Justin Sullivan

Last Friday, shares of Apple Inc. (NASDAQ:AAPL) jumped nearly 6% after the company reported its fiscal second quarter results. The headline numbers for the first three months of calendar 2024 showed top and bottom line beats, albeit after meaningfully reduced expectations. The company also grabbed a lot of positive news for its annual capital return plan update. Despite all of this, shares remain expensive at current levels, so the latest surge in shares was more of a relief rally than a turning point in my opinion.

A quick look back

It was back in early February when I last covered the name in its fiscal Q1 earnings report. At that time, reported results were decent, but guidance seemed a little weak, and I was not exactly a fan of the stock’s valuation. Since then, Apple shares have returned a little more than 2%, but that’s trailed the Invesco QQQ Trust ETF (QQQ) by more than a percentage point and is less than half the return of the S&P 500.

When we look back at Apple’s March quarter, fiscal Q2, we must remember that sentiment was rather poor here. Over the past year, the average analyst revenue estimate for this period had dropped by $8 billion. That meant that the street went from expecting a moderate amount of growth to looking for a more than 4% top line decline. In this case, it seemed like “not a bad report” would be good enough for investors.

Fiscal Q2 results

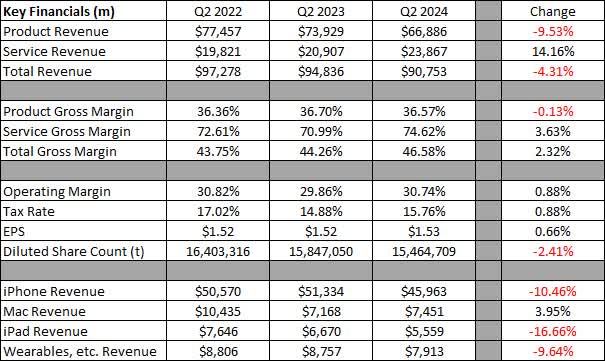

Apple did beat on both the top and bottom lines, although the bottom line beat was the smallest in the past five fiscal quarters. In the table below, you can see overall results against the last two March fiscal periods. The change column represents the year-over-year change from Q2 2023 to Q2 2024, while changes in margins and tax rates are the actual percentage difference between the two periods.

Apple Q2 Results (Company Earnings Reports)

Overall, there were not a lot of major surprises here. The iPhone was down a bit as it faced increased Chinese competition and a tough comparison from the year ago period when supply chain issues had been resolved. Revenues for the iPad also fell even more, but new tablets are expected to launch rather soon and deliver meaningful growth in the current period.

Overall gross margins could continue to rise if the Services segment continues to become a larger portion of the sales mix. However, some of that progress is usually offset on the operating line, which is why operating margins usually don’t rise as much. Apple actually reported a year-over-year decline in net income, but help from the buyback helped the earnings per share number to show a slight improvement.

The rest of this year

Perhaps the biggest theme in the technology space this year is artificial intelligence. Analysts and investors have their eyes on Apple to see what AI capabilities will be in the next round of products, especially this year’s iPhone. We should get a preview of some AI items at next month’s Worldwide Developer’s Conference. Apple took its first sizable step in this area with the Vision Pro, but this device is not expected to be a meaningful contributor to results in the short term.

I am also curious to see how Apple may price its next set of iPhones should they have a lot more AI features. In recent years, the smartphone’s lineup has gotten more expensive thanks to larger storage tiers and bigger screens. The elimination of the iPhone mini also helped push prices for older year devices up, and we could see overall prices move higher again in 2024. This may not be good for overall unit sales, especially if the US economy weakens a bit, and some growth will be needed as analysts expect overall Apple revenue growth percentages to accelerate over the next few quarters.

An important note on the buyback

Right after Apple’s results came out, there were a lot of headlines about the company’s record share repurchase plan. The board of directors authorized another $110 billion to be used to buy back stock at this year’s annual update. Apple is still planning on getting to a cash-neutral position eventually, and it finished fiscal Q2 with roughly $58 billion in net cash.

While the dollar amount of the buyback may be a record, the number itself isn’t fully useful. As I’ve stated on this site many times over the years, it really is the pace of the buyback that’s most important. Apple could have easily announced a $1 trillion buyback last week, but if the plan was going to take 1,000 years to execute, would it really be that meaningful?

In the 10-Q filing, management detailed that it still had over $30 billion left on last year’s buyback authorization at the end of fiscal Q2. We’ve seen share repurchases average around $20 billion a quarter in recent years, and I don’t think there is going to be some massive increase to that amount in the short term. Thus, while the $110 billion number was rather flashy, it probably won’t be anywhere near used up at the fiscal Q2 report a year from now.

Valuation still a bit high

I’ve mentioned in previous articles that my preferred time for investors to accumulate Apple is when shares trade in the low to mid-20s on a price-to-earnings basis. If you are looking at calendar 2024 earnings, that time would have come a bit before earnings when shares were not doing so well. However, the recent rally has pushed things back up a bit. The chart below shows Apple against Microsoft Corporation (MSFT), Alphabet Inc. (GOOG) (GOOGL), and Meta Platforms, Inc. (META).

Mega Tech Valuations (Seeking Alpha)

Apple goes for about a 6% premium to the average of the other three, yet those other names all have much better revenue and earnings growth profiles currently. I’ll be curious to see in the short term how investors react to the news of Warren Buffett trimming his stake in Apple, although the name is still his largest holding. Apple shares closed Friday roughly $11 above their 50-day moving average, so the stock does seem a little stretched in the short term.

Conclusion and recommendation

Apple’s results last week were okay. While the headline numbers did both show beats, expectations had come down quite a bit over the past year. Overall, the company isn’t growing that fast right now, and everyone is waiting to see what Artificial Intelligence areas the company goes after during the rest of 2024. The annual capital return update saw another small dividend raise and a buyback that grabbed a lot of headlines, but I wouldn’t read too much into that record because of timing. In the end, the good news here was that there wasn’t any bad news, but this wasn’t a home run report by any means.

Until we see the growth profile improve a bit, I am continuing today to rate Apple as a hold. We need to see how the AI situation evolves, and the company needs a strong iPhone refresh this year to fend off growing Chinese competition. With the valuation in the high 20s based on calendar 2024 earnings, the stock is a little stretched in the short term for my liking. Should the P/E improve a bit, and we get some decent news out of the developer’s conference next month, perhaps then we can look at a ratings change.