hapabapa

The stock of GE Aerospace (NYSE:GE) is on a wild upswing and received new fuel last week when the aerospace-focused industrial company beat the Street’s estimates easily and raised its forecast for operating profitability in 2024.

GE Aerospace profits from order strength from a buoyant airline industry, which is seeing record passengers after the Covid-era shutdown nearly obliterated the industry in 2020.

GE Aerospace is growing its sales and operating profits at double digits and though the stock is not cheap, the technical picture looks bullish and healthy. GE Aerospace also raised its dividend by 250% in April.

The valuation multiple has become a bit stretched, in my view, but taking into account that demand for engines is robust and profits are poised to grow in a growing economy, I maintain a Buy stock classification after 1Q.

My Rating History

I modified my stock classification for General Electric from Hold to Buy in January 2024, in response to the industrial conglomerate producing stellar fourth quarter results, driven by Aerospace.

In April, General Electric spun off its energy assets into GE Vernova and became GE Aerospace. The order situation for GE Aerospace looks very robust, and the macroeconomic backdrop is also favorable, with the airline industry seeing sustained momentum.

Taking into account that GE Aerospace raised its operating profit forecast for 2024 as well, I think there are plenty of reasons to anticipate further positive surprises from the company.

Strong Results For 1Q24 And Supportive Outlook

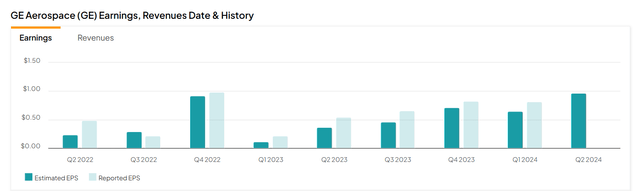

GE Aerospace reported profits of $0.82 per share for the first quarter last week, flying past the consensus Street estimate of $0.65 per share. Since the company’s financial results will now include only the Aerospace division moving forward, which is crushing it, I think that GE Aerospace has substantial profit estimate correction potential as well for the coming quarters.

Earnings And Revenue (Yahoo Finance)

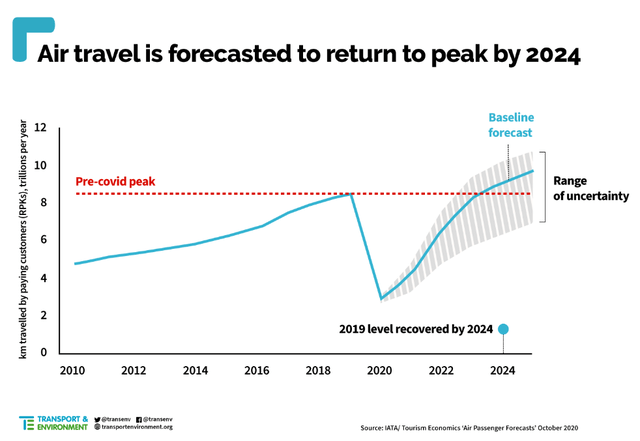

GE Aerospace is on fire because of a substantial turnaround in air travel after Covid-19 shut down the industry in 2020. The rebound in air travel passengers is leading to strong demand for aircraft as well as engines and after-market services, which provide very solid order, sales, and profit growth tailwinds for GE Aerospace.

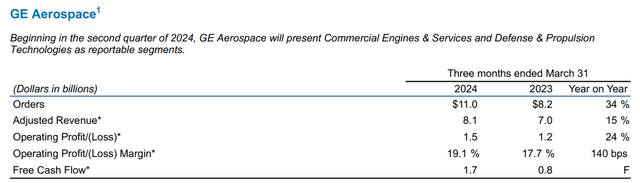

The demand situation is so strong that GE Aerospace saw a 34% YoY increase in orders in the first quarter, while operating profits skyrocketed 24% to $1.5 billion. The upswing in profitability amid persistent order strength is the primary reason why GE Aerospace raised its profit forecast for 2024.

Operating Profits (GE Aerospace)

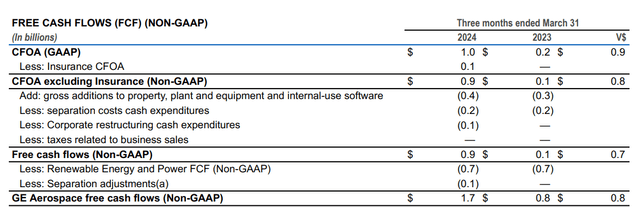

General Electric’s Aerospace division, being a standalone unit now, has room to shine in 2024, particularly because the division has substantial order momentum in both Commercial Engines & Services and Defense & Propulsion Technologies. The segment is solidly profitable, not only on an earnings basis, but also based on free cash flow. In 1Q24, GE Aerospace produced $1.7 billion in free cash flow, reflecting a $0.8 billion YoY improvement.

Free Cash Flows (GE Aerospace)

Based on projections made by Transport & Environment, the air travel industry is anticipated to exceed 2019 levels in terms of passenger volumes this year, which should provide compelling engine order and profit tailwinds for GE Aerospace.

What further supports the investment thesis for GE Aerospace is that the U.S. economy is in good shape and that the unemployment is low. I can even see a boost for GDP growth in 2024 if inflation moderates and frees up cash for consumers, which may funnel it into spending on leisure activities, such as travel.

Passenger Volume Forecast (Transportenvironment.org)

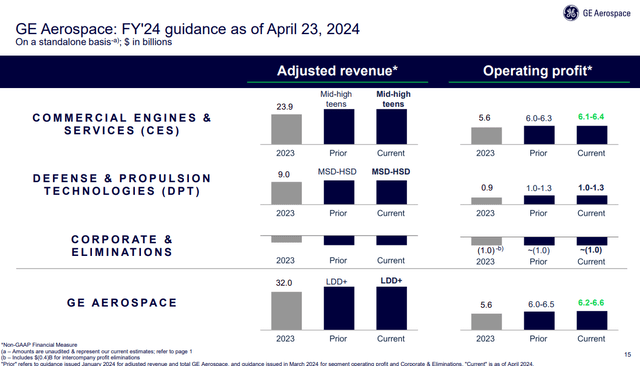

GE Aerospace Raised Guidance For 2024

GE Aerospace raised its outlook for profitability last week and now sees $6.2-6.6 billion in operating profit in 2024, up from $6.0-6.5 billion. The increase in the operating profit guidance is supported by strength in GE Aerospace’s orders, particularly in the Commercial Engines & Services segment.

FY 2024 Guidance (GE Aerospace)

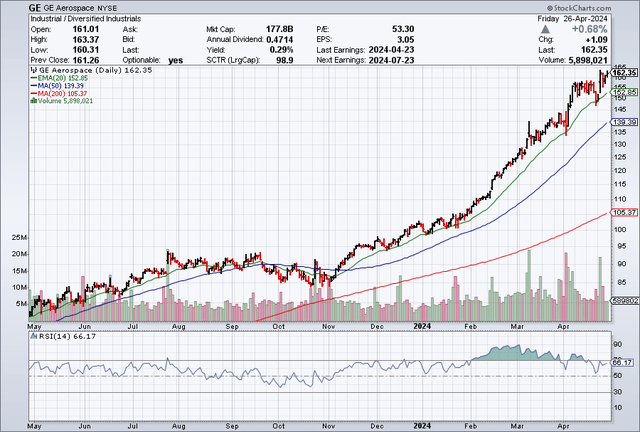

Technical Chart

GE Aerospace is presently neither overbought nor oversold based on the Relative Strength Index (with a RSI of 66.17) and the stock is in a solid up channel.

Since November, GE Aerospace has consistently been in an uptrend, remaining above both the 20-day and 50-day moving averages. From a technical angle, the chart picture is very healthy and bullish, and the raised outlook for GE Aerospace’s 2024 operating profit clearly supplied additional momentum for GE, as did the company’s announcement in April to hike its dividend by 250% to $0.28 per share per quarter. I would get worried here only if we saw a break of the 50-day moving average line, which presently runs at $139.39.

Relative Strength Index (Stockcharts.com)

GE Aerospace Is No Longer Cheap, But Retains Potential

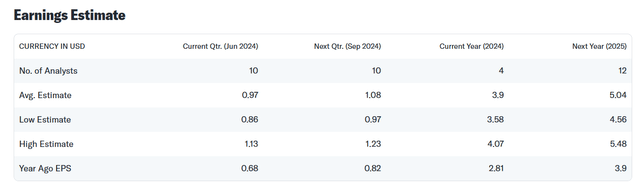

The market models $3.90 per share in profits for GE Aerospace, a figure that implies 39% YoY growth. Next year, GE Aerospace is anticipated to 29% YoY growth and earn $5.09 per share. I think these estimates are sensible when taking into account the company’s order strength, substantial support from the air travel industry and raised profit forecast.

Earnings Estimate (Yahoo Finance)

GE Aerospace is presently selling for an earnings multiple of 31x, which is clearly not a bargain. My previous stock price target for General Electric was $139.60, based on a stock multiple of 30x. This stock price target has been exceeded partially because General Electric is now a much more concentrated Aerospace investment and therefore deserving of a higher multiple.

I think a 35x multiple for GE Aerospace is not out of reach considering the very favorable industry tailwinds and that the company just raised its dividend generously. The implied stock price target thus is $180.

Honeywell Inc. (HON), which also has a sizable engine business, is selling for 18x leading (2025) profits, but Honeywell is still a conglomerate and has other segments to offset any potential weakness in Aerospace.

3M Inc. (MMM), with an earnings multiple of 10x, is still a steal, but 3M is also an industrial conglomerate with a deeper diversification profile and therefore also much less concentrated than GE Aerospace.

Why The Investment Thesis Might Not Play Out For Investors

Aerospace is unfortunately a very cyclical industry, meaning a downturn in air travel, possibly because of a recession, is a major risk for GE Aerospace. And now that General Electric spun off its healthcare and energy assets into separately traded public companies, GE Aerospace now longer has a diversified sales and profit mix, meaning it can no longer offset weak results in one segment with higher earnings in a better-performing one.

On the flip side, in a growing economy with strong fundamentals, GE Aerospace also has the potential for a higher earnings multiple as GE Power, for instance, is no longer a drag on the company’s performance metrics.

My Conclusion

GE Aerospace produced robust 1Q24 results, driven by strong demand for commercial aircraft engines and after-market services.

The Aerospace company also surprised the market with an upgrade in its operating profit forecast for 2024 that is underpinned by an ongoing recovery in the travel industry after Covid-19.

The recent 250% dividend increase makes GE Aerospace attractive for dividend investors as well.

I think that GE Aerospace’s multiple growth is justified and though the stock clearly is not as cheap as it was back in November 2024, I see re-rating potential as long as the Aerospace industry is on fire. Buy.