Justin Sullivan

Introduction

A few months ago, I wrote a Tesla, Inc. (NASDAQ:TSLA) piece citing that the stock’s selloff is far from done and that investors are likely to face max pain ahead. I also laid out a few reasons why I was hesitant to buy the stock:

- Possible negative growth in Q1.

- Profitability under pressure.

- Rich valuation.

Since that article, Tesla stock fell more than 25%.

But recently, Tesla reported Q1 earnings that sent the stock higher after hours. Just looking at the price action, you might think that Tesla reported blowout earnings.

It was the complete opposite — the results were a disaster.

So what were investors buying into?

It’s simple.

A vision.

Growth

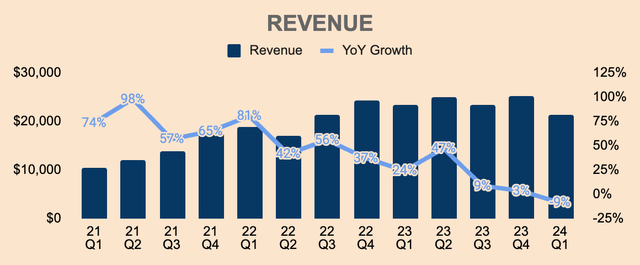

Going through Q1 results, Revenue for the quarter was $21.3B, down 9% YoY and 15% QoQ. This fell short of analyst estimates by nearly $1B — a huge miss to say the least. More importantly, this was the first YoY decline since Q2 of 2020.

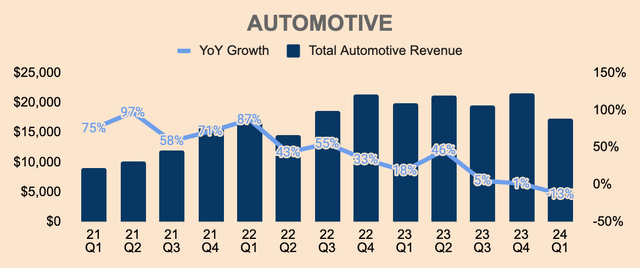

Lagging Automotive Revenue dragged the company down, which was $17.4B in Q1, a 13% decrease YoY. This was primarily due to:

- lower average selling prices (ASP), which declined 5% YoY to about $45K.

- lower vehicle deliveries, which declined 9% YoY to 387K. Production disruptions in Fremont and Berlin as well as shipping diversions due to the Red Sea attacks had an impact on sales volumes.

- Slowing global EV demand as major automakers prioritize plug-in hybrids over EVs.

Despite Automotive slowdown, management believed Q1 to be the trough in terms of vehicle deliveries.

Q1 had a lot of different things which are happening. Seasonality was a big one, continued pressure from the macroeconomic environment. We had attacks at our factory. We had Red Sea attacks, we are ramping Model 3, we’re ramping Cybertruck. All these things are happening. I mean, it almost feels like a culmination of all those activities in a constrained period. And that gives us that confidence that, hey, we don’t expect these things to recur.

(CFO Vaibhav Taneja — Tesla FY2024 Q1 Earnings Call.)

Yes. We think Q2 will be a lot better.

(CEO Elon Musk — Tesla FY2024 Q1 Earnings Call)

That’s great news for bulls.

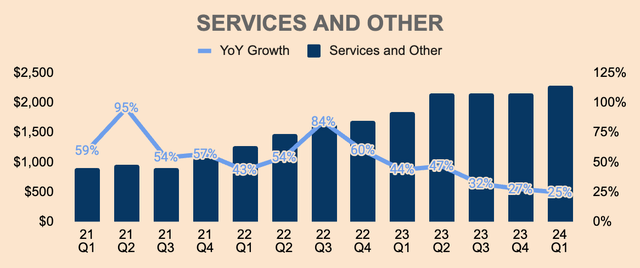

Moving on, Services and Other Revenue continued its upward trajectory, which was $2.3B in Q1, up 25% YoY. This was mainly driven by higher paid Supercharging, part sales, and used vehicle Revenue.

Of important note, Tesla began opening its North American Supercharger Network to additional non-Tesla EV owners. As of Q1, Tesla has:

- 6,249 Supercharger Stations, up 26% YoY.

- 57,579 Supercharger Connectors, up 27% YoY.

As Tesla expands its Supercharger network and as more OEMs get on board, robust Revenue growth for the segment should follow.

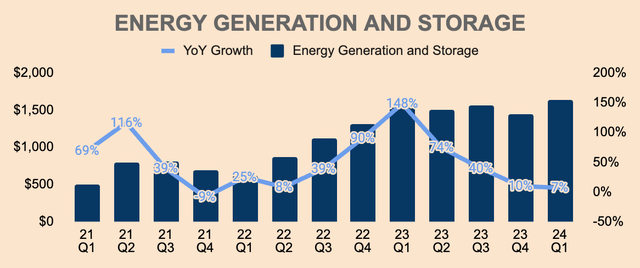

Turning to Tesla Energy, the segment generated $1.6B of Revenue in Q1, up only 7% YoY. Growth was mainly driven by higher energy storage deployments, which increased 4% YoY to a record 4.1GWh, as well as higher Megapack ASPs.

Surprisingly, Tesla stopped reporting solar deployments as it was a drag on the business in Q1.

Despite the slowdown in the segment, management expects “energy storage deployments for 2024 to grow at least 75% higher from 2023,” which is encouraging to hear. Interestingly, not many analysts pointed this out. I thought this was an overlooked part of the earnings call, as Tesla Energy is the most profitable segment for Tesla. More on this later.

With that being said, it was a disastrous quarter in terms of growth. Tesla, as a whole, contracted for the first time in a long time, which paints a gloomy picture of the current demand landscape. As discussed earlier, delivery numbers were down YoY, even despite lower ASPs.

High interest rates definitely dried up demand for Tesla’s high-ticket products. Fortunately, we can expect rate cuts later this year, which should boost demand for EVs and solar once again.

In addition, management points to better days ahead as Tesla resets its vehicle production line and maintains a robust energy storage pipeline.

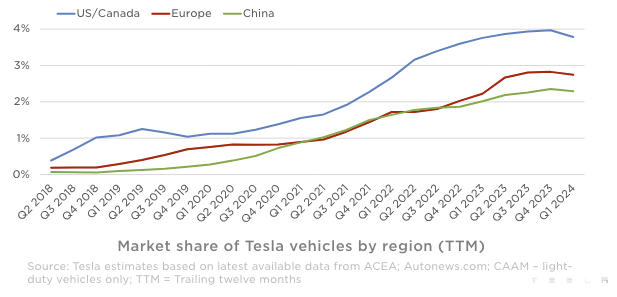

While Tesla experienced a decline in market share in Q1, Tesla’s growth story as the king of EVs is far from over — Tesla should return to growth mode as conditions stabilize.

The question is, how quickly, and strongly, can Tesla recover?

Tesla FY2024 Q1 Investor Update

Profitability

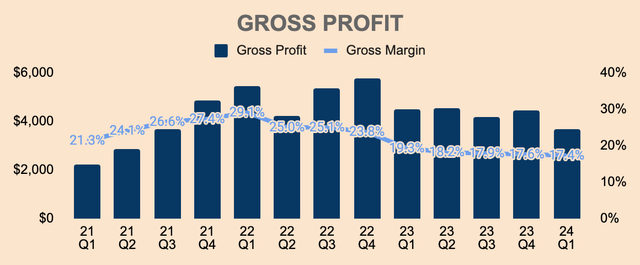

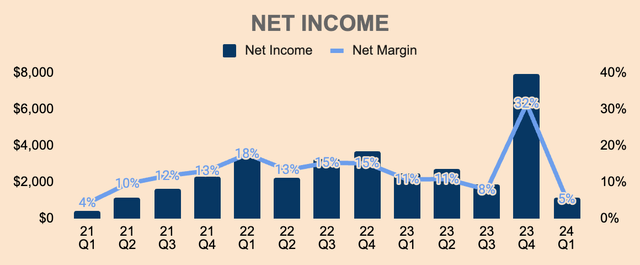

Q1 Gross Profit was $3.7B, down 18% YoY. This represents a Gross Margin of 17.4%, down 190bps YoY and 20bps QoQ. The decline in Gross Margin was primarily due to the price cuts.

COGS per unit declined 2% YoY but rose slightly QoQ due to the Cybertruck production ramp. Excluding Cybertruck, COGS per unit actually declined QoQ, driven by lower raw material costs.

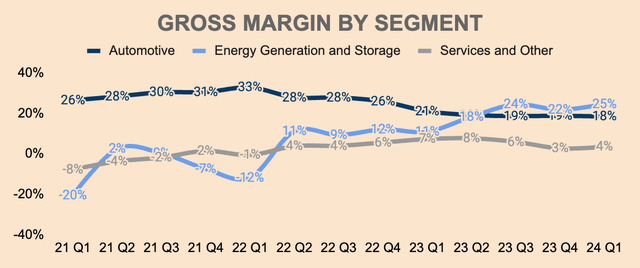

That said, Tesla is still showing economies of scale in terms of production, just that the Cybertruck ramp and factory disruptions are putting some pressure on Automotive Gross Margins, which were about 18% in Q1, down from 21% last year.

In other news, Energy Gross Margin continued to improve, which was 25% in Q1, up 1,400bps YoY, due to higher Megapack sales. Management expects “consistent profit growth” from this segment.

On the other hand, Services and Other Gross Margin declined 300bps YoY to 4%, due to lower used vehicle profit. I expect Gross Margin from this segment to improve over the long run as Tesla’s Supercharging program gains momentum.

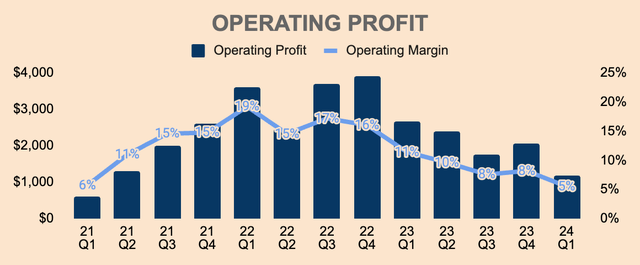

Moving down the income statement, Operating Profit is not looking so good either. In Q1, Operating Profit was $1.2B, down 56% YoY, with Operating Margin declining 600bps YoY to 5%. This was due to lower Gross Profits as well as higher R&D expenses.

On a side note, Tesla recently reduced its headcount by over 10%, which should save $1B in OpEx on an annual basis. As such, expect Operating Margins to improve from here.

In terms of the bottom line, Q1 Net Income was $1.1B, at a 5% Net Margin, which was down 600bps YoY. On a per-share basis, GAAP EPS and Non-GAAP EPS were $0.34 and $0.45, respectively, down 53% YoY and 47% YoY, respectively. Non-GAAP EPS missed analyst estimates by $0.05.

While Tesla’s margin profile remains under pressure, Tesla is actively reducing costs to increase operational efficiency, including “reducing COGS per vehicle” and “leveraging existing factories” for new products. We could see Tesla’s bottom line improving at some point in the future.

However, at this time, the issue lies in the company’s declining Gross Margin, which is probably one of the most heavily debated topics among bulls and bears.

- Bulls: Tesla is sacrificing margins today to grow market share while competitors struggle to make ends meet. In the future, Tesla will reap high-margin software Revenue from its massive fleet, thus accelerating earnings growth.

- Bears: Tesla has been cutting prices due to price competition and weak EV demand. There’s just not much demand for Tesla products.

Whichever camp you choose, you can’t deny Tesla’s deteriorating earnings power. Tesla needs to return to growth mode and improve margins to solidify its status as a more-than-just-a-car company.

Health

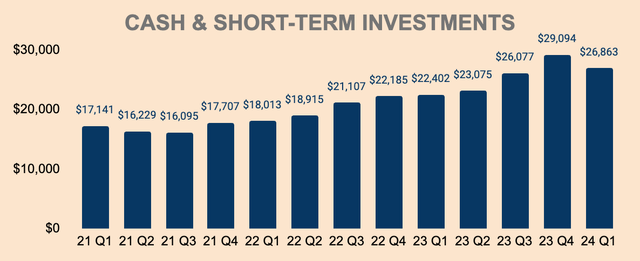

As of Q1, Tesla has $26.9B of Cash and Short-term Investments, which decreased by $2.2B QoQ. Total Debt stands at a manageable $5.4B, placing its Net Cash position at a healthy level of $21.5B.

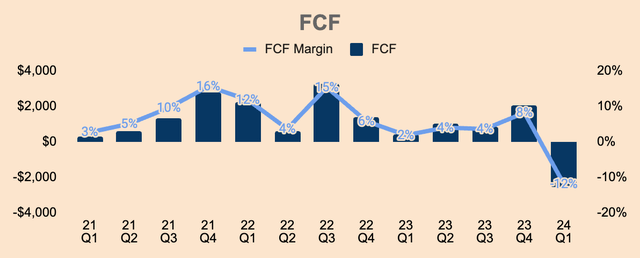

Nevertheless, cash levels dropped sequentially due to a Free Cash Flow of $(2.5)B, which turned negative for the first time in over three years.

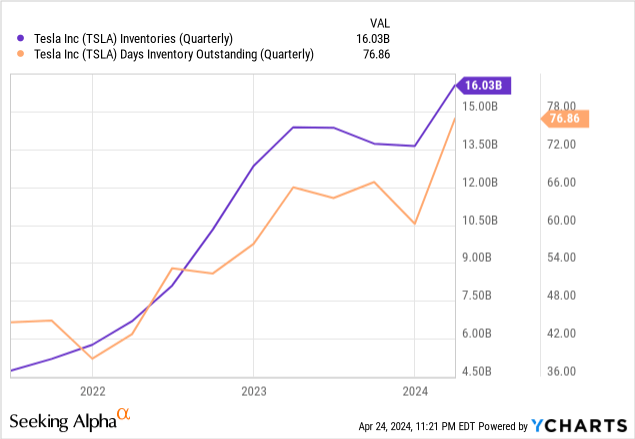

FCF turned south due to higher inventory levels, which increased $2.7B QoQ. As you can see, Tesla seems to be having an inventory problem with Days Inventory Outstanding increasing from 40 days at the end of 2022, to 77 days as of Q1. In other words, on average, it takes Tesla two times longer to sell its cars. No wonder, Tesla has been cutting prices — to offload excess inventory.

Capital Expenditures of $2.8B, which included $1.0B of AI infrastructure spending, also drove negative FCF in Q1.

While the negative FCF in Q1 was an unpleasant surprise, management reassured us that it was a one-off quarter, with FCF expected to turn positive again in Q2.

We expect the inventory build to reverse in the second quarter and free cash flow to return to positive again.

(CFO Vaibhav Taneja — Tesla FY2024 Q1 Earnings Call.)

All in all, nothing to worry about in terms of Tesla’s balance sheet. Tesla remains one of the most financially resilient automakers, with a high Net Cash position and strong FCF (excluding this abnormal quarter).

Outlook

Similar to the previous quarter, management guided for a “notably lower” volume growth rate in 2024 as compared to 2023. As a reminder, Tesla started the year with Total Production and Total Deliveries being down 2% YoY and 9% YoY in Q1, respectively.

Despite the negative growth in Q1, during the earnings call, CEO Elon Musk reassured us that Tesla will “have higher sales this year than last year.” This implies a reacceleration of growth for the remainder of 2024. Regardless, growth will be “notably lower” with analysts expecting only a 2% growth in 2024.

Here’s where things got a little interesting (emphasis added).

We have updated our future vehicle line-up to accelerate the launch of new models ahead of our previously communicated start of production in the second half of 2025.

These new vehicles, including more affordable models, will utilize aspects of the next generation platform as well as aspects of our current platforms, and will be able to be produced on the same manufacturing lines as our current vehicle line-up.

(Tesla FY2024 Q1 Investor Update.)

So, if I’m getting this correctly, Tesla expects to unveil its new vehicles (not one, but at least two new models) as early as late 2024 or early 2025. This should include its $25,000 mass-market next-generation vehicle.

At the same time, these new vehicles will be able to be produced in Tesla’s existing factories — Tesla doesn’t have to build new factories.

Put differently, faster speed-of-launch and faster speed-to-market for the new models excite many investors.

Not only that, but Tesla is expected to unveil its robotaxi product — or the Cybercab, as they call it — in August this year. In CEO Elon Musk’s words, the robotaxi business model will look like a “combination of Airbnb and Uber” where Tesla will operate its own fleet alongside Tesla car owners who opt for the robotaxi service.

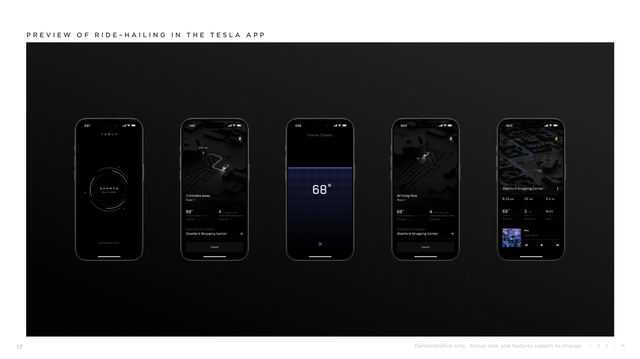

In addition, Tesla teased the initial looks of its ride-hailing service in the Tesla app. Investors can already imagine the robotaxi service coming to fruition. Nice high-margin robotaxi Revenue.

Tesla FY2024 Q1 Investor Update

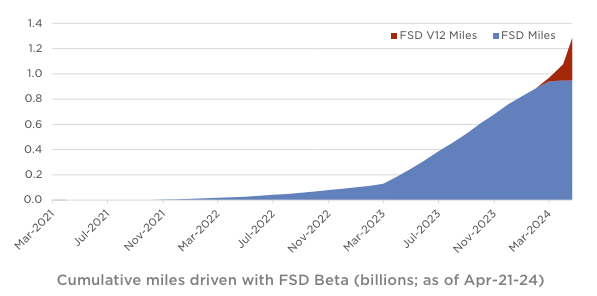

Their imaginations were further confirmed by the recent progress of Tesla FSD (Supervised), which has accumulated over 1.2B miles worth of data. And to accelerate further adoption, Tesla has lowered the price of FSD to $99/month or $8,000. Easy high-margin FSD Revenue.

This should fast-track full self-driving (“FSD”) development, enabling Tesla to scale fully autonomous vehicles for its robotaxi product sooner rather than later.

If you’ve not tried the FSD 12.3, and like I said, 12.4 is going to be significantly better and 12.5 even better than that.

(CEO Elon Musk — Tesla FY2024 Q1 Earnings Call.)

Tesla FY2024 Q1 Investor Update

Moreover, Tesla is already “in conversations with one major automaker regarding licensing FSD.” Imagine non-Tesla vehicles joining the robotaxi program. Incremental licensing Revenue.

Put simply, FSD is gaining steam… fast.

On top of new models, robotaxis, and FSD, management also highlighted the potential for its humanoid robot product, Optimus, to go to market by the end of 2025. Massive robotics Revenue.

we do think we will have Optimus in limited production in the natural factory itself, doing useful tasks before the end of this year. And then I think we may be able to sell it externally by the end of next year. These are just guesses.

As I’ve said before, I think Optimus will be more valuable than everything else combined.

(CEO Elon Musk — Tesla FY2024 Q1 Earnings Call, emphasis added.)

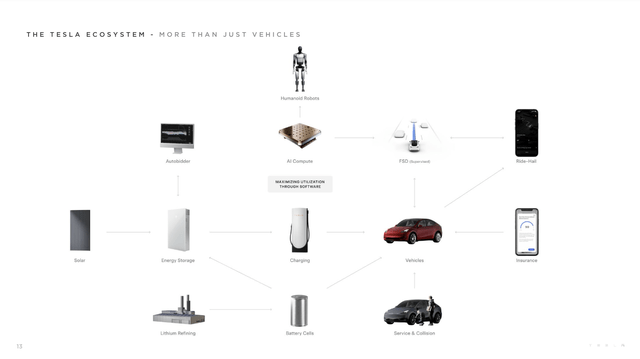

With all these developments, investors are beginning to realize that Tesla is more than just a car company. To help you visualize better, Tesla even added a neat little chart to show its ecosystem and its diverse product set.

Mind you, some of these products (Optimus, robotaxis, etc.) might still be years away before they are commercialized. But the timeline doesn’t really matter because management sold their vision particularly well during this recent quarterly update.

So much so that investors have bought into it recently…

Tesla FY2024 Q1 Investor Update

Valuation

Despite decaying fundamentals, investors cheered on Tesla’s grandiose vision, sending shares up 12%+ the following day.

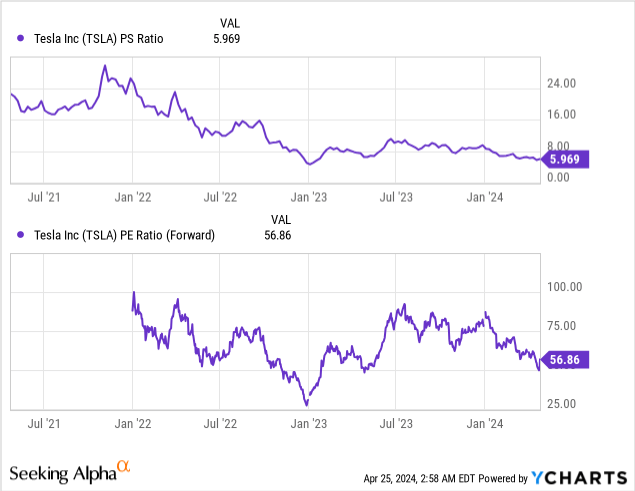

As it stands, Tesla has a market cap of slightly over $500B. The stock currently trades at:

- Price to Sales of 6x

- Price to Earnings of 57x.

Based on multiples alone, Tesla looks fairly valued to slightly expensive. Many would argue that Tesla should have a much lower valuation given its slowing growth rate and weakening margin profile.

Perhaps, investors are pricing in the fact that Tesla may actually be an “AI or robotics company” with the potential for Optimus to “be more valuable than everything else combined”… rather than a plain old auto company.

I agree. Tesla is an EV, solar, AI, robotics, ride-hailing, and self-driving super company, which is why the premium valuation is justified.

However, given the company’s shaky fundamentals, I won’t be a buyer here — I need a wider margin of safety.

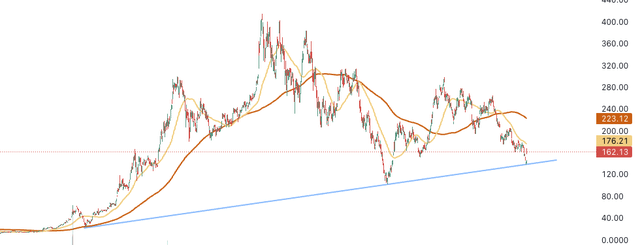

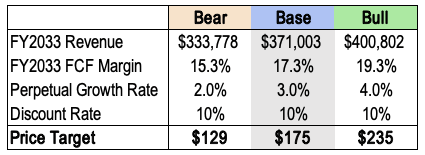

That being said, I kept my price target relatively unchanged at $175 a share, which is about an 8% upside from today’s price of $162. My assumptions are laid out below.

Author’s Analysis

I was neutral on Tesla stock a few months ago, but given its recent drawdown, I think it’s worth upgrading the stock to a Buy.

In addition, the stock seemed to have bounced perfectly on its long-term trend line, which could signify a bottom.

Risks

- Higher for Longer: high interest rates will continue to put pressure on demand for high-ticket items such as EVs and solar. For now, inflation remains stubbornly high, which has led to delays in interest rate cuts. Moreover, we could see rate cuts beginning later than expected, leading to more demand pressure for Tesla products.

- Competition: lower margins and incessant price cuts could be signs of competitive pressure. Automotive Margins need to bottom to instill investor confidence.

- Execution: as heard from Tesla’s earnings call, management is promising many things over the next 2 years, namely: the launch of new models, commercializing Optimus, Cybercab unveiling, and more. Any delays on these projects could re-rate the stock lower.

Thesis

As seen by the headline numbers, Tesla’s Q1 results were horrible. Virtually every single metric from Revenue growth to EPS was down YoY, missing analyst estimates in the process.

There’s no way to sugarcoat this — but management just did.

How? By sharing a vision that investors can look forward to.

This includes FSD. This includes the Cybercab. This includes new vehicle launches. This includes Optimus. This includes AI.

Ideas that are probably years away have completely masked Tesla’s horrifying results.

Simple as that.

While I agree that Tesla is at the forefront of a few megatrends including AI, robots, and autonomous driving, it’s difficult to ignore the fundamental damage that Tesla is going through currently.

Look, I’m no Tesla bear.

In fact, I’m all for Tesla and Elon Musk’s grand vision.

The vision — the story — is definitely convincing. But I need it to be backed up by strong fundamentals.

That being said, the selloff over the past few months has brought Tesla stock down to a much more reasonable price.

But unlike most bulls, I need a wider margin of safety before I buy into management’s vision.