NeonShot/iStock via Getty Images

Thesis

I briefly mentioned my bullish stance on Apple (NASDAQ:AAPL) a couple of months ago in my last article on Berkshire Hathaway (BRK.B).

In this initiating coverage of Apple, I will share my bullish thesis:

- Structural increase in service revenue increase will improve business quality

- Staggered Apple Intelligence features can benefit from marketing cycle refreshes

- Valuations are at a slight but deserved premium to the longer term averages

- Technicals indicate room for outperformance

- Weak consumer sentiment and iPhone adoption curves patterns indicate shift toward value over performance

Structural increase in service revenue increase will improve business quality

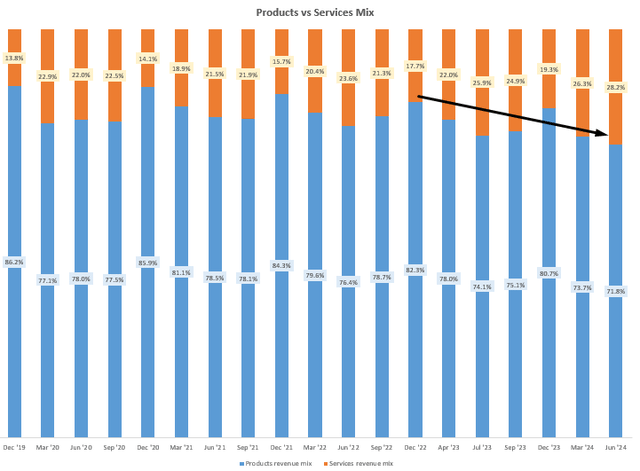

Apple’s revenue profile is showing a steady increase in the Services mix, from 18% to 28% over the past 7 quarters:

Apple Products vs Services Mix (Company Filings, Author’s Analysis)

This also marks the highest services mix over a longer time period of more than 4 years. I expect this mix shift trend to continue in an accelerated fashion driven mainly by 3 factors:

1. Increase in the installed base of products

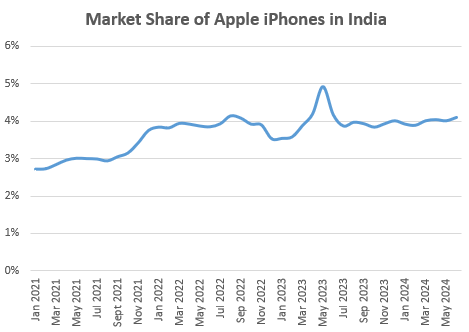

I think there is still plenty of room for increased market penetration of Apple products, particularly in the underpenetrated emerging markets as the population grows wealthier, thus increasing uptake of Apple’s premium products. Indeed, that is what we are seeing gradually in India:

Market Share of Apple iPhones in India (GS Stat Counter, Statista, Author’s Analysis)

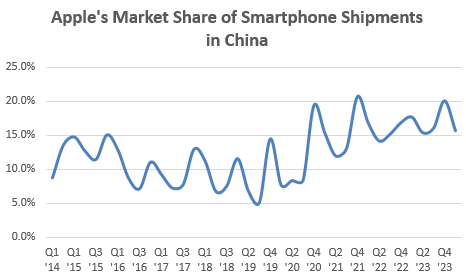

Apple’s iPhones are seeing a broad increasing market share trend in China as well:

Apple’s Market Share of Smartphone Shipments in China (IDC, Statista, Author’s Analysis)

In the latest Q3 FY24 earnings call, management highlighted that many of the customers in mainland China are first time users:

And so if you look at this on the Mac and iPad, in Mainland China, the majority of customers buying or buying for the first time, buying that product for the first time and the watch, the vast, vast majority of people are buying a product for the first time.

– CEO Timothy Cook in the Q3 FY24 earnings call

Overall, I believe the market for Apple’s suite of products is still very much unsaturated, with plenty of opportunities for increased market penetration.

2. Customer loyalty to the Apple ecosystem

Apple has a very low customer churn of 9%. Customers’ loyalty to Apple is very strong, even cult-like. For example, some studies have shown that iPhone users are 21 times less likely to switch brands compared to Samsung users. This increases the customer lifetime span for Apple users to continue being a customer of Apple Services.

3. Pricing growth

I anticipate accelerated pricing growth in Apple’s services as well with the infusion of Apple Intelligence (discussed in the next section below).

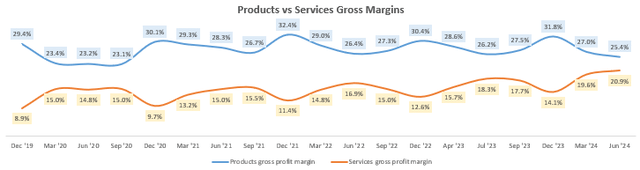

I anticipate these factors to result in further increases in Services gross margins. I believe Apple will soon have Services gross margins at higher levels than Products gross margins within 3 years:

Products vs Services Gross Margins (Company Filings, Author’s Analysis)

Note that Services revenues are a more predictable, less lumpy and faster-cycle (due to lower working capital requirements) stream of cash flows. Hence, overall, I anticipate this along with an anticipated increase in the margin profile of Apple’s business to result in a superior quality of business, making a valid case for structural multiple expansion in the stock.

Staggered Apple Intelligence features can benefit from marketing cycle refreshes

The infusion of Apple Intelligence features into the product suite will enable users to have a powerful AI assistant on their devices, marking a step-up evolution beyond Siri’s virtual assistant era. Apple is set to introduce its iPhone 16 series on September 9 2024 in its ‘It’s Glowtime‘ Launch. This model will include Apple Intelligence AI features that management intends to roll out gradually in a staggered manner over the course of a year.

I believe the staggered release is a smart move as it allows the company to benefit from a natural refresh of marketing hype cycles on social media. I think it is reasonable to assume that people talking about new features every few months in a staggered release program would lead to more marketing engagement than in a single-point full feature release program.

Furthermore, I think Apple’s partnership with OpenAI places it in good stead to monetize from distribution of AI services provided by companies that take on the burden of capex investments. This helps Apple benefit from consumer AI adoption in an asset light way. I view this favorably as asset-light businesses tend to generate superior returns.

Valuations are at a slight but deserved premium to the longer term averages

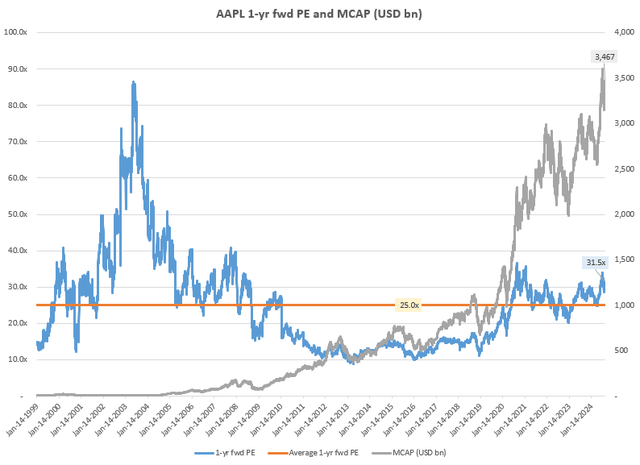

Apple currently trades at 1-yr fwd PE of 31.5x, which corresponds to 26% premium over the longer term average of 25.0x.

AAPL 1-yr fwd PE and MCAP (USD bn) (Capital IQ, Author’s Analysis)

I believe this premium is deserved due to the improved business quality of the company (discussed in the earlier section). Hence, I am comfortable in having a bullish slant at these valuations.

Technicals indicate room for outperformance

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

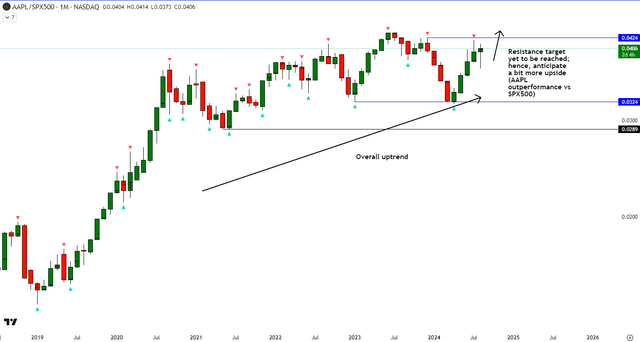

Relative Read of AAPL vs SPX500

AAPL vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

On the relative technicals vs the S&P500 (SPY) (SPX), there is an overall uptrend with some space left to go till the monthly resistance level is hit. Hence, I think there is further scope for outperformance ahead for AAPL stock.

Weak consumer sentiment and iPhone adoption curves patterns indicate shift toward value over performance

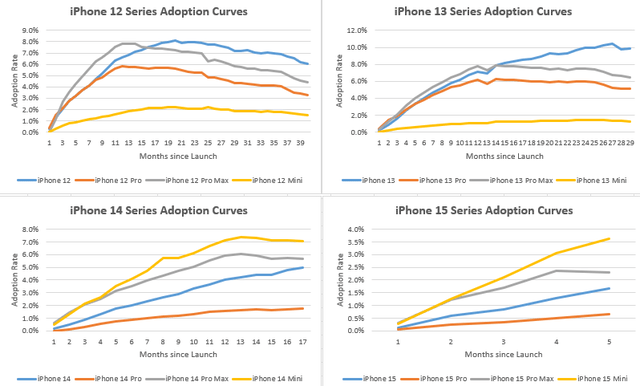

iPhone Series’ Product Adoption Curves (MixPanel, Statista, Author’s Analysis)

Looking closely at the iPhone 12-15 Series adoption curves, I noticed that for the latest 2 models (iPhone 14 and iPhone 15), customers’ have shown greater enthusiasm for the Mini models, which is the lowest-end model. This is a big change from what was seen in the iPhone 12 and iPhone 13 Series’ adoption curves, for which the Mini models saw the weakest adoption rates.

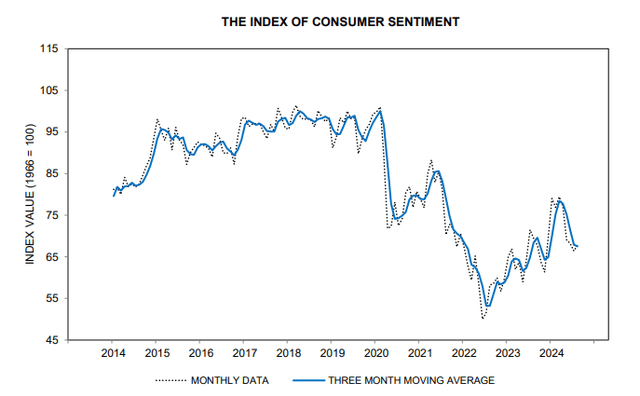

From a timing perspective, the consumer preference shift to the Mini models started 2 years ago since that is when the iPhone 14 was launched. Incidentally, the University of Michigan Consumer Sentiment Index figures show weak consumer sentiment 2 years ago to slightly improved but still low figures vs the broader history in the last decade:

University of Michigan Consumer Sentiment Index (University of Michigan)

Based on a still-weak consumer, I believe historical consumer preference trends toward the lower-end Mini models may continue. And if this happens, I suspect there would be a relatively lower willingness of consumers to spend on model upgrades, which may not bode well for the iPhone 16 launch. This is a key risk I am monitoring.

Takeaway & positioning

I think Apple has plenty of opportunities to further penetrate an unsaturated global market for its products. This will increase its installed base and when combined with its characteristic high customer loyalty and retention, and pricing levers from the infusion of Apple Intelligence AI features, I believe there is a strong case for a mix shift and gross margin expansion in the Services revenue category. This revenue stream is more predictable, less lumpy and with better cash flow conversion. Hence, the quality of the business is likely to improve, thus making Apple deserving of a more premium multiple than its longer term average valuation levels.

I think a staggered launch of Apple Intelligence AI assistant features is a smart way to increase engagement with the target market, thus increasing the chances to maximize sales of new products launched next month. Also, partnerships with firms such as Open AI will open up new AI monetization routes for the Services business without the burdens of relying on own capex expenditure.

Recent trends in iPhone adoption rates suggest a preference for the lower-end Mini models during a time when the consumer sentiment index has been near decadal lows. I am monitoring to see if this trend continues for the iPhone 16 Series model as that may also indicate consumers’ lower willingness to spend on model upgrades.

Rating: ‘Buy’

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.