Ivan-balvan

Preamble

One can imagine Mr. Cook tossing and turning in his slumbers, with sleep plagued by the formidable challenges facing Apple Inc. (NASDAQ:NASDAQ:AAPL). As dawn breaks, his mind undoubtedly turns to China, one of Apple’s most crucial markets and doubtless a source of significant concern.

There have been reports that the Chinese government are encouraging their employees to ditch iPhones, and also, local manufacturers such as unlisted Huawei are producing up-market phones that compete directly with the iconic brand.

China is a significant market for Apple, accounting for approximately 18% of the company’s total sales. In the first quarter of 2024, Apple’s sales in the Greater China region (which includes mainland China, Taiwan, and Hong Kong) declined by circa 8% year-over-year.

If you think a drop of 8% is bad, the next report could be even worse. Research firm Counterpoint have claimed that “iPhone sales in China fell 24% year-on-year in the first six weeks of 2024.” Gulp!

Yes, there may be good prospects for AI enabled phones, but replacing lost revenue from China and the rest of Asia is a big ask. On top of which, Chinese manufacturers are improving their technology, allowing them to compete on an equal footing outside the collective west.

This brings me to another issue that ought to concern Apple investors: the ease with which knowledge can be transferred from one company to another.

Back in 2016, it was reported that Chiang Shang-Yi, co-chief operating officer of TSMC, joined Chinese chipmaker Semiconductor Manufacturing International Company for an improved financial package. Again, in 2020, SMIC recruited high-level staff from TSMC. Unfortunately, the efforts of Chinese companies to grab top-level researchers have accelerated.

In this article, a close look at Apple’s quarterly report is undertaken together with a review of the pitfalls that lie ahead for the company’s R&D function, which has implications for the company’s competitiveness on the global stage.

Financials

Apple has been a growth story for what seems like decades, but a review of the Q2 2024 results released in early May tells a different story. First, the report declared a 4% YoY decline in net sales, highlighting the challenges faced by the tech titan in maintaining its growth momentum.

The divergence from the growth story is further underscored by the company’s modest increase of 7.12% in free cash flow per share. Such a growth rate barely keeps pace with the current figures given for inflation. As far as I can figure out, a superior ability to generate cash flow is a crucial factor for investors seeking companies with robust growth potential.

The Earnings Per Share figure for the quarter was surely a harbinger of tough times ahead. The actual number was $1.53, exactly the same as that given for April 2023.

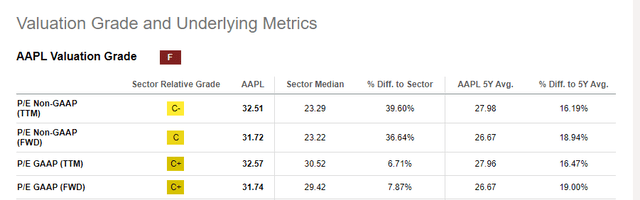

Despite the company’s poor performance, Apple has maintained a rich valuation compared to its peers, as the graphic below illustrates. Needless to say, that the P/E ratio is above the S&P 500 average of 24.79

Valuation relative to peers (Seeking Alpha)

While Apple remains a formidable player, its slowing growth and less impressive cash flow generation casts doubt on its moniker as a growth company.

From the graphic, the bleak picture is laid bare, sales of key product lines fell YoY. Although, to be fair, it is entirely possible that many customers are waiting for the launch of new models that may incorporate the much-lauded AI functionality.

Product sales (Apple quarterly report)

Positives From Report

Based on Apple’s Q2 2024 report, here are some positive aspects observed in the YoY comparison:

- Net sales in Europe increased by 6% YoY.

- Mac sales increased.

- Services net sales experienced a significant increase of 14% YoY.

- Services gross margin percentage increased in Q2 2024.

- Products gross margin percentage increased YoY during the first six months of 2024.

These positive aspects indicate growth in specific product categories and a significant increase in services revenue, which is a high-margin segment for Apple.

Balance Sheet

It’s important to acknowledge that Apple’s massive cash reserves of $162.3 billion provide it with significant financial flexibility. This could enable Apple to pursue strategic acquisitions, invest in new technologies, or return capital to shareholders through dividends and share repurchases.

Although Apple’s current ratio of 1.04 indicates that it is vulnerable to financial shocks or disruptions, meaning, if indeed the much-heralded recession comes to pass, Apple will have to dig into its cash pile, pronto.

The company has seriously high bills to pay to cover operating expenses. The total operating expenses in the first six months of 2024 were $28.853 billion, compared to $27.974 billion in the same period in 2023, representing a 3% increase.

Research And Development

Apple poured a staggering $7.903 billion into innovation in the last quarter. This colossal figure highlights Apple’s relentless pursuit of innovation across its diverse product portfolio and its ambition to maintain its dominance in the consumer tech market.

These figures do not include investments in start-ups that align with the company’s objectives. To this end. Apple also has a venture capital arm.

Developments In China

China is quietly revving up its efforts to recruit top scientific talent from overseas. The new initiative is known as Qiming and replaces the earlier Thousand Talents Plan. This new scheme offers substantial financial incentives to attract Chinese experts in sensitive fields like semiconductors.

Unlike its predecessor, Qiming operates discreetly, reflecting its sensitive nature in the current geopolitical climate. This renewed push for talent acquisition comes as China emphasizes self-reliance in the semiconductor industry, particularly in response to U.S. export restrictions. Although China claims this program aims to foster innovation and talent mobility, it has raised concerns in the West due to potential technology transfer and intellectual property risks.

I’ve previously covered a phenomenon known as “Connected Knowledge Spillover,” which means that research conducted and paid for locally can escape through the front entrance of a facility, jump onto a bus, and march into a competitor’s lab through a miracle known as the human brain. But, with Qiming, bought and paid for research can also escape via plane, as Microsoft can testify.

Shanghai-based AI startup StepFun, founded by ex-Microsoft executives, is focusing on the “scaling law” to enhance its AI capabilities. This approach involves increasing model size and training data to improve performance. Despite limited access to advanced chips due to US restrictions, StepFun remains optimistic and considers the challenges “manageable.”

The company has apparently developed large language models with over 100 billion parameters (a measure that typically indicates the model’s complexity and potential capabilities) and is currently testing a model with over one trillion parameters. Bearing in mind that 75 billion parameters was considered jaw dropping only a few short months ago.

For those who wish to delve further into both the robotics and AI sectors in China, I refer you to a previous article.

These circumstances highlight the need to minimise the risk of loss of both talent and IP in order to maximise the efficiency of R&D spend. Not forgetting, leaching of talent and knowledge clearly enables other competitors to catch up and pose a greater threat to revenues and thus profits.

Research Hubs

Apple has opened numerous R&D centers around the globe; Japan, India, Indonesia, New Zealand, Canada, France, Italy, Israel, Sweden, and the U.K. And I’m guessing Apple is one of the few tech giants that has facilities in Palestine.

Apple is in the process of bolstering its research and development capabilities in China, and has unveiled plans for a new R&D center in Shenzhen and an upgrade to its existing facility in Shanghai. The Shenzhen center will focus on testing and research for products like the iPhone, iPad, and Vision Pro, while the Shanghai center will concentrate on product reliability, quality, and material analysis.

There is no doubt that Apple will be able to tap into a vast pool of talented researchers, particularly in the field of materials technologists. A report from the Economist has highlighted China’s advances in many fields, compared to the U.S. However, as noted previously, employees have legs, and may saunter from one employer to another, especially if the government encourages them to do so.

Summary

Apple, the established giant, faces slowing sales and a rising threat from China’s growing tech ambitions.

While Apple’s vast cash reserves provide financial flexibility, the company faces challenges in maintaining its growth trajectory and navigating the evolving landscape of the tech industry, particularly in China.

The company’s high valuation compared to peers and the potential for intellectual property loss adds another layer of complexity of the investment thesis.