Jonathan Knowles/DigitalVision via Getty Images

Introduction

I initiated coverage of Apple Inc. (NASDAQ:AAPL) stock in December 2021 and gave the stock a ‘Hold’ rating, pointing to the strength of the brand but also a fairly generous valuation at the time. A few articles later, on April 10, 2023, I downgraded AAPL stock to ‘Sell’ – since then, the stock has delivered a total return of 28.7%, compared to a 30.8% return for the S&P 500 Index (SPX) (SP500).

However, my latest bearish call update hasn’t aged well – AAPL stock abruptly broke its medium-term sideways consolidation channel after investors and analysts cheered the company’s AI-centric plans unveiled at the WWDC developer conference on Monday.

Seeking Alpha (my coverage of AAPL), TrendSpider Software (AAPL, daily, notes added)

Despite the strong upward reaction of the stock, I still conclude that the current stock price is unreasonably high given its intrinsic overvaluation based on even optimistic assumptions.

Why The Market May Be Wrong?

At WWDC 2024, Apple unveiled its new AI system, Apple Intelligence, which will be available this fall in a beta version for iOS 18, iPadOS 18, and macOS Sequoia. These new features should be available on newer devices such as the iPhone 15 Pro/Pro Max and iPads/Macs with M1 chips or later. As I read in BofA analysts’ recent report [proprietary source], this could potentially trigger an upgrade cycle as consumers look to take advantage of the productivity benefits that AI-enabled IntelliPhones offer.

While most of the processing is done on-device, complex queries can utilize the new “private cloud compute” that draws on larger, server-based models powered by Apple Silicon or third-party LLMs. It looks like Apple Intelligence is a key feature of the new OS updates, relying on both on-device processing and cloud-based computing. There should be system-wide improvements to writing tools for Mail, Notes, Pages, and third-party apps, improved prioritization of notifications, and new features for understanding and creating speech. Other announcements include a new fitness app in watchOS 11, a calculator app in iPadOS 18, and enhanced spatial photo features in visionOS 2.

Apple also announced a new partnership with OpenAI to integrate ChatGPT-4.0 into Siri, allowing users on iOS 18, iPadOS 18, and macOS Sequoia to interact with ChatGPT for free without having an account. Premium ChatGPT subscribers can link their accounts for advanced features. Siri will ask for the user’s permission to send documents or images to ChatGPT when needed, ensuring that user data is not stored on Apple servers. In addition, Apple will expand the availability of Vision Pro to international markets and begin taking orders from various countries in June. The company also announced new versions of operating systems, including iOS 18, iPadOS 18, watchOS 11, visionOS 2, and macOS Sequoia, each bringing major updates and new features.

I think the new partnerships and product updates, especially in the areas of AI and machine learning, represent strong potential for future growth and user engagement. However, we must also consider the emergence of new risks, particularly regarding user data protection. Elon Musk highlighted this concern in a recent tweet, stating that he would ban his companies’ workers from using Apple phones if they integrate AI into their OS level, as this would be “an unacceptable security violation”.

Although this risk cannot be ignored and may be a stumbling block for some users, I don’t believe Elon Musk’s statement will significantly impact the future of Apple’s sales. The positive effects of integrating ChatGPT’s AI into Apple’s ecosystem are likely to outweigh such concerns. Setting this “security violation” concern aside, I think BofA’s analysts are right in assuming that the updates will potentially trigger a significant upgrade cycle as they primarily affect newer models. As a result, more people may start purchasing newer models, generating additional revenue for the company in the short term.

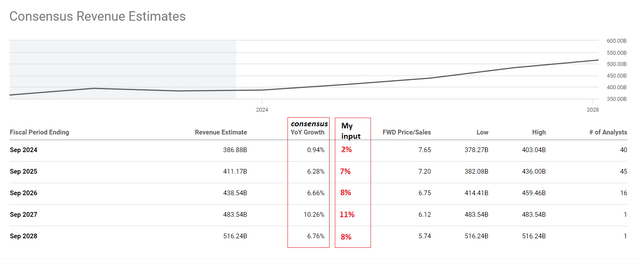

Let’s assume that the company’s current sales growth consensus forecasts, which have been raised 16 times in the last 3 months, are still too low. After the recent conference, Wall Street analysts are likely to raise their forecasts even more aggressively. On this basis, I forecast the following sales growth rates for the next 5 years:

Seeking Alpha, AAPL’s Revenue consensus, notes added

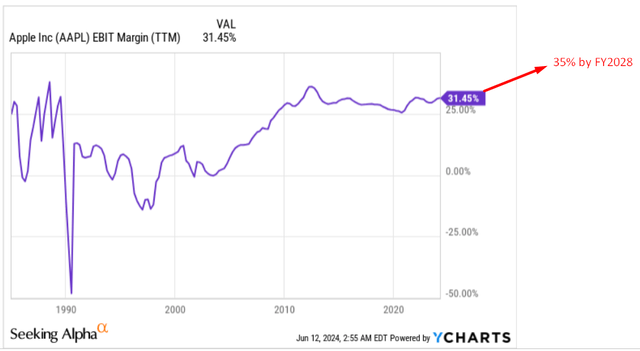

As you can see, I apply a premium to the growth rate for each of the next five projected years. I also assume that the current operating profit margin, which is nearing its peak, will continue to increase due to the new initiatives announced at the conference. These initiatives will likely lead to another round of growth by increasing the share of service revenues in the company’s total consolidated revenues – a trend that has been observed in recent years. So I expect the company’s EBIT margin to increase from the current 31.45% (TTM) to 35% by the end of FY2025 – this optimistic assumption takes into account the company’s ongoing revenue mix shift and AI innovation efforts, which should help Apple become more resilient and generate higher margins as it moves away from its historically cyclical mode of operation to a more stable and profitable framework.

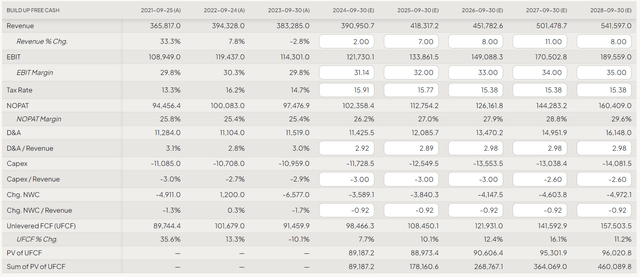

Innovation will undoubtedly require significant investment. I assume that over the next three years, the company will allocate 3% to 5% of its annual revenue to capital expenditures, which will then shift to 2.6% for the last two forecasted years. By focusing on average values for depreciation as a percentage of revenue and changes in working capital relative to revenue, I arrive at the following output data:

FinChat, the author’s input data

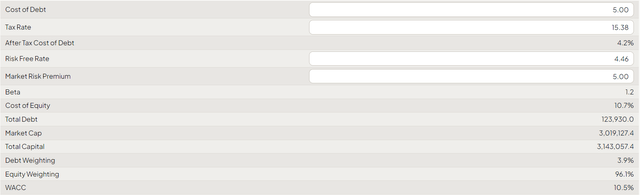

As you can see, my analysis suggests that AAPL’s free cash flow will continue to grow rapidly for the next 5 years at least. But is this free cash flow sufficient to justify the current valuation of the company? To answer that, let’s calculate the weighted average cost of capital (WACC). According to data from Seeking Alpha, the company’s market cap is $2.96 trillion. With debt on the balance sheet totaling ~$104.5 billion, the share of debt in the company’s capital structure is roughly 3.5%. The company’s bonds maturing in 2027 have a yield to maturity of about 5% today – I will use this as the cost of debt. The effective tax rate is 15.38% and the risk-free rate is 4.46%, which is the yield on the ten-year Treasury. We also have a market risk premium of 5% – a classical long-term premium size. On the basis of these figures, we get the WACC of 10.5%, which seems quite reasonable in view of the Fed’s still restrictive monetary policy.

FinChat, the author’s input data

As I have repeatedly mentioned in my articles where I use DCF modeling as a method for valuing stocks, the assumptions we make when calculating the terminal value of the company have a significant impact on the validity of our conclusions. The financial model currently being developed can calculate the terminal value based on either the perpetuity growth rate of free cash flow (after the forecast period) or based on the EV/FCF exit multiple projected for FY2028. This multiple represents the valuation at which the company is likely to be sold (theoretically), i.e. the fair multiple that a buyer would be willing to pay for the company in 2028.

For Apple, if we open the weekly chart and look at the last 10 years, we will see that the EV/FCF multiple I’m using for calculations has been steadily increasing. In December 2012, it was ~14.2x, and today it’s around 24.8x (which is a fairly high figure for a company whose EPS is projected to grow by a CAGR of just 11% for the next 5 years). Also, I don’t believe the market will be willing to pay a higher multiple for shares that generate relatively modest dividend income.

While Apple allocates a substantial amount of its FCF to share repurchases, which has significantly influenced its multiples over the past decade, I don’t see further potential for expansion. Over the last few years, even since 2020, we have observed that once the EV/FCF multiple peaked above 30x, it couldn’t go higher. So I think that in the most favorable scenario for Apple, its multiplier will remain at current levels by the end of 2028, but it is unlikely to be higher.

TrendSpider Software, AAPL, the author’s notes added

Thus, by assuming an exit multiple between 24x and 25x, I derive the following results from the model:

FinChat, the author’s input data

In my opinion, these results already call for some conclusions. Based on the above assumptions, which I consider to be quite positive, Apple’s stock still appears too expensive. This is despite the fact that I have tried to factor in the potential impact of “AI innovation” and more active buyers of new models in the short term. I’ve added a premium on Apple’s revenue growth forecast and long-term EBIT margins. I have also tried to be relatively realistic when calculating the WACC. However, despite all my efforts to maintain an optimistic outlook, we still see an overvaluation of the stock today. So in my view, this overvaluation justifies my continued bearish stance despite the recent strength of the stock.

Where Can I Be Wrong?

Since my thesis today revolves mainly around DCF modeling, the risks to my thesis should also relate to the model I use. One of the biggest risks I see with my current model relates to the WACC assumptions. In 2020 and 2021, a discount rate of 8% was considered quite high due to the market conditions at the time and the Fed’s easy monetary policy. Now that financing conditions have become more difficult, a rate of 10-11% seems to be the norm, which I also use for AAPL today. However, if we assume, as is very likely, that the norm for the discount rate will fall in the foreseeable future – let’s say a rate of 8% becomes “the norm” again – this could change the outcome of the model significantly.

For example, if the risk-free rate falls to 3% and the market risk premium falls to 4.2%, resulting in a WACC of 8%, then the current share price would be approximately equal to fair value without changing anything else in the model. This potential shift underscores the importance of the discount rate in DCF modeling and highlights a key risk to my current bearish stance.

FinChat, the author’s input data

Let’s look at another risk related to my model. As mentioned above, the company’s EV/FCF multiple has increased significantly over the last 10 years, practically doubling in just a decade. This is a very rapid increase; however, I assume that this ratio cannot increase any further for objective reasons. What reason is there to pay a higher multiple for a company that does not pay high dividends and mainly buys back its shares? This approach exposes the company to the risk that it will lack the funds to maintain its market value if its free cash flow declines, which could lead to a negative market reaction. But perhaps I am wrong in this assumption. If we assume that the widening of the multiple continues while all other factors remain unchanged, and we see an EV/FCF of 35x instead of the currently assumed 24.5x in the base case scenario, the undervaluation of Apple’s stock could be more than 17%, which is quite significant. This scenario would contradict my bearish conclusion.

FinChat, the author’s input data

The Verdict

Despite the existing risks to my thesis, which include even more bullish assumptions for Apple stock, I believe that my base assumptions are already quite optimistic. If we factor in premiums for revenue growth rates, assume that EBIT margins will continue to grow robustly not following the historical cyclicality trends, and use a relatively reasonable discount rate along with the current company EV/FCF multiple, we arrive at an overvaluation of ~12.5%. While this is not a very significant overvaluation, it’s based on optimistic assumptions. In reality, the downside could turn out to be much larger, which reinforces my cautious stance. Therefore, despite the recent strength of the stock, which I view as an irrational move, I can’t upgrade my rating. So I maintain a medium-term “Sell” rating for Apple stock.

Thank you for reading!