Brandon Woyshnis/iStock Editorial via Getty Images

Thesis

Since my last article (Tesla’s iPhone Moment) shares have rallied sharply. While I rate the company a “Buy” I continue to think they could return some of those gains as most investors view Tesla (NASDAQ:TSLA) as a car company (i.e., lower valuation multiples). In fact, shares fell sharply during the 2Q’24 conference call. Tesla is stuck between two growth cycles and the company’s been pivoting via restructuring, focusing on AI, and tinkering with its production lines. This article focuses solely on Tesla’s earnings report and how they affected my traditional “core” financial model, which doesn’t include new initiatives (e.g., Robotaxi).

Introduction

I want to emphasize that you need to be somewhat of a futurist to “get” Tesla – there’s a “second-order thinking” required to understand it. However, I’ll just be focusing on first-order thinking with Tesla’s core business for this article.

Industry Structure

In my previous article, I assigned Tesla an “Above-Average” rating for its position within the auto industry, using the Five-Forces Industry Analysis framework. Tesla’s business profile remains strong as it’s the lowest cost EV producer (perhaps even lower than Chinese makers if we exclude government subsidies), and it’s vertically integrated. This integration allows management to keep their eye on the end-goal. In comparison, General Motors (GM-USD) released better than expected 2Q’24 earnings but shares still declined 6% after-hours. I think investors are worried over its “non-vertical integration”, start-stop initiatives in EV and bloated cost-structure in electric vehicles. Ford (F-USD) is in a worse situation as just released earnings show that its EV business is tracking to lose $5Bn in operating earnings this year. Legacy automakers are reaping huge profits in expensive SUVs (have you checked the price of a Cadillac Escalade lately?) giving management absolutely no incentive in money-losing EV initiatives.

Electric Vehicle Industry

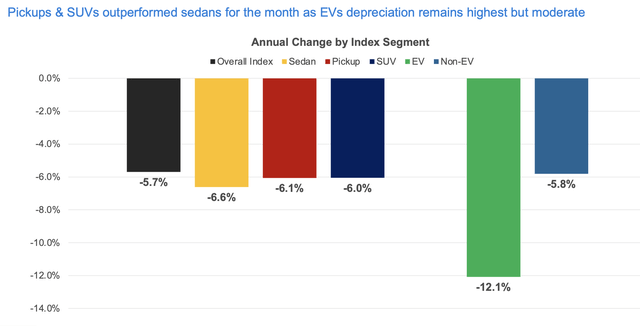

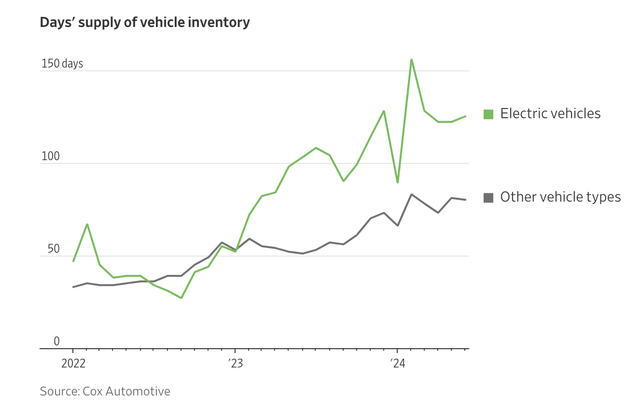

As most readers know, EV sales stalled last year despite continued U.S. government incentives to consumers. Range anxiety and high prices continue to worry consumers that I’ve spoken to. EV pricing has been quite weak, but apparently not weak enough to spur sales, according to Ark Invest. Latest data for mid-July from Cox Automotive shows that EV inventories remain high and that pricing continues weak (green bar chart below).

Tesla’s 2Q’24 Earnings Report Summary

Tesla’s results were overall a bit weak. While revenues beat consensus estimates, earnings missed estimates. Other negatives were weakening gross profit margin, operating margin (especially excluding “ZEV credits”) and lower than expected cash flow. I suffered through the conference call, which had few surprises since Elon Musk posts profusely on Twitter/X. The tone can best be described as confident now that the restructuring is complete. However, the excitement level was nowhere to be found; the feeling is that Musk didn’t want to be there.

Operational Summary

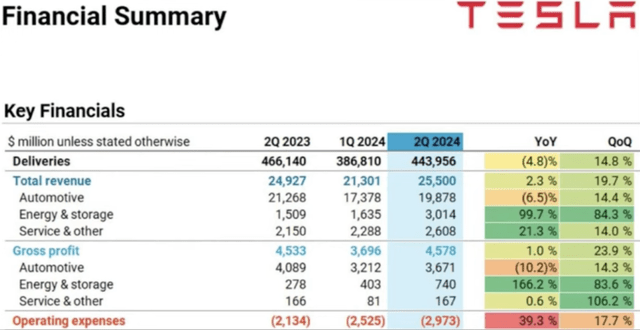

Total deliveries declined 5% Y/Y to 444k but “other” model deliveries, which includes Cybertruck, rose 12% to 21.5k, but this wasn’t enough to raise ASPs or deliveries. My previous 2024 EV unit forecast for was 1.85MM (or 2% growth) on a 5% ASP decline. I’ve reduced both unit sales to a low-single-digit decline and ASP now declines at a more rapid 6% rate in 2024 given the industry headwinds noted earlier. Note that when Tesla sells new models, it typically sells the priciest version first, which affects overall blended ASP. In this case, Tesla sold its premium CyberBeast edition, which sells for over $100,000.

Cybertruck is now the most popular EV truck in America. Of course, some of this sales volume was due to pent-up demand. Another positive is that Tesla’s inventories declined from 28 days to 18 days this quarter, which aligns with my expectations for higher FCF (Free Cash Flow). Recall that lower inventories are a positive adjustment to cash flow.

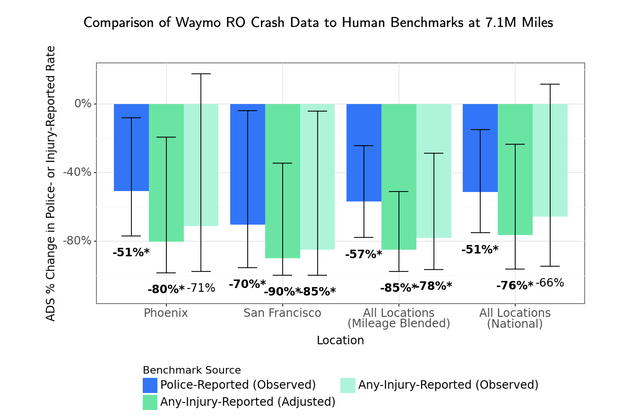

On the self-driving front, Elon Musk noted that the existing fleet of FSD (Full Self Driving) cars (not to be confused with actual ADAS 5 autonomous) is nearly 7MM. He expects the attach-rate to rise nicely as every new customer is allowed to test-drive FSD. Musk was reticent answering Robotaxi questions given the upcoming October event; however, he did say that Tesla won’t be using a Fleet business model (i.e., licensing) but instead expects car-owners will “willingly loan out their cars”. In a response to a question about regulatory hurdles, Musk said that it’ll be difficult for regulators to avoid the “data” that shows autonomous cars are safer and he cited Waymo. The bar-chart below shows the difference between Waymo’s driving record and humans.

Supercharger connector growth remained strong, at 24% y/y despite headline news that Tesla was laying off all of its employees in this unit. My Charging Revenue estimate and assumptions remained unchanged, as 2Q numbers are tracking my assumptions.

Revenues

Automotive revenues declined 6.5% in the quarter to $19.9Bn and Services revenue (which includes Charging, Insurance, Repairs..) rose 21%. However, the star of the show was Energy Generation and Storage, which saw a 100% y/y increase in revenue to $3Bn (deeper discussion in next section). Together, total revenue was $25.5Bn, rising 2% in the quarter.

Cash Flow

While Tesla reported positive FCF (Free Cash Flow) of $1.3Bn, this was lower than analysts’ estimates. Investors also worried that the FCF gain might be transitory, while spending (i.e., Capex) will remain permanent given heavy spending in AI. Musk even suggested that Tesla spend a whopping $5bn on his new xAI startup.

Unlike most analysts, I was pleasantly surprised at what I would consider a decent quarter. Recall that my previous DCF model forecasted a huge $3.3Bn FCF loss in 2024. I didn’t expect Tesla to move so quickly to align deliveries with production. Recall that when deliveries are greater than production, working capital swings positive, lifting cash flow. Hence, I have reduced the FCF loss to $1.8Bn, but I still expect losses due to weak EV demand and macro headwinds.

Energy Generation & Storage

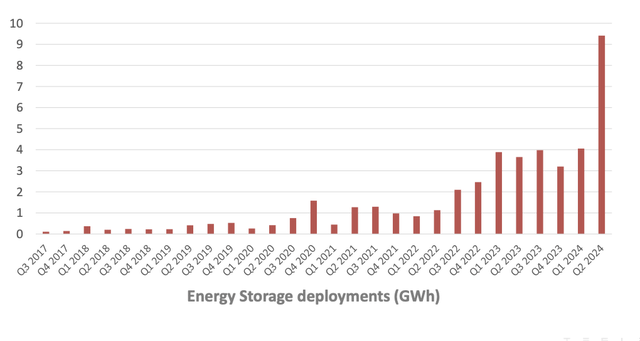

This unit includes several businesses such as solar panels, solar roofs and consumer batteries to backup homes. However, I’ll be concentrating solely on the commercial Megapack business in this section. When Tesla reported its EV deliveries in July, hidden in plain sight was news that 9.4GWh of energy storage products were deployed. My sense is that the 9.4GWh number (bar chart) was primarily for the commercial Megapack business, as consumer batteries are typically quoted in MW, and not by GW hours.

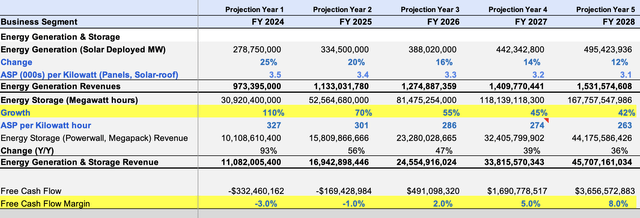

Management also noted that the segment’s Gross Profit Margin has been rising, to nearly 25% in 2Q’24 versus last year’s 20%. Consequently, I have sharply increased GWh in the commercial segment, rising 110% in 2024 to 30.9GWh, and I increased FCF margin from -6% to -3%.

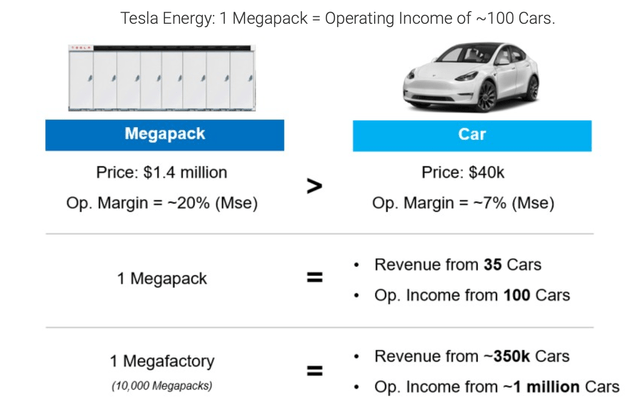

I haven’t raised long-term FCF margins as sharply despite rising profitability due to startup costs for the new Lathrop Megafactory (and Shanghai Megafactory) and my expectations that ASP/KWh will continue declining. However, Elon has said that Energy Storage is the most profitable unit of Tesla, and I believe this unit could be worth more than the car business within a decade. For context, Adam Jonas (@ Morgan Stanley) likes to compare the revenue and profits from 1 Megapack (or Megafactory) EV profitability (see below)

Revised DCF Model

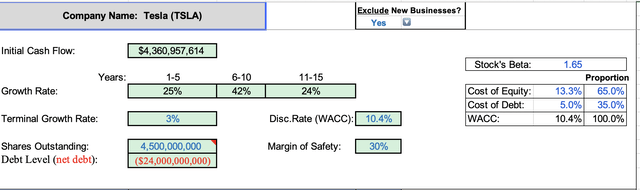

The DCF Model projects each unit going out to 2038 – thereafter, I project a conservative 3% growth rate in FCF. I calculated a conservative (i.e., high) WACC of 10.4% using a Beta of 1.65 and a 5% cost of debt, blended at 65% Equity and 35% Debt proportions. I use a high Shares Outstanding of 4.5Bn (vs. today’s 3.5Bn) to account for Elon’s hefty share compensation; however, I don’t foresee future capital raises.

Putting all the changes together, including lower unit sales of electric vehicles, lower selling prices and sharply higher GWh for Energy Storage yields a higher intrinsic value for the shares compared to the previous model. However, since Tesla’s shares ran-up, the DCF model shows an intrinsic value just 10% above today’s price (~ $217). The assumptions are shown below, and note that this version of the DCF excludes all new businesses, including Robotaxi.

Conclusion:

At today’s prices, Tesla’s shares are fairly valued using the DCF model above. However, Wall Street considers Tesla a car company and views the shares as overvalued using the conventional P/E ratio of 95x, EV/Revenue of 7x and Price/Book of 11.5x. On the other hand, I have a Buy(long term) rating on the shares, reflecting my confidence that Tesla will fulfill its vision of becoming All Things AI.

Note: if anyone’s interested in my Robotaxi or Optimus financial models, let me know in the comments.