ozgurdonmaz

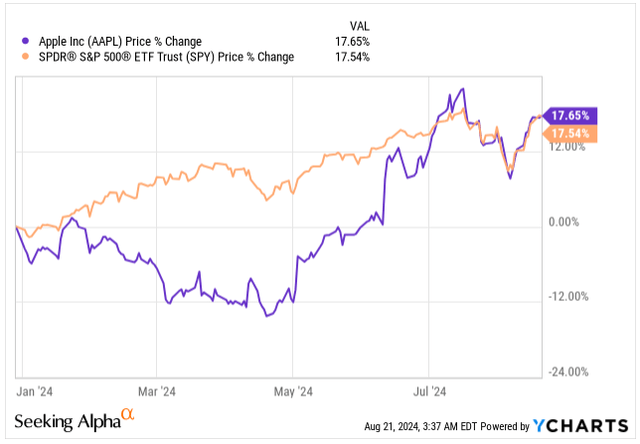

Initially, I wrote a bearish coverage of Apple Inc. (NASDAQ:AAPL) back in April this year, as I trimmed most of my relatively large Apple position, leaving just a few dozen of shares in my portfolio, rotating and parking the proceeds in SPDR® S&P 500® ETF Trust (SPY), where the risk/reward profile looked more favorable.

Now, it appears my call might have been too premature. Instead, Apple’s stock performed very well in the short timeframe, outperforming SPY 4x. With the announcement of the AI-enabled iPhones expected in September, Apple is catching up in the race to fellow Mag7’s, again sparking investors’ interest.

Apple vs. SPY Price (Seeking Alpha)

Even as the iPhone 16 might drive a more robust upgrade cycle, the better-than-expected sales appear to be baked into the stock price with limited ROR potential for investors. Furthermore, Apple lacks any new product breakthroughs to drive its massive top line further, and making a dent with niche-product releases such as Vision Pro will prove increasingly difficult.

The valuation remains sky-high amidst slowing growth, priced at a premium to the overall market (SP500), even with Apple’s superior quality and industry-leading profitability.

I stick to my call to previous call to Sell Apple’s shares and rotate the proceeds to SPY. By now, I have fully exited my Apple position, seeking more attractive returns elsewhere at a less demanding valuation with the added benefit of lesser volatility.

Slow Growth, Priced at Premium

Perhaps the most eye-catching news during an already volatile August was Warren Buffett’s disclosure of trimming his largest holding, Apple, by nearly 50%.

Even though such an aggressive move in arguably the portfolio of the best investor that ever lived sparks the wider public’s interest, I look at it with caution, following 900% appreciation since the initial purchase, instead aimed at portfolio re-balancing, realizing capital gains at current tax rates, benefiting shareholders as the capital gain taxes may increase in the future and de-risking equity holdings as Apple’s valuation stretched significantly, making outsized gains less likely mainly in the face of slowing growth.

Ultimately, the equation for total ROR is straightforward:

EPS Growth + Dividends + Change in Valuation

In 2016, when Buffett accumulated Apple’s shares, the stock was trading in the range of 10 – 15x its earnings.

Today Apple’s valuation sits at 33.8x its FY24 earnings expected to land at $6.70.

If you ask me, I see no further opportunity for Apple’s valuation to increase any further, particularly as we already find ourselves in a relatively pricey market compared to historical averages.

Even if Apple delivers the projected bottom-line growth of:

- 2024: $6.70E, YoY growth of 9%.

- 2025: $7.50E, YoY growth of 12%.

- 2026: $8.36E, YoY growth of 11%.

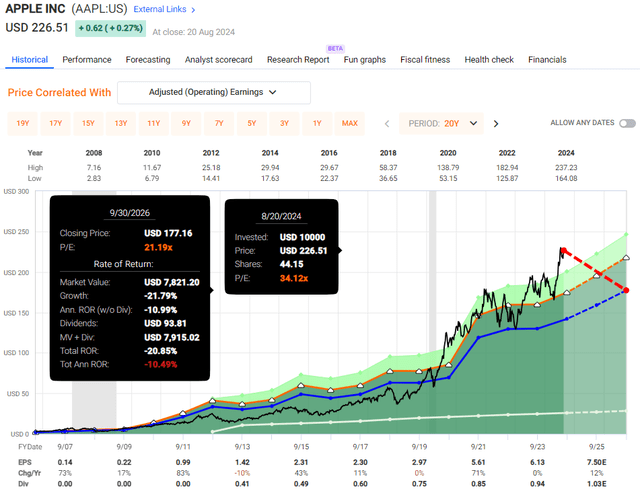

Instead, I expect Apple’s valuation to contract towards its 20-year average of 21.2x P/E ratio, leaving investors disappointed with negative ROR over the next few years even as the business performs well.

The key to successful investing is buying quality and growing businesses at a fair price, and Apple’s valuation is now simply too high.

Buying Apple’s shares at today’s price is simply speculation rather than thoughtful investing, hoping someone else is willing to pay an even higher price.

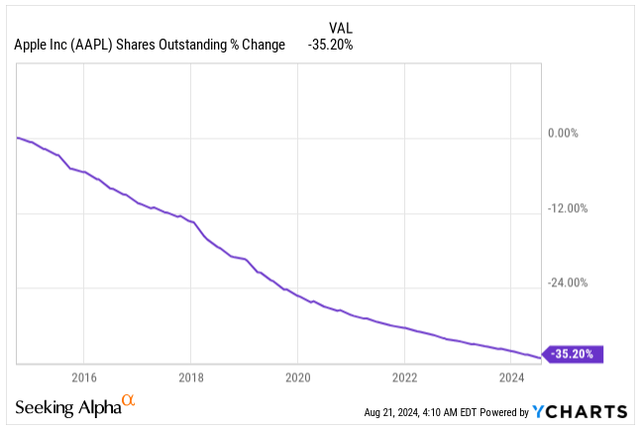

We should not forget, though, that Apple is a great capital allocator. In the past 10 years alone, its share float has been reduced by 35%, with investors benefiting from the simple demand/supply dynamics, boosting its EPS.

The aggressive share-buyback program is arguably one of the key reasons why Apple mostly surprises to the upside during quarterly earnings, artificially boosting its bottom line.

Even as Apple is in a great position to keep buying back its shares and delivering EPS around 10 – 12% annually for the foreseeable future with the business enjoying stable revenue due to its massive installed customer base and hardware industry-leading profitability, the issue is the top-line growth and moving the needle proves increasingly challenging.

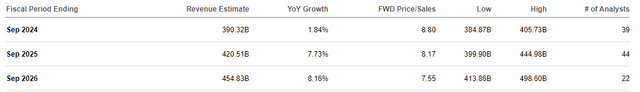

With the iPhone reaching its maturity and lack of new product break-throughs outside of the niche-like product Vision Pro, the top-line growth is expected to stay muted in the following years between 2% to 8% annually, benefiting just from minor year-over-year product updates:

AAPL Revenue Projection (Seeking Alpha)

I understand that my bearish thesis will not resonate well with many of Apple’s devoted shareholders, but I want to clarify that I myself regard Apple as one of the best companies money can buy.

With its expansive hardware and software ecosystem, 2.2B active devices ready to be monetized, and superb balance sheet strength, there is little not to like.

However, as an investor, I do not see a clear path to meaningful risk-adjusted returns given the lack of new products in the R&D pipeline, slow top-line growth, and sky-high valuation.

With that, my price target for Apple’s shares by the end of 2026 is $177, implying a 21.2x P/E ratio.

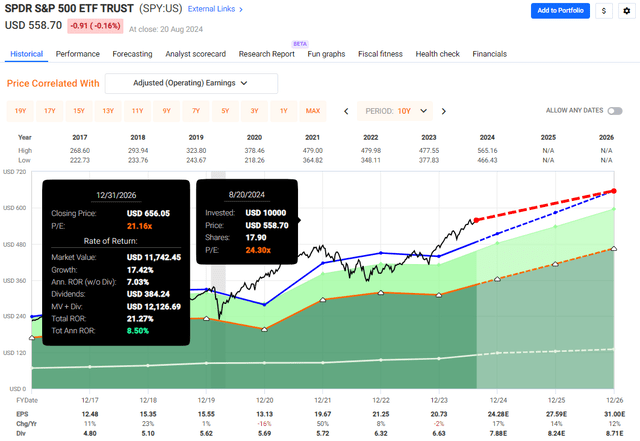

Instead, I recommend that like-minded fellow investors consider parking their proceeds in SPY, as it is trading at a discount to Apple’s shares.

The ETF, which tracks the S&P 500, is expected to deliver 14% annual EPS growth over the next three years, superior to Apple’s.

It is now trading at 23x its expected 2024 earnings, a 47% discount to Apple.

Apple is the most valuable company, so SPY still offers 6.9% exposure.

However, investing in 500 companies instead of one carries significantly less risk, even with tech’s concentration at 32.3%.

As SPY is trading at a slight premium to its 10-year P/E valuation of 21.2x, we can expect some valuation contraction as well, yet thanks to the strong EPS growth, investors can see up to 8.5% annual ROR.

I take that deal every day, with less volatility, compared to Apple’s expected annual ROR of -10.5%.

Q3 Earnings

With that, let’s have a look at the latest quarterly earnings, confirming my fears of slow growth.

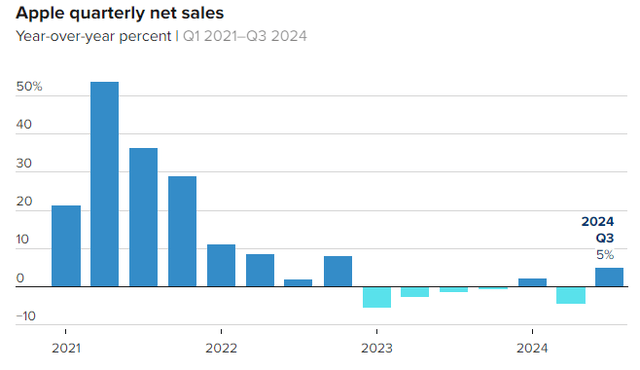

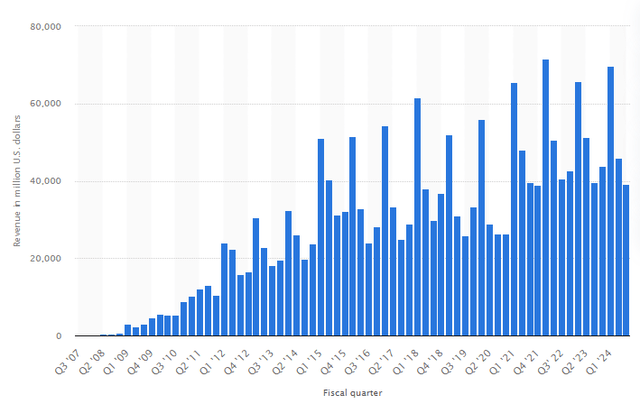

In Q3 FY24, Apple delivered 5% sales growth or $85.8B, marking a positive departure from the four consecutive quarters of negative sales growth; however, it is still underwhelming if we look at the grand scheme of things knowing that Apple grew their sales at an annualized rate of 18.6% between 2014 and 2023, a period during which the stock could have been bought below 20x its earnings.

Once again, today, the stock is priced at 33.8x its FY24 earnings, with 5% top-line growth; let that sink in.

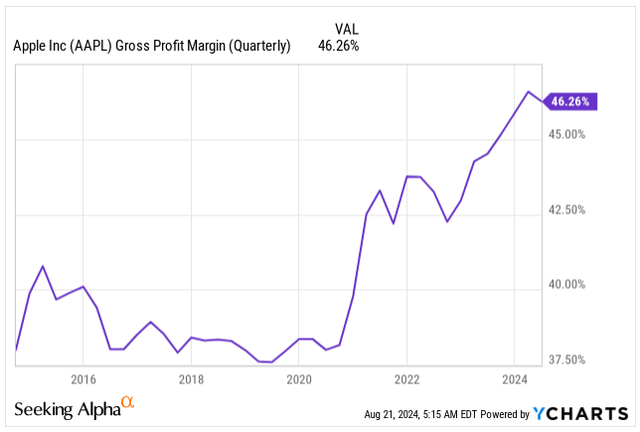

For the quarter, Apple earned $1.40 EPS, beating analyst expectations by $0.06. The company’s 10% EPS growth was helped by an improvement in its gross margin, which is currently at 46.2%.

Apple’s gross margin expansion has been a continuous benefit for the better part of the last decade, helped by the move to more cost-effective and energy-efficient in-house chips. These chips also partially differentiate the products from the rest of the market, making them more sought-after with stronger pricing power.

Let’s look at the product breakdown by revenue:

- iPhone: $39.3B, YoY growth of -1%.

- Mac: $7.0B, YoY growth of 2.3%.

- iPad: $7.16B, YoY growth of 23.7%.

- Services: $24.2B, YoY growth of 14.2%.

- Wearables, Home, and Accessories: $8.1B, YoY growth of -22%.

The revenue breakdown per product lets us better understand what’s moving the needle under the hood of the $400B annual run-rate juggernaut.

While iPad sales increased 24% year-over-year with the release of new devices, iPhone sales have plateaued since Q1 FY21, as shown in the graph below.

That’s a worrying trend, as iPhone sales represent 47% of the company’s total sales. With the lack of innovation in the already mature smartphone market, consumers upgrade their devices less frequently, every 3 to 4 years, ultimately hurting growth.

Apple is not able to offset the volume decline by price increases alone.

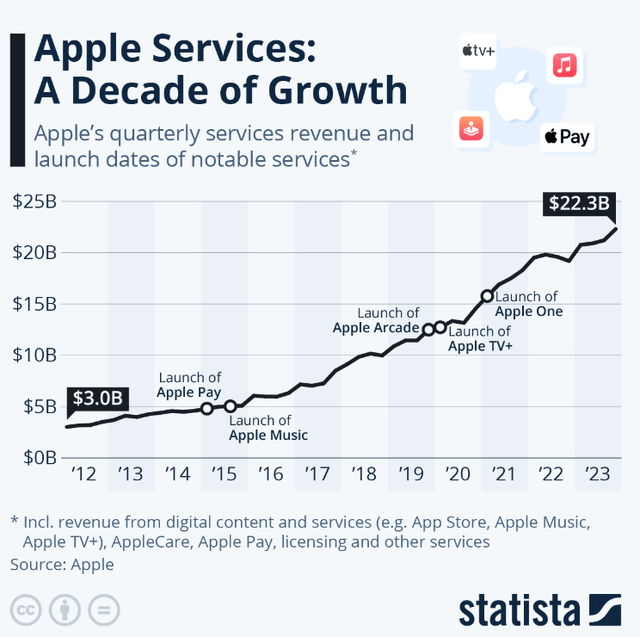

On the positive side, Apple services remain the bright spot, continuously delivering quarter-over-quarter growth, benefiting from the 2.2B devices installed customer base.

A reasonable expectation is for Apple services to grow around 10 – 15% annually for the remainder of the decade.

Geographic exposure remains a key challenge for Apple’s devices, with Greater China reporting a 7% decline in net sales; however, it has improved from a 13% contraction during the prior quarter.

Greater China remains Apple’s third-largest market; however, the local competition of more cost-competitive Huawei devices and the political battle between China and the US negatively impact Apple’s brand image during times of already weakened customer sentiment, sparking fear among investors of continuous drawdown.

Yet, the key question remains:

What will move the needle now that the iPhone has reached its maturity, Apple Service alone won’t be enough, and the Apple Car Project was cancelled?

Building on the success of wearables such as AirPods and Apple Watch, Apple launched the VR headset Vision Pro, with a hefty price tag starting at $3,499 with a relatively slow rollout across the globe. Yet, this niche-like product won’t make a dent, with Morgan Stanley estimating a run rate of $4B by FY27, roughly 1% of Apple’s revenue.

Initial analyst estimates were expecting a $20B – $70B opportunity, but this forecast was revised to reflect the current adoption trends as we should not be expecting a widespread adoption due to its hefty price tag and limited apps on the device, being a first-generation product.

At the Worldwide Developer Conference in June, Apple released its approach to AI, which involves both on-device and data-center processing and targets privacy and security.

Apple is set to reveal its AI-enabled devices this fall with integrated OpenAI’s ChatGPT, functional only on the latest devices such as iPhone 15 Pro Models and iPhone 16s, alongside other newly released hardware.

Wall Street analysts are expecting AI-enabled iPhones to drive a new upgrade cycle. However, I am skeptical as long as some ground-breaking apps are not released, which would improve user experience markedly alongside improved on-device productivity.

Takeaway

Apple is undoubtedly a high-quality business with a wide moat, industry-leading profitability, and a massive installed customer base. Yet, it’s proving increasingly more challenging to move the needle with an annual revenue run rate close to $400B without major products in the R&D pipeline.

Analysts expect a stronger and longer iPhone 16 upgrade cycle with AI-enabled phones coming this fall. Yet, I am not convinced as long as we won’t see major upgrades, significantly improving user experience and productivity before spending over $1,000 on a new device.

As it stands, Apple’s top-line projected growth is very shallow, yet the stock trades at a sky-high valuation of 33.8x its FY24 earnings.

Instead of seeing a clear path to attractive ROR, I see negative ROR ahead and advise fellow investors to trim their Apple shares and rotate to SPY, which trades at a 47% discount with higher expected EPS growth and less volatility, supported by the broader diversification by investing in 500 companies instead of 1.