Justin Sullivan

Investment Thesis

Going into the event last week, the market had high expectations around the new iPhone 16 given this is one of the first AI-enabled devices that Apple Inc. (NASDAQ:AAPL) has ever launched.

I think the stock’s rally in the months leading up to the launch showed that investors are betting on a wave of upgrades this cycle, particularly given that a portion of the current installed base has not been upgraded in four years. Some analysts are bullish, projecting a “supercycle” that could break previous sales records, with an estimated 300 million users primed for upgrades.

What’s odd about this iPhone cycle is the division in opinions among investors and analysts. Some analysts (like Dan Ives) are bullish. However, not everyone has joined the hype and some are not convinced that this new AI phone cycle will be influential.

Herein lies the opportunity, in my opinion. A lot of news headlines tout the bullish forecasts. But I think it’s clear that the overall investor community is not nearly as net bullish. This represents a tranche of capital that could be unlocked and could buy Apple shares if they surprise to the upside.

Although Apple shares have slumped more recently heading into this long-awaited product launch last week, I still think they can exceed market expectations, and closely mirror the success seen with the iPhone 6 in 2014. Back then, the larger-screen iPhone 6 triggered a massive upgrade cycle, selling 74.5 million devices in just one quarter and successfully pushed Apple’s profits to record levels at the time. In fact, the iPhone 6 has still not been passed as the best-selling touchscreen smartphone lineup ever. That is until this latest iPhone came out.

This year’s launch has similarly high expectations, with UBS recently raising their price target for Apple to $236 because of the integration of advanced AI features, including Apple Intelligence, and other features like enhanced cameras, faster chips, and improved user experience will spur demand for the new devices.

I think that with a user base of over 1.32 billion iPhones, Apple will likely benefit from a strong upgrade even if just a fraction of these users opt to do so. With this, I think Apple is still positioned as a strong buy. Despite recent slower iPhone sales, the potential for another major upgrade cycle gives Apple an edge in the smartphone market over their competitors, all powered by AI.

Why I’m Doing Follow-Up Coverage

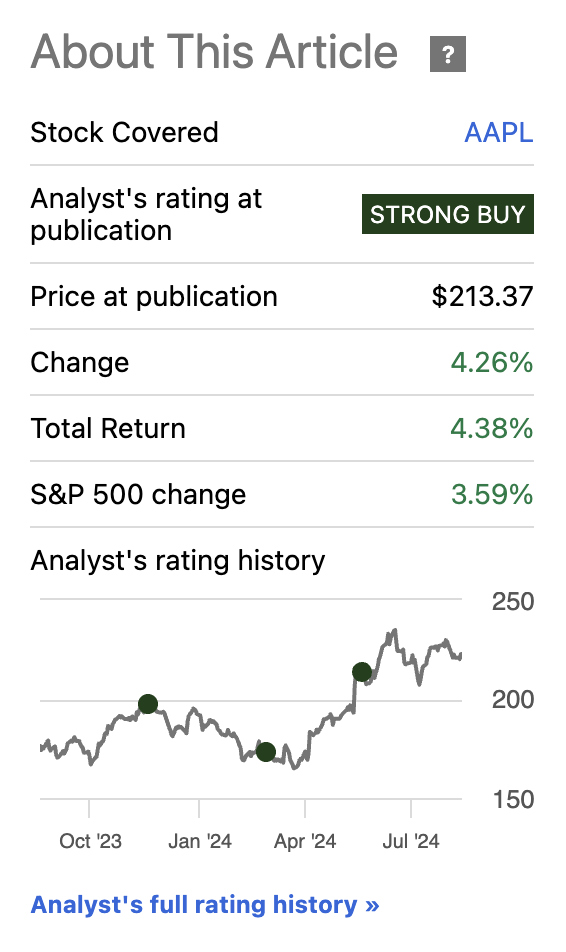

Apple’s shares have slightly beat the broader market, up by 4.38% since my last coverage in June, post-WWDC, where initial enthusiasm centered around the AI software updates that Apple is launching natively on their iPhone lineup.

Apple Stock Performance (Seeking Alpha)

So while expectations were high going into the event Monday and a lot of the new AI features were already known, the new iPhone 16 arguably surpassed many of those expectations since the device’s AI-powered capabilities, such as Apple Intelligence, go beyond incremental software upgrades and make the company capable of capturing strong demand across their large installed base.

Don’t get me wrong here, I know Apple is probably one of the most efficiently priced stocks on the street right now, given they’re one of the world’s largest companies.

But despite being one of the most closely monitored stocks on Wall Street, probably second only to NVIDIA Corporation (NVDA) in tech circles, the market actually appears to be inefficiently pricing Apple here because the investor community is so divided on this equity. As I mentioned above, UBS’s recent price target shows that the market has not fully priced in the potential impact of this launch. I think shares remain undervalued, even after a ton of publicity after the event.

With their strong AI integrations, consumer excitement for the new iPhone model, and the company’s user base that is ripe for an upgrade, the stock is positioned for further upside.

The purpose of me doing follow-up coverage is to show that because the investor base is so divided, investors have a unique opportunity.

What Made This Event So Big

Apple’s latest updates from their September 9th event refreshed a lot of their consumer lineup (across their iPhone, AirPods, and Apple Watch product lines).

I think what’s telling here is that while the innovations are incremental, they’re also valuable at the same time, and show Apple’s durable innovation pipeline with the iPhone lineup now entering its 17th year as a product line.

The iPhone 16, which is powered by the A18 Pro chip, is designed for enhanced AI tasks such as personalized recommendations and improved camera performance. The company also claims that the device’s ultra-wide camera captures 2.6 times more light, which is ideal for low-light photography, while the new “Fusion Camera” feature allows for more granular control over photo settings.

Along with the new iPhone, the Apple Watch Series 10 got a strong series of upgrades with a larger OLED display for more screen space, and advanced health monitoring features, including sleep apnea detection and heart rate monitoring. The device is also thinner by 10% for better wearability.

The AirPods 4 now feature personalized spatial audio and adaptive noise cancellation, powered by the H2 chip. These features allow the device to adjust to environmental noise and conversation settings in real-time which, I think, is a huge upgrade for Apple.

I, personally, call a lot of people that talk to me through their AirPods. I find the current AirPods excellent at capturing background noise (from simple wind noises outside to the sounds of cooking when they are in their kitchen). As a listener, I find this painful. These new AirPods solve for this.

Beyond this, the AirPods Pro 2 introduces hearing aid functionalities, which have already impacted the hearing aid market by offering a more affordable, over-the-counter solution for users with mild to moderate hearing loss. They recently became FDA-approved which is a huge milestone for Apple.

The AirPods Pro update is projected to disrupt the $13 billion hearing aid market, with its added capacity to serve as an over-the-counter hearing aid for users with mild to moderate hearing loss. This feature alone can increase accessibility to hearing support, helping to normalize hearing aids by blending them into everyday consumer tech.

Apple Has The Right Incentives

I believe Apple’s strong AI integrations on the iPhone 16 will drive a suite of AI-powered software tools into consumers’ pockets that will help the company generate increased recurring revenue from these services to support their market leadership beyond hardware. The new AI features on the iPhone are more than just the hardware. It’s about Apple growing their software business.

This leads me to one of the biggest (and I think under-discussed) footnotes from the Apple Event.

Apple is offering a powerful iPhone trade-in program that, I think, is key to driving the upgrade cycle for the iPhone 16.

U.S. customers trading in an iPhone 12 or newer can receive up to $1,000 in credit towards a new iPhone 16 Pro when purchased through major carriers like Verizon, AT&T, or T-Mobile – a move to encourage more consumers to adopt the latest hardware while Apple continues to upsell through their expanding ecosystem of apps and services. Keep in mind that the new iPhones are in the $799-$999 range. This could mean that some consumers pay net-zero out of pocket for a new iPhone.

Who wouldn’t want to take this offer?

In essence, I think the upgrade costs are going to be very low for many consumers. This is big.

I think Apple is planning to hook consumers with a new AI-enabled iPhone, but then upsell new AI features on their iPhones, especially with the introduction of Apple Intelligence during WWDC this year. Keep in mind that Apple makes up to 30% commission on in-app sales from apps listed in the Apple app store. Any new AI app in the App Store that consumers pay for (only because they have the new iPhone which was almost zero out of pocket) has to give up to 30% of their revenue to Apple.

Valuation

To be clear, Apple shares right now are not a buy when we compare their P/E to the sector median P/E. After all, Apple’s forward P/E ratio of 33.27 remains higher than the sector median of 23.53, a 41.40% premium.

But Apple is no ordinary company (no sector median company), and I think they deserve to trade at a premium. The question is how much.

Apple’s management is an excellent capital allocator with the company sporting a return on equity (ROE) of 160.58%, which outpaces the sector’s 4.65% by a whopping 3,353.03%. Even though Apple is one of the world’s largest companies, it continues to find places where a single dollar of equity at the beginning of the year yields roughly $1.60 in additional returns by year-end. That’s incredible.

As the company dives deeper into AI with their product launches this past week, I think their consumer-facing focus will help them actually do well in capitalizing on AI’s potential in the long term.

Analysts are currently projecting 9.11% YoY EPS growth for the fiscal year ending this month (September 2024), and 10.83% for the year after (FY 2025).

I think these estimates may be conservative, even though the company is one of the largest by revenue, and it’s hard to grow significantly at such a scale. The increasing role of software revenue in Apple’s business model, particularly the upselling of AI-driven services, enhance margins and cause better-than-expected EPS growth. As I mentioned before, the investor community is highly polarized right now on this Apple launch. I think when the results start to come in from this AI-driven strategy, many investors will be surprised.

I think Apple should be trading closer to a 50% premium to the sector median forward P/E to represent their unique business model that combines hardware and now AI software revenue. They are figuring out how to monetize AI for consumers. A 50% premium to the sector median would represent roughly 6% upside from here in shares not including dividends, and the powerful buyback programs that Apple has in place. A 6% upside is my conservative estimate, but I think there is room for a lot of variance to the upside.

Risks

Ironically, I think the biggest risk to this thesis playing out is not actually within the company, but actually from one of their largest shareholders.

Warren Buffett’s recent sales of Apple stock puts a lot of pressure on shares as the market absorbs the supply, and psychological pressure on the iPhone giant since Warren Buffett has proclaimed previously that his favorite holding period is ‘forever.’ The Oracle of Omaha, known for his long-term investing approach, has been systematically reducing his holdings in Apple and other stocks over the last several quarters. When Buffett starts selling, it often signals his belief that future performance may not justify holding such a large position. This case may be the exception, however.

Buffett acknowledged these sales at the Berkshire Hathaway investor conference earlier this year, which it appears was largely driven by tax considerations rather than a bearish outlook on Apple itself. I believe he is aiming to capitalize on historically low corporate tax rates to realize gains on the highly appreciated stock.

In essence, selling from Buffett is often a psychological and financial strain on a company’s investor base. This may be a rare exception. I think the fundamental performance of Apple here will outweigh the sales.

Bottom Line

Apple’s focus on AI software services, using the latest iPhone as a high-margin product to drive consumer software spending, offers a unique market edge, and helps solve the division in the investor community surrounding the release of this product. The company’s ability to upsell through their ecosystem, along with their extremely strong trade-in program, supports strong consumer demand.

I still expect the iPhone 16 launch to trigger an upgrade cycle, driven by AI-enabled features like Apple Intelligence and a trade-in program that sweetens the offer. With an estimated 300 million users primed for upgrades, this rollout could replicate the success of the iPhone 6 a decade ago. With this, I think shares are still a strong buy with a direct path to some upside in the near term, and the potential for much more over the long run.