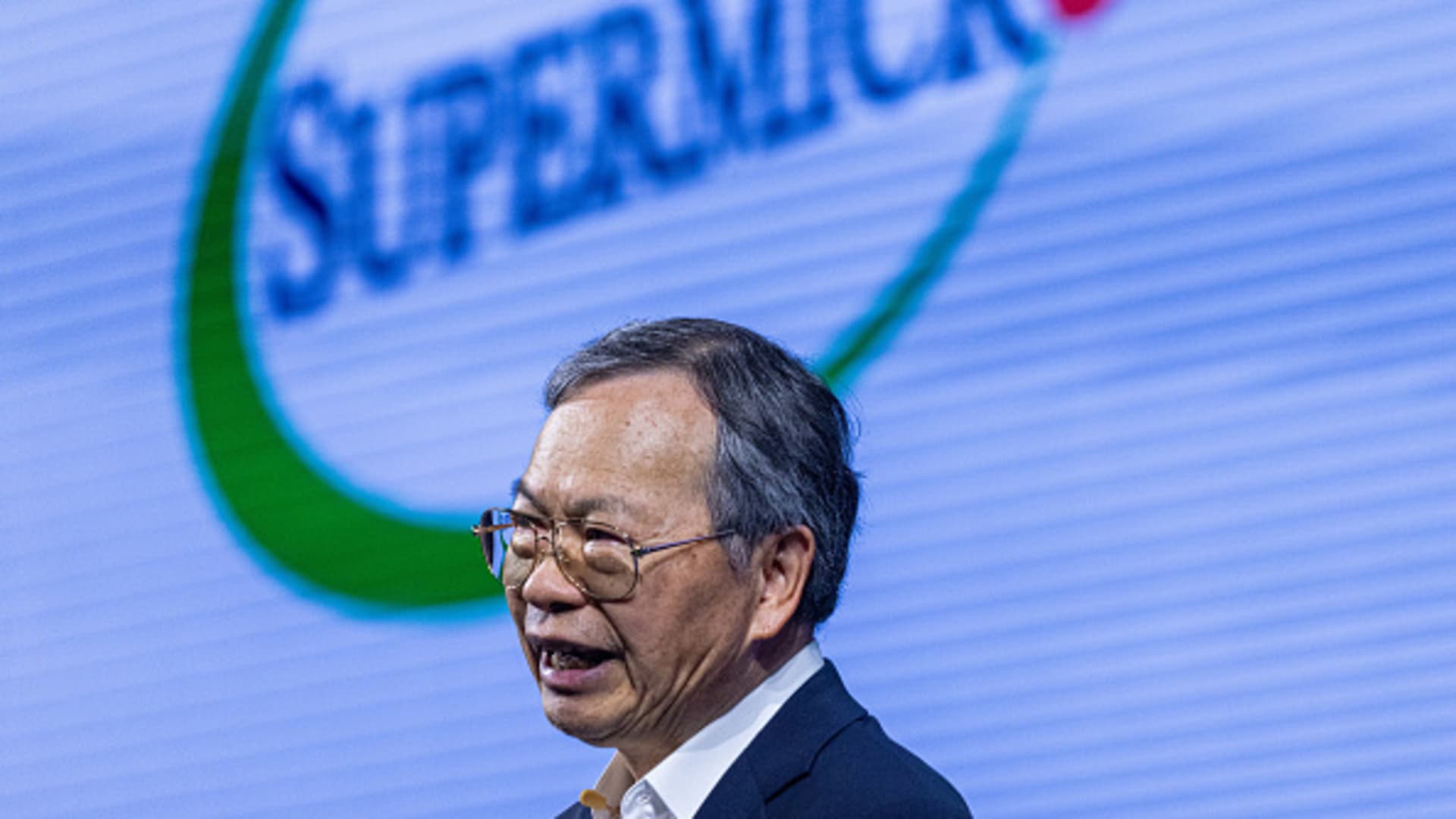

Charles Liang, chief executive officer of Super Micro Computer Inc., during the Computex conference in Taipei, Taiwan, on Wednesday, June 5, 2024. The trade show runs through June 7.

Annabelle Chih | Bloomberg | Getty Images

Super Micro, the embattled server maker that’s late in releasing annual financials and at risk of being delisted by the Nasdaq, reported unaudited first-quarter results on Tuesday.

The stock dropped 12% in extended trading after the company’s revenue trailed estimates, guidance came in weaker than expected, and Super Micro said it doesn’t know when it will file annual results for the latest fiscal year.

Super Micro shares plummeted last week after Ernst & Young, the company’s auditor, resigned. The company faces accusations from an activist of accounting irregularities and that it’s shipped sensitive chips to sanctioned nations and companies, violating export controls.

Super Micro faces potential delisting from the Nasdaq stock exchange if it doesn’t file its annual report with the SEC by mid-November. The company hasn’t reported audited results since May.

For the quarter ending Sept. 30, Super Micro said it generated net sales of between $5.9 billion and $6 billion. That’s under analyst expectations of $6.45 billion, but is still up 181% on an annual basis. The company’s business has been booming of late because it ships servers packed with Nvidia’s processors for artificial intelligence.

Adjusted net income for the quarter was 75 cents to 76 cents a share, in line with analyst expectations compiled by LSEG.

Super Micro’s forecast for the December quarter was also below estimates. The company said revenue will be between $5.5 billion and $6.1 billion, trailing the $6.86 billion average analyst estimate, according to LSEG. Adjusted earnings per share will be 56 cents to 65 cents. Analysts were looking for EPS of 83 cents.

Super Micro said on Tuesday that its board of directors had commissioned a special committee to look into Ernst & Young’s concerns. In a three-month investigation, the committee found there was “no evidence of fraud or misconduct” from management, the company said.

“The Committee is recommending a series of remedial measures for the Company to strengthen its internal governance and oversight functions, and the Committee expects to deliver the full report on the completed work this week or next,” Super Micro said, adding that it intends to take all steps to keep its listing on Nasdaq.

Super Micro shares soared 246% last year after jumping 87% in 2023. The stock peaked at $118.81 in March, shortly after being added to the S&P 500.

The company has since lost almost 80% of its value, wiping out over $55 billion in market cap.