Nikada/iStock Unreleased via Getty Images

Apple Inc. (NASDAQ:AAPL) remains the 2nd largest publicly traded company, after losing its coveted spot to Microsoft (MSFT) in the artificial intelligence (“AI”) craze. The market was excited about the company’s recent fiscal Q2 earnings, where the share price increased 6% after-hours, following a more than 2% increase during the day.

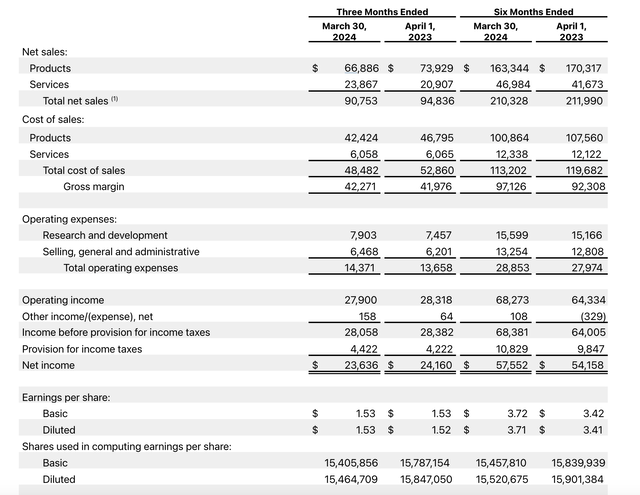

That was on the back of diluted EPS at $1.53 / share, with a 2.5% decrease in outstanding share count, and $23.6 billion in net income for the quarter. Despite strong numbers, as we’ll see throughout this article, the company’s core growth is over and its profits simply don’t justify its valuation.

Apple Financial Results

Apple had better than expected fiscal Q2 financial results, especially when accounting for a $5 billion quarterly impact of iPhone sales a year ago.

The company saw $90.7 billion in revenue for the quarter ($95.7 billion when accounting for the $5 billion iPhone one-time revenue). That would put the company’s revenue growth at just under 2% YoY for the quarter. The company did see stronger growth in its services revenue, which made up for product strength significantly, and enabled gross margins to improve.

That’s because services saw double-digit YoY revenue increase, while cost of sales actually managed to decrease slightly. Operating expenses went up by roughly $600 million, resulting in net income of $23.6 billion, down roughly 3% YoY. Thanks to a similar % in YoY share buybacks, the company managed to keep its earnings per share approximately flat.

When accounting for one-time factors, it’s clear that the company isn’t declining from a profit perspective, and improving margins is exciting, but it’s also clear that the company is seeing low-to-mid single digit % earnings growth.

Apple Segment by Segment Performance

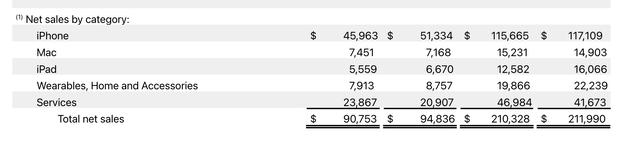

The company’s segment by segment performance shows how the company’s growth is tapering off.

Removing a tough YoY quarterly comparison, the company’s iPhone sales only decreased slightly. The company also saw strength in its Mac sales. We’ll even forgive the weakness in the iPad segment, given that the company has released no new iPads since 2022. The company is expected to launch new iPads potentially soon, which could help sales recover.

There’s also no denying the company’s services performance was strong. However, wearables, home and accessories seeing an almost double-digit sale decline was concerning. Our guess is as these are non-primary products, in an economy where customers are paying more attention to their budgets, these products are seeing lengthening replacement cycles.

Upgrade cycles are slowing, and with potential new laws forcing the company to make devices user upgradable, that could slow down further. That means even adding the $5 billion iPhone revenue comparison and new iPads, we expect the company’s revenue growth to stay at the low-to-middle single digits, a sign of an established company.

Apple Vision Pro

Apple launched its exciting Vision Pro production at a price point of more than $3000 per unit, entering a space that was previously dominated by Meta Platforms (META). Meta continues to spend more than $4 billion quarterly on Meta labs, and is willing to lose billions, despite right-sizing the project in its view from prior years.

That makes the company itself a formidable competitor to Apple, which has a quarterly R&D business of just under $8 billion for the entire company. Social media talk about Apple’s Vision Pro has largely disappeared, and customers are buying the product at well below the forecast levels. The company does not break out numbers.

However, rumors are that it initially expected to sell 800K units in 2024 and has cut that forecast to 400K to 450K. Assuming that’s true, the company, with the first year iteration of the production, is expecting barely $1 billion of revenue. Given the company’s original forecast wasn’t even 1% of the company’s annual sales, at this point it seems tough.

This new and exciting product, while incredible technologically, simply doesn’t seem to have the buzz currently to change the company’s financials. Our view is that this is because the product doesn’t have a reasonable category it slots into.

- The Mac is an incredible product in an existing popular category.

- The iPhone is (and was launched) as an incredible product during the growth of cell phones.

- The iPad was launched as a strong product in an exciting category (tablets).

- The Apple Watch provided unique health tracking and was, again, an already exciting category.

- The AirPods were dramatically more expensive than their standard category (headphones) but were more convenient, especially when iPhones lost the headphone port.

In this world, we don’t see where the Vision Pro fits. Headsets are not a popular category, it doesn’t provide unique health data that you can’t get elsewhere, and it doesn’t make using Apple’s other products more convenient. We’re confident the company has ambitious goals, and Tim Cook remains excited, but Meta has spent $10s of billions here with no significant returns.

Apple Shareholder Returns

At the end of the day, what matters is Apple’s shareholder returns, in relation to a market capitalization of more than $2.8 billion. The company’s dividend already costs it more than $15 billion annually, for a dividend that’s very minimal (0.55%) with a recently announced 4% increase. The company also announced a $110 billion buyback the market is excited about.

However, it’s worth noting that the entire buyback amount is less than 4% of the company’s market capitalization. That’s assuming the company can buy the entire buyback amount in a year, which it cannot do without taking on debt. The company’s annualized profit is $108 billion, not counting its dividend, which takes that to just over $90 billion.

And at the end of it all, the market is excited about share buybacks, but the company is spending all of its cash to generate 4% shareholder returns, and growing at the low single-digits. The path for the company to beat the S&P 500 and be worth a separate investment is tough to see.

Thesis Risk

The largest risk to our thesis is Apple’s brand strength. The company continues to drive massive sales as it focuses on the customer experience and seamlessly blending hardware and software. Additionally, the company continues to benefit from its scale, which enables margin improving developments such as Apple Silicon and the growth of Apple services.

That combination can enable strong long-term shareholder returns, justifying the company’s current valuation.

Conclusion

Apple is a phenomenal company with a commitment to increasing efficiency, building new products that the market loves, and generating strong shareholder returns. The company’s announced $110 billion buyback might only be 4% of the company, but is enough to buy the vast majority of companies in the S&P 500.

However, the company also trades at a premium valuation due to its strength. The company, combined with its dividend, is spending virtually all of its profits on a 4% shareholder return. It has risks with expanding upgrade cycles, the lack of popularity of the Apple Vision Pro, and more. The company needs to beat the S&P 500 to be worth the lack of diversification from an investment.

We don’t see a path to that happening, making the company a poor investment at this time.