grinvalds

I’ve covered Apple Inc.’s (NASDAQ:AAPL) stock many times, and while I have been an Apple bull in the past, I’ve mostly held a hold rating on Apple lately. My problem with Apple’s stock is that it’s become “dead money” as its valuation remains high for its growth prospects. Apple’s stock increased after reporting “better-than-expected” top and bottom line numbers, increasing its dividend, and expanding its buyback program. However, Apple’s growth has diminished, and there are few prospects for considerable expansion in the near term in my opinion. Yet, Apple’s stock is relatively expensive, trading around 26-28 times this year’s EPS estimates. Despite the company’s efforts to attract investors with buybacks and dividends, I believe Apple’s stock could continue being dead money from here.

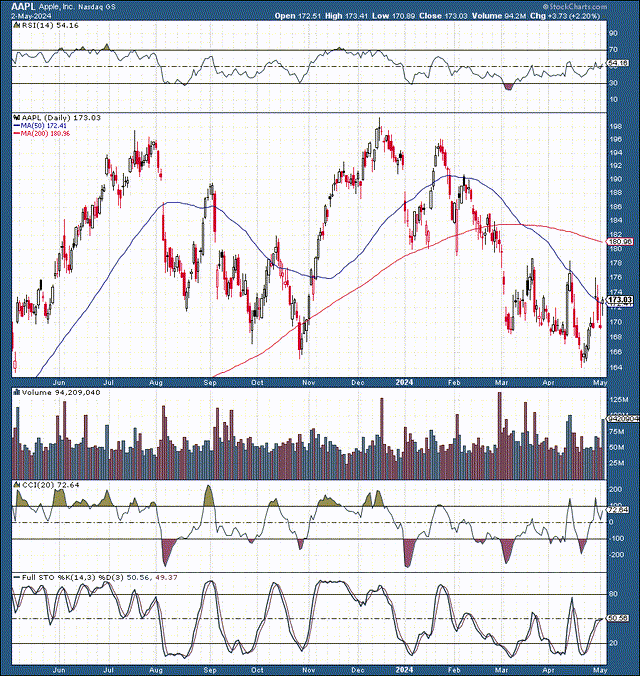

Technically – Sideways Move Could Continue

While many stocks hit new highs recently, Apple remains in a range. Over the last year, it has been stuck in a relatively tight range of roughly $160-200 and could remain range bound. There is no clear catalyst for Apple’s stock to move substantially higher anytime soon. Also, we’ve seen bearish technical factors like the 50-day MA declining below the 200-day MA recently.

Going Through The Earnings

While Apple’s introduction of the dividend increase and the additional $110B buyback are pluses, the company’s results were simply okay. Apple reported an EPS of $1.53, a 3-cent beat, and revenues of $90.8B, a $190M beat. The top and bottom line beats were unimpressive, and sales dropped by more than 4% YoY.

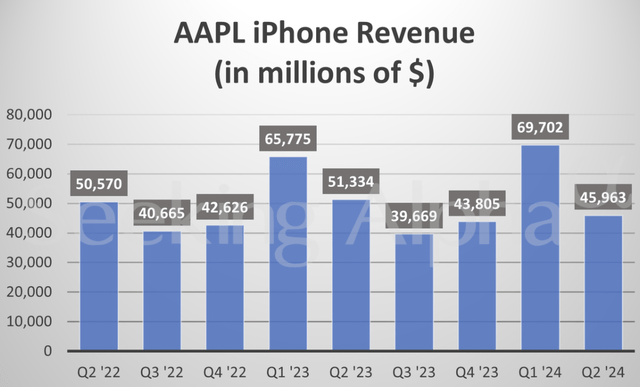

iPhone sales (seekingalpha.com)

Apple’s most significant segment of iPhone revenues registered a considerable 10% decline from the same quarter last year. I believe investors should focus on the lack of growth catalysts, slow advances in AI, China problems, and struggling iPhone sales rather than increased dividends and buybacks.

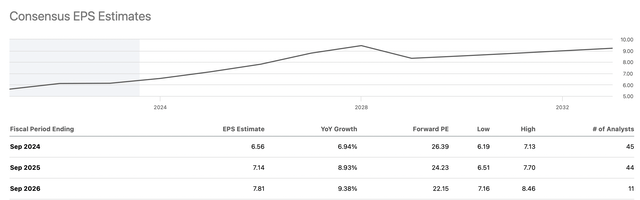

Apple can afford dividends and buybacks, but the company cannot purchase growth. Unfortunately, Apple does not have significant growth prospects, and its P/E valuation appears high at a 25-30 forward P/E ratio.

The Next iPhone Better Be A Hit

The iPhone 16 better be a big hit because the iPhone 15 isn’t, judging by the drop in sales. I keep saying this, but the iPhone has become stale. My iPhone 12 Pro Max is very similar to the 13, 14, and 15 Pro Max models. I don’t see a reason to upgrade. Also, nothing screams upgrade louder than boosted exterior features. Expanding upgrade cycles may be one reason for the decline in iPhone sales; another reason is China.

China, the world’s most competitive smartphone market, poses a significant challenge for Apple. The company is grappling with increased competition from domestic smartphone makers like Huawei and Xiaomi. The smartphone market is buzzing with innovation, and Apple’s stagnant exterior design and other issues may be costing it some sales in this crucial market.

The iPhone 16 better become a massive hit if Apple intends to claw back any of its lost market share. The iPhone 16 could have new design features, including an upgraded camera and a larger display.

However, the iPhone 16’s most significant differences may be its fusion with AI. The new iPhone and the increasing AI capabilities should provide an increasingly intuitive and powerful user experience, perhaps helping Apple to get its iPhone sales back on the right track.

Examining Apple’s Valuation

EPS estimates (seekingalpha.com)

Given Apple’s low growth scenario, its stock is relatively expensive here. Apple certainly is not cheap, at 26-28 times this/next year’s EPS estimates. Apple is expected to generate about $7 in EPS, and with the stock price around $185, its forward P/E is around 26.5. Therefore, there could be limited upside for earnings growth, multiple expansion, and stock price appreciation in the near term for Apple.

Apple’s Dead Money Run Could Continue

Apple’s been dead money for years. Its stock still trades around the same level we witnessed in 2021, several years ago. Moreover, the company needs concrete catalysts that may improve the struggling giant’s growth story. Unfortunately, Apple still commands a premium valuation (25-30), but the company likely needs growth to sustain the rich valuation. Otherwise, we could see the stock weaken due to multiple contractions. While dividends and buybacks may prop up Apple’s stock price in the near term, its stock could move sideways while its growth outlook remains cloudy.

Risks to My Thesis

While I am neutral on Apple’s stock in the near-term 6-12 months, Apple’s stock could continue trending higher in the intermediate and long term. Apple’s stock should move higher as it remains a dominant market-leading company. I believe Apple’s stock will likely move higher down the line, but not likely in the near term. Also, its business is cyclical, going through low growth periods where its multiple becomes compressed. Still, we could see better-than-expected growth prospects from Apple as the new iPhone comes out. Additionally, Apple’s business could improve in China, and its services and other segments like VR could do well, unlocking growth and profitability prospects for the sleeping giant.