Nodokthr

Introduction

We are back with another Apple (NASDAQ:AAPL) event. This was great timing for this follow-up article that I wanted to publish anyway, as I aim to publish follow-up coverages every quarter.

It is getting more and more difficult to be surprised at these events. My reactions to supposedly big announcements have been limited, and this is what I have observed from people around me. I acknowledge the fact that the loyal customer base might get more excited, but this article will evaluate these announcements from a perspective that incorporates the future of the business and the stock price.

While Apple already has a significant competitive advantage in the mobile phone space, I am unsure if it will be able to turn AI (artificial intelligence or Apple Intelligence; however, you like to read this) into an advantage over its peers. The new features, the Apple ecosystem has, are easily replicable by its competitors.

Therefore, I struggle to see a “replacement cycle” as some people are suggesting. With that in mind, and concluding that the stock price is fairly valued, I reiterate my “Hold” rating on Apple. I think there are better opportunities in the market.

Business Description

This description will be even shorter than last time. People are aware of what Apple does and how it earns money. However, I would like to highlight a couple of interesting details.

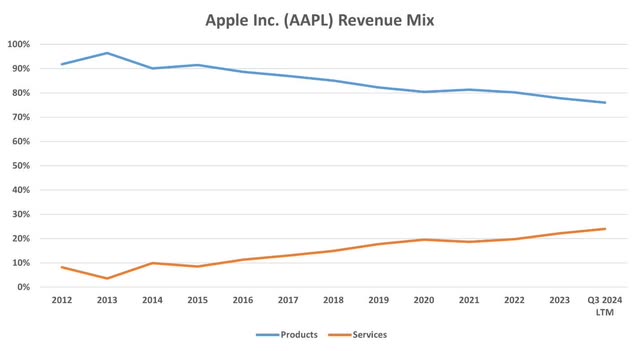

iPhone sales made up more than half of Apple’s total revenue in 2023. That’s why these big events where they introduce newer models are crucial for the business. 26% of revenue was from other products including Mac, iPad, wearables, and home and accessories, while the remaining 22% was services including Apple Store, Apple TV, Apple Pay, and more.

This is where I want to remind readers that Apple has been transitioning from a product-focused company to a services-focused one. The services mentioned above are significantly more profitable. To be exact, the gross margin on services was 74% in Q3 2024 LTM, compared to 37% for products in the same period. This transition makes the company more profitable overall and may even extend its lifetime as it diversifies its offerings.

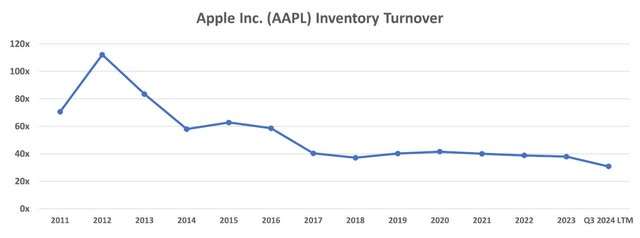

However, it’s not only the gross margin we need to look at. As the business grew, Apple started producing significantly more products than it sells. Although it has an immense cash position, this was a poor capital allocation decision by the company, leading to a significant decline in inventory turnover and ROA.

This cash could have been used better if it had been directly distributed to shareholders.

Naturally, the market changes and Apple has a lot more competitors now than it did back in the early 2000s. Although the company kept its margins high due to a strong brand image, that may have led to a decline in inventory turnover.

The company’s investments in AI have the potential to reverse this trend if it leads to higher sales and a better replacement cycle, as people have been discussing. However, it is uncertain whether this is happening.

Apple Introduces iPhone 16 And New Gen Products

Apple’s September event was highly anticipated after the WWDC 2024. The company introduced many new features for the new Apple Watch and AirPods, including the hearing health capabilities of AirPods Pro, turning the product into a “clinical-grade hearing aid”. While the Apple Watch and AirPods had some nice updates, I want to focus on the iPhone, as it is by far Apple’s largest product.

iPhone 16 and iPhone 16 Plus will be available on September 20, with pre-orders beginning on September 13. So, we’ll see how strong the demand is just in two days from the time of this article. Apart from the aesthetic updates, which have become traditional, the phone comes with a slightly improved battery life, a new Camera Control button, new lenses, and more importantly, “Apple Intelligence at its core”.

I didn’t notice anything significantly new with Apple Intelligence compared to what the company already announced at the WWDC 2024. It includes smart writing tools, text-to-emoji capabilities, and the ability to use your entire Apple identity to answer personal questions. Visual intelligence seems a bit more advanced.

To summarize, it is a great-looking phone with good features that people might want to use in their daily lives, like every other iPhone ever introduced… That is why Wall Street’s reaction to it was also “largely as expected“.

Don’t get me wrong, I do believe these are great products. However, we need something extraordinary that would push up earnings beyond the expected levels to get excited. Some argue that Apple Intelligence is that extraordinary development, which we will discuss in the next section.

The Future Of AI Is Uncertain

In my last Apple article, I touched on the issue of monetizing artificial intelligence. Many companies investing in AI and introducing new features are struggling to monetize it separately. These new features are mostly included in what the company has already been offering to customers. Although companies claim AI will increase the demand for their offerings, that remains a tough bet.

Apple Intelligence is integrated into IOS 18. Any Apple device with this operating system has access to it. Although new products are more expensive, the price premium is similar to what the company typically charges when introducing new products. It doesn’t seem to have a premium specifically for the AI tools it includes. The starting price for iPhone 16 will be $799.

This means that Apple counts on acquiring new customers and the replacement cycle, which is Apple users replacing their old phones with iPhone 16 to be able to use new features. I believe the new features are great, but I also believe they are easily replicable by Apple’s competitors. These features will no longer be unique within a year, maybe even in 6 months.

AI features have become a requirement to maintain sales, but not a way to increase earnings significantly more than historical growth rates. AI is the new normal. That is why I am skeptical that iPhone 16 will lead to a strong replacement cycle. With price points not leading to significantly higher margins, I believe earnings will not be as high as the expectations implied by the stock price.

Valuation

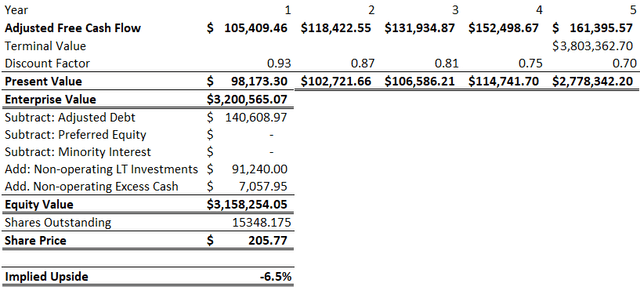

The following DCF model follows the same assumptions as the one in my previous article. Please refer to that for a more detailed explanation of my calculation methods.

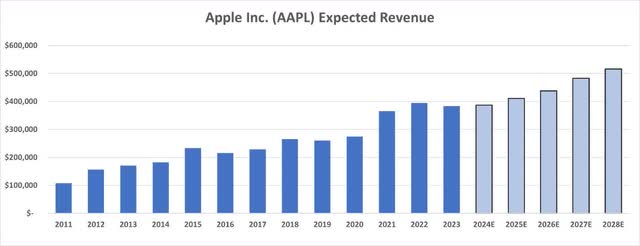

Although I may be painting a negative picture with my growth analysis above, I still think Apple is one of the highest-quality companies that will keep growing at a steady rate. It has a loyal user base and can pass on increased costs to its customers easily. That’s why I expect revenue to keep increasing strongly.

In addition to the revenue growth assumptions, I assume the company will be able to maintain its margins.

Using these assumptions, I find an equity value of $3.16 trillion, which translates to a target share price of $206. This presents a 6.5% downside scenario over the current share price at the time of this article’s writing, suggesting that the stock is fairly priced.

Conclusion

Apple is a company I would like to own if it was inexpensive. I don’t believe that the company will see sustainable higher growth rates compared to its history. However, even without that excess growth, Apple is an incredibly high-quality company. I think it will keep growing.

However, I think the stock is fairly valued, and there are more catalysts for the downside than for the upside. The venture into AI was necessary to maintain its competitive advantage, but it will not necessarily increase earnings more than the historical growth average, which is what the market has been betting on. Like many other companies, Apple is likely to struggle to monetize its AI offerings.

After an “okay” event, Apple stock remains fairly priced. That is why I reiterate my “Hold” rating. I think the market presents better opportunities for equity investors.