Sjo/iStock Unreleased via Getty Images

Investment thesis

My previous bullish call about Tesla, Inc. (NASDAQ:TSLA) underperformed the broader U.S. market with a -3% share price change since early February. However, as I always say, Tesla is an inherently volatile stock and is not a suitable option for investors who are seeking rapid returns. It is an apparent long-term play, and recent developments give me even more optimism about the company’s long-term prospects.

I consider the weak recent Tesla performance to be temporary, and the management’s long-term mindset with focus on unmatched technologies is much more important than near-term challenges the company faces. According to my discounted cash flow (“DCF”) simulation, the stock trades with a substantial discount, and I reiterate my “Strong Buy” rating.

Recent developments

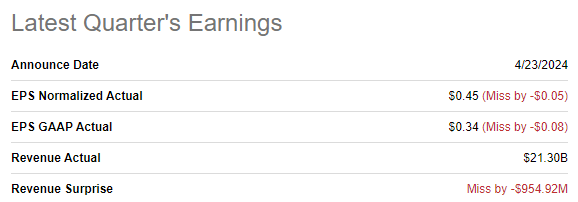

The latest quarterly earnings were released on April 23, when TSLA missed both revenue and EPS consensus expectations. Quarterly revenue dropped on a YoY basis first time since June 2020, decreasing by 8.7%. As a result of revenue decline, the adjusted EPS almost halved YoY, from $0.85 to $0.45.

Seeking Alpha

Despite Q1 performance looking disappointing, the stock has grown by around 30% between April 22’s close and the latest close. Investor optimism is related to several positives highlighted by the management during the earnings call. This optimism was backed by the management’s reiteration of plans to continue investing in innovation, particularly in the company’s AI potential, and the intention to accelerate the launch of new models ahead of previous plans.

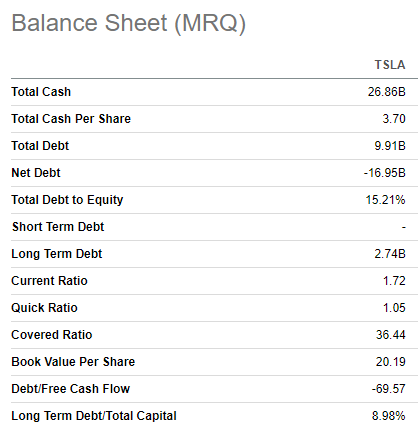

While new ventures and investments in innovation are inherently risky, Tesla’s $27 billion cash pile, together with almost no debt [compared to the company’s market cap], suggests that the company likely has sufficient financial resources to fuel its ambitious plans to ramp up and maintain a firm commitment to innovation.

Seeking Alpha

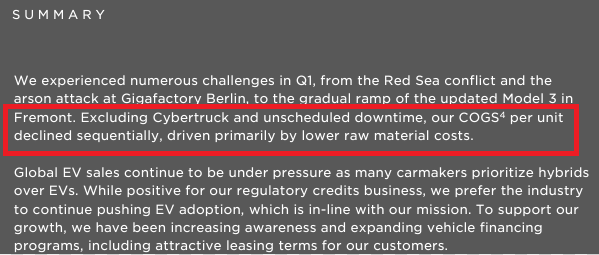

What was important to me is that during the earnings call, the management reiterated its strategic goal to launch low-cost vehicles. There are not many details about the timeline yet, but Elon Musk promised to reveal more details on August 8th. Despite the vague timing and lack of details, the most important thing to me is the fact that the management is committed to releasing a more affordable electric vehicle, or EV. I believe that offering the market a more affordable vehicle is achievable for Tesla because it consistently demonstrates improvements in cost per vehicle sold, including in Q4.

Tesla’s latest earnings presentation

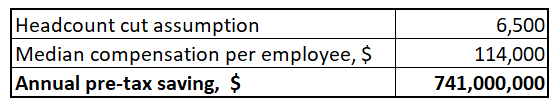

It also appears that a 10% headcount cut announced a couple of weeks ago is just a beginning. Recent news reports suggest that Tesla likely intends to lay off even more employees, which will also be beneficial to bring down cost per vehicle. According to Comparably, the median compensation per employee in Tesla is $114k. If we assume that Tesla ultimately cuts 6,500 jobs during the current round, it will mean $741 million in annual savings, excluding indirect employee costs.

Author’s calculations

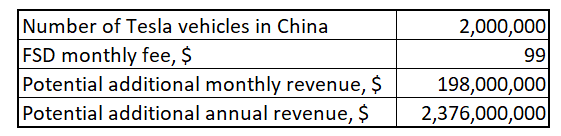

Another significant reason for the recent substantial optimism around Tesla is Elon Musk’s visit to China. We all know that China is a crucial market for Tesla, as one of the company’s first Gigafactories was opened in Shanghai in late 2019. Last September, Giga Shanghai celebrated its two millionth vehicle produced at this facility. With at least two million potential Tesla FSD (Full Self-Driving) users in China, receiving a tentative “green light” for the FSD option there last week is a major bullish sign. Having over two million potential FSD customers in China suggests that the company could potentially boost its annual revenue by $2.4 billion. Since most of the FSD costs are related to the research and development phase and are already incurred, I believe that the additional future FSD revenue will be highly profitable.

Author’s calculations

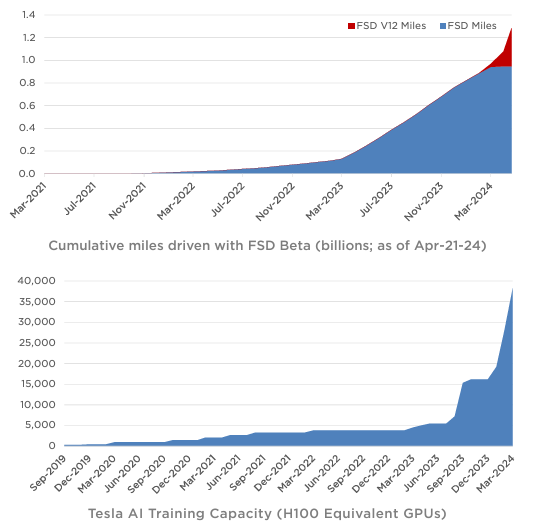

It is certain that not all two million Chinese Tesla owners will buy the FSD subscription, but we should not forget that Tesla Shanghai is ramping up. For example, in 2023, this facility delivered 947,000 vehicles. If this level of annual deliveries is sustained, Tesla’s Chinese customer base will grow multiple fold within the next five years. Therefore, I believe the market’s optimistic reaction to positive developments for the Chinese FSD segment was adequately absorbed. I am confident in FSD’s bright prospects in China because none of Tesla’s competitors have invested more in autonomous driving than Tesla. The FSD system has driven far more than 1 billion cumulative miles, and Tesla’s AI training capacity is growing exponentially.

Tesla’s latest earnings presentation

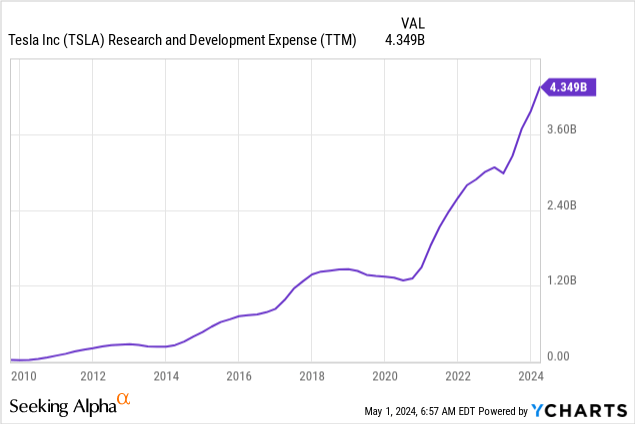

Despite facing challenges due to the harsh macroeconomic environment, as evidenced by the recent decline in revenue and EPS, Tesla continues to increase its R&D investments aggressively. This strategy will likely fortify the company’s position at the forefront of the technological revolution in the automotive industry. In addition to China, Tesla is expanding its FSD technology to Canada and aims to release FSD Beta in Europe by the end of 2024. This expansion also potentially increases revenue potential from FSD, especially considering that Tesla recently surpassed the 4 million cumulative sales milestone.

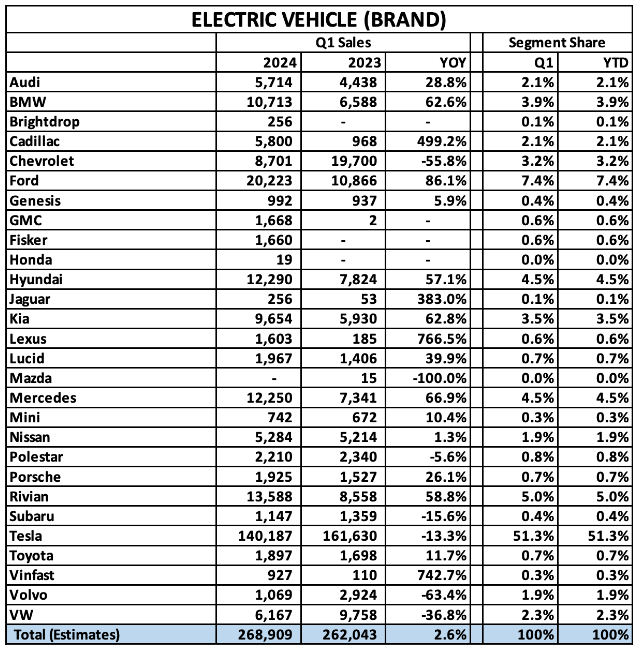

Let us also not forget that Tesla remains the undisputed leader in the domestic EV market. Tesla’s market share in the American EV industry still exceeds 50%, while Ford (F), its closest rival, had seven times fewer EV deliveries in Q1. With such a substantial lead over the second-largest EV manufacturer in the U.S., I anticipate Tesla will maintain its dominance in the U.S. EV space for several years to come. Furthermore, I believe the recent acceleration in Cybertruck production at Giga Texas will further solidify Tesla’s market leadership. Considering that pickup trucks have been America’s bestsellers for over four decades in a row, this move is strategically significant.

insideevs.com

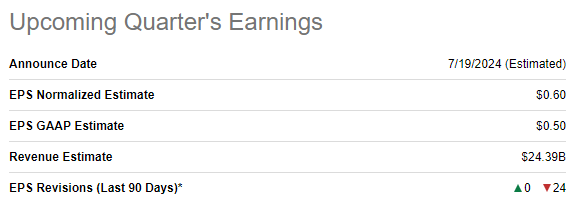

The next earnings release is scheduled for July 19, and Q2 revenue is expected by consensus to be $24.4 billion, approximately flat compared to the same period last year. However, temporary bottom-line challenges are expected to persist, as the adjusted EPS is projected to decline from $0.91 to $0.60. I consider the anticipated recovery in revenue dynamics compared to the decline in Q1 to be a positive sign for Tesla.

Seeking Alpha

Overall, the company faces challenges, but I view them as temporary rather than secular. As a long-term investor, it is crucial to me that Tesla’s position in the world’s largest economy remains intact and that the company continues to build its massive technological moat by investing heavily in FSD. This technology is also likely to expand internationally, further strengthening Tesla’s position compared to its global rivals.

Valuation update

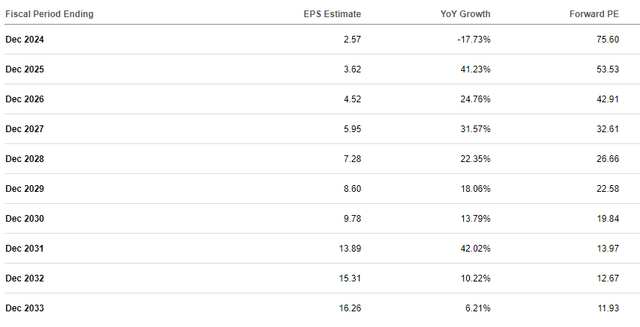

Tesla delivered a 13% share price growth over the last twelve months, lagging the broader U.S. market. However, 2024 is even worse for TSLA since the stock price declined by 26% YTD. Tesla’s valuation ratios are inherently high due to the company’s historical revenue growth rate and unmatched profitability in the automotive industry. However, I want to emphasize that due to the expected rapid EPS expansion, the P/E ratio is expected by consensus to drop below 30 in FY 2028 and below 20 in FY 2030. That said, I think that Tesla’s currently high valuation ratios are justified by the expected EPS expansion.

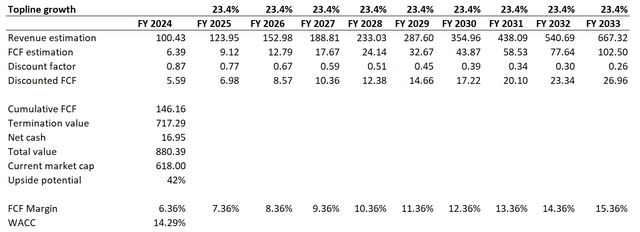

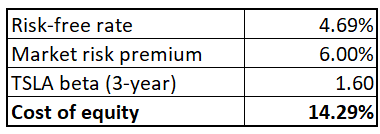

As usual, I am proceeding with the discounted cash flow [DCF] model. The range of WACC recommendations for TSLA from resources I usually rely on is wide, so I decided to calculate it by myself using the CAPM approach. I am ignoring the cost of debt for TSLA due to its extremely low leverage. I use the current 4.69% 10-year Treasuries yield (US10Y) as a risk-free rate, and use a 5.7% U.S. equity market risk premium and a 3-year TSLA beta of 1.6. As a result of high beta, the WACC is high at 14.3%. However, I am okay with this level given the current challenging environment and highly volatile stock’s performance in 2024.

Author’s calculations

Now, let me continue with the remaining DCF assumptions. For the base year, I rely on FY 2024 revenue consensus estimates and project a 23.4% revenue CAGR for the next decade. I expect the free cash flow [FCF] margin to expand by one percentage point yearly, which is a conservative assumption compared to the expected 23.4% revenue CAGR. For the base year, I take the last five years’ FCF margin average of 6.36%.

According to my DCF valuation, Tesla’s fair value of the business is $880 billion. This is around 42% higher than the current market cap. That said, my target price for Tesla is $260.

Risks update

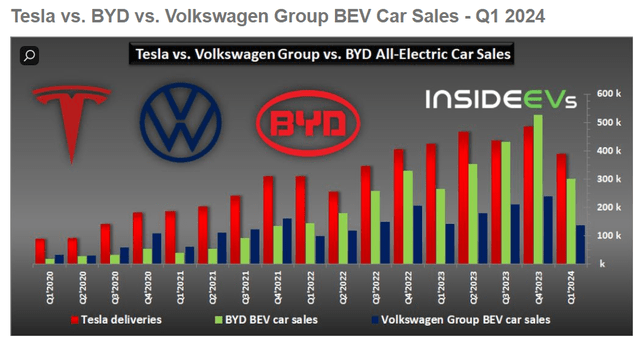

While Tesla continues to dominate in the U.S. market, I consider global competition to be the most significant risk for Tesla. Despite the vast long-term potential I see from the expected release of affordable EVs and FSD, I also have to admit that Tesla underperformed globally in Q1 compared to the entire global EV industry. Tesla delivered 386,810 vehicles in Q1 2024, which was 9% lower on a YoY basis. To provide context, BYD Company’s (OTCPK:BYDDF) EV sales were up 13% YoY in Q1, and Volkswagen (OTCPK:VWAGY) demonstrated a more modest, but still notable, 3% growth. Many other players also recorded good EV sales dynamics in Q1.

However, Tesla has regained its crown as the largest EV manufacturer by volume in Q1. Furthermore, Tesla’s decline can be partially attributed to the Model 3 update at the Fremont factory and production disruptions at Giga Berlin. Therefore, I consider the Q1 dip compared to competitors to be temporary rather than secular. I will closely monitor delivery numbers of competitors in Q2 and Q3, and if this unfavorable trend persists, I may begin to reconsider my bullish stance on Tesla’s long-term prospects.

While I have no doubt about Tesla’s dominance in the domestic EV market, there is a significant constraint for the entire automotive industry in the U.S. Approximately 80% of new car purchases in the U.S. are financed with some form of debt, and the Fed’s current tight monetary policy appears to be a constraint for the entire U.S. automotive industry. With inflation still running high in the U.S., there is a high level of uncertainty about the timing of monetary policy easing. Even JPMorgan Chase’s (JPM) iconic CEO has warned the market that U.S. interest rates could climb even higher. If this is the case, the American automotive industry will continue to face substantial macro headwinds.

Bottom line

To conclude, Tesla is still a “Strong Buy.” The company continues differentiating itself by constantly innovating, and it has all the resources to remain at the forefront of the emerging EV market. I consider all the challenges to be temporary and ease once the Fed’s pivots its monetary policy. Moreover, the valuation is very attractive with a 42% upside potential for TSLA.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.