President Donald Trump on Thursday urged the Federal Reserve to cut interest rates, assuring that the tariff policies would ease the economy. He described April 2 as a “liberation day” for the country, marking the implementation of new trade measures.

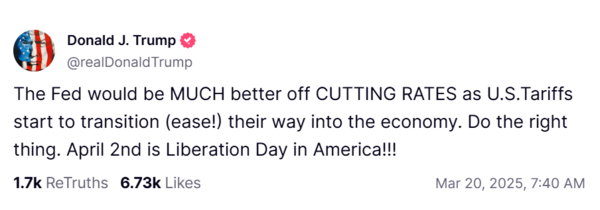

In a post on Truth Social, he wrote, “The Fed would be MUCH better off CUTTING RATES as U.S.Tariffs start to transition (ease!) their way into the economy. Do the right thing. April 2nd is Liberation Day in America!!!.”

On Wednesday the Federal Reserve kept its benchmark interest rate unchanged for the second consecutive meeting, while reaffirming plans to cut rates twice before the end of the year. However, officials acknowledged rising uncertainty as inflation remains persistent and economic growth slows.

In its latest forecast, the Fed revised its growth expectations downward and projected a slight increase in unemployment to 4.4 per cent by the end of 2025. Inflation, currently at 2.5 per cent, is now expected to rise to 2.7 per cent this year. Fed Chair Jerome Powell warned that new tariffs could further delay inflation relief by increasing costs on imported goods.

It also announced a slowdown in the reduction of its US treasury holdings, limiting the monthly runoff to $5 billion instead of $25 billion. This move aims to keep long-term borrowing costs in check.

Bringing back lost wealth

Previously, speaking to reporters aboard Air Force One, Trump defended his tariff policy, claiming it would reclaim wealth lost under previous administrations.

“April 2 is a liberating day for our country,” he said. “We’re getting back to some of the wealth that very, very foolish presidents gave away because they had no clue what they were doing,” quoted by The Hill.

The move marked a major escalation in his trade policies, which the White House alleges, would affect ‘trillions’ of dollars in goods, Finance News Network reported.

Despite growing concerns about the impact on financial markets in the US and abroad, Trump dismissed the idea of pulling back on tariffs. When asked whether he had any plans to ease trade restrictions, to which he firmly replied, “No.”

“It’s a liberation day for our country because we’re going to be getting back a lot of the wealth that we so foolishly gave up to other countries, including friend and foe,” he added.

Reciprocal taxes

Trump’s tariff plan includes major reciprocal measures and sector-specific duties, particularly targeting steel and aluminium used in auto production.

“If India, China, or any other country hits us with a 100 or 200 percent tariff on American-made goods, we will hit them with the same exact tariff,” he said.

While his approach has rattled markets and triggered talk of retaliation from Canada, Trump signalled an even more aggressive stance, announcing that the steel and aluminium tariff would increase from 25 per cent to 50 per cent in response to Canada’s electricity surcharges.

Global market concerns

Trump’s tariff policies have rattled investor sentiments. S&P 500 has fallen more than 8 percent in the past month, while the Nasdaq has dropped nearly 13 percent.

Though detailed tariff plans are expected to be revealed over the upcoming weeks, the move is expected to trigger tensions with major trading partners and add to global economic uncertainty.

Since taking office, Trump has imposed tariffs on approximately $800 billion (£630 billion) worth of imports from China, Mexico, and Canada. Despite these concerns, his administration is pressing ahead with an even broader tariff strategy, led by vice president JD Vance, commerce secretary Howard Lutnick, and treasury secretary Scott Bessent.

Trump, however, remains adamant that his policies will ultimately benefit the US economy and help in fostering domestic industries.