PM Images

Apple Inc. (NASDAQ:AAPL) held its iPhone 16 launch event earlier this week, debuting iPhone 16 Pro and iPhone 16 Pro Max alongside other new products, including the new AirPods and Apple Watch Series 10. The event received a less than enthusiastic reaction from customers and the market alike and a more provocative one from Huawei, which unveiled its Huawei Mate XT Tri-fold smartphone the same week. We maintain a positive outlook on Apple for 2025 despite concerns about negative impactions from Huawei’s comeback and muted smartphone end demand. Our upgrade note on Apple from early July is based on two factors that remain largely at play for the stock: 1. The market has recognized the muted smartphone demand and intensified competition on the Chinese front, and 2. better positioning to reverse its lackluster iPhone sales with Apple Intelligence. We’re unpacking our sentiment on Apple in more detail in light of the iPhone event and Huawei release.

Here’s our breakdown of both factors:

1. The market has recognized the muted smartphone demand and intensified competition on the Chinese front:

The muted smartphone demand remains largely digested by the market, in our opinion. Having said this, there are hopes for a better iPhone replacement cycle this time around after Apple told the production supply chain to prepare for 90M units, a 10% increase from the production set for the iPhone 15 series. This news caused semis exposed to Apple, like Qorvo, Inc. (QRVO), Skyworks Solutions, Inc. (SWKS), and QUALCOMM Incorporated (QCOM), to trade slightly higher in late August. We think the market is more optimistic about smartphone end demand now than it was prior to Apple’s third quarter earnings, in which Apple outperformed on better-than-feared iPhone sales, dropping 0.9% better than the expected 2.2%. Additionally, we’re seeing more iPhone discounts, mentioned on the Q3 earnings call, explaining the better unit volume data points coming through, and the optimism generated by that. We think Apple should be able to outperform expectations in the December quarter not on real-end demand recovery but on a better iPhone replacement cycle compared to the iPhone 15 lineup due to the added Apple Intelligence feature.

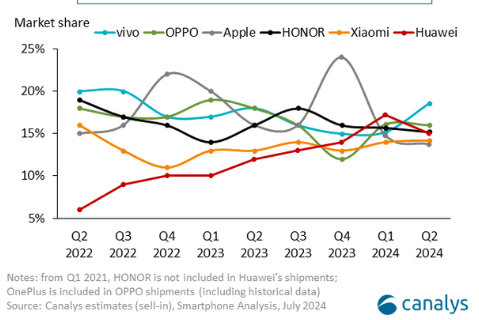

We think the concern over intensified competition on the Chinese front has also been recognized by the market but continues to be a headwind for the stock. Huawei’s launch of the world’s first tri-fold smartphone design that, when fully unfolded, measures 10.2 inches diagonally, showcasing Huawei’s potential ability to out-innovate Apple. News of Huawei’s release and the already pre-ordered +3.5M units became more concerning in light of Apple’s existing struggles on the Chinese front. The stock didn’t react substantially, showcasing the priced in competition risk. The company also reported a decrease of 6.5% Y/Y for the whole of Greater China in 3Q24 and didn’t make it to the top five smartphone vendors for the Mainland China smartphone market in 2Q24, which marked the first historical quarter in which domestic players dominated the top five vendor positions in the market, as shown below.

Canalys

In the large picture, we don’t think Apple is going anywhere, even with Huawei’s seemingly impenetrable all-internally sourced comeback and China’s national efforts in tech. The reason we’re not too concerned has a lot to do with price. We expect Apple to dominate the mid-to-high-end smartphone market, with Huawei potentially dominating the high-end market given the latest product price tag, which stands at almost 4x Apple’s iPhone 16 starting price, at $799. Additionally, we remind investors that Apple hasn’t built a single device; it’s built an ecosystem. Apple services’ business segment remained the company’s fastest-growing segment in Q3 and is expected to see double-digit Y/Y growth next quarter. We think Apple Intelligence will play a visible role in enhancing Apple’s service revenue in FY25.

2. Better positioning to reverse its lackluster iPhone sales with Apple Intelligence:

This takes us to the second factor: Apple Intelligence acting as a catalyst for the iPhone replacement/upgrade cycle. The iPhone 16 series is powered by the A18 chip and the A18 Pro chip based on Taiwan Semiconductor Manufacturing Company Limited’s (TSM) second-gen 3 nm tech that’ll provide “twice as fast as previous chips for machine learning,” 17% more system memory bandwidth, and the new-5 core GPU in the A18 chip provides “up to 40 percent faster than the GPU used in the A16 Bionic (used in the iPhone 15)” using 35% less power. It was discussed on the earnings call that the iPhone 15 performed better than the iPhone 14 in terms of iPhone replacement cycles. CEO Tim Cook noted in the Q&A that “if you look at the same number of weeks of the 15 from launch and compare that to the 14, the 15 is doing better than the 14. And so that’s a state of where we currently are.” We think this sentiment can be extended into the iPhone 16 series, and we could see a healthier-than-expected refresh cycle on potential pent-up demand and discounting, providing affordable premium devices. We were watching for the pricing of the iPhone 16 relative to the iPhone 15, and we think the fact there was no change in starting price there also does well to show Apple’s advantage and ability to play on pricing.

Valuation and Word on Wall Street

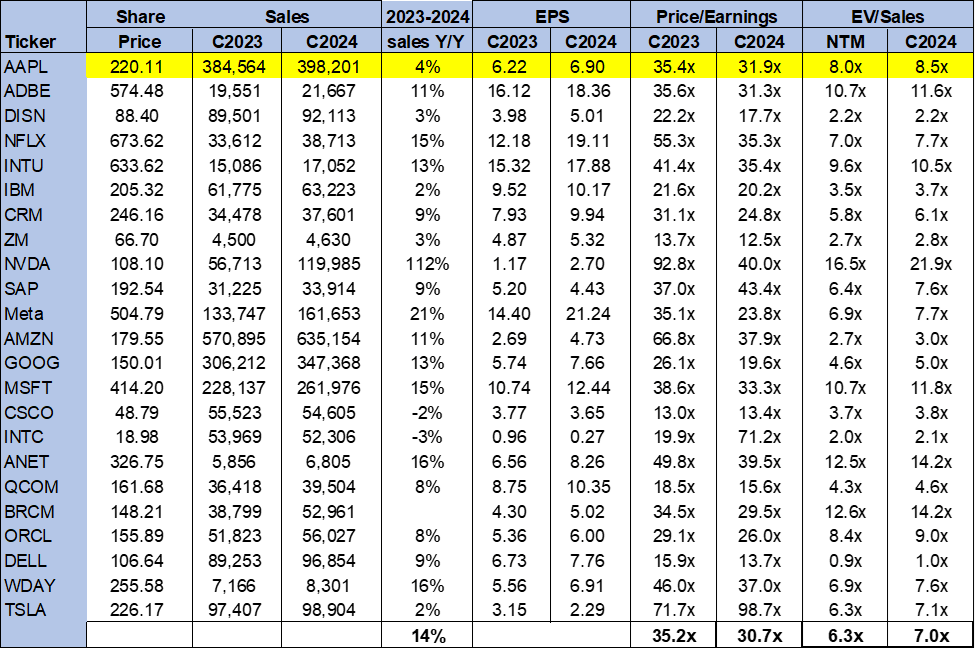

Apple stock is still trading slightly above its large-cap peer group average. On a P/E basis, the stock is trading at around 31.9x C2024 compared to a peer group average of 30.7x and not too far from its ratio of 31.5 when we upgraded back in early July. The stock is trading at 8.5x EV/C2024 Sales vs. the peer group average of 7.0x and its ratio of 8.4 in July. We continue to believe Apple is fairly valued considering that the iPhone remains the gold standard for smartphones and Apple, with a market cap of $3.38B, is the largest company by market cap. The following chart outlines Apple’s valuation against the peer group average.

TechStockPros

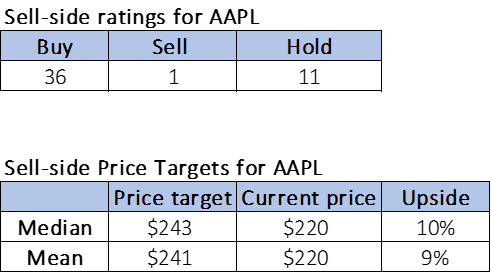

Wall Street remains more bullish on the stock. Of the 48 analysts covering the stock, 36 are buy-rated, 11 are hold-rated, and the remaining one is sell-rated. Sell-side price targets expect a potential upside of 9% to 10% for the stock, with a median price target of $243 and a mean of $241. The following charts outline Apple’s sell-side ratings and price targets.

TechStockPros

What to do with the stock?

We maintain our positive sentiment on Apple into the December quarter. While the Chinese competition headwind continues to weigh on sales in China, we’re more optimistic about Apple’s standing in the mid-end market with Apple Intelligence and discounting until end demand recovers. We also think that the discounting should cause some hurt to the Android market, Samsung in particular. This is notable considering Samsung dethroned Apple back in 1Q24 as the top phone maker. We expect Apple to take back the title from Samsung in 2025. We’re watching to determine the added value Apple Intelligence will bring to the consumer experience. We think it’s still too early to define its success. However, we believe in the ability of a solid refresh cycle even ahead of that being determined. We expect Apple to be a solid outperformer next year.