fazon1

Investment Thesis

I am bullish on Apple Inc. (NASDAQ:AAPL) due to its astute response to the China market headwind as well as its investment in AI. Further, my bullish stance is solidified by increasing investor confidence, as shown by a double-digit upside potential from the consensus price target. In February 2024, I published a neutral thesis where I discussed Apple’s balanced risk-reward profile, especially given the challenge it had with the growing competition in the Chinese market. While the neutral outlook was exhibited in the short run with the price showing some relative downward pressure to as low as ~$164, the stock has since shown an upward momentum to as high as $237.23 which is its 52-week high.

With the current upward momentum, and the solid cash position, this company has which I believe bodes well for its sustainable developments as well as return of capital to shareholders, I believe AAPL stock is a buy. To support my buy rating is a double-digit margin of safety from a DCF model.

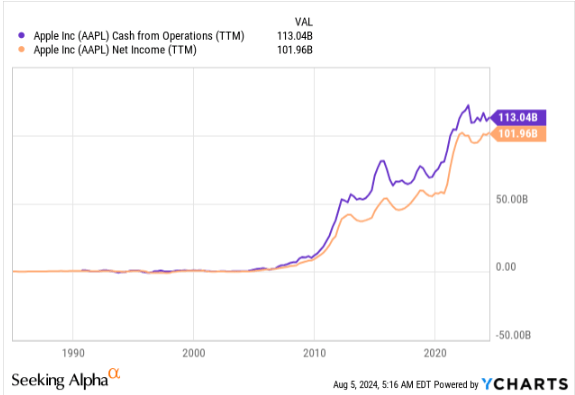

YCharts

Facing Away From The Chinese Market: A Solution To Growing Domestic Competition

In my previous coverage, I had detailed the growing competition between Apple and Huawei where the former was the casualty of the fierce battle as shown by the declining sales. Due to its usage of locally produced chips, which gave Chinese consumers a feeling of ownership, Huawei enjoyed an advantage in the home market. In light of the intense competition, AAPL is addressing the headwind by diversifying and facing off the Chinese market and concentrating on more auspicious markets such as India and Southeast Asia.

Apple’s CEO Tim Cook visited Singapore and devoted $250 million to grow the company’s operations there. In addition, Apple has made significant investments in India as a market for its products and services as well as a manufacturing partner with the company set to assemble iPhone 16 and Pro Max in India.

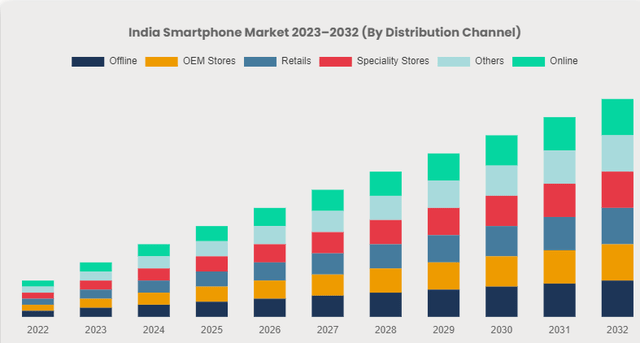

According to Bloomberg, India produced $14 billion worth of iPhones in the last FY with revenue growing by 33%, and welcomed the inauguration of its first Apple shop. In Q3 2024, AAPL appears to be getting the best out of the Indian market with a historical revenue of $85.78 billion, the company broke revenue record in India. With these encouraging advancements, it is undoubtedly a strong beginning to wean itself off China, where conducting business is becoming more and more difficult. Given this promising development, I am optimistic about Apple’s success in this promising market given the solid projected market growth by 2032. The Indian smartphone market is estimated to grow by a CAGR of 8.1% between 2023-2032 which bodes well for Apple’s future growth and revenue generation, something that I believe will significantly cushion the effects of the China competition.

Innovation: AI Takes Centre Role

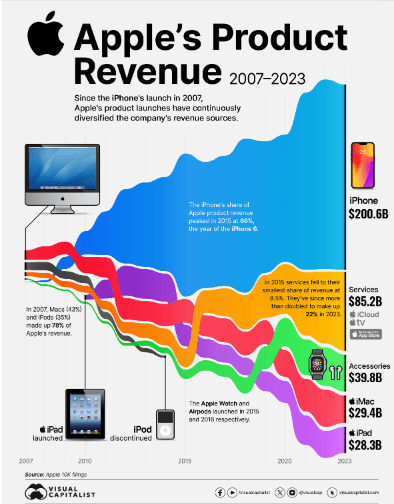

Apple’s investing appeal is largely fueled by its dedication to innovation. I believe that the company’s upcoming product lineup, which will include the much-awaited iPhone 16, will increase sales and keep it competitive this is based on historical performance where its revenue has been responsive to new iPhone launches adding revenue diversity.

Visual Capitalist

Furthermore, the introduction of artificial intelligence elements into Apple’s next products has the potential to completely transform user interfaces and create entirely new revenue streams. The CEO announced in February that the company’s next-generation technology would include some AI-powered capabilities that would be unveiled later in the year. Considering the innovations the company has been doing, it’s reasonable to believe that users of iPhones will be able to perform generative AI work on their devices instead of in the cloud, where the majority of generative AI tasks are currently handled, thanks to Apple’s new A17 processor and the upcoming iOS 18 operating system. Of course, this may give Siri, Apple’s built-in assistant, even more capabilities.

The AI innovation has come with a lot of optimism. Following the company’s June announcement of its AI strategy, sentiment toward Apple shares has significantly improved. The idea, dubbed “Apple Intelligence,” calls for the ChatGPT technology from OpenAI to be integrated into future iPhone models along with a redesign of the Siri digital assistant. In the future, Siri will be able to compose emails, send messages, and work with calendars. CEOs refer to the overall approach as “AI for the rest of us,” with a focus on consumers rather than enterprises.

Apple is hoping that its new AI features will persuade one billion+ users to upgrade to the upcoming iPhone model. The iPhone remains Apple’s most important product, accounting for half of the company’s yearly revenue.

Why I Believe The AI Strategy Counts

Along with its innovation in AI, AAPL’s expansion into India and other prospective regions is a strategic move that is essential to the company’s future success. Here’s why I think so:

To begin with, India has a high potential with a significant untapped market. With just half of its 1.4 billion people possessing a smartphone, it offers a substantial growth opportunity. The opening of retail locations in India, such as the Bandra Kurla Complex in Mumbai, has made it possible for Apple to provide customers with the renowned Apple retail experience, something I believe will help exploit the market better through direct contact with its consumers where feedback is direct, and therefore decision-making is swift and less costly. Moreover, the launch of Apple stores in India has resulted in enormous revenues; on the first day of business, the Mumbai store alone generated $1.2 million in sales. This speaks volumes about the high potential of the Indian market as well as the viability of its strategic approach in the market, direct selling through retail stores. This is supported by the company’s Q3 2024 sales, which showed a $760 million increase in revenue from the Rest of the Asia Pacific region—which includes Thailand, the Philippines, Indonesia, India, and the Philippines—in the June quarter when compared to the prior year.

On the other hand, the adoption of AI in my view could be a revolutionary force for this company. First off, Apple devices become indispensable for customers due to their improved user experience, which is largely enhanced by its AI features as discussed in the previous section. Additionally, it will provide it a competitive advantage because it makes use of unique information from 1.2 billion users and over 2 billion devices, offering insights that spur innovation and individualized experiences. Its emphasis on data privacy guarantees the security and reliability of AI-driven features, which is essential for gaining customer adoption.

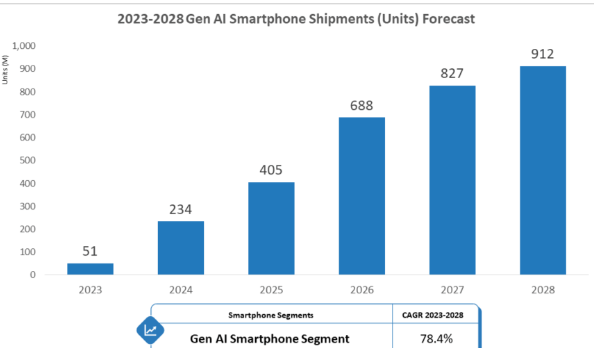

Lastly, by 2030, AI is projected to become widely used, with consumer adoption surpassing that of earlier technology like PCs. Global Gen AI smartphone shipments are projected to reach 912 million units by 2028, yielding a CAGR of 78.4% for the years 2023 through 2028.

IDC

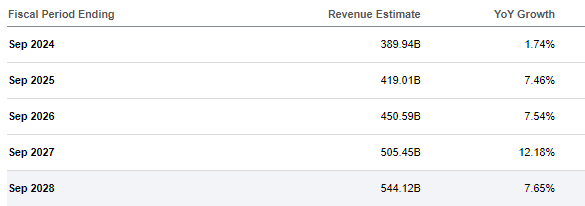

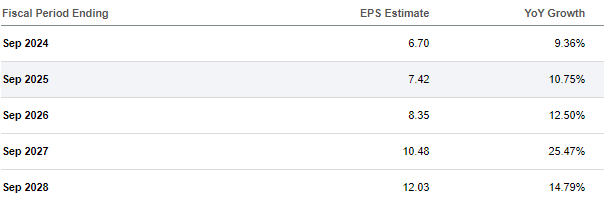

In summary, taking advantage of new markets, Apple’s market diversification and AI innovation enable the company to lead the technology industry by providing customers with cutting-edge, customized, and privacy-focused AI capabilities. Its ability to grow and remain competitive in the global market depends on its dual strategy of investing in AI and reaching a wider audience. This in my view explains the bright outlook for the company as depicted by its solid financial and EPS projections.

Seeking Alpha Seeking Alpha

Q3 2024 Report: Highlights & My Thoughts

On 1st August 2024, Apple reported its Q3 2024 earnings with the following major highlights and my thoughts. First of all, it declared $85.8 billion in quarterly sales beating estimated by $1.40 billion, a 5% rise year over year. This growth indicates a robust demand for Apple’s products and services, even in the face of global economic uncertainty. Its earnings per share increased by 11% to $1.40, exceeding projections by $0.06, a sign of increased profitability and effective cost control.

Furthermore, services income reached a new all-time high of $24.2 billion. This move away from a reliance on hardware demonstrates a revenue source that is maturing and may provide more stability and room for expansion. The organization has demonstrated its dedication to innovation by introducing a personal intelligence system that uses generative AI models. This can revolutionize the industry by improving user experience and creating new income opportunities.

The company gave back more than $32 billion to shareholders during the quarter, including $26 billion in open market share repurchases and $3.9 billion in dividends and equivalents as well as announcing the payment of a $0.25 dividend per share of common stock to shareholders who were registered as of August 12, 2024, on August 15, 2024. This illustrates the company’s confidence in its cash flow and dedication to providing shareholders with value.

In summary, these factors point to Apple’s continued growth and ability to leverage emerging technologies, such as artificial intelligence, to adjust to shifting market conditions. An optimistic prognosis is further supported by the company’s capacity to produce substantial operating cash flow, which permits sizable shareholder payouts. Furthermore, the growth of the services sector points to a strong ecosystem that may support further expansion.

Valuation

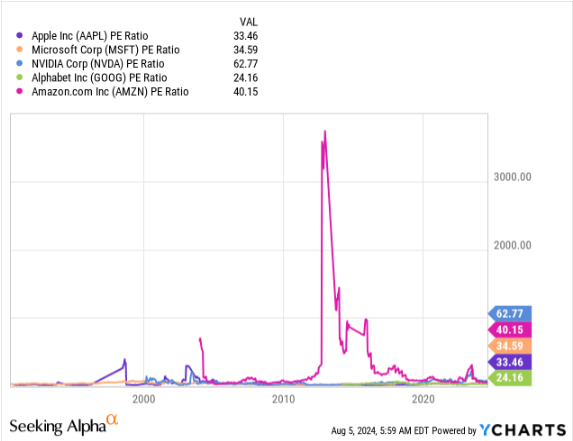

From a relative valuation point of view, AAPL is the second least valued stock from the top mega caps with a PE of 33.46 despite it having the highest market cap meaning that the company is undervalued.

YCharts

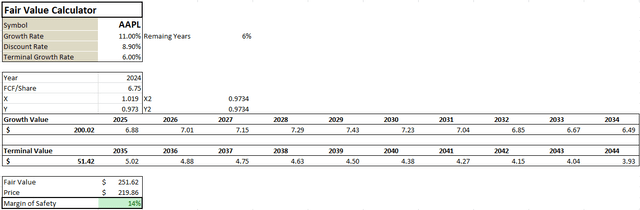

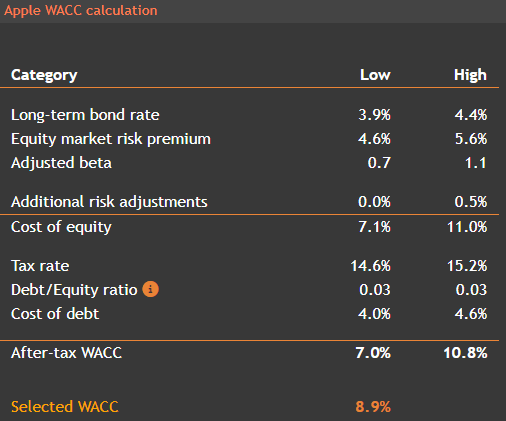

To support my undervaluation assertion is a DCF model output. The company is well-suited to this model as it takes into account future cash flows, which are essential factors that determine value. To address the primary limitation of the model—its excessive dependence on assumptions—I employed cautious growth rates and set the discount rate at WACC. Since the WACC accounts for the risk associated with its capital structure, it incorporates both opportunity cost and risk accounting.

In light of this justification, I worked with a conservative growth rate of 11% considering a 5-year free cash flow CAGR of 12%, and a terminal growth rate of 6%. For the discount rate, I used the company’s WACC, which is 8.9% according to value investing.

Value Investing

Using these assumptions and adopting the trailing FCF/share of $6.75 as the base case I arrived at a fair value of $251.62 translating to a 14% margin of safety justifying a buy decision.

Risk

While I am optimistic about investing in Apple, investing in this stock carries risks similar to any other business. A major risk of investing in Apple is its reliance on iPhone sales. Apple’s financial performance is heavily reliant on iPhone sales, which make up half of its revenue. Factors such as market saturation, greater competition, or a lack of innovation in future models could lead to lower demand for iPhones, lowering Apple’s stock value.

Conclusion

To wrap up this analysis, I reiterate my buy recommendation for AAPL in light of its diversification and innovative strategy mix. Its double-digit margin of safety offers a decent entry point for potential investors. For investors seeking a blend of stability and growth potential, Apple offers an unparalleled opportunity in the current market landscape.