jetcityimage/iStock Editorial via Getty Images

July 23rd ended up being a really positive day for shareholders of GE Aerospace (NYSE:GE). Shares of the company spiked, closing up 5.7%, after management announced financial results covering the second quarter of the company’s 2024 fiscal year. Even though revenue fell short of analysts’ expectations, adjusted earnings per share reported by the company came in higher than what the professionals thought. In addition to this, the company posted strong orders year over year and generated significant positive cash flow. Unfortunately, shares are still very pricey. But that doesn’t mean that the company should not be on investors’ radars.

Back in April of this year, I did conduct an analysis of GE Aerospace. This was my first and, up to now, only article on the company since the spin-off of GE Vernova (GEV) from General Electric and General Electric’s rebranding into GE Aerospace. For years, I had been bullish about General Electric in general. And the upside scene from this was rather significant. But given how much shares of its component parts had appreciated, I argued that the best rating I could give both GE Aerospace and GE Vernova was a ‘hold’.

So far, the market has agreed with me when it comes to GE Aerospace. Since I wrote about the company earlier this year, shares are up only 6.4%. That’s a bit below the 9.3% increase seen by the S&P 500 over the same window of time. The good news is that management came out with guidance that is better than what it was previously. But that is not enough, in even the more bullish assumptions, to rate the business anything higher than the ‘hold’ I have had it as of late.

A solid quarter

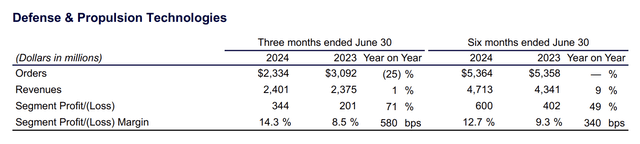

If there was one weak spot regarding GE Aerospace for the second quarter of the 2024 fiscal year, it would involve the company’s revenue. To be fair, the $9.09 billion management reported for that quarter came in 3.9% above the $8.76 billion generated one year earlier. However, the sales reported by the company fell short of analysts’ expectations to the tune of $350 million. Based on the data provided, the laggard here was the Defense & Propulsion Technologies segment. Revenue inched up by only 1.1% from $2.38 billion to $2.40 billion. This was in spite of the fact that Propulsion & Additive Technologies’ revenue had spiked roughly 16% year over year. The decline, then, was attributable to a 6% drop involving the company’s Defense & Systems segment. Management attributed that to lower engine deliveries.

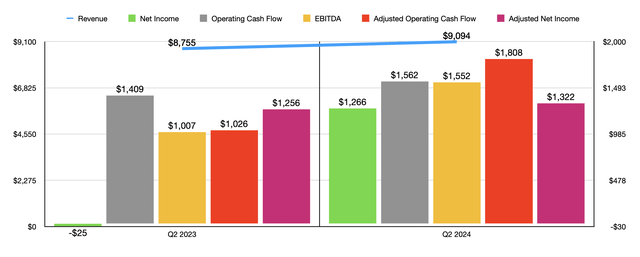

Author – SEC EDGAR Data

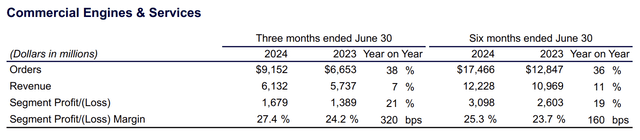

By comparison, the Commercial Engines & Services segment performed far better. Revenue of $6.13 billion ended up being 6.9% above the $5.74 billion generated the same time last year. This was mostly because of a 14% surge in internal shop visit growth that more than offset the 11% drop in equipment revenue that came from lower shipments caused by changes in customer mix and product pricing. In fact, management reiterated in the earnings release that the picture regarding shop visits is so positive that the company intends to allocate around $1 billion toward both organic and inorganic investments over the next five years specifically for the purpose of expanding and upgrading its maintenance, repair, and overhaul facilities.

GE Aerospace

In addition to reporting gradual revenue growth, the company also provided some positive leading indicators. For the Commercial Engines & Services segment, orders during the quarter came in at $9.15 billion. That’s a whopping 37.6% increase over the $6.65 billion reported just one year earlier. Management said that this was largely because of strong spare parts demand. This is not to say that all of the orders data came in positive. Orders under the Defense & Propulsion Technologies segment actually dropped from $3.09 billion to $2.33 billion. But if management is being truthful, this is not something that investors should be terribly concerned by. The claim is that this is largely because of the timing of orders under the Defense & Systems unit. In fact, when we look at the first half of 2024 as a whole, orders for this segment were virtually flat at $5.36 billion.

GE Aerospace

In total, orders for the quarter came in at $11.49 billion. That represents sizable growth over the $9.75 billion reported for the second quarter of 2023. Considering that orders represent future revenue, this does indicate that overall sales for the business should be higher next year than they are going to be this year, so long as nothing else changes moving forward. But of course, we do need to pay attention to more things than just the top line. Profits and cash flows are also significant.

For the second quarter of the year, GE Aerospace reported $1.20 per share in earnings from continuing operations. This was up from the $1.09 reported the same time last year. It was also $0.21 per share greater than what analysts expected for the quarter. This translated to a gain for net income from continuing operations from $1.26 billion to $1.32 billion. Having said that, GAAP net income grew from negative $25 million to positive $1.27 billion. Fortunately, other profitability metrics for the company also came in strong. Operating cash flow managed to grow from $1.41 billion to $1.56 billion. If we adjust for changes in working capital, the increase was even more impressive, from $1.03 billion to $1.81 billion. And finally, EBITDA for the company expanded from $1.01 billion to $1.55 billion.

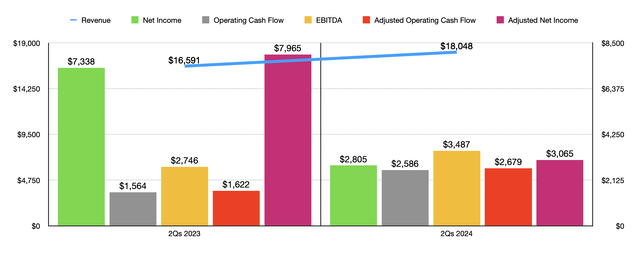

Author – SEC EDGAR Data

The second quarter of 2024 was not the only positive time for shareholders. For the first half of the year as a whole, as indicated in the chart above, revenue and each of the company’s cash flow metrics, came in higher than what analysts were expecting. Net income was more complicated. And that’s largely because of $6.60 billion in ‘other income’ that the company booked in the first half of 2023. That was the result of gains on retained and sold ownership interests. This large one-time gain is the reason why I believe that the cash flow metrics for the company are more reliable.

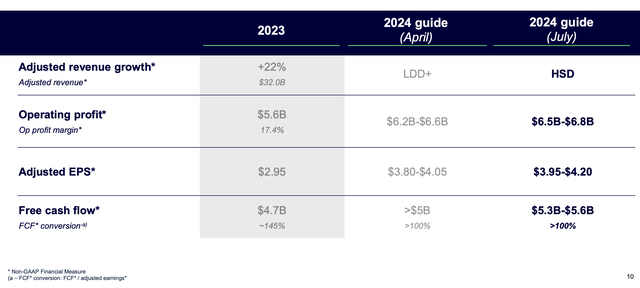

As for the rest of the year, management seems quite optimistic. The current expectation is that adjusted revenue will grow at a high single digit rate this year. That compares to a low double-digit rate that management anticipated when they announced results in April. As a result of this, operating profits are expected to come in somewhere between $6.5 billion and $6.8 billion. That is an improvement over the previous range of between $6.2 billion and $6.6 billion. Another metric that saw a positive revision was earnings per share. Management now believes that this should come in at between $3.95 and $4.20. By comparison, prior guidance had called for this to be between $3.80 and $4.05. But even if earnings would have come in at the lower end of the previous range, that still would have been a remarkable improvement over the $2.95 reported for 2023.

GE Aerospace

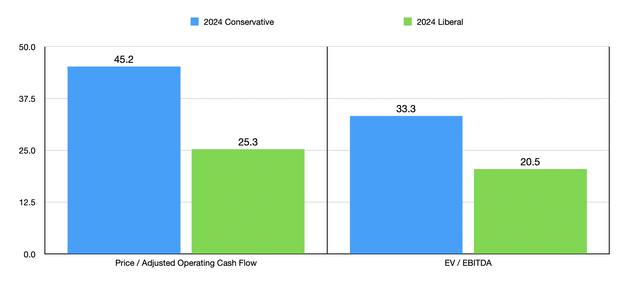

Management also decided to increase guidance for free cash flow. In 2023, free cash flow for the business came in at $4.7 billion. Initial guidance for this year had been for a reading in excess of $5 billion. But now, management expects this to be somewhere between $5.3 billion and $5.6 billion. This is where some complexities come into play. Given the major spin-off and reorganization that occurred earlier this year, management has not provided as much detail regarding historical results as I would like to see. But in my prior article on the company, I estimated a range for both adjusted operating cash flow and EBITDA for 2023, 2024, and 2025. We still don’t have enough data to know the full picture or what to expect for this year. But if we increase estimates for 2024 to reflect the increase in operating profit guidance, this would imply operating cash flow of between $4.2 billion and $7.5 billion, as well as EBITDA of between $5.3 billion and $8.6 billion.

Author – SEC EDGAR Data

If the operating cash flow figures seem peculiar to you, it’s because management is including in the free cash flow estimates for this year one-time changes in working capital. This is not indicative of the company’s long-term health. So my estimates remove this from the equation. Using the figures estimated for 2024, you can see in the chart above how shares of GE Aerospace are valued for the 2024 fiscal year. Even if we take the liberal scenario where cash flows are higher, the stock looks quite pricey. I wouldn’t go so far as to consider a downgrade for it. But I certainly can’t be a buyer at these prices.

Valuation aside, there are a couple of other interesting data points that investors should be aware of. First, the company has a really strong balance sheet at this point in time. The firm has only $1.70 billion in debt on its books. It also has $15.45 billion in cash and cash equivalents. This gives us a net cash position of $13.75 billion. The second is that management has been making good use of this capital. In addition to focusing on growth opportunities, such as the aforementioned investment in its MRO facilities, management has also been focused on buying back stock. During the second quarter alone, GE Aerospace repurchased about $2.3 billion worth of shares. Given how expensive the stock is, I personally would prefer this capital be allocated in some other way. But it’s better to be like this than have a company that is fundamentally struggling.

Takeaway

All things considered, GE Aerospace is doing quite well for itself. Yes, revenue fell short of expectations. But guidance is strong and both profits and cash flows are doing nicely. Management is buying back stock and the company has a great balance sheet. Unfortunately, the market realizes the quality of the operation we are dealing with. And it has applied a premium to the stock as a result. Unfortunately, this means that the best that I can rate the company is a ‘hold’. But if something changes for the better moving forward, I would love to consider upgrading it.