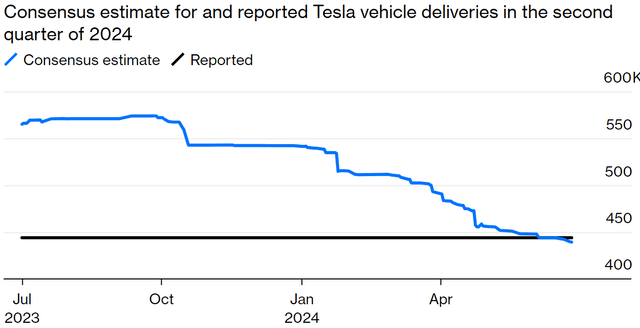

As Bloomberg shows, consensus estimates for Tesla’s vehicle deliveries have been in a declining trend since July 2023. Analysts had been overly optimistic about deliveries until now, when expectations were so low that Tesla managed to exceed them even with flat delivery numbers.

This is not a success story. This is a story of adjusting expectations. It is shocking to me that exceeding lower expectations can lead to such a big jump in the stock price. That shows how reactive the investor base of the company is, which I believe is not a good thing.

Core Business Continues To Struggle

Apart from the Q2 2024 production and delivery numbers, there have been numerous developments in the last quarter indicating the weakness of the core business of Tesla: making cars.

Electric vehicle sales were significantly down in Europe as a result of government budget cuts and efforts to reduce the import of foreign-made EVs. The countries are slowly realizing that subsidies aimed at increasing the number of EVs on roads are not the most optimal usage of taxpayer’s money. Customers are already struggling with high rates, and with subsidies and discounts gone, they will struggle even more.

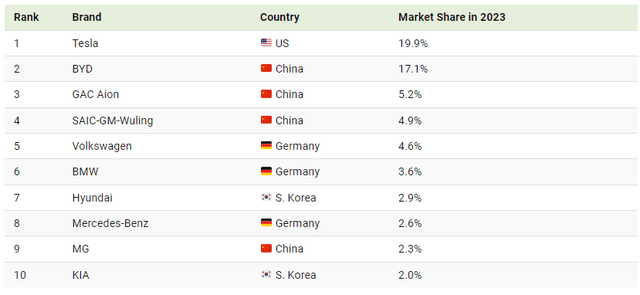

Additionally, Tesla’s dominance over the EV market continues to fade. I shared three months ago that Tesla was able to protect its lead over BYD in 2023, capturing nearly 20% of the market. However, investors are concerned about Chinese competitors that can produce similar-quality vehicles at lower price points. Tesla is beginning to feel this competitive pressure, and operating metrics such as inventory turnover show it.

visualcapitalist.com S&P Capital IQ

According to Morgan Stanley, Elon Musk has acknowledged that China has won the battle for affordable electric vehicles.

Finally, Tesla recently had to recall thousands of cybertrucks over safety issues. It seems like a minor windshield wiper failure; however, it is concerning that a brand new and highly marketed product is facing recalls. This is not the first instance either. In April, Tesla recalled four thousand Cybertrucks due to a faulty accelerator pedal.

Growth Prospects Are Promising But Remain Distant

I have explained at the beginning of this article that an investor should understand the current state of a business but should also evaluate its future prospects. This is valid for Tesla as well.

I discussed many of these growth opportunities in my initial article. However, a few of them still stand out.

Firstly, Tesla will host the Robotaxi day on August 8, 2024. Although I am not sure what exactly the company will present, it has to be revolutionary and will probably aim to excite investors. I don’t think Elon Musk would organize a conference for such a product if it wasn’t interesting. This gives us little to bet on, but the event is worth watching.

Additionally, Morgan Stanley believes that Tesla will play a bigger role in the US energy market, as the demand for power grows with advancements in technologies like artificial intelligence. Tesla’s energy generation and storage business may benefit from this and potentially grow faster.

Apart from these, Tesla continues to lead in self-driving cars and the full transition to electric vehicles (EVs). However, there are substantial regulatory hurdles, and I do not anticipate these technologies being widely implemented soon.

My Expectations From The Upcoming Earnings Call

As announced, Tesla will hold its Q2 2024 earnings call on July 23rd, 2024. I expect this summer to be exciting for Tesla’s reactive investors, and this earnings call is a part of it.

We already know the production and delivery numbers, which are arguably the most crucial numbers for an automaker. That is why I believe this earnings call is all going to be about future technologies.

I expect the management to discuss in detail the adoption of EVs, autonomous vehicles, the energy business, and maybe even artificial intelligence. In addition, management may provide some hints about the upcoming Robotaxi day, which is going to take place two weeks later.

This is an earnings call where it seems tough to hear any negative news about the business. Instead, it is an opportunity for the management to highlight their strengths.

A CFRA analyst noted that Musk is very successful at shifting investor focus to longer-term opportunities in AI, robotics, and other fields where Tesla is active, diverting the attention away from shorter-term challenges. I agree with this statement, and I think the upcoming earnings call will be similar in that regard.

The Stock Is Getting More and More Expensive

My initial article concluded that despite the significant decline from its highs, Tesla’s stock still appeared expensive. I find it reasonable that Tesla trades at a slightly higher forward P/E multiple compared to its peers in the global car industry. It is an automaker, but it is apparent that it has better growth prospects in the long term.

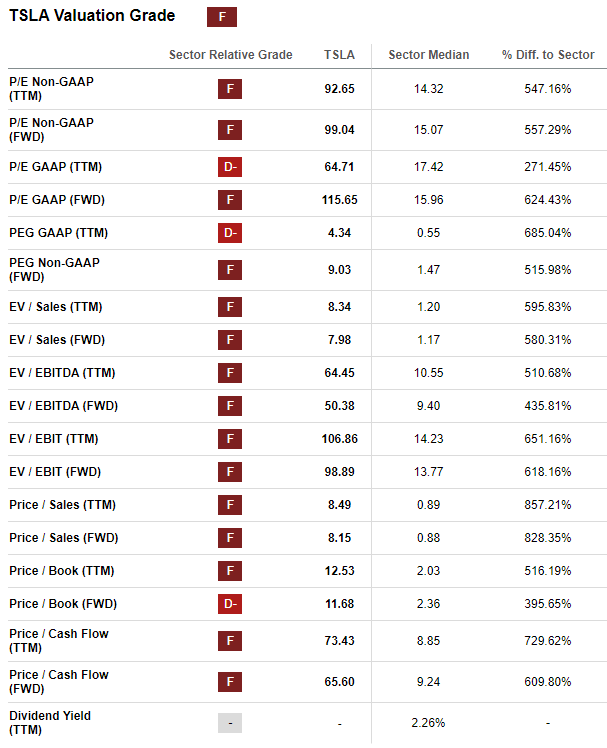

However, the multiples the Tesla stock traded at were significantly higher than those of Tesla’s peers, and I believed it was overvalued. Now, after the stock surged nearly 50%, I find it incredibly expensive.

Additionally, a look at Seeking Alpha’s valuation scores shows that Tesla receives an “F” in almost all factors affecting the overall valuation grade, indicating its expensiveness.

Seeking Alpha

Final Thoughts

I mentioned this before. I believe Tesla is a very high-quality company with great products. Its products are preferred not only because of the brand image but because of the features it has that its competitors do not have.

The stock, however, is another story. It has been expensive for a long time with expectations that the company is going to transform the industry and benefit from other growth verticals such as autonomous vehicles and energy. While these opportunities remain possible, they are uncertain and, if profitable, their earnings are far in the future.

Despite “positive” news on Q2 deliveries, the core business continues to struggle with lower demand for EVs and the emergence of Chinese competitors. This should be the primary factor affecting pricing, but investors focus on longer-term stories, and the stock price is driven mostly by hype and momentum.

This would normally be a short thesis. However, I believe an irrational market can remain irrational without a clear catalyst. Tesla’s upcoming earnings call and Robotaxi day are events where management is likely to shift attention from the core business to growth opportunities.

Even though the stock is expensive, there is a chance it will continue to go up in the upcoming months. That is why I will maintain my “Hold” rating.

The earnings call and the robotaxi are events I will follow, and I am sure there will be more developments to discuss when I provide the next follow-up article in a quarter. Until then, I would be cautious when considering an investment in Tesla.