Jetlinerimages

GE stock completed Vernova spinoff

General Electric (NYSE:GE) recently completed its GE Vernova spinoff. In early April, holders of GE common stock received one share of GE Vernova common stock for every four shares held as of March 19. GE Vernova, which is the gas power and renewable energy business of the previous parent company, will now trade under the ticker GEV on the New York Stock Exchange. This move completes General Electric’s plan to split into three separate entities, which was originally announced back in 2021. What’s left under the GE ticker now is the aerospace operations of the portfolio. After the spinoff, this remaining entity will rebrand to GE Aerospace.

I believe this spinoff is a very good move not only for GE Aerospace but also for the two divisions spun off as well. They simplify the business structure so that each can better focus on their own strength. They also add clarity to the valuation of each entity for shareholders. Specific to GE Aerospace (referred to simply as GE hereafter), I’m optimistic about the growth prospects. Aviation has been picking up steam recently as commercial air traffic ramps up in the post-pandemic world. GE’s aero propulsion engines are well positioned to be capitalized given the leading technologies, leading market share, and considerable recurring service revenues.

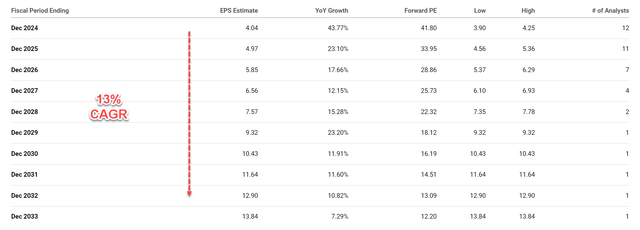

Wall Street projections also point to healthy growth in the long term. More specifically, the chart below shows the consensus EPS estimates for GE stock in the next decade. As seen from the data in this chart, analysts expect GE’s EPS to grow steadily over at a CAGR of 13%. In particular, the consensus estimates for FY 2024 points to an EPS of $4.04, representing a whopping year-over-year growth of 43.77%. This growth is expected to slow down but remain close to double digits annually throughout the following years. By the end of 2033, analysts estimate EPS to reach $13.84, reflecting a 10-year compound annual growth rate (“CAGR”) of 13%.

However, note that even with the large growth projected in 2024, GE’s FY1 P/E ratio is 41.80x. And next, I will discuss why this multiple already has many years of growth priced in.

Seeking Alpha

GE stock: My growth analysis

First, let me first present my own independent growth rate estimate for GE. My method for estimating long-term growth (say over a decade) involves the use of ROCE and reinvestment rates. The method is detailed in my other articles, and here I will just cite the end results:

The method involves the return on capital employed (“ROCE”) and the reinvestment rate (“RR”). My estimated ROCE for GE after the spinoff is around 24.6%. Its RR is about 30% on average in recent years. With these inputs, GE’s organic growth rate would be ~7.38% (24.6% ROCE x 30% RR = 7.38%). Note this number is the real growth rate without inflation. To obtain a notional growth rate, one would need to add an inflation escalator.

Assuming an average inflation of 2.5% would bring the growth rate to about 10% (9.88% to be exact), slightly below the consensus estimate above, but still quite a robust rate over the long term. Also note how much benefit the spinoff can generate for its ROCE. As seen in the chart below, GE’s long-term ROCE has been in the single digits in the past before the spinoff.

Seeking Alpha

GE stock is fairly priced

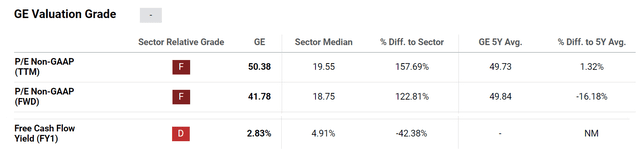

Despite the robust growth curve ahead, as aforementioned, my view is that its current FWD P/E of 41.8x already has many years of growth priced in. Here, I will rely on a discounted FCF (free cash flow) model to make this argument. In this model, the fair value of a company is the present value of all its future FCF. More specifically, I will apply the following 2-stage discounted FCF model:

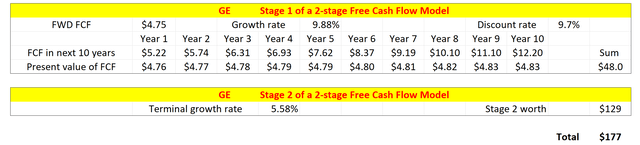

There are a total of 3 key parameters in the 2-stage discounted FCF model: the discount rate, the growth rate in stage 1, and the terminal growth rate. For the discount rate, I relied on the so-called WACC, the weighted average cost of the capital model. The discount rate for GE is about 9.7% on average in recent years following this model.

GE’s FWD FCF yield is around 2.83% as seen in the first chart below. For the growth rate in the first stage of the FCF model, I will use my own estimate of 9.88% as presented above. For its terminal growth rate in the second stage, I will assume the same ROCE of 24.6%, but I will turn down the RR to 12.5% (which is the average for mature large companies in the industrial sector). With the lower RR and a 24.6% ROCE, GE’s terminal growth rate would be 3.07% in real terms. Adding an inflation factor of 2.5% again would bring the notional growth rate to 5.58%.

Based on these parameters, the second table below summarizes my FFC results. As seen, the fair value of GE works out to be around $177, a bit higher than its current market price (about $168 as of this writing) but I think the difference is completely within the margin of error.

Seeking Alpha

Author based on Seeking Alpha data

Other risks and final thoughts

In terms of downside risks, like other aviation companies, GE Aerospace faces the headwinds of a volatile macroeconomic climate and potential disruptions in the global supply chain. The outbreak of another pandemic or geopolitical conflict can interrupt global travel and transportation again and significantly impact demand, production costs, and delivery schedules. However, GE Aerospace also carries some company-specific risks. The top one on my mind is its reliance on the LEAP engine. The success of its commercial aviation segment hinges heavily on the performance of its flagship LEAP engine, manufactured through a joint venture. Any technical issues or delays could disproportionately affect GE compared to its peers with a more diversified product portfolio. Second, as aforementioned, I expect rising demand for engine aftermarket services and further expect this recurring income stream to play a larger role in the years ahead. This outlook, however, is currently clouded by the shortage of skilled workers and high labor costs.

To conclude, while GE Aerospace presents compelling growth prospects after the spinoffs are completed, the high P/E ratio currently prices in much of this growth already according to my analyses. This leaves a very limited margin of safety, especially in the near term, given the ongoing uncertainties in labor costs and inflationary pressure. As such, I do not see a clear bias in its stock prices movements and rate it as a Hold.