Lobro78

Introduction

Three months ago I shared my ‘Strong Buy’ recommendation regarding Apple (NASDAQ:AAPL). AAPL rallied by around 18% since May, significantly outperforming the S&P 500. Apple’s brand and pricing powers are intact, and the company recently announced its game changing iOS18 with AI-features. Apple continues betting big on innovation by investing billions in R&D and investors will likely see several new promising product releases soon. Moreover, pivots in monetary policies of developed countries are approaching. Therefore, I believe that the iPhone sales growth is poised to rebound. Apple also continues enjoying strength of its ecosystem and intact brand power as Services revenues continue soaring. I still believe that AAPL is a “Strong Buy” and I am adding more shares to my position since my valuation analysis suggests there is a 30% upside potential.

Fundamental analysis

Apple is firmly committed to innovation. The company has spent $8 billion on R&D during the latest reportable quarter. R&D investments are paying off since there were a few crucial software releases since I wrote my previous article. The company unveiled an iOS 18 version with several AI-powered features in June during the WWDC 2024. The most crucial part is that the updated iOS will leverage generative AI capabilities, which means that criticism about Apple’s presence in the AI revolution did not age well. At the same event Apple also unveiled software updates for the iPad, Mac, Watch, and VisionPro.

Recent reports suggest that investors can expect more new products releases soon. According to Seeking Alpha, the company is working on a redesigned Mac mini which will be powered with a powerful M4 chip. Having this chip in its design means that the updated product will leverage AI capabilities, which aligns with the evolving technological landscape. The company also moves forward with a tabletop robot, and this device could come to market as soon as 2026. The uncertainty is high here, but at the same time the robotics market might be a new strong growth opportunity. According to the same source, the company also works on several other interesting products like “augmented reality glasses; smart glasses akin to Meta’s (META) Ray-Ban glasses; a version of its popular AirPods headphones that have cameras; and a foldable iPad”.

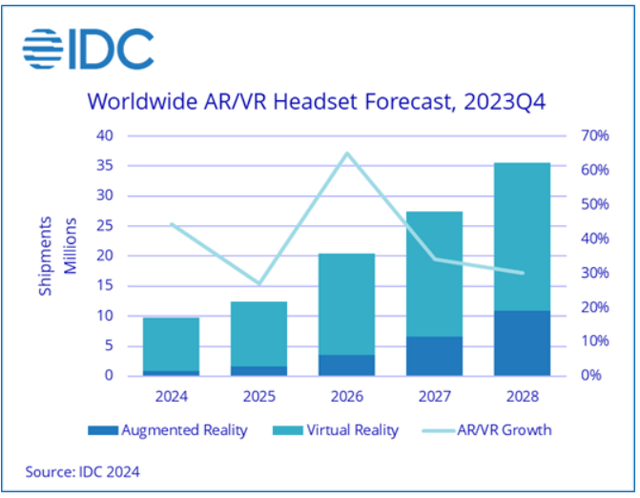

The management also demonstrates commitment to maximize the potential of the Vision Pro headset. The product is now officially available in countries with large economies like China, Hong Kong, Japan and Singapore. Apple is also working on a lower cost version of Vision Pro. This one is expected to be presented in 2025. These developments are also positive as IDC forecasts strong growth in AR/VR headsets shipments over the next five years.

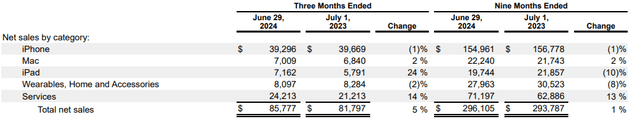

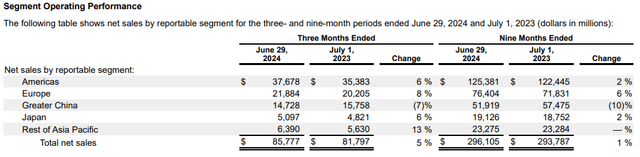

Apple’s Q3 2024 earnings release is another crucial development supporting my bullish stance. Revenue grew by 4.87% on a YoY basis, while the non-GAAP EPS grew from $1.26 to $1.40. The quarter was not flawless from the topline perspective since only Services and the iPad demonstrated strong YoY growth. There also was a modest YoY growth in Mac, but the contribution was insignificant in absolute terms.

AAPL bears are likely to say that revenue dynamic is not so optimistic as the iPhone and Wearables sales continue stagnating. However, I am confident that headwinds for these categories are likely to be temporary due to the current unfavorable macroenvironment. While in the modern world having a smartphone is vital, upgrading from iPhone 14 to iPhone 15 is a discretionary spending since such a purchase can be easily postponed without losing the quality of life. As households across the developed world continue suffering from high interest rates, their discretionary spending deteriorates.

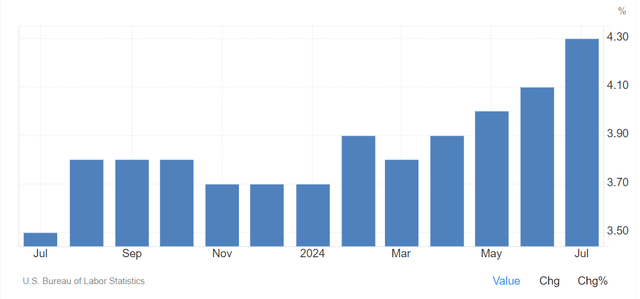

Inflation fell below an important 3% psychological level in July, which is quite a good development that likely approaches positive shifts in monetary environment. The Fed still did not start cutting rates but the fact that inflation is now below 3% makes the start of interest rates cutting much closer anyway. The fact that the U.S. unemployment rate increased from 4.1% in June to 4.3% in July is also another solid reason for the Fed to start monetary policy easing due to its ‘Dual Mandate’. The U.S. unemployment rate clearly demonstrates an uptrend, as shown below. That said, I expect the demand for Apple’s products to rebound as monetary policies across developed economies will become less restrictive.

Overall, I see no reason to become less bullish about AAPL. Headwinds for the iPhone revenue are temporary, and headwinds are highly likely to resolve soon. The company works on developing several promising products and I firmly believe that the WWDC2024 presentation was a game changing event in changing the market’s perception of Apple’s ability to drive AI revolution. The company’s ecosystem and brand loyalty help rapidly expand the EPS even with some temporary challenges for the top-line, meaning that the company’s moat is still intact.

Valuation analysis

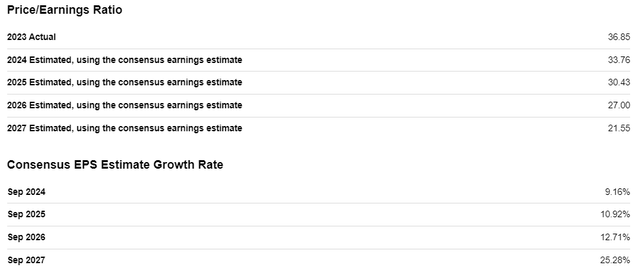

Apple is a unique company having no peers that boast the same level of the ecosystem of products and services. Therefore, it appears impossible to me to find a company to compare its valuation ratios with Apple’s. Therefore, looking at how the company’s P/E ratio is expected to move in the next few years will provide better understanding of the company’s valuation. As outlined in the below screenshot, the P/E ratio is expected to decline notably within the next five years. This means that the current valuation is reasonable considering the EPS growth potential.

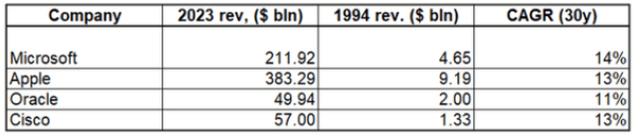

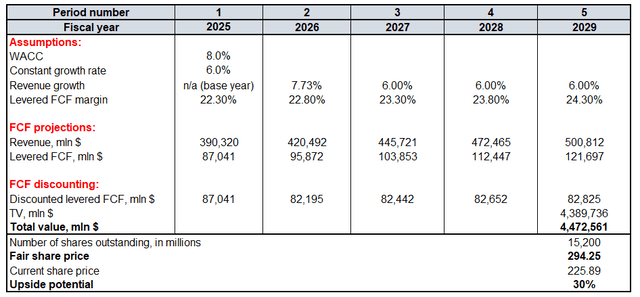

The discounted cash flow (‘DCF’) analysis will help me in figuring out AAPL’s fair share price. Future cash flows will be discounted using an 8.0% WACC. Since my previous thesis aged well, I reiterate a 6% constant growth rate for my DCF model. Bears will definitely challenge my 6% constant growth rate in comments, but I insist that this level is conservative for an unparalleled ecosystem like Apple. My analysis suggests that Apple delivered above 10% revenue CAGR over the last three decades. Moreover, the below compilation shows that Apple was not the only company that was able to sustain double digit revenue CAGR over the last three decades. With all my respect to companies like Oracle (ORCL) and Cisco (CSCO), their business models do not leverage a massive ecosystem that Apple has. That said, AAPL’s revenue CAGR over the last three decades, along with the vast potential in AI after the iOS 18 release, makes me confident that a 6% constant growth rate is sound.

When projecting a constant growth rate, we should also keep in mind that corporations have an option to grow via acquisitions. Of course, if companies were able to drive organic growth only, my forecasted constant growth rate would have been in line with average GDP growth rates. For example, Apple acquired 32 AI startups in 2023. These acquisitions helped Apple to incorporate AI capabilities into its iOS 18. To sum up, I believe that the ability of corporations to grow via M&A is a strong catalyst that helps companies in driving revenue growth beyond GDP growth levels.

Relying on FY 2024-2025 revenue consensus is sound because the sample of around 40 Wall Street analysts is representative, in my opinion. For years beyond 2025 I use the same 6% CAGR, in line with the constant growth rate. I use a 22.3% TTM levered FCF margin for the base year, anticipating an annual increase of 50 basis points. My confidence in Apple’s ability to improve its FCF margin is based on the company’s historically strong operating leverage.

My fair share price estimate is $294, 30% higher than the current share price. A 30% discount for a stock like Apple is a steal, in my opinion.

Mitigating factors

There is a risk that my fundamental analysis might be missing something important because Warren Buffett’s Berkshire Hathaway (BRK.B) has significantly trimmed its stake in Apple, according to the latest reports. Warren Buffett is considered to be the greatest investor of all times and all his moves are highly likely well-considered. The convergence between my opinion compared to Mr. Buffett’s might mean that I have missed some fundamental flaws in my analysis. On the other hand, my bullishness about Apple has never let me down so far.

According to the below breakdown of the company’s revenue, China is the third largest market for Apple. As we can see in the breakdown, Chinese segment was the only one demonstrating revenue decline in FQ3. This is explained by geopolitical difficulties and intensifying competition in smartphones from Huawei. Apple even lost its top 5 spot in China recently. On the other hand, Apple is not ready to continue losing market share in this crucial market and has vast resources to sustain the fight. Moreover, the expected release of AI-powered iPhone 16 in September will likely help in improving Apple’s competitive position against aggressive local players like Huawei.

Conclusion

A stock like AAPL with a 30% discount is a no-brainer. I expect more promising new product releases and updates soon. The ease in monetary policies across North America and the Eurozone will also likely help to close the gap between the current share price and its fair value.