Kevin Dietsch/Getty Images News

Warren Buffett Dumped Apple Shares

Apple Inc. (NASDAQ:AAPL) investors are likely bracing for a massive impact. The market mayhem looks set to continue after Berkshire Hathaway Inc. (BRK.A, BRK.B) cut 50% of its Apple holdings in Q2, following Berkshire’s 13% reduction in Q1. As a result, AAPL’s exposure has declined to less than 30% of its public equities portfolio, underscoring a strategic adjustment by CEO Warren Buffett.

Astute Berkshire investors could point out that Buffett’s move isn’t surprising. Barron’s pointed out before Apple’s recent earnings release that “Buffett often continues to sell a large equity stake once he gets started.” As a result, investors might also need to price in the possibility that Buffett could unwind its full AAPL position eventually. However, that thesis is uncertain, given Buffett’s strong confidence in the stock. As a reminder, Buffett telegraphed his conviction in AAPL just three months ago at Berkshire’s annual meeting. He highlighted:

That’s the story of why we own American Express Company (AXP), which is a wonderful business. We own The Coca-Cola Company (KO), which is a wonderful business. And we own Apple, which is an even better business. And we will own, unless something really extraordinary happens, we will own Apple, American Express, and Coca-Cola. – CNBC coverage of Berkshire’s annual meeting 2024.

In my previous update in June 2024, I urged investors to be cautious about AAPL. I emphasized that the stock could be close to a decisive breakout (which panned out) as the market reacted to a possible iPhone “supercycle.” Despite that, I informed investors that the stock’s sharp surge could lead to a steep selloff. Therefore, it’s prudent for investors to wait for a pullback before assessing another buying opportunity.

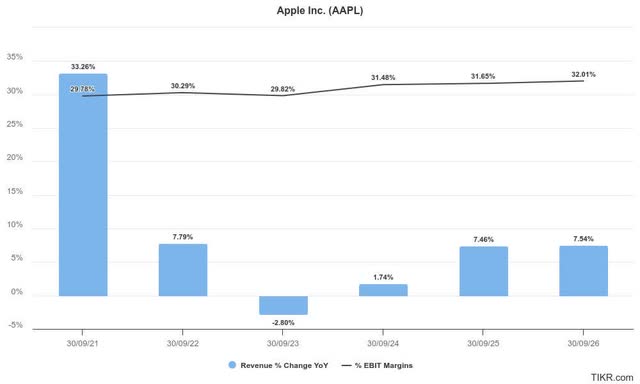

As I write this update, AAPL is down more than 6% (and down almost 18% from its recent highs through this week’s lows). I believe some Apple investors have likely joined the selling bandwagon. However, what has turned so “horribly” wrong for Apple that Buffett has decided to cut such a significant stake? Did something “extraordinary” happen in AAPL? Not as far as I’m concerned. Wall Street estimates on Apple have been upgraded since its FQ3 earnings release last week.

Apple Intelligence Possibly Overhyped?

As a result, Apple seems well-positioned to take on arguably its most transformative growth opportunity: driving the next iPhone upgrade cycle with Apple intelligence.

Apple’s take on Generative AI is expected to drive a multi-year upgrade, leading to palpable Wall Street optimism on the opportunities ahead. Moreover, the Cupertino company emphasized that its “iPhone active installed base grew to a new all-time high in total and in every geographic segment.” Therefore, it should sustain the company’s ongoing diversification with its higher-margin services segment.

The potential multi-year iPhone upgrade opportunity is also expected to underpin Apple’s most critical revenue segment. The stability and clarity of its next-gen iPhone’s upcoming September 2024 launch must be scrutinized. However, given the phased Apple Intelligence launch cadence, the market could be concerned with potential execution risks. Moreover, the GenAI era could also reignite the momentum of its keen smartphone rivals, as its iPhone’s growth momentum in Greater China has slowed.

Notwithstanding my caution, I have not assessed structural risks in Apple’s forward estimates, suggesting the need for investors to turn highly pessimistic. It’s critical to note that Buffett could have unloaded the entire Apple stake if he believed its growth story was “broken.”

Furthermore, AAPL is still Buffett’s largest holding in its public equities portfolio by a mile, accounting for almost 30% of total portfolio exposure. Hence, the fears about Buffett turning pessimistic about Apple stock seem overstated.

However, I cannot rule out valid concerns over whether Apple Intelligence’s growth prospects could have been overhyped. I assess that the recent surge in AAPL toward a new high is likely predicated on an upgraded iPhone launch cadence. Therefore, pessimism attributed to a more tepid response to the recent “early preview of Apple Intelligence” could intensify uncertainties for the stock.

Accordingly, the features are not included in the “initial version of iOS 18 and other new operating systems.” Therefore, it could hamper a more robust adoption of its newest iPhone Pro series. Moreover, Bloomberg’s early preview suggests Apple’s take on GenAI “doesn’t yet live up to the excitement.” Accordingly, investors might need to contend with potential disappointment as the features in the preview are assessed to be a “far cry from the game-changing technology that fans and investors hope Apple Intelligence will become.”

In other words, I believe Bloomberg proposes that the enthusiasm leading to AAPL’s surge to a new high could have been overhyped. In addition, investor optimism about the transformative potential of Generative AI could be misplaced. Therefore, it could intensify execution risks for the company, given the level of excitement in Apple Intelligence’s anticipated launch. Furthermore, AAPL’s valuation metrics suggest the stock is overpriced by a fair distance, even when accounted for growth. Therefore, I assess that Buffett could have decided to cut Berkshire’s Apple stock holdings to account for these assessed risk factors.

Is AAPL Stock A Buy, Sell, Or Hold?

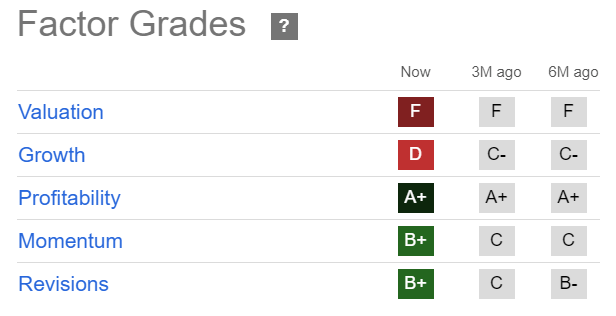

AAPL Quant Grades (Seeking Alpha)

As seen above, Apple Inc. stock is valued at a steep premium (“F” valuation grade), underscoring the need for Apple to deliver with little margin for error. Based on AAPL’s forward P/E of more than 30x, it’s over 40% higher than its tech sector median. It’s also nearly 20% higher than its 5Y average, corroborating the marked optimism already priced into the stock.

In addition, AAPL’s forward PEG ratio of 2.94 is more than 60% above its sector median. As a result, I assess that Buffett’s decision to cut significantly could have shaken the market’s perception of the appeal of its risk/reward profile.

Buffett is known for being a relatively risk-averse investor with a long-term outlook on Berkshire’s key holdings. Given Apple’s importance in Buffett’s portfolio strategy, it could imply that the Oracle of Omaha is worried about execution risks attributed to Apple Intelligence. We will never know what’s going on in Buffett’s head, and thus have to take calculated guesses. However, given the substantial premium priced into the stock, AAPL’s steep selloff seems justified.

I assess AAPL’s long-term uptrend bias has not been affected so far. However, I have not evaluated an attractive entry point yet. Therefore, investors looking to add exposure amid the market mayhem should consider giving a few weeks to assess where Apple Inc. stock could consolidate first. Despite that, high-conviction investors could also consider the selloff as a golden buying opportunity to add exposure, as the market de-rated AAPL’s premium.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive comments to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below to help everyone in the community learn better!