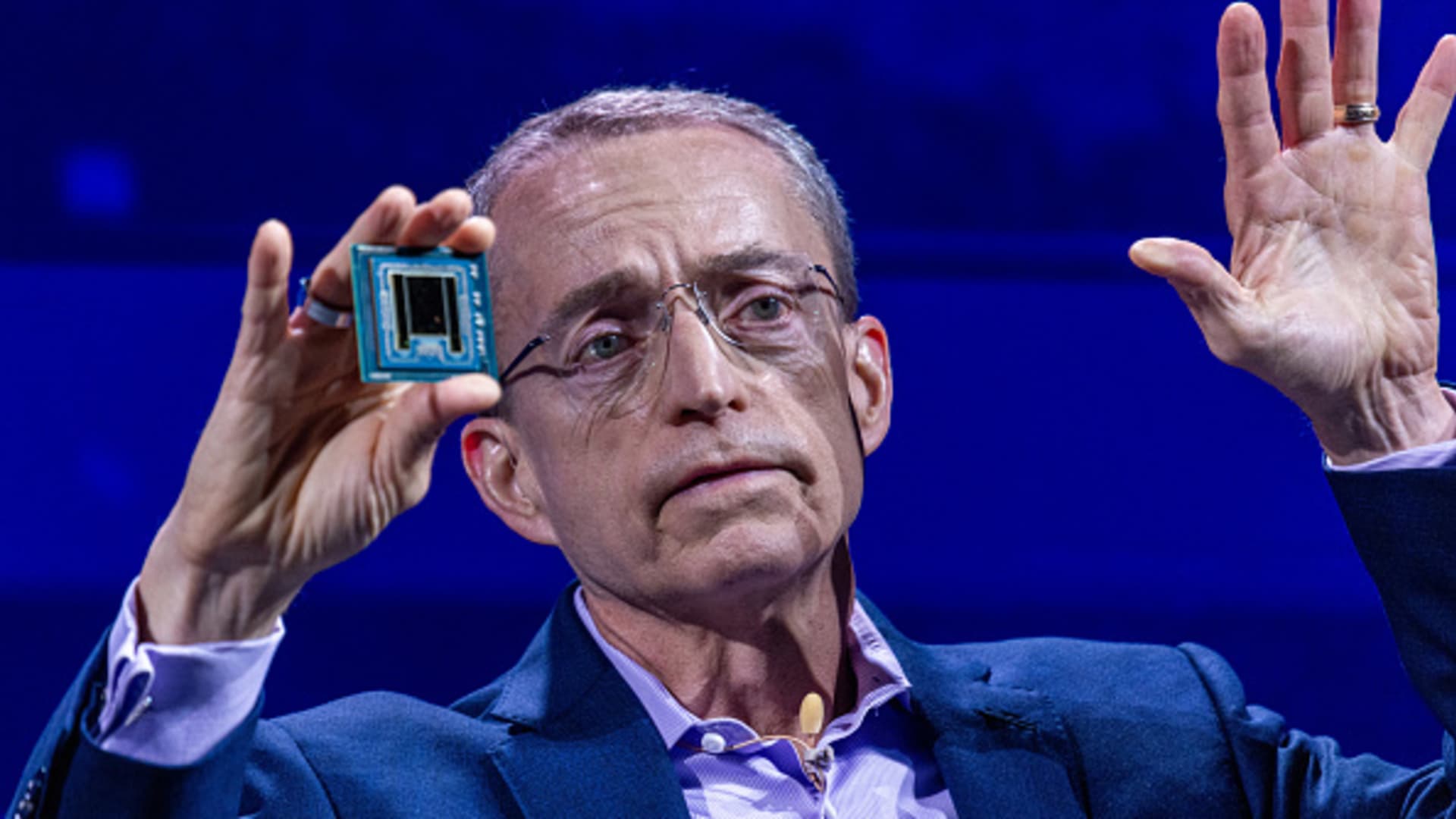

Intel CEO Pat Gelsinger holds an artificial intelligence processor as he speaks during the Computex conference in Taipei, Taiwan, on June 4, 2024.

Annabelle Chih | Bloomberg | Getty Images

Intel shares rose 7% in extended trading Thursday after the chipmaker reported better-than-expected earnings and issued quarterly guidance that topped estimates.

Here’s how the company did in comparison with LSEG consensus:

- Earnings per share: 17 cents adjusted vs. loss of 2 cents expected

- Revenue: $13.28 billion vs. $13.02 billion expected

Intel’s revenue declined 6% year over year in the fiscal third quarter, which ended Sept. 28, according to a statement. The company registered a net loss of $16.99 billion, or $3.88 per share, compared with net earnings of $310 million, or 7 cents per share, in the same quarter a year ago.

As part of a cost reduction plan, Intel recognized $2.8 billion in restructuring charges during the quarter. There was also $15.9 billion in impairment charges tied in part to accelerated depreciation for Intel 7 process node manufacturing assets and goodwill impairment in the Mobileye unit.

The company is carrying out one of the most seminal restructuring processes since its establishment in 1968, CEO Pat Gelsinger said on a conference call with analysts.

Intel said in a filing that on Oct. 28, the board’s audit and finance committee approved cost and capital reduction activities, including lowering head count by 16,500 employees and reducing its real estate footprint. The job cuts were originally announced in August. Restructuring should be done by the fourth quarter of 2025, Intel said.

The company has been mired in an extended slump due to market share losses in its core businesses and an inability to crack artificial intelligence. Intel revealed plans during the quarter to turn the company’s foundry business into an independent subsidiary, a move that would enable outside funding options.

CNBC reported that Intel had engaged advisors to defend itself against activist investors. In late September, news surfaced that Qualcomm reached out to Intel about a possible takeover.

The Client Computing Group that sells PC chips recorded $7.33 billion in fiscal third-quarter revenue, down about 7% from a year earlier and below the $7.39 billion consensus among analysts surveyed by StreetAccount.

Customers drew down their inventories in the quarter after dealing with supply shortages.

“We anticipate inventory normalization will continue through the first half of next year,” Dave Zinsner, Intel’s finance chief, said on the call.

Revenue from the Data Center and AI segment came to $3.35 billion, which was up about 9% and more than the $3.17 billion consensus from StreetAccount.

Intel called for fiscal fourth-quarter adjusted earnings of 12 cents per share and revenue between $13.3 billion and $14.3 billion. Analysts had expected 8 cents in adjusted earnings per share and $13.66 billion in revenue.

During the quarter, Intel announced the launch of Xeon 6 server processors and Gaudi AI accelerators. Uptake of Gaudi has been slower than Intel anticipated and the company will not reach its $500 million revenue target for 2024, Gelsinger said on the call.

As of Thursday’s close, Intel shares were down about 57% in 2024, while the S&P 500 had gained 20%.

WATCH: Qualcomm buying Intel would be a ‘horrible decision,’ says Harvest’s Paul Meeks