deliormanli/E+ via Getty Images

We previously covered Apple (NASDAQ:AAPL) in February 2024, discussing why it deserved its profitable growth valuations – albeit somewhat pulled forward by the overly optimistic market sentiments, attributed to its increasingly rich operating and Free Cash Flow margins.

However, with the stock already underperforming the SPY and QQQ on a YTD and twelve months basis, worsened by the uncertain market sentiments from the slowdown in iPhone sales, we had rated the stock as a Hold then while highlighting that a moderate pullback to the $165s might be possible.

The caution has been proven right indeed, with AAPL losing much of its 2024 gains while retesting its $165s support levels by mid-April 2024. Even so, bullish support remains robust, with the stock already bouncing off those levels by the time of writing.

With its ecosystem increasingly sticky and the Services segment being its bottom-line driver, we believe that AAPL remains a Buy at every dip, significantly aided by the upsized share repurchase program worth $110B.

The AAPL Investment Thesis Remains Robust – Thanks To Its Ecosystem Strategy

For now, AAPL has reported a double beat FQ2’24 earnings call, with overall revenues of $90.75B (-24.1% QoQ/ -4.3% YoY) and adj EPS of $1.53 (-29.8% QoQ/ +0.6% YoY).

The star of the show is naturally its eponymous iPhone, which has been the subject of much scrutiny as sales decline in China and it faces lower activation in the US, triggering market concerns of slowing growth.

Those fears have materialized after all, with AAPL reporting $45.96B of iPhone sales (-34.1% QoQ/ -10.5% YoY) in FQ2’24, worsened by the fact that it lost the top spot in the global smartphone market to Samsung (OTCPK:SSNLF) in Q1’24.

Even so, we believe that the Cupertino giant is more than an iPhone designer, especially due to its well-diversified smart devices across tablets, laptops, smartwatches, TVs, and smart home systems, on top of the iOS ecosystem, including Apple Pay and Apple Store, amongst others.

Given that “iPhone’s retention rate ranges between 85% and 88%,” it is undeniable that customers may remain loyal to their preferred operating systems, with the AAPL reporting 28.58% in smartphone market share as of February 2024 (+5.87 points from 2019 levels of 22.71%).

This is compared to the share erosion observed in the Android market share to 70.69% (-4.78 points from 2019 levels of 75.47%).

And this leads us to our second point, the iPhone is not AAPL’s bottom-line driver after all, since the smart devices are a means to an end, which is to attract users to its highly sticky iOS ecosystem.

While the exact number for AAPL’s installed base of active devices is not disclosed for the FQ2’24 quarter, the management has already commented that the number has “reached an all-time high across all products and all geographic segments,” likely to be higher than the 2.2B reported in FQ1’24.

These numbers further demonstrate why the Cupertino giant remains a force to be reckoned with in the smart devices market, especially since iPhone users have higher spending power compared to Android users, both in terms of device and app purchases.

And this is also why AAPL already reports $95.44B of annualized Services revenues (+3.2% QoQ/ +14.1% YoY/ +106.3% from FY2019 levels of $46.29B) in FQ2’24, with the segment generating a rich gross margin of 74.6% (+1.8 points QoQ/ +3.6 YoY/ +10.9 from FY2019 levels of 63.7%).

This is compared to its Product segment LTM revenues of $291.1B (-4.4% sequentially/ +36.1% from FY2019 levels of $213.88B) and gross margins of 37.2% (+1.4 points sequentially/ +5 from FY2019 levels of 32.2%).

These numbers demonstrate that AAPL’s Services segment is the bottom-line driver indeed, mostly responsible for the rich LTM net incomes of $100.38B (+6.4% sequentially) and margins of 24.7% (+0.2 points sequentially).

Combined with the “increased customer engagement within its ecosystem” and over 1B in paid subscribers across its services (up from 975M reported in FQ2’23 and supposedly more than double from 515M reported in FQ2’20), we expect to see AAPL’s Services revenues to continue growing moving forward, no matter the fluctuation in its Products revenues.

For now, most US consumers have an average smartphone replacement cycle of approximately 3.5 years by the end of 2023, higher than the 2.9 years reported in 2019.

With the macroeconomic outlook still uncertain and borrowing costs high, we can understand why there have been some changes in consumer behavior, triggering weakness in iPhone demand, with 2024 also overlapping the record high smartphone replacement cycle in 2022 globally and China in 2023.

As a result of these developments, we believe that anyone who continues to harp on the lower iPhone sales may have direly missed the cyclical nature of smartphone sales and the crux of the AAPL’s highly profitable Services investment thesis.

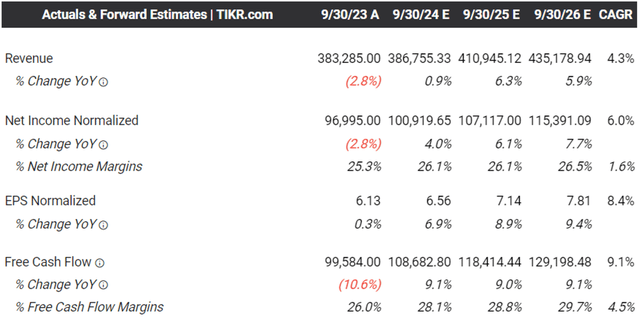

The Consensus Forward Estimates

With the AAPL management continuing to focus on shareholder returns, we believe that the stock may continue to enjoy bullish support, especially aided by the recent hike in quarterly dividends by +4.1% to $0.25 and the upsized share repurchase program of $110B.

Readers must note that 380M shares or the equivalent 2.3% of its float have already been retired over the last twelve months, and 3.13B/ 16.8% since FY2019.

Most importantly, AAPL remains well capitalized and profitable enough to continue doing so, based on the Free Cash Flow of $101.91B (+4.5% sequentially) and margins of 25.5% (+0.2 points sequentially) reported over the LTM, with the consensus still expecting robust growth in cash flow generation through FY2026.

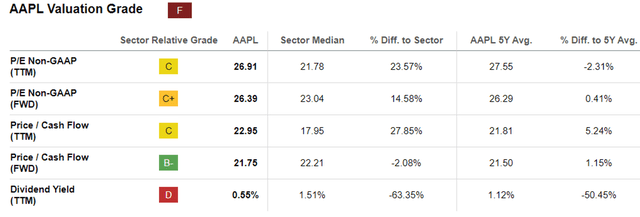

AAPL Valuations

And finally, AAPL continues to trade at relatively stable FWD P/E valuations of 26.39x, compared to its 1Y mean of 27.95x and the sector median of 23.04x.

While there may be some bears that believe the stock does not deserve the premium P/E valuations, due to the single-digit growth prospects in its adj EPS over the next few years, we maintain our belief that the company demonstrates a highly competent monetization strategy across its sticky Products offerings and increasingly profitable Services platform.

Most importantly, given the robust Free Cash Flow generation thus far, we believe that AAPL remains well positioned to achieve its net cash neutral target previously announced in 2018, as observed its moderating net debts of -$24.69B in FQ2’24, compared to -$21.98B in FQ1’24, -$41.18B in FQ2’23, and $8.7B of net cash in FY2019.

This is based on the cash/ equivalents and marketable securities of $67.14B (-8.1% QoQ/ +20.1% YoY) and the long-term debt of $91.83B (-3.4% QoQ/ -5.3% YoY).

So, Is AAPL Stock A Buy, Sell, or Hold?

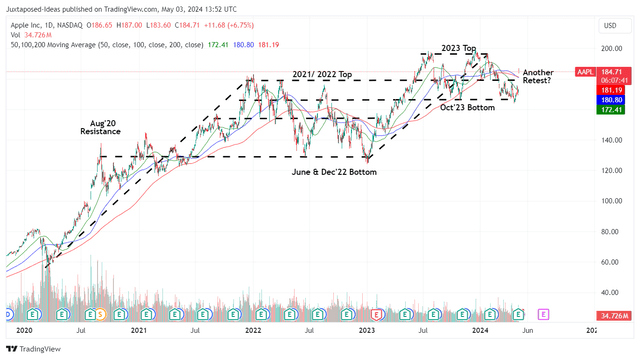

AAPL 4Y Stock Price

For now, AAPL has rallied tremendously by +9.1% since the recent earnings call, with the stock also temporarily breaking out of its previous resistance levels of $179s.

It appears that an attractive entry point has escaped us again, given our fair value estimates of $169.60, based on the FWD P/E valuations of 26.39x and the LTM adj EPS of $6.43.

Based on the consensus FY2026 adj EPS estimates of $7.81, there seems to be a minimal upside potential of +11.5% to our long-term price target of $206.10 as well.

Even so, based on the AAPL’s stock sideways movement over the past few months, we believe that an attractive entry point may come soon enough for those whom are patient enough to wait, with another retest of the $160s very likely as the macroeconomic outlook remains uncertain through 2026.

If anything, readers may also look forward to the tailwinds from the potential inclusion of the more popular OpenAI’s generative AI capabilities in the iOS 18, one upping other smartphone players whom have introduced different forms of on-device AI tools.

Combined with the multiple promising factors discussed above, we believe that AAPL remains a stock that one may chase at every dip, naturally depending on individual investors’ dollar cost average and investing style.

AAPL remains a long-term Buy.