Lobro78

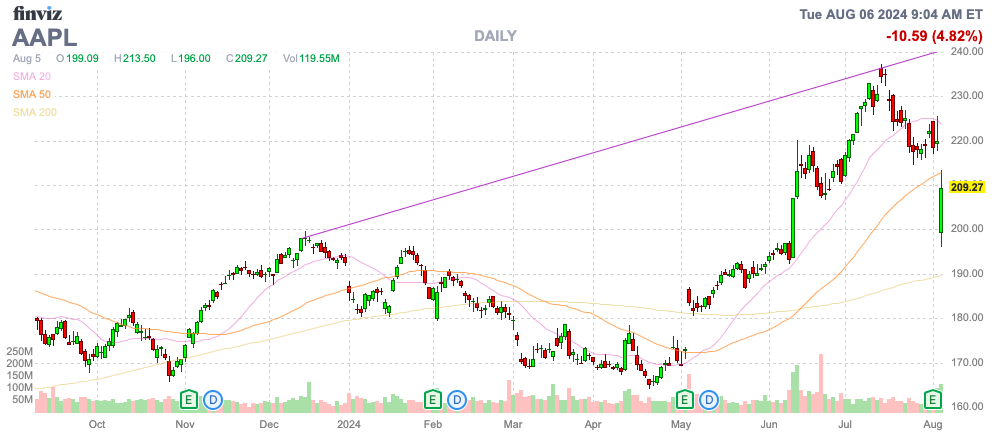

After the market attempted to push Apple Inc. (NASDAQ:AAPL) back up following a return to tepid growth in the last quarter, the news of Berkshire Hathaway Inc. (BRK.B) cashing out might finally return the stock to a normal valuation. Even after the news, Apple still trades near $210. My investment thesis remains Bearish on the stock due to the stretched valuation and signs of a top.

Source: Finviz

Tepid Growth

Last week, Apple reported sales finally returned to growth after a couple of years of sales declines. The tech giant reported the following FQ3’24 numbers:

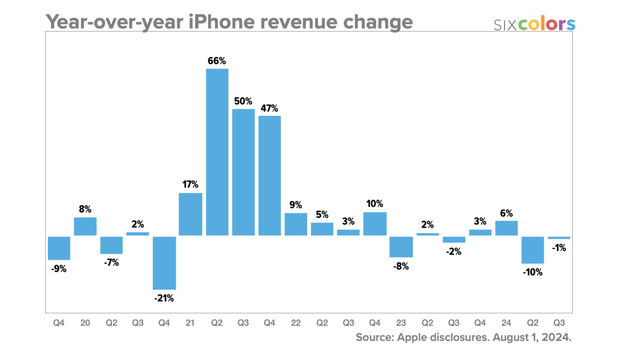

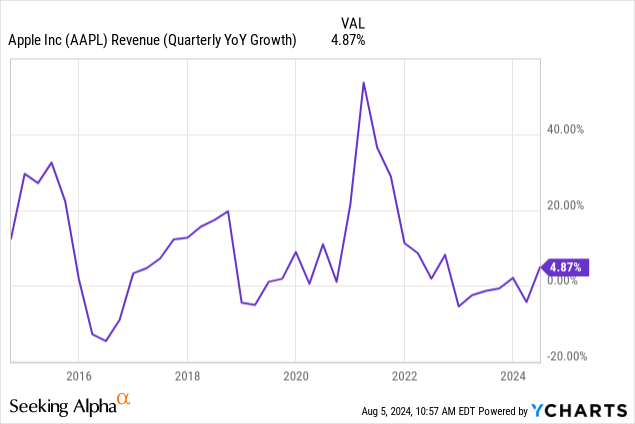

Apple hadn’t reported anywhere close to 5% growth going back to FQ4’22, or nearly 2 years ago. The tech giant reported massive growth during COVID-19, but Apple hasn’t seen consistent growth above 5% in years, maybe going back to before 2016.

The tech giant had quarters during 2016, 2019, 2022, 2023, and 2024 where quarterly sales were negative. Apple is now a rare stock where the tech company lacks consistent growth, yet the market assigns a rich valuation multiple.

Apple just reported FQ3 sales of ~$86 billion, while FQ3’21 sales were above $81 billion. In a period of 3 years, the tech giant only grew sales ~5%, so easy comps made the June numbers appear better than reality.

The key iPhone sales highlight the problems facing Apple. The smartphone sales fell 1% during FQ3 and continues a trend of limited growth outside the COVID-19 pull-forward period in FY21.

iPhone accounts for over 50% of annual sales. Apple was able to produce a minimal 5% growth from Services growing at a 14% clip in the quarter to reach quarterly sales of $24 billion, or 28% of sales.

Remember, though, the June quarter is the lowest revenue level of the fiscal year and Services revenues amount to a higher percentage of revenues. The upcoming FQ4 and FQ1 results are far more tilted toward the non-growth product areas of the Mac and iPhone.

A big issue with the iPhone upgrade cycle due to AI is China. The company doesn’t have an AI solution in China and maybe will never have one. This sets up an issue over servicing the local market going forward, where quarterly sales were nearly $15 billion in FQ3 and have already topped $52 billion for the first 9 months of FY24.

Uncle Warren Exiting

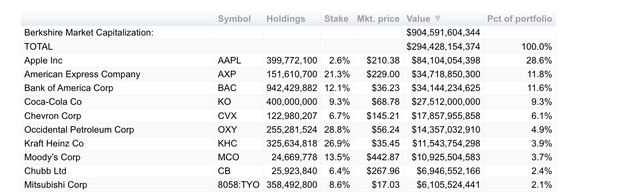

While investors saw a very bullish future for Apple due to AI, Warren Buffett and Berkshire sold ~50% of their position during FQ3. The stock only reached a high of $210 to end June. So, Berkshire was selling before the recent $237 all-time high.

The investment firm ended the quarter with ~400 million additional shares to dump. Considering the stock still trades at or above the levels where Berkshire sold shares during the June quarter, investors should assume Buffett will dump the rest of the shares.

Warren Buffett had previously made the claims that previous Apple sales were made due to tax implications. The investment guru feared higher capital gains taxes in the future and suggested selling the stock in Q1 was prudent for tax purposes, though one wouldn’t want to unload this large of a winning position to pay massive capital gains taxes now, if the goal was to hold the stock for years, if not decades.

Berkshire ended the quarter with a massive cash balance of $277 billion and has apparently further built the cash position to $294 billion via additional sales of Bank of America Corporation (BAC). Buffett clearly didn’t need the cash to make investments, and selling the shares only added to the already large tax position.

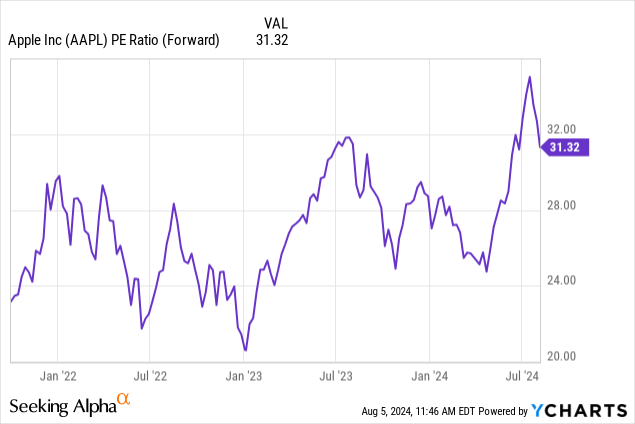

The reality is that Apple still trades at a highly stretched valuation multiple. The tech giant is talking about 5% sales growth in FQ4, and the stock still trades at over 30x forward earnings.

Even after an FQ3 earnings report the market appeared to like, Apple EPS estimates for FY25 are only $7.42. Analysts forecast earnings growing 10% from an Apple Intelligence boost, yet the stock still trades at nearly 30x this updated EPS target.

The big question is whether Apple really sees a boost from Apple Intelligence. China and the EU are big problems for AI.

Influential Apple analyst Ming-Chi Kou has already forecasted iPhone sales aren’t going to jump in the 2H of the year. According to the analyst, Apple suppliers Taiwan Semiconductor Manufacturing Company Limited (TSM) and Largan both supported iPhone 16 sales in the 87 million unit range, down from 91 million units in the 2H’23 for the iPhone 15. The main issue is that Apple Intelligence is only expected to be in beta, suggesting the market is far too aggressive on a sales uplift already.

A more normal valuation for Apple is roughly 15x EPS targets, or ~$111. Warren Buffett selling the stock above $200 is likely due to this valuation disconnect, not necessarily capital gains taxes.

For an investor expecting more stock gains, one has to assume a massive increase in the capital gains tax rate to warrant dumping a long-term winner here. The real logical reason to sell Apple is the stock has been dead money for years, combined with the potential for higher tax rates in the future. In this scenario, an investor wouldn’t win out with minimal to no gains ahead and higher tax rates.

Takeaway

The key investor takeaway is that Apple remains extremely overvalued. The stock is expensive even with a return to growth and expectations for a solid iPhone 16 launch due to AI. The reality is that Warren Buffett is selling shares due to the valuation disconnect, and investors should exit along with his investment firm. The real risk is that Apple doesn’t even hit the 5% sales growth target as the iPhone 16 sales disappoint.

The stock still trading close to $210 is a gift for long-term investors to exit the stock along with Buffett.