Pgiam/iStock via Getty Images

We argued in a previous article that Tesla, Inc. (NASDAQ:TSLA) is facing multiple headwinds like electric vehicle (“EV”) market growth decelerating sharply or even contracting, at the same time as a wave of cheap Chinese competition arrives, resulting in price competition and lower sales. Indeed, the Q1 results confirmed this bleak picture:

Yet, the stock was up 10%+ after earnings. Since we also promised in our last article that we would look at some things that Tesla still has going for it, this seems an opportune time to do that.

Cheaper models

As we argued in our previous article, most of the demand is in the low end, where Tesla has no presence. The cheapest version of the Model 3 is $39K, while Chinese competitors can bring cars on the market selling for $10K (albeit not in the U.S.).

Hence, the ambition of Tesla to bring a cheaper model to the market, the Model 2 aka Redwood, which was supposed to sell for about $25K. We didn’t hear anything specific on the Model 2 on the CC, but we did hear this (Q1CC, our emphasis):

I think we – Elon mentioned it in the opening remarks. But as you mentioned, we’re updating our future vehicle lineup to accelerate the launch of our low-cost vehicles in a more CapEx efficient way. That’s our mission to get the most affordable cars to customers as fast as possible. These new vehicles we built on our existing lines and open capacity, and that’s a major shift to utilize all our capacity with marginal CapEx before we go spend high CapEx to do anything.

We have emphasized the company using existing production lines (where excess capacity is materializing due to the demand slowdown) because it implies that Tesla isn’t making a more fundamental shift in production lines which go under the banner of the “unboxed” manufacturing process, which is supposed to be as revolutionary as Ford’s assembly lines.

The unboxed process involves breaking the car into subassemblies and producing these concurrently, see an animation here:

Moravy says this “unboxed” method of building a car can reduce costs “as much as 50%” and allow vehicles to be built in factories with 40% smaller footprints.

So while the market was jubilant about cheaper models coming sooner (the company could perhaps even start production by the end of the year), but given the use of traditional assembly lines, they are unlikely to lead to a car that can be sold for $25K.

It remains very much to be seen how much cheaper these new models will be compared to the cheapest existing Model 3. Most of the cost reductions will have to come from the car itself (that is, lesser features) rather than the production process.

The latter has some room as the industry slump is creating excess capacity at suppliers, so costs are falling, but this holds for Tesla’s competitors as well, indeed (Q1CC):

Excluding the impact of Cybertruck, the impact of pricing actions was largely offset by reductions in per unit costs and the recognition of revenue from Autopark feature

So it’s gradualism rather than revolution, and we think that the effects of price reductions (25% before another recent price cut) have shown that this isn’t really giving much bang for the buck, so we think that investor enthusiasm is overdone here.

Long-range Model Y

One of the cheaper models seems to already moving forward as Tesla is introducing a cheaper Model Y in Europe with an extended reach (600km or 373 miles) with the lowest cost per kilometer in the electric SUV market (14.9kWh/100km). The cheapest version is EUR 49K.

Tesla Semi

Perennially running behind schedule (only 70 were built in October 2023 with most for internal use and just one customer). Production was supposed to move to the gigafactory in Reno, Nevada, but construction of that has only just begun.

So despite finding another customer who seems satisfied with the Semi (but bought only two of these), this isn’t going to pull Tesla out of the slump anytime soon.

Tesla Cybertruck

While CEO Elon Musk expects 250K sales in 2025 (probably helped by a cheaper $70K version that is scheduled to appear next year), the Cybertruck isn’t exactly off to a flying start as was revealed in a recall in April 2024:

The 3,878 Cybertrucks covered by the recall represent all of the vehicle deliveries completed by the company since the rollout of the long-awaited truck in late November.

Painful in a double sense, as the recall itself is not good for the brand, but the low sales figures are a far cry from the stated expectations. Production is increasing though, from the Q1CC:

4680 production increased about 18% to 20% from Q4 reaching greater than 1K a week for Cybertruck

It’s early days, though it’s not impossible to get to 250K sales by the end of 2025, we’ll just have to wait and see.

Services

Services are already an important revenue source for Tesla in their own right and a category of revenues that are still growing, increasing 37% y/y to $8.3B in 2023 and still growing 25% y/y in Q1/24 to $2.29B.

However, services also offer a way to get cheaper entry-level models, simply by offering bare-bones services (infotainment, heated seats, etc.) and offer these on a subscription basis.

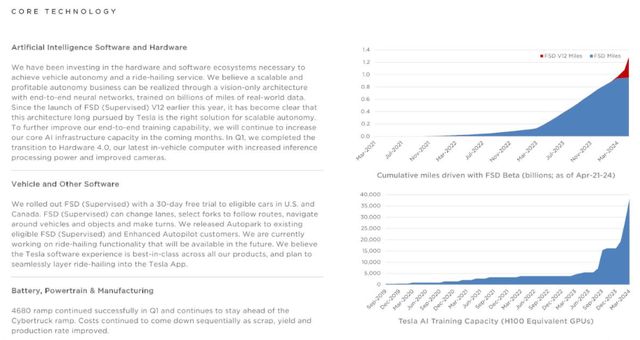

FSD

The most promising part of the services is FSD, Tesla’s Full Self-Driving software. Tesla recently lowered the one-time purchase price of FSD from $12K to $8K in the U.S. and the monthly subscription price from $199 to $99 per month.

Tesla’s Full Self-Driving software has the potential to revolutionize driving as it could lead to full (level 5) autonomy, opening up whole new business models, which were compared to Airbnb and Uber on the Q1CC.

This is probably its best bet to turn things around, as Tesla has a huge data advantage with millions of cars driving around gathering billions of miles of data that serves as input for training its FSD. This creates a flywheel effect (Q1CC):

So we have this like constant feedback loop of issues, fixes, evaluations and then rinse and repeat. And especially with the new V12 architecture, all of this is automatically improving without requiring much engineering interventions in the sense that engineers don’t have to be creative in like how they code the algorithms. It’s mostly learning on its own based on data.

Several business models can be based on this:

- Licensing FSD

- Robotaxi

- Fleet operation

- Excess inference capacity.

Tesla is already in talks with another Tier 1 car company interested in licensing FSD, so this is the most imminent monetization avenue, although still likely to be years off, by management’s admission (Q1CC):

I think we have a good chance we do sign a deal this year, maybe more than one. But yes, it would be probably three years before it’s integrated with a car.

Integration should be fairly simple (Q1CC):

it is obvious that our solution with a relatively low-cost inference computer and standard cameras can achieve self-driving. No LiDARs, no radars, no ultrasonic nothing… So it really just be a case of having them use the same cameras and inference computer and licensing our software.

Tesla has taken quite a different technological route with FSD compared to others, but its data advantage could very well make up for the lack of LIDAR (or radar). But there are still quite a few kinks to be ironed out.

Robotaxi

Early August this year, the company will unveil a robotaxi, designed from the ground up without any pedals or steering wheel for driverless ride-sharing with a compact two-door, two-seat layout.

But it’s unclear when it will hit the road in a revenue-generating capacity, as there are some hurdles to overcome:

- Regulatory hurdles; Federal safety standards even prohibit its production, let alone its use on the road, but that could change in September, although it could launch in Texas, where rules are less strict.

- Production hurdles, the robotaxi was supposed to share a common platform with the $25K Model 2 and use the new unboxed production method, both seem to have been put on the back burner.

We’ll have to see, this is a bit of a wild card. How fast are regulations going to change, how fast can Tesla get it on the road in significant numbers, will there be serious teething problems when it does, will this concept catch on? We don’t have the answers, but if history is any guide, these things always take longer than expected/hoped.

If it does catch on, it will be a viable step towards Tesla’s Airbnb future business model where car owners can rent their cars out on Tesla’s platform and make a bit of money (and Tesla as well, of course), that is, Tesla Fleet.

Tesla Fleet

Here is management explaining the concept during the Q1CC:

So you can think of like how Tesla, think of it’s like some combination of Airbnb and Uber, meaning that there will be some number of cars that Tesla owns itself and operates in the fleet. There will be some number of cars and then there’ll be a bunch of cars where they’re owned by the end user. That end user can add or subtract their car to the fleet whenever they want, and they can decide if they want to only let the car be used by friends and family or only by 5-star users or by anyone at any time they could have the car come back to them and be exclusively theirs, like an Airbnb.

Musk quoted Cathy Wood that Tesla should be considered an AI or robotics company, considering it a car company is the wrong framework, going as far as to argue that (Q1CC):

if somebody doesn’t believe Tesla is going to solve autonomy, I think they should not be an investor in the company.

However, Musk has been talking about this for a decade, but it is still not imminent. Let’s see what will happen with the Robotaxi first.

Excess inference capacity

Once Tesla has millions of self-driving cars on the road, they can sell the excess inference capacity for when the cars aren’t in use, from the Q1CC:

Tesla’s AI inference efficiency is vastly better than any other company. There is no company even close to the inference efficiency of Tesla. We’ve had to do that because we were constrained by the inference hardware in the car, we didn’t have a choice. But that will pay dividends in many ways… And even in an autonomous future where the car is, perhaps, used instead of being used 10 hours a week, it is used 50 hours a week. That still leaves over 100 hours a week where the car inference computer could be doing something else. And it seems like it will be a waste not to use it.

This is also years off.

Insurance

The company gathers billions of miles of customer driving data, which isn’t only a crucial input in its FSD software, it has also enabled Tesla to offer its own car insurance with policies based on individual driver behavior (which produces a safety score that forms the basis of next month’s premium).

This is not only bypassing expensive third-party car insurance (insuring EVs is more expensive than ICE cars), it produces another recurring income stream for Tesla. Tesla’s insurance is often significantly cheaper.

Charger network

One thing that Tesla has going for it is that it has the most extensive charger network in the U.S., powered by its Supercharger technology, which it is licensing to companies like BP and the EG group for hundreds of millions and many opportunities remain:

The fact Tesla is offering up its technology as a quasi-plug and play solution means more energy providers, shopping mall owners, car parks and even hotel chains could be convinced to buy in bulk.

Batteries

The company is embarking on producing its own battery cells, the 4680 (46mm diameter and 80mm tall cylindrical cells, much larger than the previously used 2170) which management claims can increase the range by 16% and reduce costs by 56%.

They started doing this as a hedge when demand for EV batteries was greatly outstripping supply, but that situation has reversed, so there is somewhat less urgency behind this, with the immediate need being to stay ahead of the Cybertruck ramp. The Q1 shareholder letter didn’t provide a lot of information:

4680 ramp continued successfully in Q1 and continues to stay ahead of the Cybertruck ramp. Costs continued to come down sequentially as scrap, yield and production rate improved.

But they used the production (and the oversupply situation) to reduce input costs for other batteries going into the rest of their vehicles, so that’s a positive (although, given the oversupply, are unlikely to be exclusive to Tesla).

Energy business

FY24 growth is predicted to be 75%+ and the business will begin contributing significantly to the bottom line with record margins reaching 24.6%.

Optimus

A humanoid robot to perform dangerous and repetitive tasks could be a huge winner as Tesla plans to use them in their own factories as well as sell them to the public, but shipping next year (as Musk mused on the Q4/23CC), well, as so much with these broad brush visions, we’ll have to see about that.

Finances

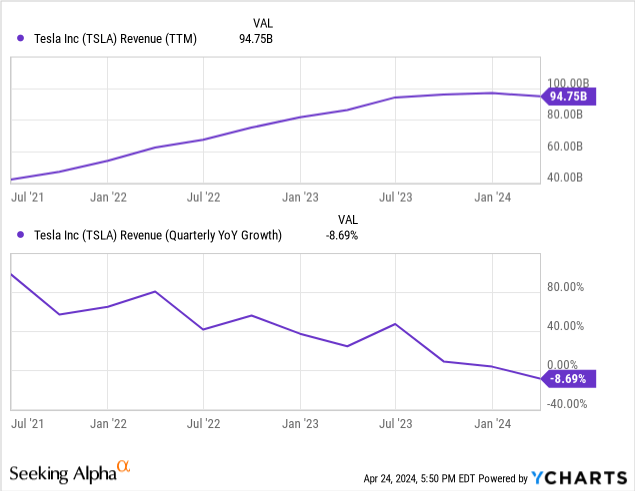

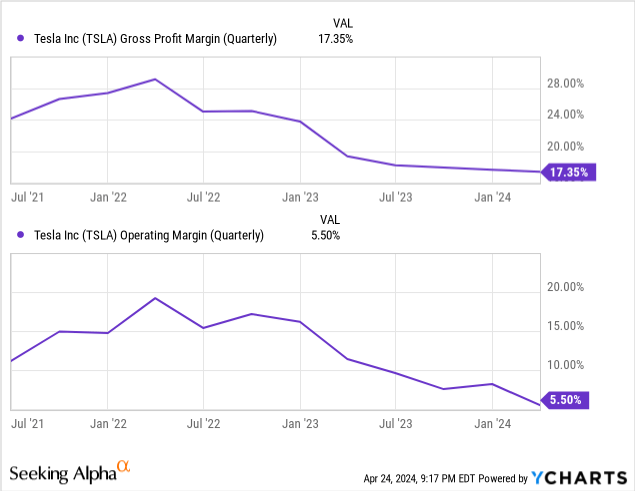

Just as revenue growth has gone into reverse despite multiple price cuts, it’s no surprise margins have declined significantly as well:

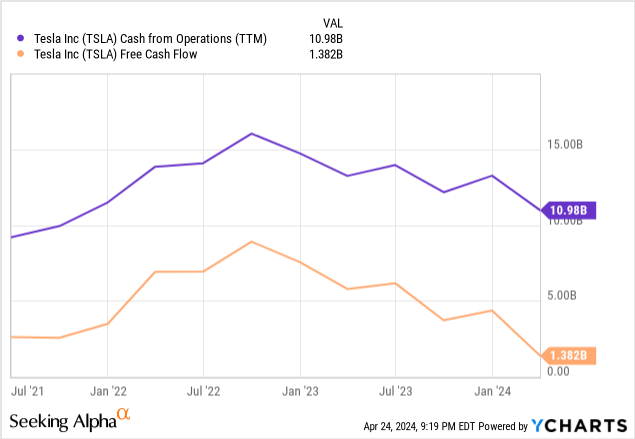

Not to mention cash flow, operational cash was down to just $200M in Q1, and free cash flow has plunged to a negative $2.5B in Q1, mostly on rising inventories, although that’s expected to reverse in Q2:

The explanation given by management (Q1CC):

Q1 had a lot of different things which are happening. Seasonality was a big one, continued pressure from the macroeconomic environment. We had attacks at our factory. We had Red Sea attacks, we are ramping Model 3, we’re ramping Cybertruck. All these things are happening.

This was a series of one-offs that will not recur and Q2 will be “a lot” better, Musk argued. We’ll have to see about that.

Valuation

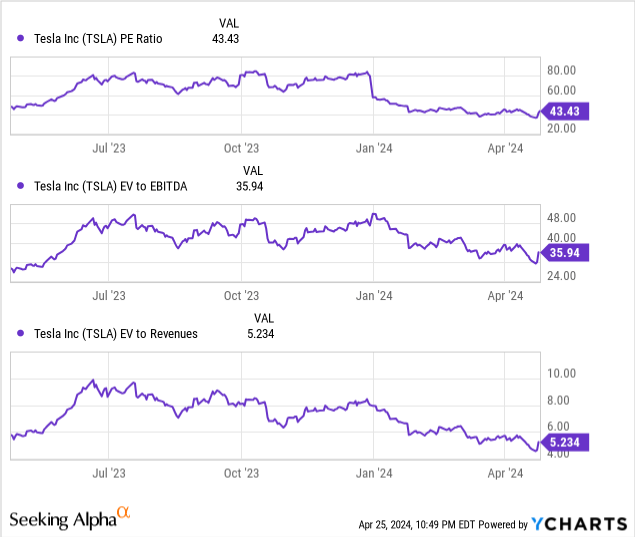

Since our last article published on April 19 valuation metrics have actually moved up quite significantly on a 15% stock rally and lower earnings.

Conclusion

We never argued Tesla had nothing going for it, promising a separate article to concentrate on these, which is the article above. The 15% rally post-Q1 earnings was certainly not caused by the earnings themselves, these were bad, and growth has gone into reverse.

Management blames this on a series of one-off factors, but we think the EV market is hitting a wall, and it will take much cheaper EVs to entice buyers back and reestablish the double-digit growth the market was accustomed to.

Overcapacity at suppliers, most notably at battery makers, and letting go of 13K people will contribute to a lower cost base, as will the introduction of unspecified cheaper models.

However, the $25K Model 2 that needs the unboxed production method is on the back burner. Management couldn’t even specify whether these more imminent, cheaper models were new models or variants of existing ones (we think the latter).

Some parts of Tesla are still growing nicely, like its charging network, its energy storage business, and the like, but we would be surprised if any investors are buying the shares for these segments.

Apart from the promise of imminent cheaper models, we think most investors are buying into the whole AI-driven FSB vision of the Robotaxi and Tesla Fleet.

We wholeheartedly agree that this is a nice prospect, and many of its building blocks are in place and Tesla is likely to be significantly ahead of the competition here.

However, for now, it’s a vision. Musk has a history of painting nice visions and investors keep buying into these, but the practice is nearly always a little harder. We think that it will be years before this vision starts to generate significant revenue.

So, it ultimately depends on whether you buy into Elon Musk’s vision and are willing to pay a huge valuation premium for the shares (compared to its peers) at a time when the EV market is hitting a brick wall in many places.

We don’t, but we acknowledge that there are enough investors willing to do just that, so we remove our Sell rating and change to a Hold rating.