Hiroshi Watanabe

I last covered Apple (NASDAQ:AAPL) in June; at the time, I put out a Hold rating, stating both valuation and innovation concerns, as well as a lack of a real moat in AI to sustain growth over the long term. That thesis presented a 10Y price target. However, in this analysis, I am presenting a 2Y market cap target based on the Apple Intelligence upgrade “supercycle” that begins in September. I think there is an indisputable case that this is going to drive high revenue growth for Apple, even if this is a one-time major occurrence. It is likely that the stock will also have its valuation multiples temporarily expand, even from current highs, opening up a 2-year alpha opportunity based on present growing sentiment and momentum.

Q3 Earnings Insights

In Q3, Apple recorded a 5% YoY growth in revenue and a 7.89% YoY growth in net income. Apple’s iPhone saw a slight decline of 0.94% YoY, Mac revenue rose 2.46% YoY, and iPad revenue rose 23.63% YoY. One area of significant growth is services, which saw a 14.14% increase YoY. Apple highlighted its advancements in AI, mentioning the strength of Apple Intelligence, which will be the focus of this analysis. The introduction of AI features is expected to enhance Apple’s service offerings, which is going to further strengthen the growth in this segment.

Based on this earnings report, it is clear that Apple still needs a boost for its iPhone and Mac sales, despite the iPad doing well. The Apple Intelligence upgrade supercycle may be just what the company and shareholders need in the short term to medium term.

Apple Intelligence, Upgrade Supercycle, And Sales Estimates

Apple Intelligence is a new personal intelligence system that will be integrated into the iPhone, iPad, and Mac, aiming to enhance the user experience through advanced AI capabilities. It includes writing tools, visual expression, enhanced Siri, and a continued focus on privacy, with data processed on-device and the utilization of Private Cloud Compute. While the offering is not pushing the envelope in AI capabilities, it does make tasks more efficient, boost Emojis with Genmoji, and allow for complex task performance across apps with Siri. Apple has cleverly marketed this as “AI for the rest of us”, and I think this is apt. A lot of professionals and people not in the technology industry may not be utilizing chatbots as much as they would use their iPhones and laptops. As a result, integrating AI features into the usability and comfort of Apple products is a clever way to capitalize on AI trends whilst also improving the accessibility of the technology.

The introduction of Apple Intelligence is expected to drive a significant upgrade “supercycle”. This will particularly be for devices capable of handling new AI features. There are hardware requirements for this, which is conducive to the upgrade supercycle. Advanced AI features are limited to the latest devices like the iPhone 15 Pro and Pro Max and Macs with M1, M2, or M3 chips. Analysts predict that the AI-drive supercycle will boost iPhone sales and overall revenue as customers adopt new devices to leverage Apple Intelligence.

Analysts have predicted that the AI upgrade supercycle could lead to an annual incremental growth of $10B in high-margin services for Apple. Dan Ives from Wedbush maintains an Outperform rating on Apple with a $275 price target, which is underpinned by several key factors, including that the AI-driven supercycle can capitalize on 270 million iPhones not upgraded in over four years.

In my opinion, this is undoubtedly going to be a high growth period for Apple fundamentally, but even more so for the stock price. I think it is probably likely that the stock will undergo significant margin expansion over the next 12 months, possibly lasting for 5 to 10 years, if the company can continue to embed and integrate its products with evermore significant AI computational capabilities that require new hardware to cater to the compute demand. Despite this favorable outlook, it is probably more reasonable to assume that the bulk of the upgrade cycle will be in fiscal 2025/2026, with the remaining years being less pronounced. As a result, I consider this a medium-term opportunity as an investor and not a long-term one, where growth rates should begin to stabilize again and the valuation multiples potentially contract following the increased sentiment initially.

Valuation Analysis, Fundamental Growth Projections And 2Y Market Cap Target

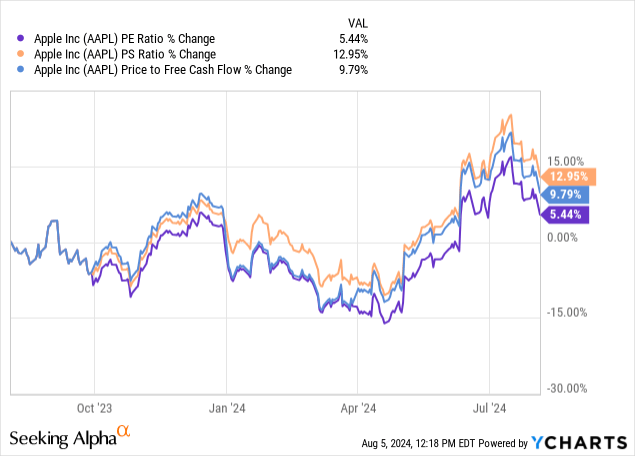

Apple stock has already experienced a lot of growth since it announced Apple Intelligence, and some believe that the upgrade supercycle is already priced in. The growing sentiment is made evident in the valuation expansion:

That being said, the expansion likely does not fully price in the fundamental growth estimates that are beginning to appear on Wall Street related to Apple Intelligence. The average analyst price target on Wall Street based on 37 analysts is $234.18, implying a 10.5% upside, but the high estimate is near $300, which is likely too high, but I believe $250 is achievable based on both fundamental growth and market sentiment related to Apple stock during the upgrade cycle. However, this would likely lead the stock into significantly overvalued territory and increase risk.

To give evidence of fundamental expansion, Apple is expected to achieve only 1.73% revenue growth for fiscal 2024 but nearly 7.5% for fiscal 2025 and 7.5% for fiscal 2026.

Apple currently has a PS ratio of 8.8, which is higher than its 5Y average by 30.72%. However, I think this ratio could potentially expand slightly, given the sentiment that could accrue from the upgrade cycle. Therefore, I think Apple could trade at a PS ratio of 9 during this cycle, with my bullish estimate of 8.5% YoY revenue growth for fiscal 2025 and again for 2026. If growth resumes for Apple based on an elongated upgrade cycle and new upgrade incentives emerging related to AI, the market cap and high valuation could remain steady at fiscal 2026 year-end. Therefore, my base-case market cap target for Apple is $4.13T at the end of fiscal 2026. The current market cap is $3.34T, indicating an increase of 23.65% over the period. However, I think this could be significantly beaten by higher sentiment, but it runs the risk of overvaluation, which is why I think a suitable take-profit market cap is approximately $4.15T if one is looking only for the supercycle alpha and protection from contracting sentiment following the bulk of it.

Long-Term Drawbacks, Overvaluation Risks, And Take-Profit Incentive

Some think that the supercycle will be short-term, and this is a valid concern. Sustaining the growth from the advent of Apple Intelligence will be difficult, and once the initial wave subsides, we could see the stock’s valuation multiples contract on lower future growth prospects. It would take significant technological advancements for Apple Intelligence to require even further hardware upgrades to run on, which is unlikely in the next 5 years, in my opinion. Therefore, I think this is quite a rare and potentially short-term opportunity, even if the benefits can be extended for medium-term gains. Furthermore, customers could feel forced into upgrades and feel they are being imposed with product obsolescence. This is one of the things that I think Apple needs to be careful of; by focusing too much on maintaining growth, its customer experience may suffer. At one point, every company must begin looking at shifting toward a more comprehensive dividend strategy to remain attractive to shareholders and not overoptimize for growth at the expense of the brand.

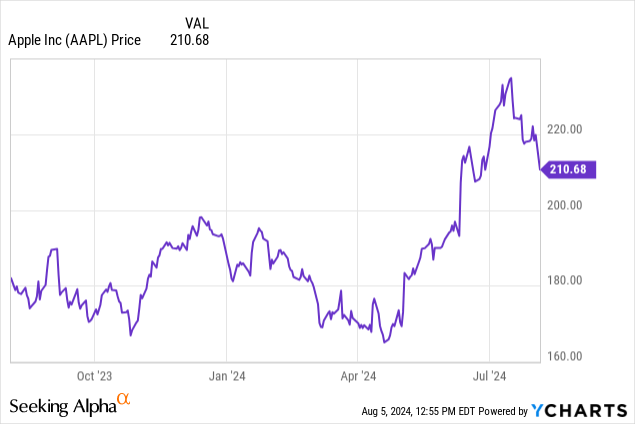

Furthermore, the recent growth in price for AAPL stock suggests that a lot of the future market cap gains could already be priced in. I think that there is more growth to come, and Wall Street estimates may be revised upwards once the upgrade supercycle begins; however, as it currently stands, AAPL could be deemed overvalued. This is why this must be viewed as a momentum trade and not a value investment. For those that are comfortable with that, it could work, but it is both not a Strong Buy and not a long-term play.

Furthermore, once the upgrade cycle largely culminates, there is a risk that the market for the iPhone will reach saturation. The demand for new devices may then plateau, causing stock price volatility. By taking profits at a specified market cap, for example, $4.15T, investors protect themselves from downside volatility from changing sentiment whilst also still allowing themselves to capitalize on the expanding sentiment and fundamental growth related to Apple Intelligence.

Conclusion

In my opinion, Apple is richly valued right now, but there is still medium-term alpha to be made until fiscal 2026 ends, and potentially longer. However, due to the uncertainty with sentiment and the ability of Apple to sustain growth rates, a potentially reasonable take-profit market cap of $4.15T allows for alpha generation as a momentum trade based on the upgrade supercycle beginning in September related to Apple Intelligence. My thesis posits an upside of nearly 24% by the fiscal 2026 year-end.