Nikada/iStock Unreleased via Getty Images

I have been writing about Apple (NASDAQ:AAPL) since 2018, and no matter what the bear case was, AAPL continued to prove the bears wrong. Now, the latest highlight for the bears is that Berkshire Hathaway (BRK.B) reduced its position by -49.33% as it unloaded 389,368,450 shares. None of us are Warren Buffett, and just because he cashed in on some of the gains doesn’t mean the bull thesis has stalled. There is nothing wrong with taking capital off the table, or exiting a position, but blindly making a decision because of what someone else did isn’t a great way to conduct an investment strategy. I will discuss why BRK.B reducing its position in AAPL doesn’t bother me and why I believe the iPhone upgrade cycle and other aspects will continue to support a bull cycle for AAPL. Jerome Powell just delivered the message everyone has been waiting for and stated that the time for rate cuts is upon us. I think some investors are overlooking why rate cuts will be positive for AAPL even though they are in a cash-rich position. I am still surprised by how many AAPL bears there are, and I feel that AAPL will continue to increase in number into 2025. Shares of AAPL are currently in a bullish trend as they are up 25.24% over the past year and 17.82% YTD. AAPL continues to be the most profitable company in the market, and anyone who has held AAPL over the past 5 years is up 347.77%. APPL is one of the few companies I plan on holding for decades to come and adding to the position when opportunities present themselves, as I believe it will continue to outperform the market going forward.

Following up on my previous article about Apple

I have been a shareholder of AAPL for quite some time and wrote my first article about AAPL back in 2018 (can be read here). Since then, I have written a bunch of articles about AAPL, and it’s been a question of how bullish I was, as I have never written a neutral or bearish article about AAPL. Shares of AAPL have increased by 517.97% since my first article compared to the S&P 500 increasing by 139.66%. I wrote my last article on June 14th (can be read here), and since then, AAPL is up 6.07% compared to the S&P 500, climbing 3.88%. I am following up with a new article as there is a lot of news that makes me believe AAPL will continue going higher throughout the remainder of 2024 despite BRK.B reducing its position in half. I firmly believe AAPL can be a cornerstone to any portfolio the same way it is to many index funds, and AAPL is a name to hold and add rather than trade.

Risks to my investment thesis in Apple

Despite generating over $90 billion in net income on an annual basis since 2021, there are still risk factors to investing in AAPL. Enterprise applications or cloud computing has never been AAPL’s forte, and they have been primarily a consumer-facing company, even though their products are utilized in businesses. Not diversifying into enterprise software could end up being a mistake as it is a way to diversify their revenue mix. AAPL faces competition in every business segment, from computers to smartphones to services. While AAPL has a gigantic install base in the billions, there is a chance growth will stall or decline if companies such as Alphabet (GOOGL) and Samsung create future products that are significantly more enticing from a technological standpoint. As revisions to jobs come in and more companies are set to conduct layoffs, AAPL may not benefit from an upgrade cycle the way some anticipate. AAPL is also in a delicate situation as their upgrade cycle depends on what Tim Cook showcases at the September 10th event. If AAPL doesn’t impress its userbase or get the street excited, more investors could follow BRK.B and look for other investment opportunities. While I am bullish, investors should consider what could go wrong with the investment thesis for AAPL, as there is competition around every corner.

I believe that the Fed will be more impactful to the investment case for AAPL than Berkshire reducing its AAPL exposure

BRK.B made headlines after reducing its position in AAPL by almost -50% when the new filing was released. Its cash reserves increased to $276.94 billion at the end of Q2 from $188.99 billion at the end of Q1. Back at the annual meeting, Buffett answered some direct questions pertaining to AAPL and stated that he felt AAPL would still be the largest holding at the end of 2024. BRK.B has tremendous gains in AAPL, and there is nothing wrong with them taking some of their profits off the table. BRK.B still has 400 million shares of AAPL, which is worth $90.74 billion. BRK.B still owns more than 60 operating companies, including Benjamin Moore, Berkshire Hathaway Specialty Insurance, Duracell, GEICO, Dairy Queen, Fruit of the Loom, and See’s Candies to name a few. I have no idea what Warren Buffett is going to do, but I don’t think he is just going to sit in T-bills for the next several years. I believe that BRK.B is going to make an acquisition, and they are trimming AAPL to have a large war chest of cash after their acquisition spree is over. Even if BRK.B liquidated their entire AAPL position, I wouldn’t consider that a bearish argument against AAPL, considering the fundamentals haven’t changed. BRK.B has a long history of allocating cash toward acquisitions and buying assets from companies, just as they did when they purchased 7,700 miles of pipeline from Dominion (D) in 2020. My opinion is that the bears are trying to use BRK.B to fuel their bear case because, from a product and financial aspect, AAPL continues to prove them wrong.

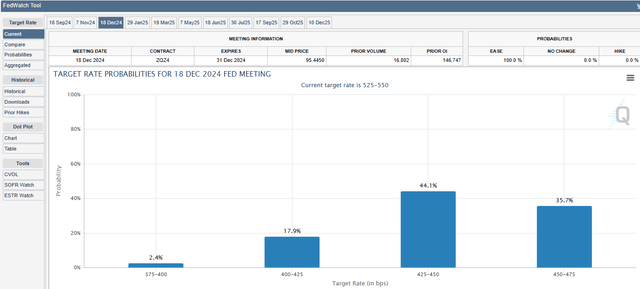

Jerome Powell just delivered a speech from Jackson Hole that was much-anticipated, as he signaled that the time to adjust rates is here. CME Group is projecting that the most likely scenario is that the Fed reduces rates by 100 bps by the end of the year. Their worst-case scenario is that 75 bps come off the current levels. I believe that this will be more impactful for AAPL than BRK.B, selling half its position for several reasons. As rates decline, so will the cost of capital, and businesses will be more likely to expand, as tapping the debt markets will make it easier to build into their profitability models. As this occurs, businesses will need more products and services to conduct business, and AAPL could see a boost in their iPhone, iPad, and Mac sales. As interest rates decline, so will the carrying costs on credit cards, and AAPL could see a boost on the consumer side as well. AAPL also has $86.2 billion in long-term debt on the balance sheet. At some point, AAPL will be able to refinance at lower interest rates. In 2021, AAPL paid $2.65 billion in interest expenses, which increased to $3.93 billion in the trailing twelve months (TTM). As rates come down, so should their interest expenses, as AAPL will be in a position to renegotiate terms or purchase more lucrative swaps against their debt. While a big deal is being made about the impact to small caps, the larger companies such as AAPL should also see a large direct and indirect benefit from rate cuts.

I believe this upgrade cycle and the introduction of Apple Intelligence will provide the catalysts needed to surpass a $4 trillion market cap

Once again, AAPL surpassed estimates in Q3 after generating $85.78 billion in revenue, which was a YoY growth rate of 4.9% and $1.42 billion more than the street expected. AAPL also produced $1.40 in GAAP EPS, which was $0.06 larger than expected. On the Q3 conference call, Luca Maestri (Apple CFO) indicated that they expect Q4 revenue to grow at a similar rate as their Q3 revenue on a YoY basis, which should put it in the neighborhood of $93 – $94 billion. This would put the 2024 fiscal year revenue at around $390 billion, which is an increase of about $6.79 billion YoY. It’s always amazing to me when people turn bearish, as AAPL has an install base in the billions and a cult-like following with legions of people who consistently upgrade their hardware. It’s hard to compete with a company that has $61.80 billion in cash on hand, $91.24 billion in long-term investments, and generates over $100 billion in FCF on an annualized basis. The September event should set the tone for AAPL, and I believe the bears underestimate how powerful Apple Intelligence will be.

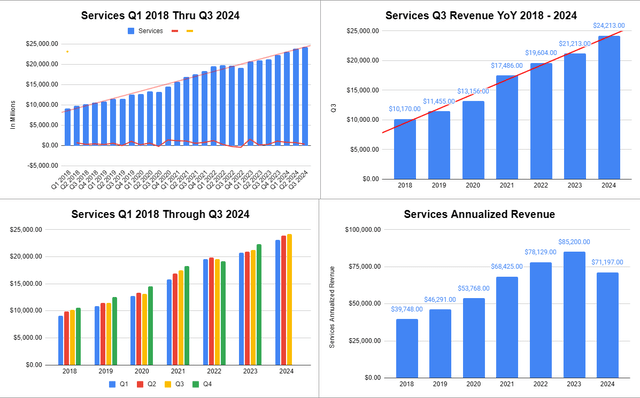

If you take the time to dissect what AAPL has created in its Services business, it’s very hard to believe that Apple Intelligence won’t be accreditive to its earnings potential. In the first 9 months of 2021, Services represented 17.75% of AAPL’s total revenue after generating $50.15 billion. In 2024, Services increased the amount of revenue it generated over the first 9 months by $21.05 billion (41.97%) as it drove in $71.2 billion. This is 83.56% of the total revenue Services generated in 2023, representing 24.04% of their total revenue in the first 9 months compared to 17.75% back in 2021. AAPL has done a fantastic job building in a recurring revenue structure to augment physical hardware sales. Over the past 5 years, Services has an average annual growth rate of 16.62%. If Services only replicates its Q3 revenue in Q4, it will finish the year at $95.41 billion in revenue. There is a small chance that Services will become a $100 billion run rate business in the 2024 fiscal year, which would come ahead of my estimates for 2025. Whether it happens in 2024 or 2025, AAPL has built a recurring revenue stream that will reach $100 billion in less than a decade from scratch.

I think that Apple Intelligence is going to be a game changer as it will merge AAPL’s investments in AI and machine learning with its innovation across application software. AAPL has a chance to change how humans interact with technology, and based on what AAPL has done with the Services division, I believe they will create a free version and a tiered version to access different features through a subscription platform. It’s going to be interesting to see the framework behind how this will work, but Apple Intelligence could be the next catalyst for Services and for the company. Apple Intelligence will be able to run on iPad and Macs that use M1 or higher chips and iPhone 15 Pro models and above. This should also create a large multi-year upgrade cycle on the hardware side and push Services revenue well past a $100 billion run-rate segment.

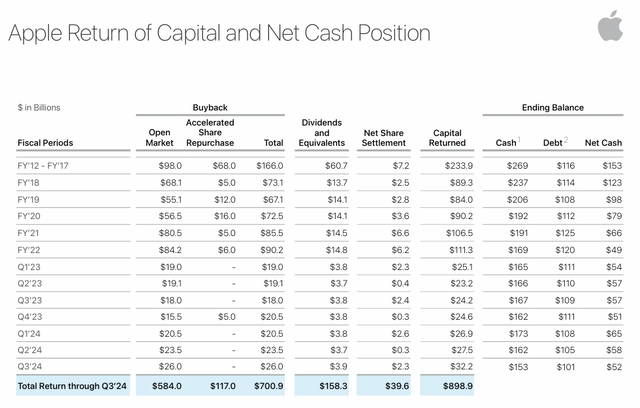

The other aspect that people seem to overlook is how much cash AAPL returns to shareholders. In Q3, AAPL repurchased $26 billion of shares on the open market, which increased the amount of capital allocated to buybacks to $700.9 billion since 2012. Between dividends and buybacks, AAPL has returned $898.9 billion to shareholders since 2012 and is the most pro-shareholder company in the market. AAPL is likely to continue repurchasing shares, which will increase their EPS as their earrings will be distributed across a lower number of shares. Since the close of 2014, AAPL has repurchased 8.24 billion shares and reduced its share count by -35.11%. Bears talk about AAPL’s low growth, but they often overlook the power of AAPL’s profitability as they can continue manufacturing EPS increases each year just from the rate at which their repurchasing their shares.

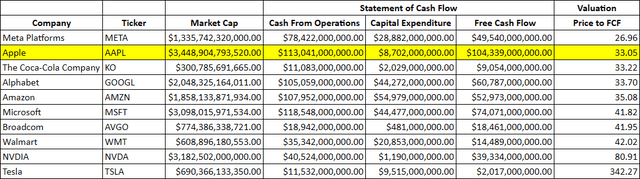

When I look at how AAPL is being valued on a price-to-FCF basis, it looks undervalued. I compared AAPL to the rest of the Magnificent Seven, The Coca-Cola Company (KO), Broadcom (AVGO), and Walmart (WMT). AAPL is trading at 33.05 times its FCF, and only Meta Platforms (META) trades at a lower valuation. Even at a $3.35 trillion market cap, AAPL would generate its entire market cap in 33.05 years, based on its current level of $104.34 billion in annualized FCF. I look at this metric because it’s harder to be manipulated, and since AAPL buys back so much stock, its forward EPS can fluctuate quite a bit. AAPL is the only company exceeding $100 billion in FCF or coming close to this figure. This leaves AAPL with the ability to buy back shares, pay dividends, and allocate as much capital as needed to grow their business. AAPL has been criticized for their lack of innovation on the AI front, but AAPL isn’t competing in the same space. AAPL isn’t running a web service business, and their AI capabilities will be unleashed on the consumer front through their hardware products. I think the market will be shocked at how Apple Intelligence impacts the Services business and how AAPL will continue to utilize their FCF to benefit shareholders.

Steven Fiorillo, Seeking Alpha

Conclusion

Shares of AAPL are at all-time highs, and I am not changing my stance on being very bullish about AAPL’s future. AAPL is a stock that I want to own for decades to come and will continue to add when opportunities present themselves. I think people are putting too much emphasis on the fact that BRK.B reduced its position by half rather than looking at how AAPL is setting the stage for the future of their company. While past history isn’t a blueprint for what will happen in the future, I believe it’s more likely that AAPL will move higher with the market as it increases its earnings potential rather than sell off its share price. I think the upcoming upgrade cycle will last for several years and increase the growth rate on its Services segment. I think AAPL will reach $4 trillion in market cap sometime in 2025, and it has the potential to be the first $5 trillion market cap company.