Nikada/iStock Unreleased via Getty Images

Shares of Apple (NASDAQ:AAPL) soared more than 6% after the tech company reported better than expected second fiscal quarter earnings on Thursday. Apple saw a 4% decline in its revenue based amid moderating growth in its hardware categories, especially its iPhone category. However, the decline in the revenue base, in my opinion, was compensated for with a record amount of revenues created in the Services category, which further helped diversify Apple’s revenue streams. Lastly, Apple announced a new, massive $110B stock buyback plan which will allow the company, at its current market cap, to repurchase approximately 4% of its outstanding shares. With shares remaining as cheap as they are, Apple is going to continue to buy back a ton of shares at a relatively low P/E ratio!

Previous rating

I upgraded Apple from hold to buy at the beginning of the year due to an improving, favorable macro setup driven by potentially strong tailwinds for consumer electronics products: 2024 May Be A Breakout Year. Recent IDC data further indicated that the consumer electronics market is stabilizing and set for a return to positive growth this year (which would lend support to Apple’s hardware businesses). Apple’s new buyback especially has considerable value for shareholders, and it is the main reason behind me upgrading shares of the company to strong buy.

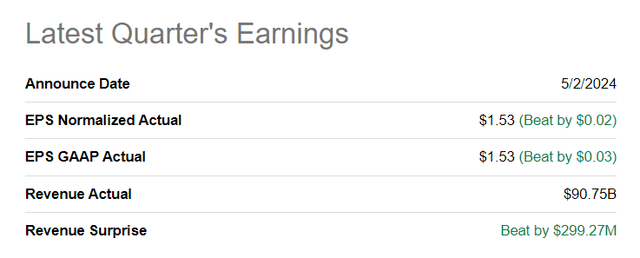

Apple beats estimates

Apple reported both a top line and a bottom line beat for its second fiscal quarter. Apple reported adjusted earnings of $1.53 per-share on revenues of $90.75B. While the earnings beat was not that significant, the large share buyback likely explains the market’s reaction to Apple’s earnings release on Thursday.

Apple faces continual revenue challenges

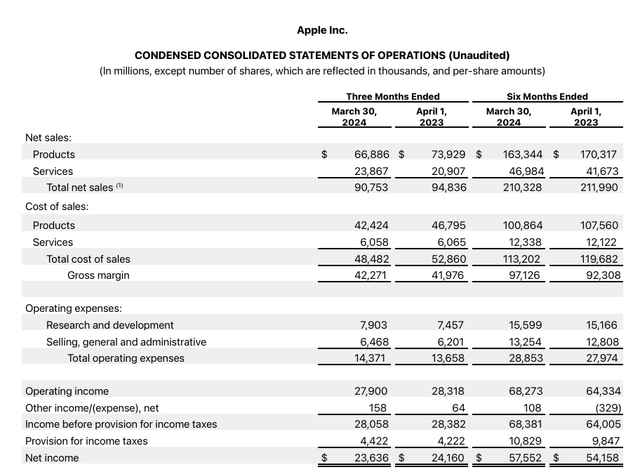

Apple reported total revenues in the first quarter of $90.7B, which implies a year-over-year top-line drop-off of 4%. The biggest driver of this decline was the iPhone segment, which saw its revenues fall almost 11% Y/Y and hit $46.0B. This negative growth was driven by general weakness in the hardware segment, in part coming from China, but the company’s strong Services segment, which I mentioned in the past as a significant growth driver, prevented worse results. Research firm IDC recently projected that device shipments could be set for 2.0% growth in FY 2024, which could be a positive catalyst for Apple’s struggling hardware business.

Apple generated $23.9B in Services revenues in the second fiscal quarter, showing 14% year-over-year growth. Services are an increasingly important component of Apple’s revenues, and I mentioned in my last work that Services are a way for Apple to diversify its hardware-dominated revenue mix going forward. Services consolidates all businesses within Apple that are not related to hardware, such as Apple TV+, Apple Music, Apple Arcade and iCloud. In FY 2023, Apple’s Services business accounted for 22% of revenues. In FQ2’24, this percentage has risen to 25%, and I expect this percentage to further grow going forward.

Accelerating capital returns at a low P/E ratio…

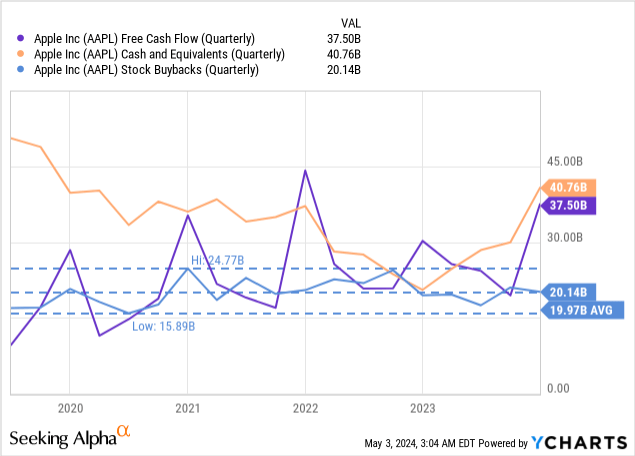

Apple announced on Thursday, as part of its earnings release, a massive $110B new stock buyback authorization which is set to reduce the company’s amount of outstanding shares by approximately 4%. Apple has been a prolific repurchaser of its own shares, with the technology company buying back $43.4B in the first six months of the current fiscal year… which was about 4.3B more than it bought back during the same period last year. The new $110B buyback plan is the largest in the company’s history, and Apple simultaneously announced a dividend raise of 4.2% to $0.25 per-share.

Apple has been an aggressive buyer of its own shares in the past, which was fueled by the company’s enormous free cash flow power. In the last three years, Apple bought back an average of $20B each quarter of its own shares. These capital returns are now set to accelerate, potentially providing an upside revaluation catalyst for shares of Apple.

Apple’s valuation

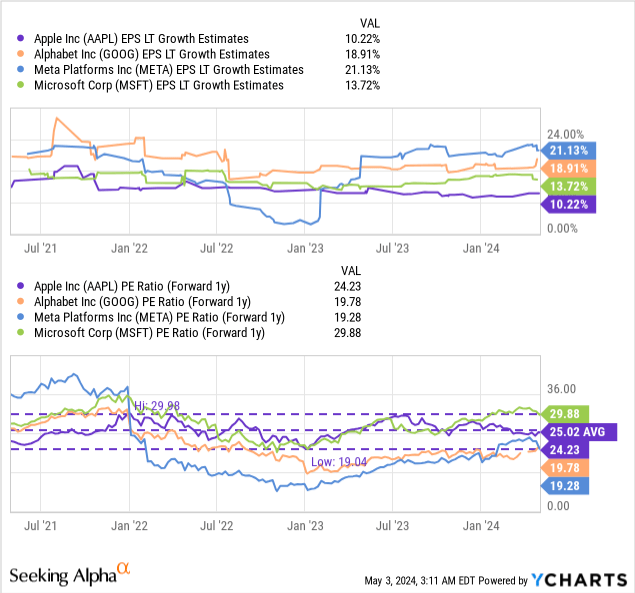

The real value of these coming buybacks is that Apple’s shares are trading at a competitive P/E ratio… especially when compared against other very free cash flow-strong companies like Microsoft (MSFT). Apple’s shares are currently valued at a P/E ratio of 24X — which is about in line with its 3-year average P/E ratio of 25X. The industry average P/E ratio, including Alphabet (GOOG) and Meta Platforms (META) is 23X, so Apple is slightly more expensive than the average, large-cap US company represented below. However, no other company has a comparable buyback program in place, and even Google’s new $70B buyback authorization almost looks small in comparison. I believe Apple could trade at least a Microsoft’s P/E ratio of 30X given its free cash flow and buyback strength, implying a fair value of approximately $215.

Risks with Apple

Although Apple has succeeded in reducing its reliance on hardware sales, which is seen in the growing importance of the Services business, the technology company will remain dependent on device sales for a long period of time. Unfortunately, this means that the company will be exposed to temporarily unpredictable swings in consumer spending, especially if the US economy skids into a recession.

Final thoughts

Apple had a pretty decent second-quarter overall as the company reached a new Services revenue record and the Services business, as a percentage of consolidated sales, reached its highest sales representation ever at 26%. This means that Apple’s push to diversify its hardware sales-dependent enterprise is succeeding. The most compelling element of an investment in Apple is that the company is earning a ton of free cash flow that is set to be returned to shareholders through a very generous $110B stock buyback program. With shares trading below fair value and the company set to buy back approximately 4% of its outstanding shares, I believe a rating upgrade to strong buy is justified, despite the presence of negative top-line growth in FQ2’24.