ozgurdonmaz

When our long-term competitive position improves as a result of these almost unnoticeable actions, we describe the phenomenon as “widening the moat.” And doing that is essential if we are to have the kind of business we want a decade or two from now. We always, of course, hope to earn more money in the short-term. But when short-term and long-term conflict, widening the moat must take precedence.

– Warren Buffett

Warren Buffett wrote in his 2005 shareholder letter that managers make a serious mistake when they prioritize increasing short term earnings at the expense of customer satisfaction, or brand strength. With Apple (NASDAQ:AAPL) boosting short term profits by aggressively increasing prices and prioritizing financial engineering over product innovations, it has weakened its moat. This is probably the main reason Buffett has decided to start selling Apple shares, even if he hinted tax reasons were also a consideration. Clear signs that Apple’s moat is weakening are evident in its loss of market share to rivals, including Samsung Electronics (OTCPK:SSNLF), which recently regained the smartphone crown by selling more than 60.1 million devices, compared to Apple’s 50.1 million iPhones sold. Perhaps more worryingly, iPhone sales were down 10% year-over-year, while rivals like Xiaomi (OTCPK:XIACY) saw sales skyrocket 34%.

A second reason we believe Buffett is trimming Apple is that the company is facing increasing regulatory and geopolitical risks. We know Buffett takes these risks seriously, as geopolitical risk appears to have been the main motivation behind his selling of Taiwan Semiconductor (TSM) at a similar price to what he had paid to acquire the stake a few months earlier and just before shares experienced a significant price increase. Those risks that have scared Buffett with TSM, could also severely affect Apple, as it would be nearly impossible for Apple to continue building its devices should TSM stop operations. In addition to this geopolitical risk, regulatory risks have also increased for Apple, as the U.S. government and the European Union are increasingly looking at alleged anti-competitive behavior.

As a Dale Carnegie fan, Buffett goes out of his way to avoid criticizing people or companies where he has invested. It would have been particularly awkward for him to have said something bad about Apple with CEO Tim Cook present at Berkshire Hathaway’s (BRK.A)(BRK.B) shareholder meeting. This behavior is so ingrained in Buffett, that he even had difficulty criticizing Wells Fargo (WFC), even when it became clear the bank had seriously misbehaved. He even called John Stumpf, the CEO pushed out as a result of the mess, a “very decent” man. How did he show his disapproval? By quietly selling shares, until eventually he completely exited the position.

While we do not disagree with Buffett’s logic that taxes could be increased given the widening deficits, we must also remember that he is famous for saying “our favorite holding period is forever.” If it was really just a matter of saving money on taxes before they are increased, he should also be selling other positions where Berkshire has large unrealized gains like Coca-Cola (KO) and American Express (AXP). We therefore believe that while the tax argument could have influenced the timing, he did have the intention of reducing Berkshire’s exposure to Apple. It is not as if Berkshire needed the cash either, as its cash and short term investments have surged to $189 billion.

Titanic Disaster

Perhaps there is no better example of Apple’s waning innovation prowess as its failure to deliver project “Titan”. Despite spending billions of dollars over a decade, the company completely failed to launch its autonomous electric car. If Apple had been successful, it could have actually moved the needle for the company, unlike its Vision Pro headset, Apple’s first new gadget in a decade, which has so far not made a significant contribution to the company’s revenue.

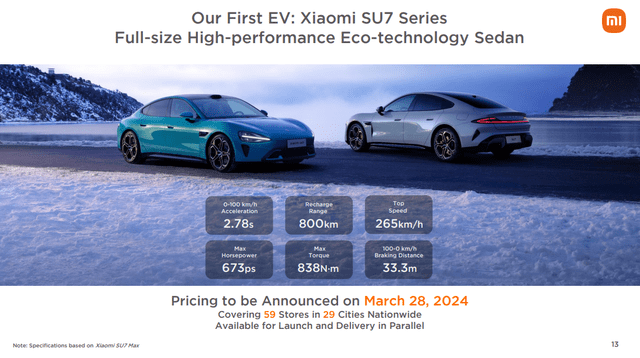

What is even more embarrassing for the company is that its much smaller smartphone competitor Xiaomi did manage to launch their electric vehicle. Despite having significantly more modest economic resources, and a fraction of Apple’s R&D budget.

Geopolitical, Regulatory, and Antitrust Risks

Apple is by far Taiwan Semiconductor’s largest customer, which means that geopolitical risks for TSM could also have an enormous impact on Apple’s capacity to ship devices in the even TSM had to stop production. Buffett mentioned this risk when asked why he sold the stake he had previously build in TSM, and perhaps it is know a factor in his decision to trim Berkshire’s Apple stake too.

Apple’s competitive moat is also being threatened by government regulations, and complaints from company’s like Spotify (SPOT) that have argued that Apple has engaged in anti-competitive practices with its app store. This had important repercussion for the company, including the European Commission giving the company a $2 billion fine. Apple has had issues with other large app developers, including Epic Games, which fought to force Apple to allow alternative app stores.

It is not just the European Union that is investigating Apple’s business practices. In the U.S. the Department of Justice has filed an antitrust lawsuit accusing Apple of engaging in “a broad, sustained, and illegal course of conduct” to establish a smartphone monopoly.

Growth Multiple for a No Growth Company

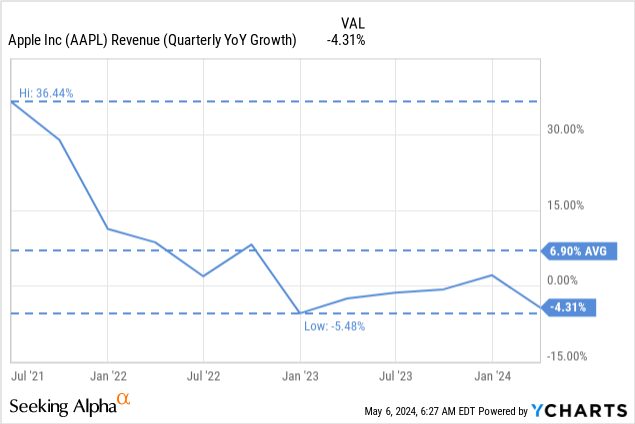

Does Apple really deserve a growth company valuation multiple when it is delivering negative revenue growth? After significant growth in the post-pandemic boom, growth has clearly been decelerating, with the most recent quarter showing negative revenue growth.

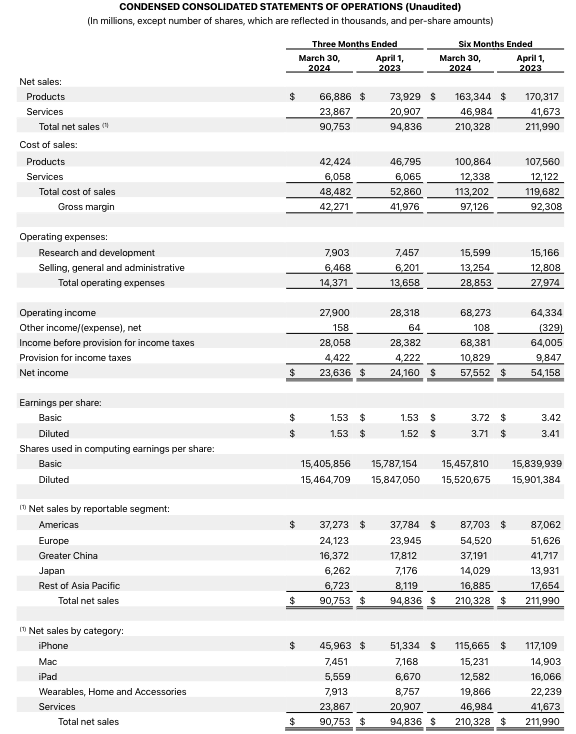

Despite the enormous amounts spent on share repurchases, the company only managed to increase earnings per share by one cent. While sales remained relatively stable in the U.S. and Europe, they experienced a significant decrease in China, Japan, and the rest of Asia. This is due to a combination of a strong dollar, but also to the company losing market share to some rivals. Looking at the different product categories, the iPhone experienced a significant decline, as did the wearables segment, with ‘Services’ being the only segment delivering meaningful growth.

Apple Inc.

Growth

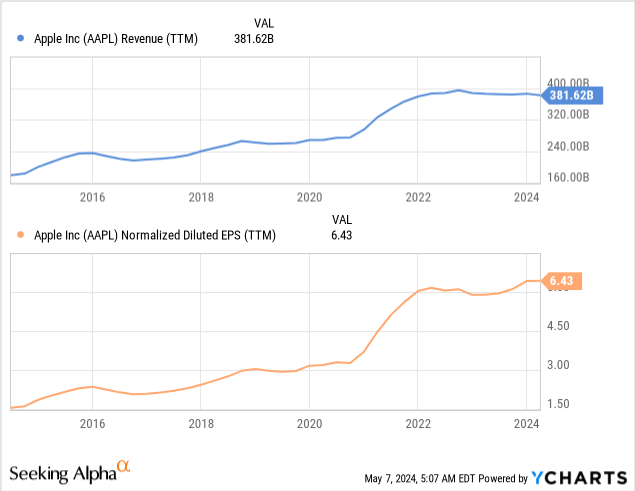

Zooming-out to see revenue and earnings per share (EPS) over the past decade, we can see that part of the gains made by Berkshire in its Apple investment can indeed be attributed to growth in the business. Since Berkshire invested in 2016, revenue has grown more than 50%, and EPS roughly tripled. However, since 2022 both appear to be stalling, with revenue trending lower for several quarters, and EPS rising only modestly despite massive amounts of capital deployed to repurchase shares.

Valuation

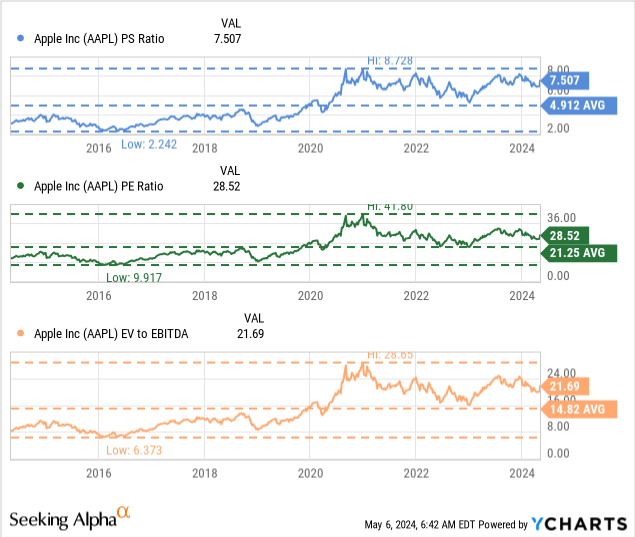

While business fundamentals are responsible for part of the share price increase since Berkshire started buying Apple in 2016, some of the gains can be attributed to swelling valuation multiples. Despite delivering negative revenue growth last quarter, Apple is currently valued with a Price/Sales multiple more than 50% higher than its ten-year average. Similarly, its EV/EBITDA is about 50% higher compared to the ten-year average.

When Buffett started buying, the Price/Earnings ratio was close to 10x, and it has now almost tripled, and is considerably above the ten-year average as well. With earnings and revenue stagnating, we find these high multiples difficult to justify, especially at a time when the company is losing market share to rivals. As we saw in the section above, revenue and earnings growth has been disappointing since 2022, and the near term outlook is not good either, with an analyst recently downgrading her estimates for the second quarter based on what she described as “anemic and/or negative growth outlook”.

Risks

We have already mentioned several of the risks Apple is facing, including regulatory and antitrust investigations. The company is also facing increased competition from Chinese and Korean manufacturers, and some even argue the brand has lost some of its prestige. Apple is also facing a ban from the Chinese government restricting its use for government state firm employees.

Apple is also highly dependent on Taiwan Semiconductor for the supply of most of the advanced chips used in its devices, and would probably experience significant issues manufacturing its devices if TSM experienced disruptions. Apple is TSM’s biggest customer, responsible for an estimated 25% of its revenue, or about $17.5 billion in 2023. For comparison, NVIDIA (NVDA) is estimated to have represented about 11% of TSM’s revenue in 2023. Of course this risk applies to several other U.S. chip companies with a fabless business model, such as NVIDIA and AMD (AMD), and it is one of the reasons the U.S. passed the “CHIPS for America Act” to incentivize semiconductor manufacturing in the U.S. Taiwan Semiconductor in now building fabs in the U.S. including one estimated to cost around $40 billion in Phoenix, with Tim Cook saying that Apple will be proud to be the fab’s biggest customer. Still, it will take time for this massive new factories to be ready, and even then the chips might have to be sent to Taiwan for packaging, at least in the beginning. In other words, Apple and the whole industry is aware of this risk and they are working to mitigate any potential impact, but it will take time. As Peter Wennink, ASML’s (ASML) CEO, told Bloomberg TV: “if you want to reallocate semiconductor build capacity, manufacturing capacity, you have to think in years.”

We see a risk that the high valuation multiples might not be sustained if Apple fails to reignite growth. It abandoned one of its most promising projects, an autonomous electric car that could have rivaled the likes of Tesla (TSLA), and so far it appears to be trailing technology rivals such as Microsoft (MSFT), Alphabet (GOOGL), and Amazon (AMZN) in the artificial intelligence race.

There are upside risks as well, and we do not think it would be particularly wise to short the company. Apple is part of the “magnificent seven” group of companies, and investor excitement could send valuation multiples higher. Apple is looking at adding AI functionality to its devices, as a recent report of talks with OpenAI details. Even if the technology comes from another company, if the new features result in a significantly improved experience, this could generate some investor and consumer excitement. Finally, there is a risk that the massive $110 billion buyback the company recently announced could send shares higher, even if the fundamentals do not justify it.

Conclusion

Buffett’s tax argument for selling Apple shares contradicts his famous stand that his favorite holding period is forever. Diversifying the portfolio would be a better argument, since the tax logic could be applied to several other Berkshire holdings. We know Buffett cares enormously about a strengthening competitive moat, and Apple’s moat appears to be weakening instead. The company is delivering lackluster financial results, faces multiple risks, and is trading with high valuation multiples. These factors likely contributed to Buffett’s decision to sell Apple shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.