Brandon Bell/Getty Images News

I wrote an article nearly 10 years ago titled: “What Can the Kentucky Derby Teach Us About the Stock Market.” The main idea of my article was how betting on the winning horse, even though a great idea, could be a poor investment. I have a confession to make, and it might be a cardinal sin, I am presently long Tesla, Inc. (NASDAQ:TSLA). Tesla was one of the greatest market darlings, its explosive share price growth rivaled the fastest racehorse. However, much like the Kentucky Derby will heavily discount a 1973 bet on Secretariat, the market gave Tesla a valuation that even CEO Elon Musk now says was crazy, although he conveniently does not mention a certain tweet claiming Tesla would be taken private for $420…

Maybe Buying Tesla Was a Bad Idea? (ChatGPT 4.0)

I warned investors in 2015 that shorting Tesla was a bad idea. I love Tesla’s brand and drive a Model 3, but recent market gyrations make me realize that the surge in Tesla’s stock was beyond anything the market could justify. When ahead on an investment, it is very difficult to hit the sell button. This week, Tesla announced layoffs of more than 10% of its global workforce, equating to over 14,000 employees losing their jobs. This broad corporate restructuring, while potentially reducing costs and improving productivity, concerns me and sent the stock price tumbling. It is certainly concerning for a company that is built on growth, after all: how can Tesla grow while its headcount is shrinking? Since I began writing this article, Tesla had to recall 3878 Cybertrucks due to an accelerator problem.

Tesla is becoming a case study on a previous winning stock that has fallen on hard times. The company drew immense attention from investors and the media alike, now it is only the company’s restructuring and Elon Musk’s pay package that concern the market. Every day seems to bring new negative news.

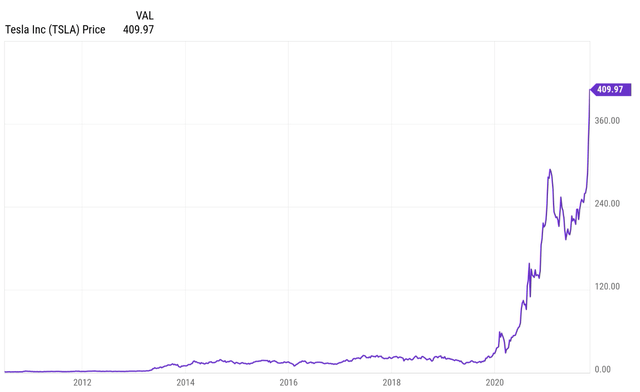

Indeed, the price return on Tesla’s stock into 2021 was astonishing. The stock rocketed to over $400/share early that year, the surge was fueled by milestones, such as: consecutive profitable quarters, inclusion in the S&P 500 (SP500) and growing use of electric vehicles by the public.

Price Return on TSLA into early 2021 (YCharts)

But since, it has been a very bumpy ride, and presently the stock trades near $155/share. The sharp reversal in Tesla’s share price also has several catalysts, including:

- Excessive valuation. This was noted most pessimistically by Gordon Johnson of GLJ Research, who set a price targeting a 90% decline in Tesla’s stock.

- Excessive Market Capitalization: As noted by CNBC, Tesla’s market capitalization topped the nine largest automakers combined. Clearly, Tesla is a valuable brand, but was it really worth more than the nine largest carmakers combined, despite selling a fraction of the vehicles?

- Excessive concentration and engagement from individual investors. Even in 2023, after years in the doldrums, Tesla saw the highest net inflows from retail traders of any security. While Tesla is, doubtless, a disruptive brand, does it truly merit this level of interest?

It has been a rocky few years for the company, but a picture is worth one thousand words:

TSLA: Price Return Since the 2021 Peak (YCharts)

Simply because a stock has gone up, doesn’t make it expensive. Neither is it cheap because it has gone down. However, with Tesla, there is some reason to hope that the worst is behind us. The valuation, which was incredibly expensive at $400/share, now seems quite reasonable near $155/share.

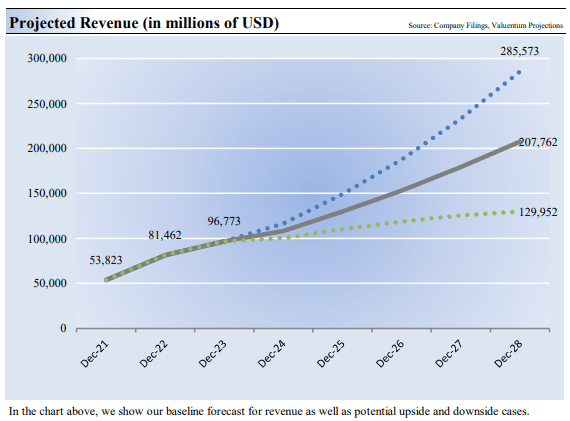

Valuentum, a website that I subscribe to, performs an in-depth discounted cash flow analysis of many companies. Today, it could be argued based on past growth and projections that Tesla is cheap. This analysis depends on several factors, notably:

- Projected revenue growth: the model expects continued growth of Tesla’s revenue from $96.7 billion in Dec-2023 to $207 billion in Dec-2028 at the valuation mid-point. The low-point of valuation expects $130 billion.

TSLA: Projected Revenue (Valuentum)

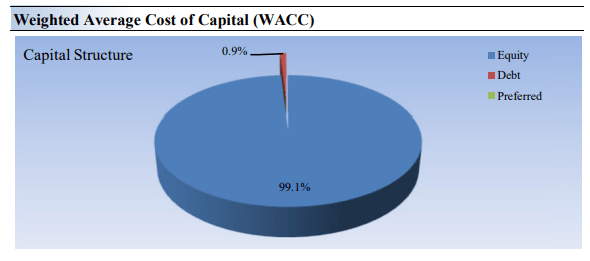

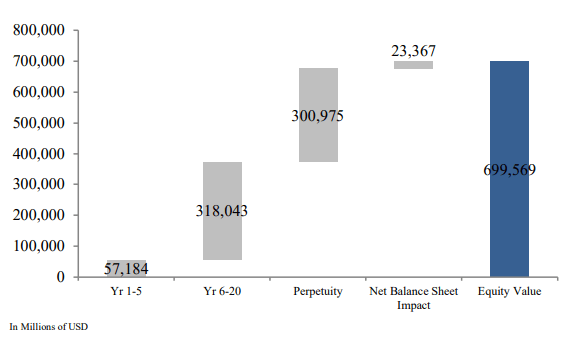

- Net Balance Sheet Impact: Tesla’s balance sheet contains little net debt. The capital structure of Tesla only contains limited debt, as evidenced by only $2.682 billion in long-term debt on the balance sheet. This is not all-encompassing, and total debt is listed around ~$9.57 billion. This created a low impact on the value of the company relative to its market capitalization.

TSLA: A Capital Structure with Little Debt (Valuentum)

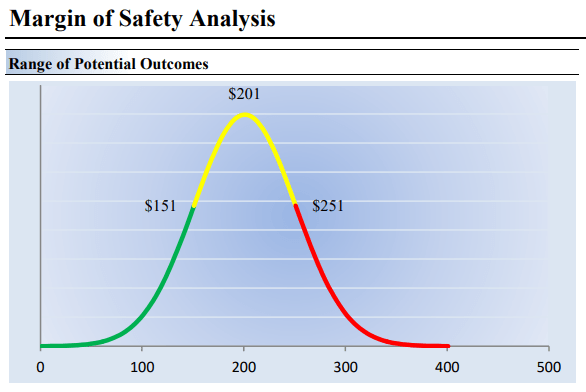

- Discount Rate: Interest rates have been rising lately, and Tesla’s discounted cash flow, or DCF, valuation is dependent on the discount rate applied. The model assumes an average after-tax cost of debt of 4.8%, perhaps slightly low given the recent increase in Treasury yields. The first phase of the company’s valuation is described above (years 1-5), with growth anticipated to decrease to 8.9% over years 6-20 and 3% thereafter. This leads to a final mid-point valuation of approximately $700 billion ($201/share).

TSLA: Breakdown of DCF Components (Valuentum)

In totality, the valuation of Tesla’s brand should be seen as uncertain (like the market sees it, hence the volatility of the stock). However, given the assumptions above, an investment in Tesla is becoming reasonably priced.

TSLA: DCF Valuation Different Growth Rates (YCharts)

Of course, this is not what is going to motivate investors to buy the stock. Tesla as a car company is not S3XY (sexy, derived from – Model S, 3, X and Y). Investors must consider catalysts that could improve Tesla’s outlook, and these could be:

- Cybertruck: Tesla’s all-electric pickup truck. It was first unveiled in November 2019 and deliveries have now begun. This is a tiny component of Tesla’s business as yet, but the market will likely be looking for growth in this new segment.

- Full Self-Driving (“FSD”): Tesla’s FSD system is a suite of advanced driver assistance. It remains an elusive goal, although falls short of its namesake. At present, FSD includes capabilities which fall short of Full Self-Driving. It can navigate on autopilot and other features but cannot navigate without human control. Someday, we may put a destination into the car and be whisked away to any location we desire. That day is a long way off, but is also a catalyst that the market may not yet be considering.

- Successful Expansion into New Markets: New geographical regions may become accessible, even if the most popular ones at present are becoming saturated.

- Advanced Battery Technology: There may be breakthroughs in battery technology on the horizon.

- Expansion of Energy Business: Solar and Energy storage are limited portions of Tesla’s portfolio. However, it is well-known that Elon Musk wishes to increase these.

- Uncertainty of Management: Elon Musk, the CEO of Tesla, has contributed to uncertainty in the stock. He is an interesting personality, but the market has been conflicted regarding his attention to other projects and the status of his pay package. Musk is certainly a genius, but these uncertainties have weighed on the stock. Perhaps we have reached peak uncertainty.

- Q2 Earnings will be reported post-market on Tuesday, April 23rd.

In summary, Tesla has moved from being massively overpriced at $400/share, to arguably cheap at ~$155/share (as of this writing). The company is not going away, even if its growth prospects have slowed. The market appears to be rather pessimistic, although it could be argued that strictly as a car company, Tesla remains very overpriced. However, Tesla is a tech company, not a car company. As such, the major growth prospects noted above may still propel the stock to new all-time highs someday. But given the recent price action of the stock, someday remains a long way off…