Hiroshi Watanabe

Apple Inc. (NASDAQ:AAPL) reported its second quarter results for FY2024.

In this article, I will share more about the results, generative AI commentary, Apple Vision Pro adoption, the China recovery and the strong shareholder returns Apple continues to deliver to shareholders.

I have written extensively about Apple on Seeking Alpha, which can be found here. My neutral rating going into the earnings has played out well, given that Apple has underperformed the S&P 500 (SP500). I continue to maintain my neutral rating on Apple after the second quarter FY2024 results, as I do not see sufficient upside for a Buy rating, as I will explain more below.

FY2Q24 results

The second quarter 2024 revenues came in at $90.8 billion, down 4% from the prior year. This met the consensus expectations of $90.4 billion and assured investors that things are not as bad as initially thought. As I will explain in greater detail, excluding the one-time impact from iPhone channel inventory of $5 billion, total revenues would have been up 1% from the prior year instead of being down 4% from the prior year.

Products revenue was $66.9 billion, down 10% from the prior year, due to the mentioned one-time impact from iPhone channel inventory from the prior year, which was partially offset by a stronger Mac segment.

iPhone revenues came in at $46 billion, down 10% year-on-year, which was in-line with consensus expectations.

As highlighted earlier about the one-time impact, there was a one-time impact of $5 billion from the prior year that made compares a bit more difficult this year. In the March quarter from a year ago, Apple was able to replenish its iPhone channel inventory in the quarter and, thereafter, fulfill the significant pent-up demand from the December quarter Covid-19 supply disruptions on the iPhone 14 Pro and 14 Pro Max.

If we adjusted for the $5 billion channel inventory impact from the prior year, the March quarter revenue would have been up 1% from the prior year and iPhone revenue would have been flat compared to the prior year.

Mac revenue grew 4% from the prior year to $7.5 billion, largely due to the solid demand from its new M3 chip powered MacBook Air.

The iPad continued to be challenged by a difficult compare too due to launch of the launch of the M2 iPad Pro and iPad 10th Generation one year ago. As a result, iPad revenues were down 17% from the prior year to $5.6 billion in the current quarter.

Lastly, the Wearables, Home and Accessories segment also saw a tough launch compare due to the launches of the AirPods Pro second-generation, the Watch SE and the first Watch Ultra in the prior year. Revenues for the segment came in at $7.9 billion, down 10% from the prior year.

Services revenues were strong, growing 14% from the prior year and reaching a record $23.9 billion this quarter, contributed by both developed and emerging markets. This beat consensus expectations by 2.6%.

The overall gross margins came in at 46.6% for the quarter, up 70 basis points sequentially due to favorable mix and cost savings initiatives.

Operating expenses came in at the midpoint of the guidance range at $14.4, up 5% from the prior year, net year-over-year.

Diluted EPS came in at $1.53 for the quarter, beating expectations by 2%.

For the June quarter or the third quarter of 2024, Apple expects total revenues to grow in low-single-digits year-over-year, and this is including a foreign exchange currency headwind of 2.5 percentage points.

The services business is expected to grow double digits from the prior year, and iPad revenue to grow double digits from the prior year.

Gross margins are expected to be between 45.5% and 46.5%, while operating expenses are expected to come in between $14.3 billion and $14.5 billion.

The June quarter guidance assumes that the macroeconomic environment does not worsen compared to what we see today.

Operational updates

The iPhone active installed base continues to be strong and in fact, it grew to a new all-time high on the overall basis and in every geographic segment.

iPhone models were the top-selling smartphone models across the globe during the March quarter.

iPhone models were the top-selling models in the US, Urban China, Australia, the UK, France, Japan and Germany, according to a Kantar survey.

Moreover, 451 Research saw that the iPhone 15 models continue to do well across the customer base, with 99% customer satisfaction in the US.

As highlighted before, Mac revenues were boosted by the strong demand seen by the new MacBook Air, which is powered by the new M3 chip, and customers are commenting about the great AI performance seen in the latest MacBook Air and MacBook Pro models.

The installed base for Mac also reached a record high, with half of the MacBook Air purchasers in the quarter being new to Mac.

The customer satisfaction for Mac remains high at 96% in the U.S.

The installed base for iPad continues to grow and also reached an all-time high, with half of the customers who purchased in the quarter being new to the product.

There was a 96% satisfaction rate for the iPad in the U.S.

Apple continues to attract new customers to the Apple Watch, with two-thirds of buyers in the quarter being new to the product. As a result, the installed base for the Apple Watch also reached a record and customer satisfaction remained high at 95% in the US.

Cash generation

Apple continues to be a huge cash generation machine and very shareholder friendly.

At the end of the second quarter of 2024, Apple has $162 billion in cash and marketable securities and has a net cash position of $58 billion. This was after returning $27 billion to shareholders ($3.7 billion through dividends and $23.5 billion through share repurchases), and also further repaying debt of $3.2 billion.

Apple’s long-term goal is to be net cash neutral over time, and to be clear, given the strong cash generation of Apple, this will take some time.

The company announced an additional $110 billion in share repurchases that were approved by the Board, as the company continues to see confidence in its business.

Apple generated $100 billion in free cash flows in FY2023 and is expected to generate $104 billion in free cash flows in FY2024.

With this kind of cash generation, the company can very comfortably buy back shares and add value to shareholders.

In fact, as mentioned above, Apple continues to be a very shareholder friendly company, with the company dominating the top six largest share repurchases since the records started.

History of largest buybacks (Bloomberg)

Apart from the share repurchases that it has been actively carrying out, Apple is also committed to annual increases in dividends as it has done in the last 12 years and also raised dividend by 4% to $0.25 per share in the current quarter.

China

When asked about the confidence about China in the long-term and whether Apple is seeing the turnaround or bottom in China, I think Apple gave confidence on this front.

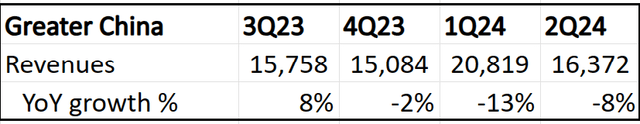

From a re-acceleration front, with Greater China being down 8% in the second quarter, this is an acceleration from the first quarter and that was largely driven by the iPhone. For reference, in the first quarter, Greater China revenues were down 13%, as shown below.

Greater China revenues (Author generated)

In addition, the iPhone revenues within Mainland China also grew on a reported basis before any normalization for the supply disruption that affected things one year earlier.

I think the numbers for the Greater China region are starting to look more promising, with revenues seeming to have bottomed in the first quarter of 2024 and are starting to improve in the current second quarter of 2024.

On the competitive front, according to Kantar, during the quarter, the two best-selling smartphones in Urban China were Apple’s iPhone 15 and iPhone 15 Pro Max.

CEO Tim Cook continues to have a positive view on China in the long-term, and while there may be variability and volatility to its results in China in the near-term, the long-term demand outlook remains positive.

The AI question

Apple’s message on generative AI is clear, but the company is not revealing what is hidden under its sleeves, with the main reveal to come in the product announcement next week and the Worldwide Developers Conference next month.

The messaging that I get out from Apple is that it sees generative AI as a huge opportunity for Apple across its multiple products. Apple thinks it is well positioned for the opportunity and that it has clear advantages that differentiate it from everyone else.

I think the key here is that Apple has been and continues to make significant investments into AI, and will likely share more about these AI initiatives and developments in the coming weeks and months.

Also, I think Apple has multiple differentiating factors, including its own Apple Silicon, its very own industry-leading neural engines, a huge Apple ecosystem user base, and strong expertise in the integration of hardware, software and services.

While not much has been revealed in the current quarterly earnings call, I think investors get the sense that Apple already has something planned in the coming weeks and months, and that Apple also is well positioned and invested in the AI opportunity.

Enterprise

Enterprise customers continue to invest in Apple products to improve productivity, especially as Apple sees more enterprise customers adopting the Mac.

Since the launch of the Apple Vision Pro last quarter, Apple shared that more than half of the Fortune 100 companies have actually already purchases Apple Vision Pro units to see how it can be applied to their businesses.

I think the narrative here is quite interesting and could be the catalyst for enterprise customers to find new use cases for spatial computing.

For example, Apple has noted that KLM Airlines used the Apple Vision Pro for aircraft engine maintenance training, and at Porsche, the Apple Vision Pro is used for real-time team collaboration for racing.

I think this is just the beginning of enterprise customers discovering how Apple Vision Pro, or spatial computing in general, could add value to the business or drive productivity gains.

Valuation

Apple is currently trading at 25x 1-year forward P/E.

Apple has a 5-year average P/E of 27x and 10-year average P/E of 22x.

I think the higher P/E we see today is due to the consistent and strong shareholder return Apple is generating as a result of its strong business moat.

Apple’s share buybacks generated 3% returns on average for the past six years. The dividend yield is about 1% and the dividend has grown by 8% each year on average over the past six years.

This is on top of the EPS CAGR of 8% that consensus estimates are pricing in for the next five years.

Apart from the long runway Apple has not just for the iPhone but its other products and services, I think another point to note is whether Apple’s subsequent announcements around its generative AI initiatives could drive a larger replacement cycle in the coming or next iPhone launches.

This could directly translate to stronger EPS growth and thus, enable Apple to continue to command a premium multiple.

My 1-year price target is $203. This is based on a 27x FY2025 multiple, which is in-line with the 5-year average P/E for Apple.

Conclusion

I think it is difficult to argue against owning Apple as a stock.

While it is certainly not growing the fastest, Apple Inc. continues to command a strong brand reputation with a very loyal customer base, has an ecosystem of hardware, software and services to leverage on. It is a highly cash generative business model that continues to generate significant returns for shareholders.

In the quarter, while not absolutely clear, we are starting to see some modest improvements in China amidst the negative news flow.

The $110 billion share repurchase program that was authorized this quarter is the largest in the history of U.S. share buybacks and Apple continues to dominate that list, with the top six largest share buybacks in the U.S. conducted by Apple.

The company will soon be addressing how it plans to tackle the generative AI opportunity in the coming weeks and months, which will serve as a driver for growth and demand for new customers and replacements, especially for the iPhone.

While very early days, the Apple Vision Pro looks promising and could have multiple use cases, especially among its enterprise customers.