jetcityimage/iStock Editorial via Getty Images

Introduction

In recent months, I have increasingly discussed my plans to add a new stock to my portfolio. After being an aggressive buyer in the first half of this year, I wrote a number of articles about stocks on my radar, including recent articles titled “My Top 3 Dividend Stocks To Buy Amid Market Uncertainty” and “Bull Market Millionaires: 3 Dividend Stocks To Build A Fortune,” which you can access here and here.

Although I would have liked the market to drop a bit more, I finally pulled the trigger on a stock I have watched for a long time. As the title of this article already gave away, that company is GE Aerospace (NYSE:GE), a company I started covering in 2023 again, using words like “Industrial Powerhouse” and “Moat Monster” to describe it.

Seeking Alpha (Leo Nelissen Articles)

My most recent article was written on July 23. Since then, shares have dropped roughly 6%, underperforming the S&P 500’s 3% decline by a few points.

Although I would have liked a bigger correction, I decided to finally pull the trigger and add the fifth aerospace & defense company to my portfolio.

Ironically, the only reason I missed the massive uptrend in its stock price was that I did not want to add even more aerospace exposure. Now, I changed my mind, as I truly believe GE is the perfect investment for my portfolio.

Hence, in this article, I’ll update my thesis and explain why I bought the company. It will be a full review of what makes this company special, including its wide-moat characteristics, long-term tailwinds, and new economic, industry, and business developments.

So, as we have a lot to discuss, let’s get to it!

Why I’m So Bullish On Aerospace

Aerospace has always been a sector that fascinated me. For example, I minored in Aerospace Management & Operations, which taught me a lot about the entire industry, including the best places to put money to work.

In general, commercial aerospace is an industry with strong secular growth. Since the start of humanity, we’ve always wanted to explore other places.

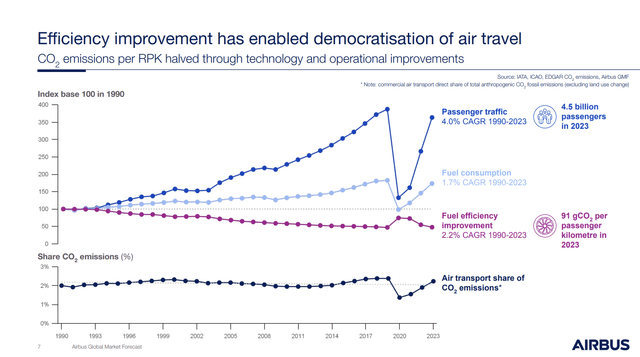

Using Airbus (OTCPK:EADSF) data, passenger traffic has grown by 4.0% per year in the 1990-2023 period, which includes the devastating pandemic.

While 4.0% annual growth may not sound like a lot, it’s a great number for at least two reasons:

- Global annual population growth was in the 0.8% to 1.8% range during the 1990-2023 period. Close to 80% of the global population has never flown. This hints at elevated secular growth.

- 4.0% annual volume growth bodes well for any company with even minimal pricing power, as strong aerospace players could grow their revenues by much more than 4% per year in 1990-2023. When adding higher margins, some companies turned into fantastic investments. Essentially, any industry with consistent mid-single-digit growth is worthy of further research.

Going forward, growth is estimated to remain strong.

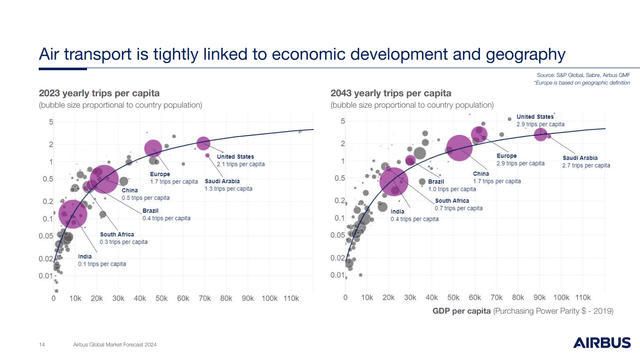

For example, the richer a nation becomes, the higher the demand for commercial aerospace. This makes sense, as flying isn’t cheap. It also requires top-notch infrastructure (among other factors).

As we can see below, until 2043, we will see much more growth from nations like Saudi Arabia, China, India, and other emerging markets.

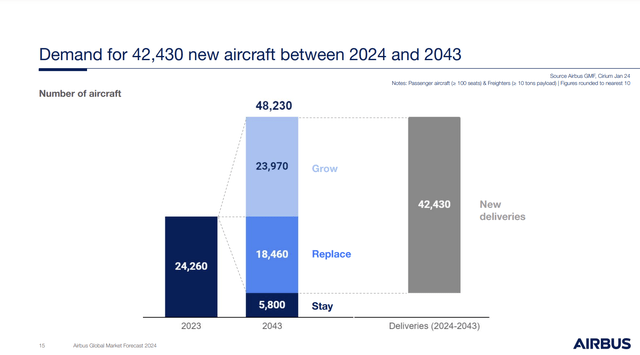

As a result, the European aerospace giant expects demand for new aircraft to be more than 43 thousand units through 2043 – most of them being fleet additions! This would indicate a global fleet growth rate of roughly 100%.

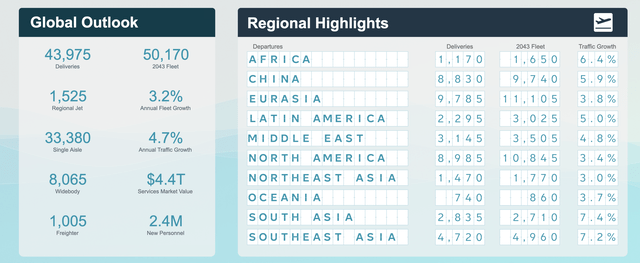

Its American peer, Boeing (BA), is even more upbeat, expecting a global fleet of more than 50 thousand units by 2043. This comes with annual traffic growth of 4.7%, similar to pre-pandemic growth numbers.

Even developed markets are expected to see close to 4% annual traffic growth.

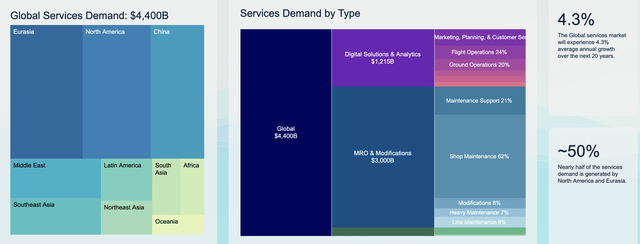

On top of that, services are expected to see 4.3% annual growth over the next two decades, turning into a $4.4 trillion addressable market!

With all of this being said, I own two companies with significant commercial aviation exposure.

The first stock I added was RTX Corp. (RTX). This company owns the engine producer Pratt & Whitney, which produces single-aisle engines for the Airbus A220 and Airbus A320. It also owns Collins Aerospace, which produces an almost endless range of products, including avionics, landing gears, lights, business class seats, and much more.

The other investment is GE Aerospace, which became a part of my portfolio on September 6.

Why GE Aerospace Is Such A Special Stock

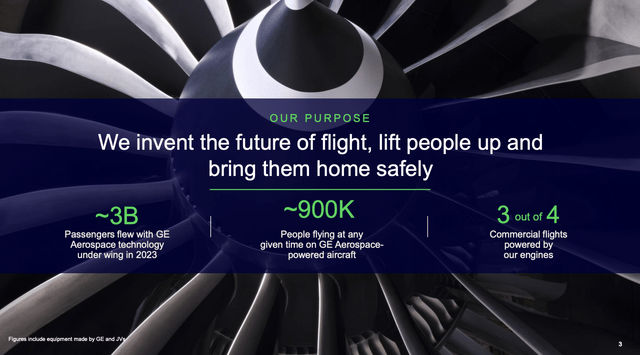

GE Aerospace is what’s left of General Electric after the company spun off GE HealthCare (GEHC) and GE Vernova (GEV). Now, the company is a pure-play engine producer with a business model that makes my heart beat faster.

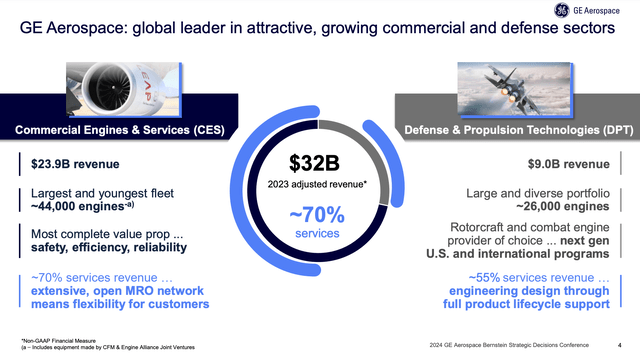

Its business model consists of both commercial and defense engines. Last year, for example, it generated $32 billion in revenue. Commercial aviation accounted for 75% of its revenue. Across both defense and commercial aviation, services accounted for 70% of its revenues.

Even better, the company has built an ultra-wide-moat business, as it has an installed base of more than 40,000 commercial aircraft engines and the expertise on how to maintain these engines. This comes with extremely deep customer ties.

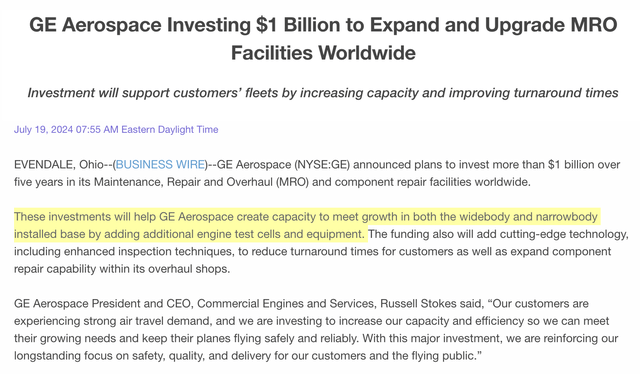

It recently invested $1 billion into expanding its MRO (maintenance, repair, and operations) capabilities in order to be prepared for long-term growth in aviation demand.

What’s even better is that GE isn’t just one of many players. It’s the biggest producer of commercial and defensive engines in the world. Including its 50/50 Joint Venture with Safran, called CFM, it controls roughly 75% of the commercial jet engine market.

As its engines usually last for multiple decades, the company has business relationships that are extremely hard to interrupt.

I also want to bring up something Morningstar noted in its report on the company, which is that the technology of the company’s engines, including titanium materials that can withstand temperatures of up to 1,000 degrees Fahrenheit, is very hard to beat.

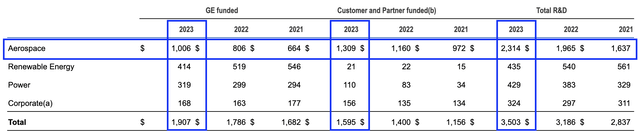

When adding that the U.S. government (customers and partners) funds a big part of its research and development (see below), we get a business that new entrants cannot easily compete with – to put it mildly.

In this case, it helps that GE is the biggest producer of defense engines, including the F-15, F/A-18, Sikorsky helicopters, and many more. These awards include government support for R&D and come with knowledge that can be used in its commercial programs as well.

It also needs to be said that most airplane models are usually configured for just one or two engine types. This deepens the relationship between GE and its customers. After all, airlines are unlikely to make new changes or go for low-cost producers, as the risks of unplanned downtime and failed inspections are just too high. As one can imagine, the margin of error in aviation is zero.

Allow me to give you some examples of GE’s market penetration.

- Its GE90 engine has an installed base of more than 2,250 engines with an average age of 12 years and a 99.98% departure reliability after 130 million flight hours. This is the sole source engine for the Boeing 777, one of the biggest long-haul programs in the world.

- The CFM56 (from its Sanfran Joint Venture) is the best-selling engine in commercial aviation history. This engine is the sole source engine for Boeing 737NG models and powers almost 60% of Airbus A320ceo models.

- The GEnx engine has been in service since 2011. It’s the sole source engine of the Boeing 747 with a 70% win rate on its 787 program.

- The LEAP engine has been available since 2016. It has a 99.95% reliability rate and it’s the sole-sourced engine of the 737MAX and the Chinese Comac C919. It also has a 60% win rate on the Airbus A320, a market it shares with Pratt & Whitney.

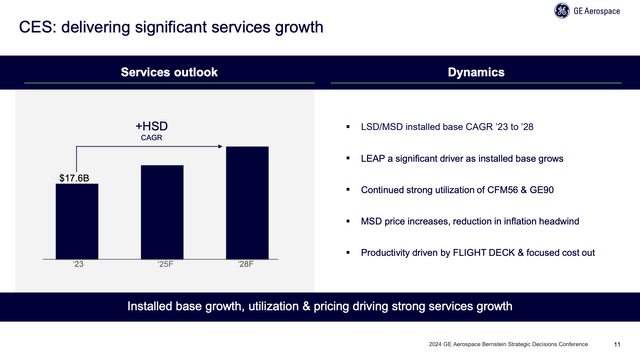

Based on these successful engines, the company expects to grow service revenue at a high-single-digit CAGR.

The cherry on top is its CEO, Lawrence Culp, who joined in 2022. Before that, he was the CEO of Danaher (DHR), one of my largest dividend investments.

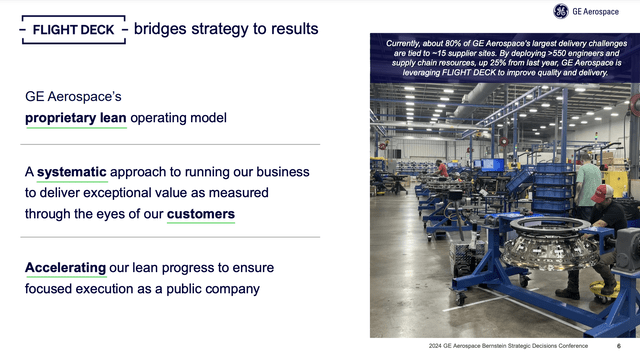

Danaher is known for the Danaher Business System, a model that has allowed it to consistently grow margins and improve innovation. At GE, Mr. Culp has introduced something similar: FLIGHT DECK. This model is based on operating streamlining, risk reduction, innovation, and more.

The implementation of this system also involves familiarizing and activating a glossary of evident Japanese derivation: Kaizen, Shingijutsu, Hoshin Kanri, Genba… All words that are becoming increasingly familiar among employees and (between the enthusiasm for novelties that mixes with the natural skepticism of human environments) find a place in the daily routine thanks to teams of experts who facilitate understanding and adoption. – About Magazine

Based on this context and in light of strong secular aviation growth, I believe it is very hard to find a better business model than GE’s.

Where’s The Shareholder Value?

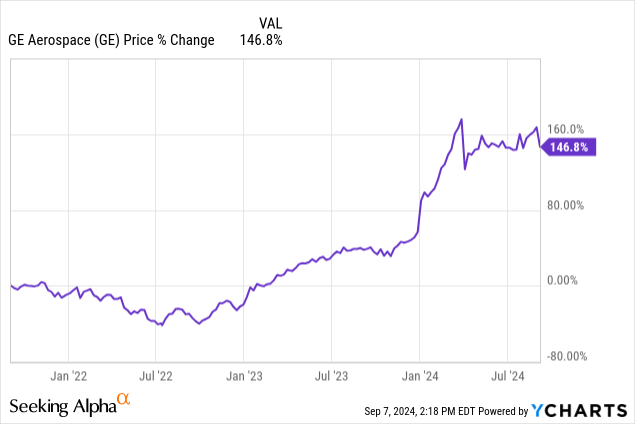

As I already briefly mentioned, I made a mistake by not buying GE when I became bullish. That would have been a home run.

I did not buy GE because I already owned four aerospace and defense companies. Although it made sense from a diversification point of view, I changed my mind. I do not care about being overweight in this industry anymore, as I believe I understand the industry very well and potentially benefit from many decades of elevated growth.

Excluding dividends, the stock price is up almost 150% over the past three years, making GE the biggest company in its industry with a market cap of more than $170 billion.

Needless to say, I expect more upside.

One reason is strong growth expectations and fantastic operating results.

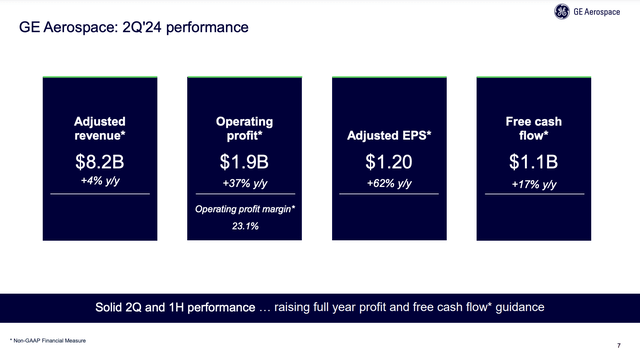

In 2Q24, for example, the company reported 37% higher operating growth, thanks to 560 basis points higher operating margins. Free cash flow grew by almost 20% to $1.1 billion.

Adjusted EPS rose by more than 60% to $1.20.

On top of that, the company addressed supply chain issues using its FLIGHT DECK operating model. This includes the deployment of more than 550 engineering and supply chain resources to collaborate with suppliers.

Moreover, with regard to its maintenance business, the company has achieved a 15% sequential improvement in shop visits and reduced the turnaround time for LEAP engine maintenance from 100 to 86 days.

Given the size of the company’s maintenance footprint, these improvements are massive.

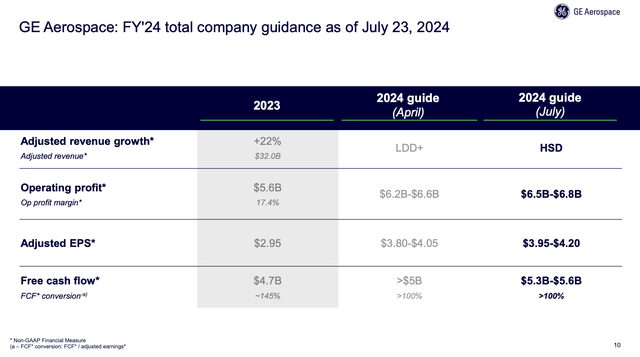

Thanks to strong demand, including 38% growth in commercial orders, the company raised its full-year guidance, expecting at least $6.5 billion in operating profit and no less than $5.3 billion in free cash flow.

The free cash flow conversion rate is expected to be at least 100%, which means free cash flow is likely to exceed net income, a sign of high-quality earnings.

This also bodes well for shareholder distributions.

Although GE yields just 0.7%, there is good news:

- The $1.12 annual dividend has a 2024E payout ratio of just 27%. The 2025E payout ratio is 22%.

- Its most recent hike was 250% on April 8. Although this won’t likely be repeated, it shows the company is serious about paying at least a “semi-decent” dividend. Also, note that the dividend yield is low because of the stock’s performance. The market usually decides the yield (dividend/stock price). The company decides the payout, as it cannot directly control its stock price.

- During its Investor Day, the company announced a $15 billion buyback program, roughly 9% of its current market cap.

- Dividends and buybacks are protected by a balance sheet that is expected to see more cash than gross debt at the end of this year.

Given strong long-term growth expectations, I expect dividend growth to remain strong, supported by aggressive buybacks.

I also like the valuation.

Although GE does not offer “deep value” (I will not fight readers on that), I believe there is room for growth.

Using the FactSet data in the chart below, analysts expect aggressive EPS growth, including 25% growth in 2025 and 21% growth in 2026.

Applying its five-year average P/E ratio of 35.7x, we get a fair stock price target of $220, 37% above the current price.

While a multiple this high won’t last forever, the company is well-positioned for elevated long-term returns, thanks to an expected 4% average annual passenger growth rate, favorable trends in the defense sector, and a potential surge in maintenance demand for older engines.

As such, I deployed a huge part of my cash, making it a 4.6% position in what has become a 23-stock portfolio.

I currently hold 1.2% cash, which I will deploy if the market keeps dipping.

In the not-too-distant future, I will write an article on the five dividend stocks I bought this year, investing more cash than in any other year.

Takeaway

After much anticipation, I finally added GE Aerospace to my portfolio, making it my fifth aerospace & defense stock.

Despite waiting for a bigger market correction, the company’s ultra-wide moat, impressive market penetration, and strategic position in both commercial and defense engines convinced me it was time to pull the trigger.

In addition to its moat, GE’s leadership in the aerospace sector, backed by strong secular growth trends and its innovative FLIGHT DECK operating model, makes it a perfect fit for my portfolio.

I’m also excited about the potential for shareholder value through dividends and buybacks, and I see continued upside as GE capitalizes on growing demand and improves operational efficiency.

Although I did not get the entry price I wanted, I’m ready to buy more on weakness.

Pros & Cons

Pros:

- Industry Leader: GE Aerospace is the largest producer of commercial and defense engines, with a dominant market share and a massive installed base. Its strong customer relationships and cutting-edge technology create a wide moat that’s hard to beat.

- Secular Growth: The aerospace sector has consistent mid-single-digit growth, driven by increasing global travel and defense spending. GE is in a great spot to capitalize on this long-term tailwind.

- Strong Financials: GE’s impressive operating margins, robust free cash flow, and commitment to shareholder returns through dividends and buybacks make it a compelling investment.

- Innovative Management: CEO Lawrence Culp’s FLIGHT DECK model is driving operational improvements, potentially similar to what giants like Danaher have achieved.

Cons:

- High Valuation: GE Aerospace is trading at a premium, with a high P/E ratio reflecting strong growth expectations. While I’m confident in the long-term outlook, the stock may face pressure if growth slows. Or, to put it differently, there’s little room for error.

- Competition: Despite its leading position, GE faces strong competition from other industry giants like Pratt & Whitney and Rolls-Royce.

- Disruption Risks: The aerospace industry is vulnerable to disruptions, including geopolitical tensions and pandemics.

- Boeing/Airbus: Boeing’s operating challenges are a good example of external factors that could temporarily hurt engine demand.