fazon1

Investment Thesis

Since our last coverage, Apple (NASDAQ:AAPL) has delivered an impressive 8% return, moving closer to our previous year-end target price of $240. Warren Buffett’s recent sale of nearly half of his Apple stake appears to be a strategic portfolio rebalancing rather than a signal of declining confidence in the company.

This has likely tempered short-term price action, but Apple’s robust institutional backing, strong financials, and solid product performance support its long-term growth potential, reducing concerns over Buffett’s sale.

Finally, Apple appears fairly valued at its current price, with strong institutional support and solid financials, though it is nearing overbought territory, suggesting limited short-term upside potential.

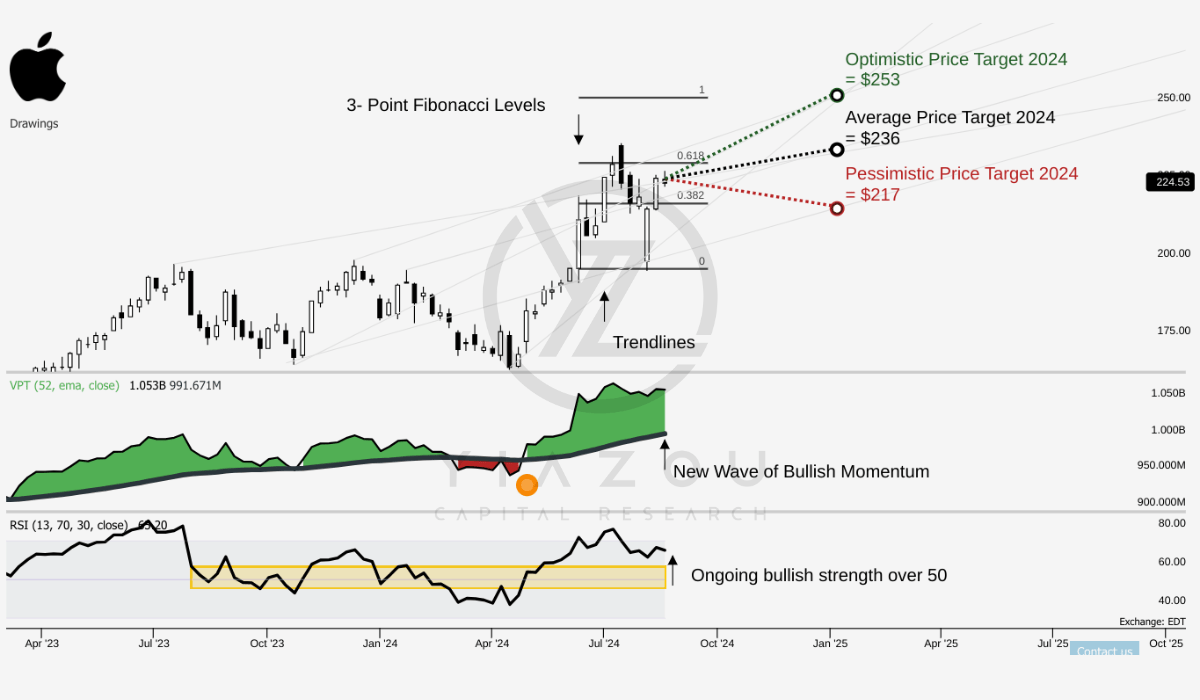

Apple’s Stock May Hit $236 Or Higher Target

AAPL stock is currently priced at $225. The stock’s average price target for 2024 is $236, aligning with the 0.618 3-point Fibonacci retracement level, suggesting potential resistance at this level. The optimistic target of $253 aligns with the 1 Fibonacci level, while the pessimistic target of $217 correlates with the 0.382 level, which indicates potential support if the stock faces downward pressure. These levels are critical for traders monitoring retracements or extensions in price action, particularly in short-term trends projected across Fibonacci levels.

Moreover, the RSI value of 65.20 suggests that the stock is nearing overbought territory, although the sideways trend with a downward reversion indicates weakening bullish momentum. The absence of bullish and bearish divergence further emphasizes that the RSI is not signaling any significant reversal or sell-off patterns. Still, the market may expect a minor correction as the RSI reverts towards the 50 level.

Further, the Volume Price Trend (VPT) line, currently upward but reverting, suggests increased buying pressure, albeit with signs of slowing momentum. The VPT value of 1.05 billion against its moving average of 991.67 million indicates a bottom touchdown could serve as a potential support level.

Yiazou (trendspider.com)

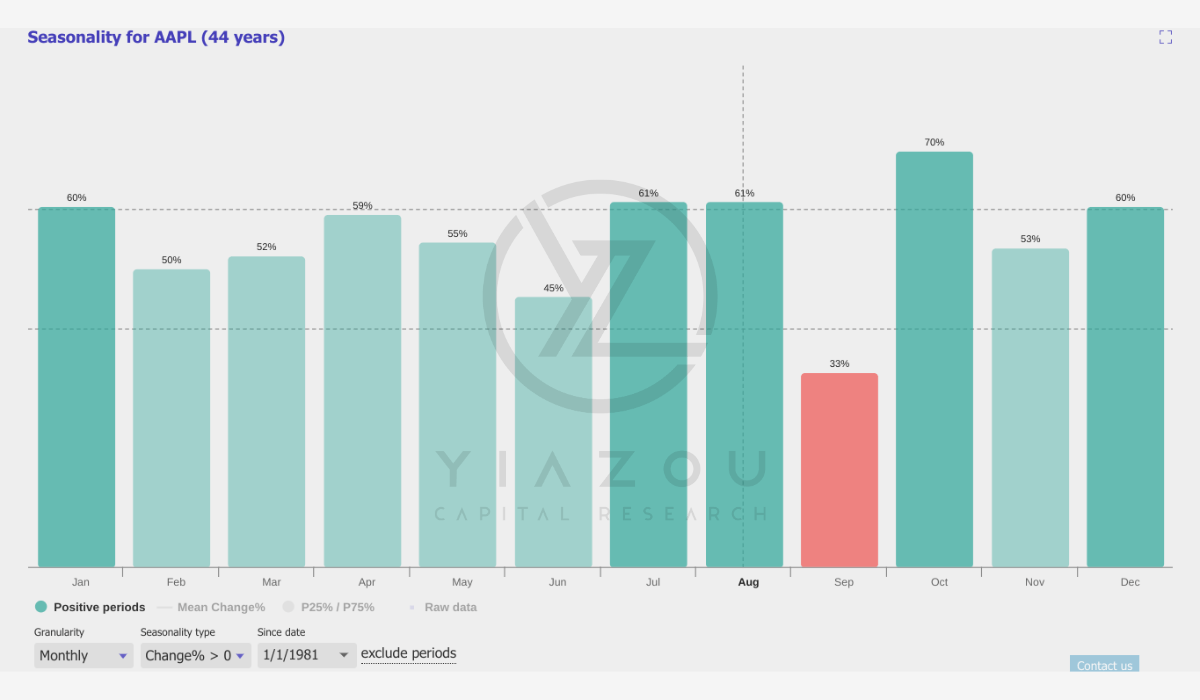

Finally, seasonality analysis for August 2024 over 43 years indicates a 61% probability of positive returns if an investment is made this month, making it an appealing entry point for those considering historical trends. However, September has historically been a weak month for AAPL returns, leading some investors to capitalize on any correction to maximize long-term gains.

Yiazou (trendspider.com)

Apple’s Institutional Strength: Buffett’s Strategic Shift, Big Players Double Down

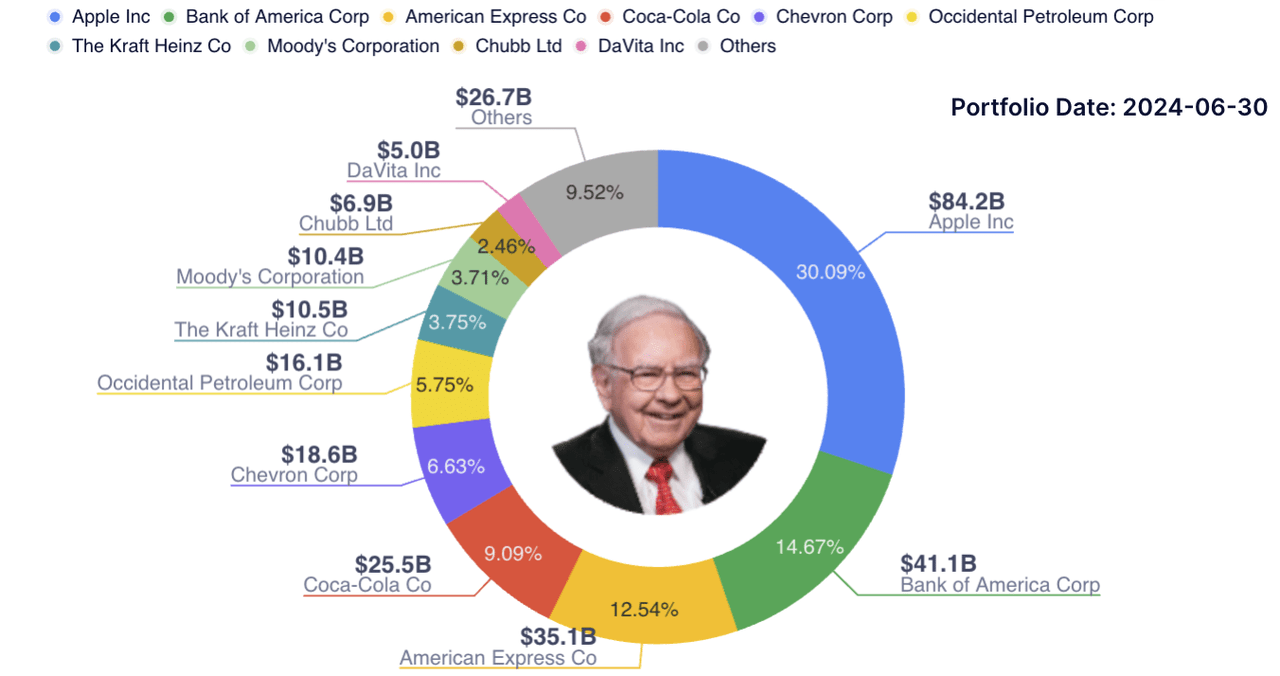

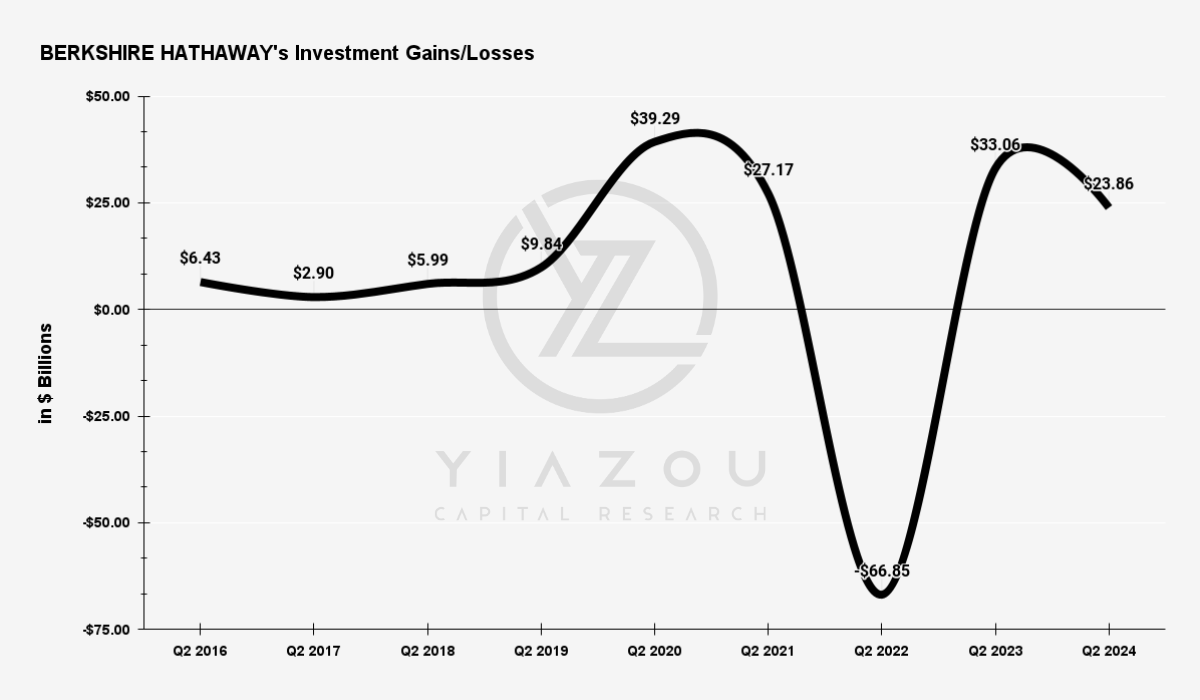

Berkshire Hathaway holds a massive portfolio position in Apple’s stock. Buffett’s investment philosophy focuses on long-term and value-oriented approaches that typically avoid high-tech companies. However, Buffett’s investment in Apple has treated it like a consumer products company.

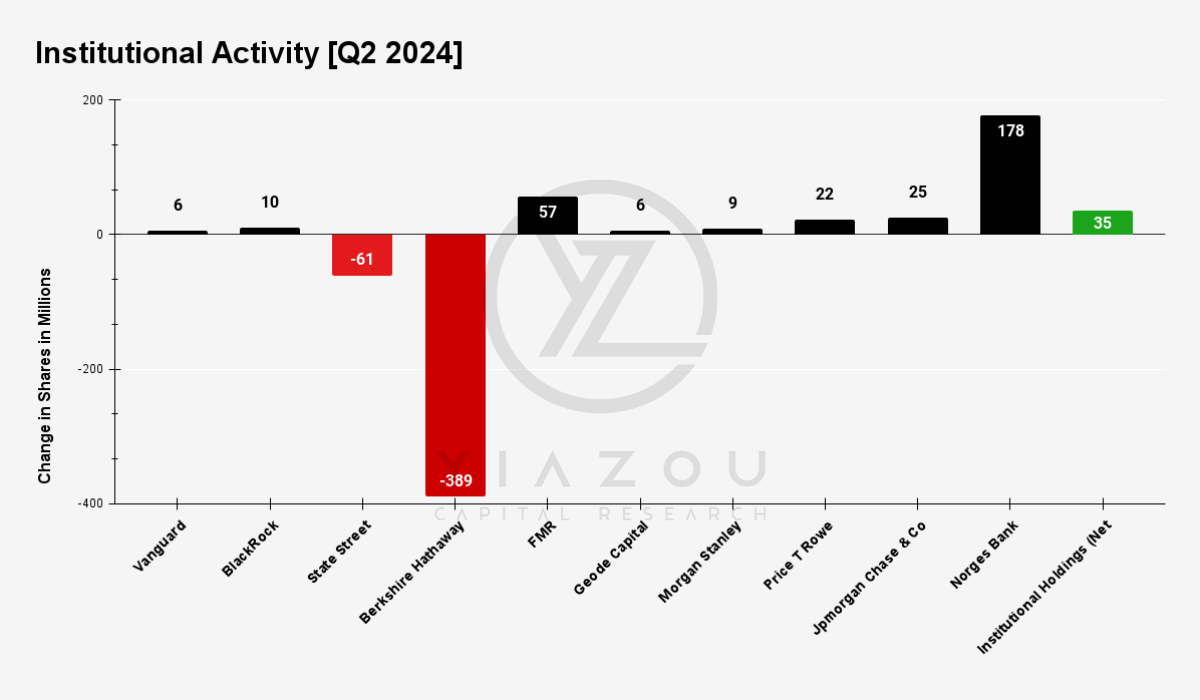

Apple aligns with his long-standing preference for businesses with a loyal customer base and solid top-line. Interestingly, Berkshire Hathaway reduced its stake in Apple by 49% through selling 389.37 million shares during Q2 2024. Despite this significant reduction, Buffett’s holding in Apple still represents 30.09% of his portfolio.

Buffett focuses on maintaining 400 million shares identical to his long-term Coca-Cola holdings (a company he has held for decades). This investment strategy shift suggests Apple may remain a vital and prolonged part of Berkshire’s portfolio strategy.

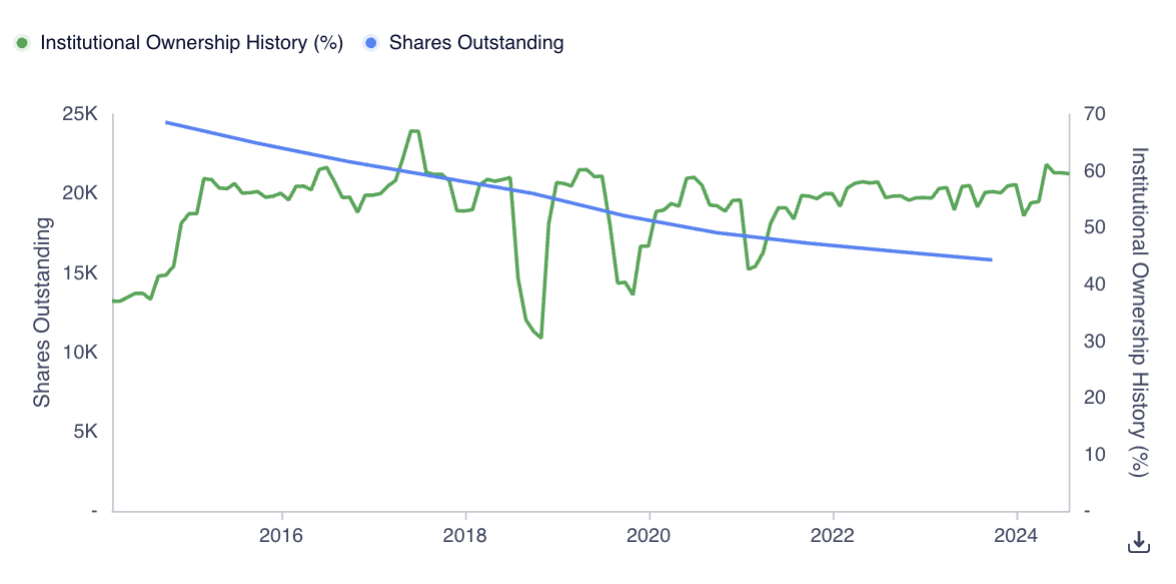

Beyond Warren Buffett, Apple is heavily backed by the world’s largest and most sharp institutions. The company’s institutional holding structure points to its high perceived value and stability on the street. As of Q2 2024, the largest institutional shareholders include Vanguard and BlackRock.

To begin with, Vanguard holds the largest stake in Apple, a portfolio allocation of 5.36% (1.32 billion shares) valued at $279 billion. It has made a modest increase of 6.11 million shares (+0.46%), which signals confidence in Apple’s long-term prospects even at the all-time high. This slight increase reflects Vanguard’s mark on Apple’s sustained growth potential. With that, Apple is a cornerstone of Vanguard’s portfolio at an average buy price of $28.84.

GuruFocus

Similarly, BlackRock (largest asset manager) holds 5.02% of its portfolio in Apple (1.05 billion shares) valued at $221.20 billion with an average buy price at $38.57. The addition of 9.69 million shares represents a more aggressive increase than Vanguard. The nearly 1% increase in holdings suggests that BlackRock still perceives Apple as a critical component of its investment strategy. Further, FMR has increased its holdings by 19.61% by adding 56.66 million shares, bringing its buying average to $57.54. This substantial increase signals that FMR anticipates high price returns from Apple. Other significant transactions were executed by Geode Capital (+5.65 million shares) and Morgan Stanley (+9.07 million shares) in Q2.

Finally, Price T Rowe Associates also boosted its holding with a large increase of 21.52 million shares. The 10.4% growth in holdings indicates that Price T Rowe expects Apple to continue its upward trajectory. Norges Bank has chosen to invest a substantial portion of its portfolio in Apple right from the start. Norges Bank’s new massive position of 177.53 million shares at $191.05 average price and JPMorgan Chase & Co’s 15.85% increase (24.73 million shares) in holdings indicate a fresh wave of smart money in Apple’s growth potential.

Yiazou (hedgefollow.com)

In short, the total institutional activity reflects an increase of 35 million shares. Here, the number of hedge funds holding AAPL has increased to 803 in Q2 2024 against 710 in Q1. There were 233 new institutional holders in the AAPL during Q2. These ownership trends mark AAPL as a solid investment option. Buffett’s move on AAPL can be considered an act of portfolio rebalancing instead of a systematic exit. This move by Warren Buffett is warranted to preserve the investment gains that were not progressive over the decade.

10Q (Yiazou)

Apple’s Record Q3: Double-Digit EPS Growth, Strong Product Lineup, Robust Cash Reserves

Apple’s EPS grew by double digits to $1.40, setting a record for the June quarter. This double-digit growth in EPS points to Apple’s high profitability. The company’s ability to attain record EPS in a single quarter, considering its size and during macroeconomic uncertainty, reflects its capacity to derive solid market value.

Product Line Performance was solid beyond the 14% annual jump in services revenue. iPhone revenue was $39.3 billion, representing a slight decline of 1% year-over-year. However, on a constant currency basis, the iPhone segment showed growth.

Moreover, Mac revenue increased by 2% to $7 billion due to the popularity of the M3-powered MacBook Air models. The back-to-school season and the increasing demand for computing devices among students and professionals have led to this growth. Moreover, iPad revenue surged by 24% year-over-year to $7.2 billion. The launch of the new iPad Air and iPad Pro models with M4 chips led to this jump.

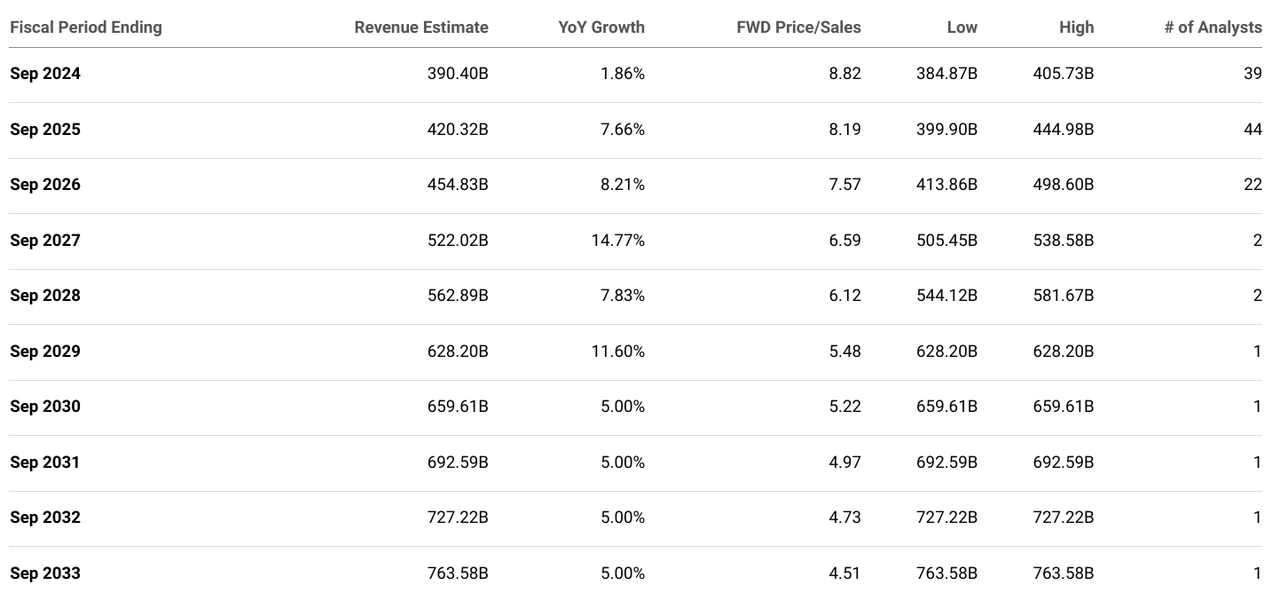

In short, new product launches rapidly benefit the company’s top line, considering the upcoming iPhone 16 launch fiscal 2025 revenue may experience growth beyond analysts’ estimates.

Finally, Apple’s financial stability and substantial cash reserves are significant strengths that support its growth potential. Apple’s cash flow generation remains solid. The company generated $23 billion in operating cash flow during Q3 2024, which enabled Apple to return $24 billion to shareholders during the quarter, including $19 billion in share repurchases and $5 billion in dividends. As of the end of Q3 2024, Apple’s cash reserves stood at $166 billion, providing the company significant financial flexibility.

Apple’s AI Gamble: Can Vision Pro and Late AI Push Overcome Big Risks?

Apple’s significant investments in AI and machine learning with the introduction of Apple Intelligence is a delay against the competitor’s AI launches. However, the success of these AI initiatives is far from guaranteed. The tech industry is highly competitive with Apple’s late entry into certain AI domains against rivals like Google and Microsoft, which may hinder its top-line growth and capability to dominate the AI market (due to the lack of first mover advantage).

On the other hand, the launch of Apple Vision Pro (a high-end mixed reality device) represents a bold step into new product territory. However, the success of this product is still uncertain due to its premium pricing and the nascent state of the mixed reality market. The risk is that the initial excitement and interest may not translate into widespread adoption if competing products offer similar capabilities at lower prices. Additionally, the heavy reliance on developer support to create compelling apps for Vision Pro could be a bottleneck for the top-line.

Finally, the blind following behind Warren Buffett may continue to misinterpret the sell action on Apple’s stake as an inflection point for the stock. This may create short-term selling pressure on the stock.

Takeaway

While Warren Buffett’s reduction of his Apple stake may create short-term selling pressure, it appears to be a strategic portfolio rebalancing rather than a lack of confidence in the company. Apple’s solid institutional backing, robust financials, and consistent product performance support its long-term growth potential. However, with the stock nearing overbought territory, further short-term upside may be limited.